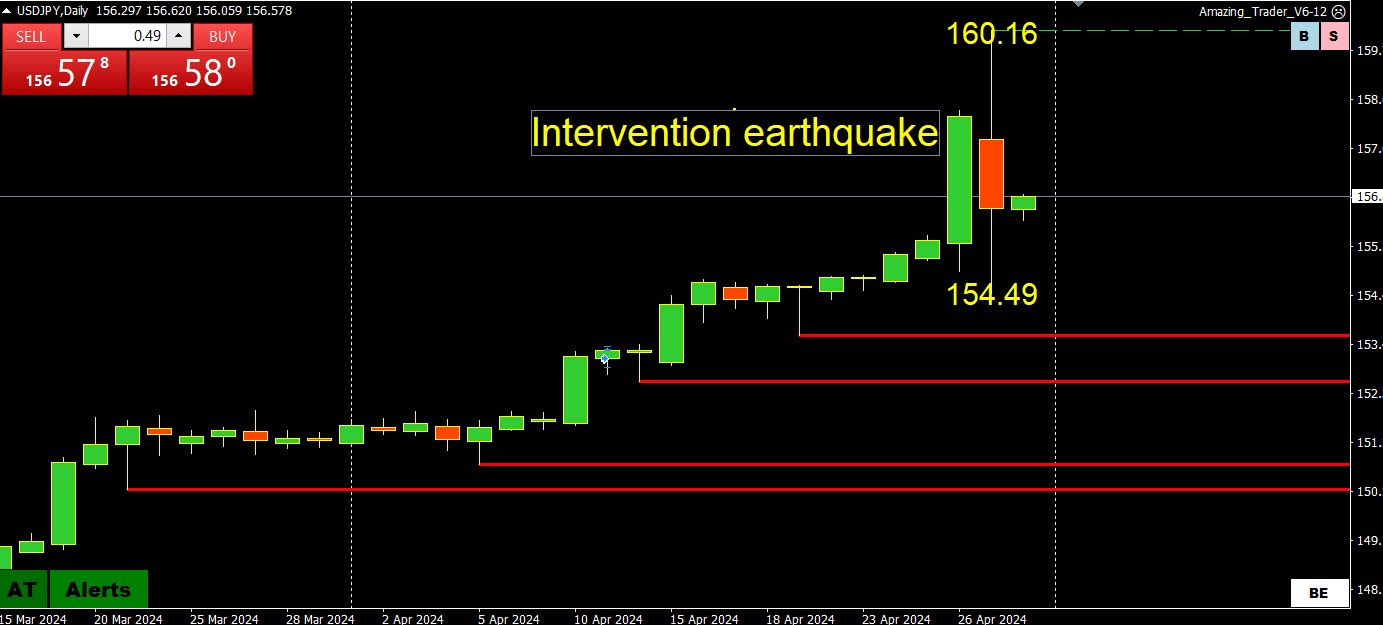

There was a Global-View member. a bank trader working for Japanese bank who gave the JPY a nickname I never forgot. He called the JPY “The Devil “ The reason, as he said was because “the YEN...

Return to previous page