Forum Replies Created

-

AuthorPosts

-

New Month and New Quarter

–

First some base points from which markets will head into a new month and quarter

SPX 5 day -1.53%; 1m -6.27%; 3 m -6.53%; ytd -5.11%

DJIA 5 day -0.96%; 1m -5.15; 3m -3.28%; ytd -2.26%

Nazdaq 5 day-.25%; 1m -8.09%; 3m -12.16%; ytd -10.29%Group-think pundits observe that Q1 bear sentiment is typically a seasonal phenom.

(As is, typically, positive for the DLR)Partial-group think optimists speculate that next month “could” offer “an opportunity” for players.

Recent incoming data related to growth in economic activity has been rather dismal, referring to metrics that the FED claims matter to it.

Businesses and individuals, for their part, have been sending out smoke signal data indicating concern about future financial and economic growth prospects. Some portion of pundits are protracting that into increasing odds of coming Recession. But not all – i.e. no consensus on the matter.

There appears to be a softening amongst pundits about “soft landing” and increased itchings about potential of stagflation in various degrees of intensity.On the topic of anchor, inflation and expectation:

University of Michigan: Inflation Expectation (MICHTrading Tip 15: When to Fade a Correction *repeat of Trading Tip 1 with an

The key to any strategy is to be able to put it into practice in real time. We all know that trading rarely operates like a textbook so it is important to understand the logic behind a strategy and why it works so you will know when to employ it. I call this common sense approach and you will see why as I explain when you should fade a correction.

The Strategy

You will be hard-pressed to find this in a trading book or course as this trading tip comes from my many years of experience trading in the forex market.

Simply put it is better to fade a correction or counter-trend move that takes place early in a session (i.e. European or NY session) than one that occurs later in the day, One reason is the market is better able to absorb flows earlier in a session when there is full liquidity and participation. In other words, the trend is not likely to reverse unless key technical levels are taken out. Unless this occurs, buyers are likely to be found below the market in an uptrend and sellers are likely to step in above the market in a downtrend.

Here is the logic: Once a correction runs out of steam and the weak longs or shorts taken with the prevailing trend (i.e. longs in an uptrend or shorts in a downtrend) are squeezed out, the market has less capacity to absorb fresh buying or selling, as the case may be, with the existing trend. This is why you often see the market snap back in the direction of the trend after a correction runs out of steam. It is also why looking to fade an early in the session correction tends to be a high-odds trading strategy. .By fade I mean looking for levels to buy when an uptrend corrects lower or sell when the downtrend corrects higher. .

On the other hand, a retracement that occurs later in the day, especially in the NY session, is more difficult to fade as the market has less capacity to absorb the flows and fresh buyers or sellers are less likely to emerge. In this case, those looking to fade a correction should be prepared to hold the trade into the next trading day.

Summary:

Early in the session correction => Look to fade the move => Expect a snapback.

Late in the day retracements => harder to fade unless you plan to hold the position into the next trading day.

As with any trading pattern, the overall picture needs to be taken into account and whether key technical levels and/or indicators have been violated that would change the risk. As long as this does not occur, corrections that take place early in a session offer trading opportunities for the reasons explained above.

This is a strategy you can put into action as you understand the logic behind why and under what conditions it should work.

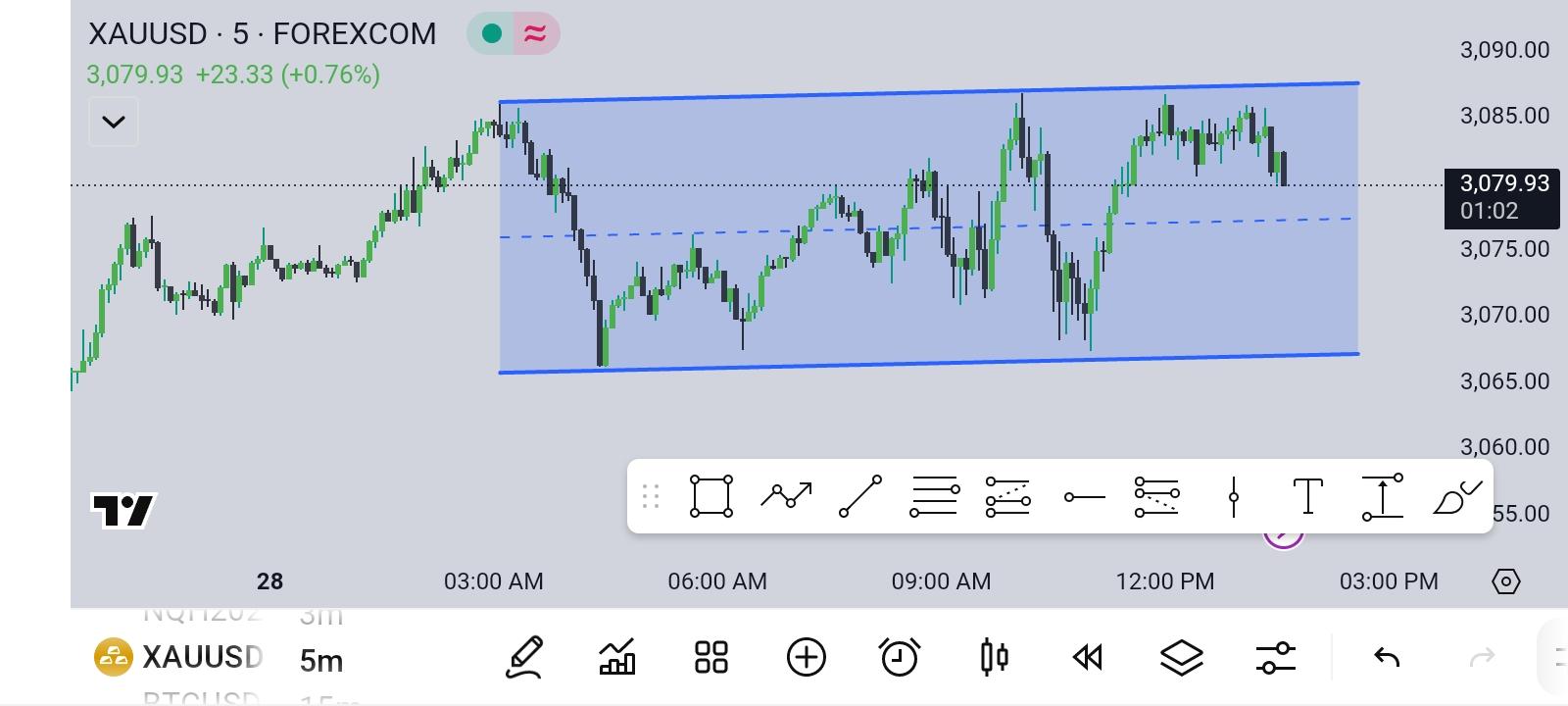

Here is a real-time illustration of when to fade a correction and when to avoid it.

ADDENDUM:

Why did XAUUSD surge higher?

The obvious reason is a run to safety ahead of the April 2 reciprocal tariff announcement.

The other reason is applying the same logic of when to fade a correction to longermterm charts,

‘

3 day retracement attempt.

• Shook out erak longs

• Left market with lkess abikity to absorb fresj buying,

• Rest is historyPlease feel free to contact me with any questions or comments.

DAX Index Closes Lower Amid German Labor Market Focus

Closes 0.96% Lower

Frankfurt’s DAX dropped 0.9% to close at 22,460 on Friday, marking its third straight session of declines and underperforming its European peers.Local equities were in the red on Friday after latest data showed continued weakness in the German labor market, weighing on the already-cautious market sentiment due to US tariff concerns.

Technically, DAX went below channel trend line that indicates more losses on a horizon

Close below 22.400 would be very bearish sign and opens a way for 21.700

Resistances above the head: 22.600, 22.750 & 23.0150

Yes Jay, I see it – for me it is just an intermediary level that might serve its purpose…

If 1.08300 slows EUR down today, but it closes tonight above 1.08150/200 we can have a decent run and attack at 1.08600 Monday.

However, if EUR goes straight away for it ( 1.08600) it can easily collapse on Monday…

That is my way of seeing it…

EURUSD

And here we go – 1.08600 next resistance to watch.

If EUR manages to stay above 1.08150/200 till tonight’s close, this should be a start of a new Uptrend.

In case 1.08600 proves difficult to overcome on the first attempt, we might see another test of 1.07300

These are all possibilities and before we see how this day ends it is all just a speculation.

-

AuthorPosts

© 2024 Global View