Forum Replies Created

-

AuthorPosts

-

US OPEN

Pronounced risk off into ‘Liberation Day’, though crude remains underpinned on US-Iran relations

Good morning USA traders, hope your day is off to a great start! Here are the top 6 things you need to know for today’s market.

6 Things You Need to Know

US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd; reportedly revived the idea of a flat universal tariff single rate on most imports.

European bourses and US futures in the red given the above and into month & quarter end, Euro Stoxx 50 -1.5%, ES -1.0%; NQ -1.3% with NVDA pressured.

DXY has been on either side of the unchanged mark throughout the morning, EUR and GBP flat/slightly softer while USD/JPY hit a 148.71 low as the Nikkei 225 entered correction territory.

Fixed benchmarks bid on the broad risk tone, German State CPIs sparked a fleeing move lower into the mainland figure, JGBs slipped as the BoJ cut its bond purchase amounts.

Crude firmer as geopolitical tensions outweigh the macro tone following reports around Trump on Iran, XAU at a fresh record high, base metals dented.

US President Trump threatened to bomb Iran if a nuclear deal can’t be reached, while he also warned of secondary tariffs on Russian oil.

USDJPY DAILY CHART – Safe haven

JPY getting the safe haven flows, helped by a fall in US bond yields )10 YEAR 4.20%) In a risk off start to the week.

Trendline broken at 149.80 following the failure to reach 151.30

Key support at 148.15… only below it (and then 148) would shift the focus from 150.

Intra-day range: 148.70-149.74

Conspiracy theory says, if I was the MoF/BoJ I would be on alert to prevent a meltdown if the downside starts to accelerate.

XAUUSD DAILY CHART – NEXT TARGET?

Soars to another record high (3128) as Trump Liberation (reciprocal tariff) Day looms.

The surge in GOLD should be setting off alarmw in the White House but it is falling on deaf ears,

No reason to guess at a top so if I had to try, I would put 3150 and 3200 on the radar. In the meantime, use the new rexord high (3128) as the key resistance.

On the downside, 3057 is closest key area so 3080-3100 needs to hold to keep an uber bid.

Using my platform as a HEATMAP shows

Risk off… stocks down, bonds up, gold soars…and..

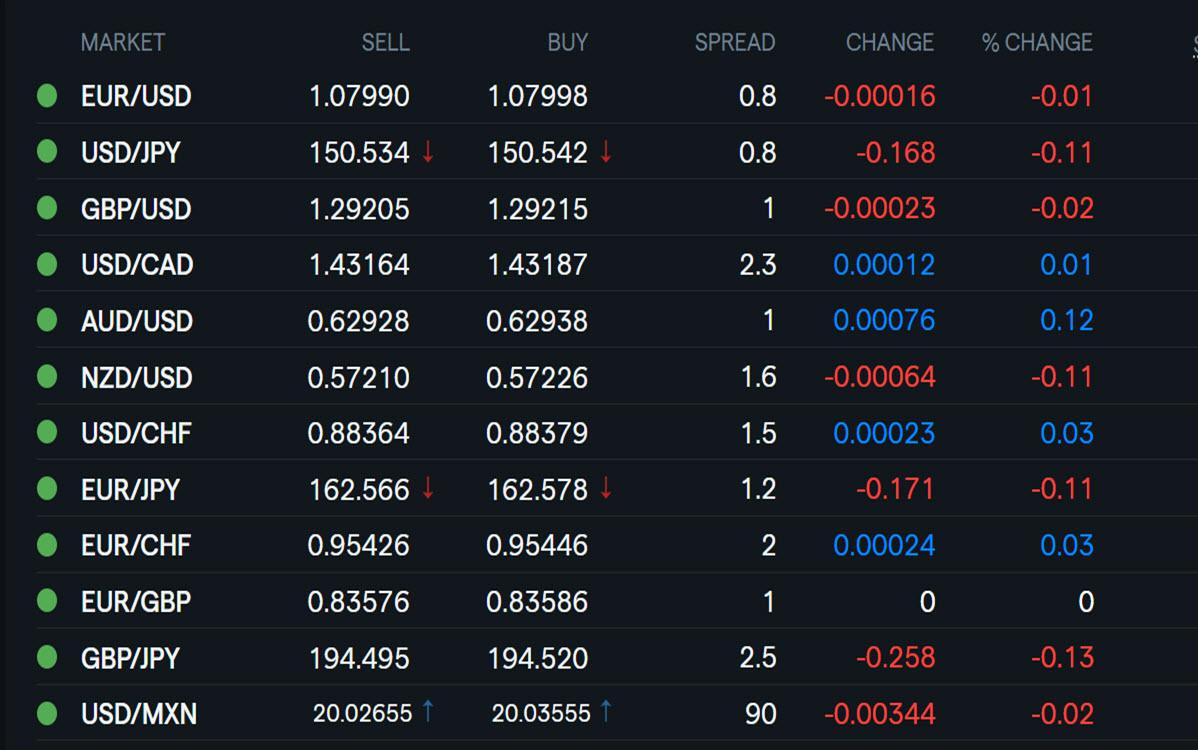

… dollar mixed.. JPY up on safe haven flows… AUD, CAD, NZD down.. EUR and GBP not far from unchanged

What caught my eye in EURUSD was a failure at 1.0850 (high 1.0849)

Looking ahead: German CPI, Chicago PMI… month/quarter end

… April 2 reciprocal tariffsTHIS WEEK’S MARKET-MOVING EVENTS (all days local)

The coming week brings crucial economic data amid intensifying global trade tensions triggered by new US auto tariffs. Investors will watch closely for signs of labor market softening in the US, stability in Eurozone inflation, and growth signals from Asia’s manufacturing sectors. Central banks, including the RBA, remain cautious, navigating sticky inflation and slowing demand.

Econoday

re “Doesn’t care if car prices go up”

and the full and real statement by President Trump:

Asked if he was concerned about car prices going up, Trump said, “No, I couldn’t care less, because if the prices on foreign cars go up, they’re going to buy American cars.”

Trump says he ‘couldn’t care less’ if foreign automakers raise prices due to tariffs – cnbc

March 29, 2025 at 4:26 pm #21664

Global Synchoronity between central banks to bring about a global stagflationary environment… to de-dollarize into CBDC which is repegged and counter pegged to dollar via gold, of which the plan is to make dollar become worthless but it’s not possible for them to shake up the dollar as a reserve… so they first buy large amounts of gold…

They are going to fuck with my status quo and suffer consequences of their own doings.

If they feel adventurous enough to do that then it’s better for them to go jump into the sea rather than try to tamper with the reserved status,…

They have done some real damage to the franc’s safe haven status already.

Newsquawk Week Ahead Highlights: 31st March-4th April 2025

Highlights include US Trade Policy Review, US NFP and ISM PMIs,RBA, ECB Minutes and Canada Jobs

-

AuthorPosts

© 2024 Global View