Forum Replies Created

-

AuthorPosts

-

Just posted in our blog

Good reading during the wait for the FOMC

What is President Trump’s Tariff Game Plan?

Watch the Dot Plots

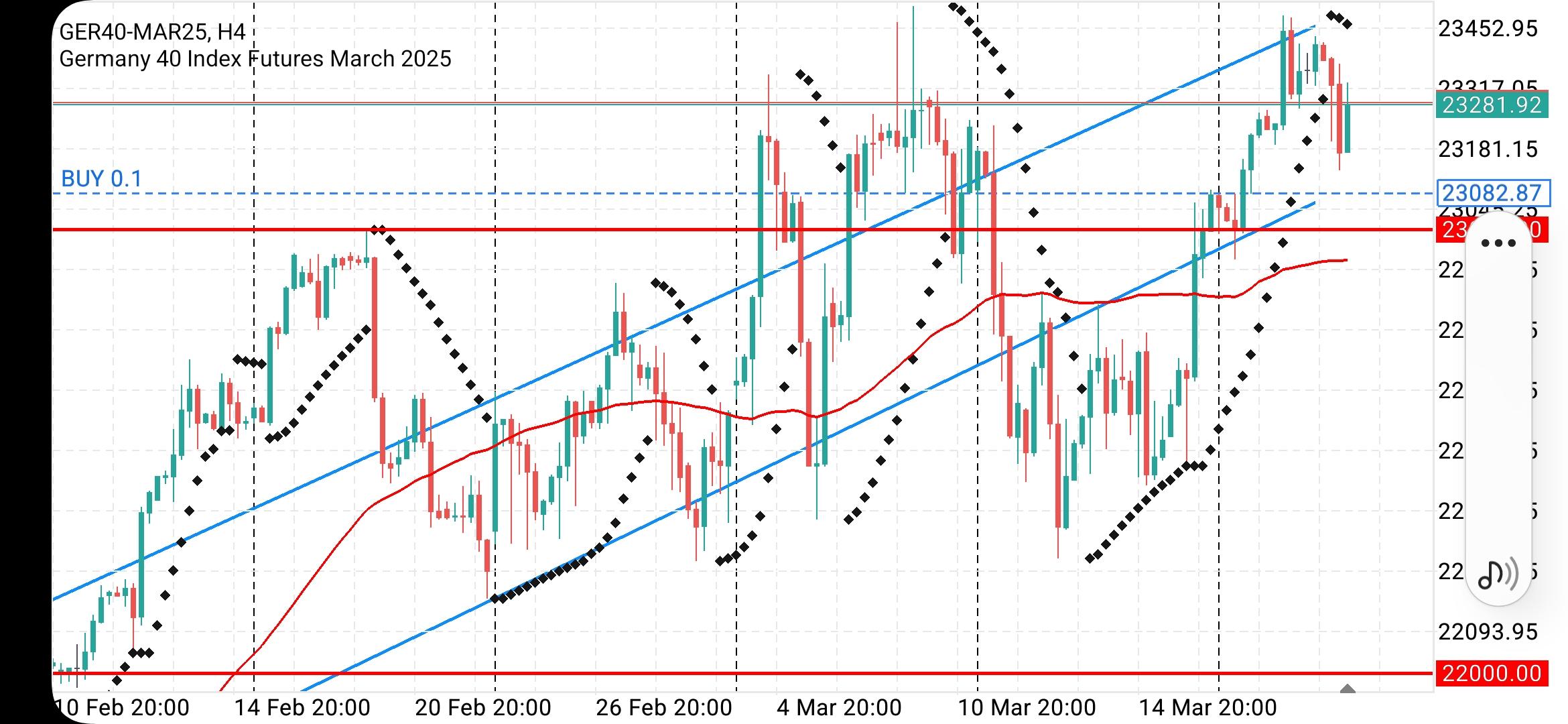

FOMC dot plot projections are updated at today’s meeting. Given the economic uncertainties resulting from tariffs, Fed members will have a hard time making interest rate projections.

What is the dot plot?

The FOMC dot plot is a chart published by the Federal Open Market Committee (FOMC) of the Federal Reserve that shows the interest rate projections of its members. It is released four times a year as part of the Summary of Economic Projections (from the internet).

European rally faces tariff reckoning

Is it a time for some clear thinking ?

· STOXX 600 up 0.1%

· IT firm Softcat pops on results

· Fed rate decision awaited

· Turkish assets tumble

· Wall St futures inch up

· Fast money investors have been a key force behind this year’s strong rally in Europe, and now that real money flows are starting to pour in, tariff risks are back to the fore.

· This could keep volatility high and curb gains near term, say Barclays, pointing to the April 2 deadline by which reciprocal tariff rates in the U.S. are intended to take effect.

· “A ‘worst case’ 25% blanket tariff, should it materialise, would indeed take away most of the growth expected this year in Europe,” says strategist Emmanuel Cau at the UK bank.

· “However, US goods exports are only c.12% of revenues for (the STOXX 600)… And, with tariff losers underperforming notably ytd, some of the risks are arguably priced in.”

· Despite the short-term risks, Cau is upbeat about the long-term as a landmark fiscal reform in Germany will likely boost the broader European growth for 2026 and beyond.

· This could drive “more inflows/rotation”, Cau notes.

· As a result, Barclays has doubled its 2026 EPS growth forecast for the STOXX SXXP to 8%, lifting the year-end target to 580 from 545 – a 4.7% upside to Tuesday’s close.

EURO 1.0887

–

PUPPY CAME TO REST ATM IN THE HIGHER 1.088″s after majestically failing to pierce N of 1.0950on the larger time frames puppy still in uP trend and still I d be looking to B-o-minorDips

for this puppy to turn in its trand would probably take over 100 – 125 pips dump and stay there.

which raises the Q of what thinng would make the dollar rally thusly

–

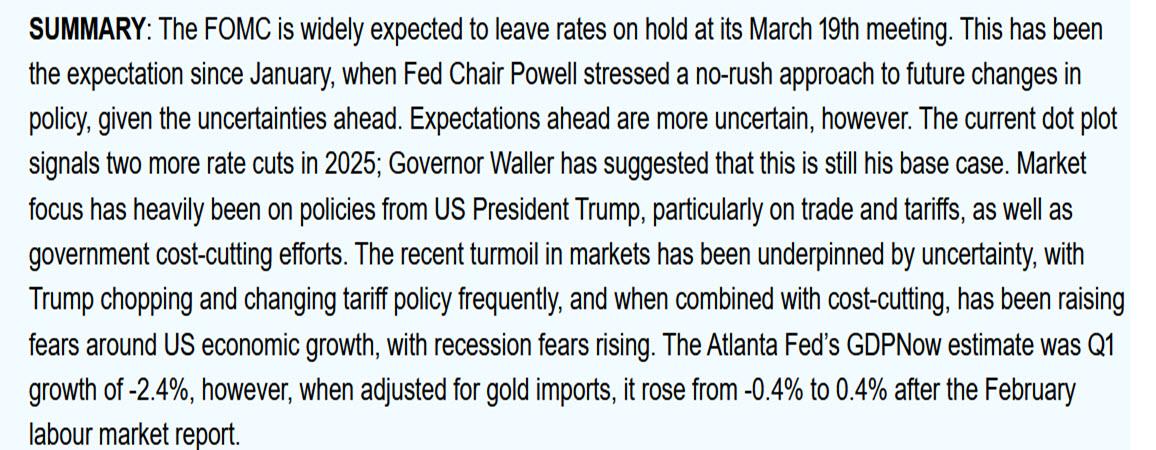

14:00 FOMC decision on policy around “money”

— players and pundits are expecting no change (to 4.5%)

— markets is pricing total of 50bps easing for all of 2025 max.

—- half hour later jerome will try to explain his and gang’s thinking about inlation that is NOT working its way towards his 2% target and that in the by tariff muddied and fogged environment. Jerpme may try to bambooxle players using his staff’s dot-plot and thus try to wash his hands off any allusions to future directional prognostication.At this junction for the dollar to rally players would somehow have to draw a perception that the FED is in a hawk mood (if only to try to piss off donald)

-

AuthorPosts

© 2024 Global View