Forum Replies Created

-

AuthorPosts

-

Data and tariff talk lift dollar to three-week high

The dollar ticked up to an almost three-week high on Tuesday after some strong U.S. services data and cautious optimism on the tariff front.

President Donald Trump said not all of his threatened levies would be imposed on April 2 and some countries may get breaks, which helped the mood on Wall Street overnight by soothing some fears about a possible slowdown in U.S growth.

The U.S. dollar index DXY notched a fifth straight session of gains, rising 0.15% to 104.46, its highest since March 5.

Meanwhile the euro EURUSD slipped to $1.0777, around its lowest in three weeks, and was last down 0.1%.

A strong services component in S&P Global’s flash U.S. PMI figures on Monday alongside a rotation back into Wall Street stocks helped push up U.S. bond yields, which supported the dollar.

The dollar has rebounded somewhat after falling to a five-month low in mid-March as Trump’s stop-start tariff campaigns dented company and investor confidence and darkened the outlook for U.S. growth.

The view that tariffs are unambiguously bullish U.S dollar has been challenged by the price action in 2025, and so even when we get the information on what tariffs look like next week, it will be hard to know what we are supposed to do.

<p style=”text-align: center;”>

</p>

</p>

US OPENEuropean bourses positive despite lower US futures, DXY veers lower and Crude climbs on Venezuelan tariffs

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

US President Trump sanctioned Venezuelan oil. Elsewhere, India has proposed the removal/reduction of tariffs

European bourses defied the lead from futures and opened in the green, US futures in the red but only modestly so and hold onto the bulk of Monday’s gains

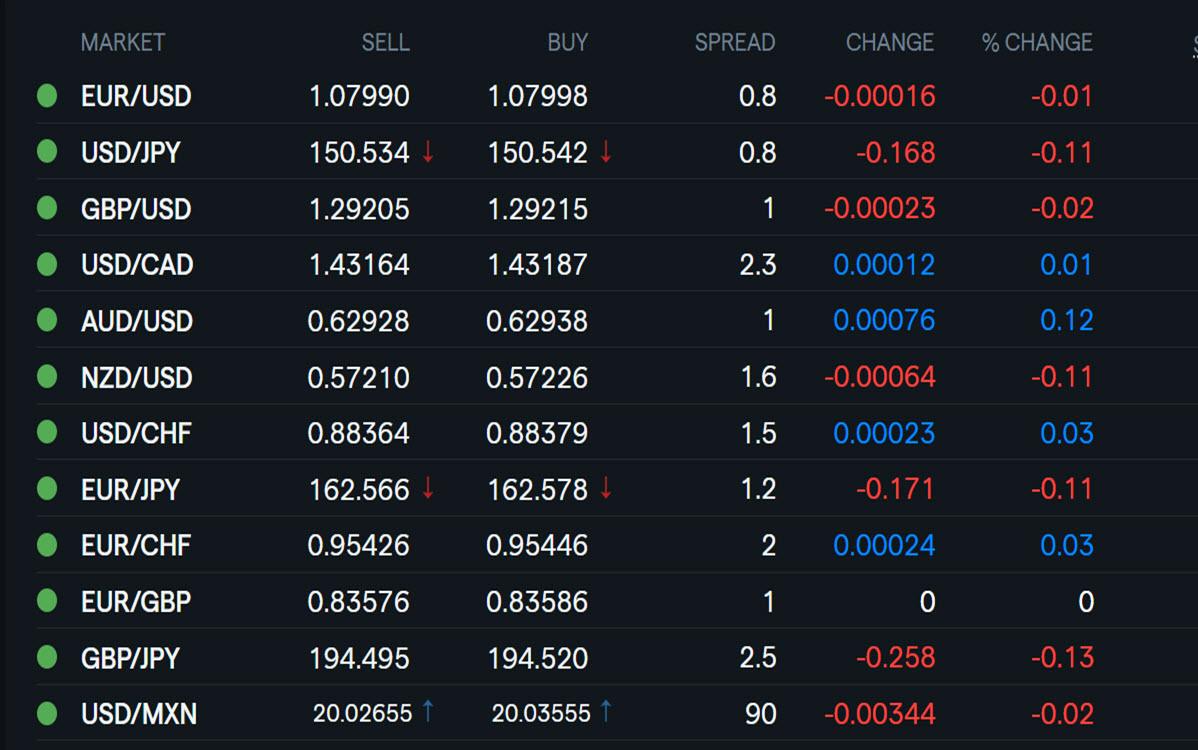

DXY steady throughout the morning but most recently at a session low to the benefit of peers across the board, EUR also aided by Ifo

Fixed benchmarks in the red, weighed on by Ifo and supply; USTs await Fed speak

Crude bid in an extension of Monday’s action, TTF softer on Ukraine updates while Gold has inched to fresh highs

<p style=”text-align: center;”>Try Newsquawk for 7 Days Free</p>EURUSD 4h

Supports: 1.08100, 1.07950 & 1.07750

Resistances: 1.08300, 1.08550 & 1.08900

Current momentum Up

As long as below 1.08550 daily direction is Down

Looking at 2-3 days period, EUR can spike up to around 1.09200 and then turn down again.

If above 1.09200 targets 1.10850

Personally, I would like to see this correction going all the way to 1.06850 before Up again.

In our weekly email, I called this a tricky week with attention looking ahead to next week when there will be month/quarter end (Monday) and reciprocal tariff day (Wednesday). .

Barring any definitive tariff news, this is a week that should be dominated by position adjustmwents (including pre quarter end) rather than aggressive positioning.

Markets seem to be grabbing on to any headline that gives a glimmer of hope on the tariff front.

USDJPY 4 HOUR – Chart tells the story

This is one of those days where this chart tells the whole story

Bid while above 150.18 but upside contained unless 151.30 is taken out.

Back below 150.18 would negate yesterday’s mini breakout and shift the range to 149.50-150.00

150 the clear bias setting level going forward.

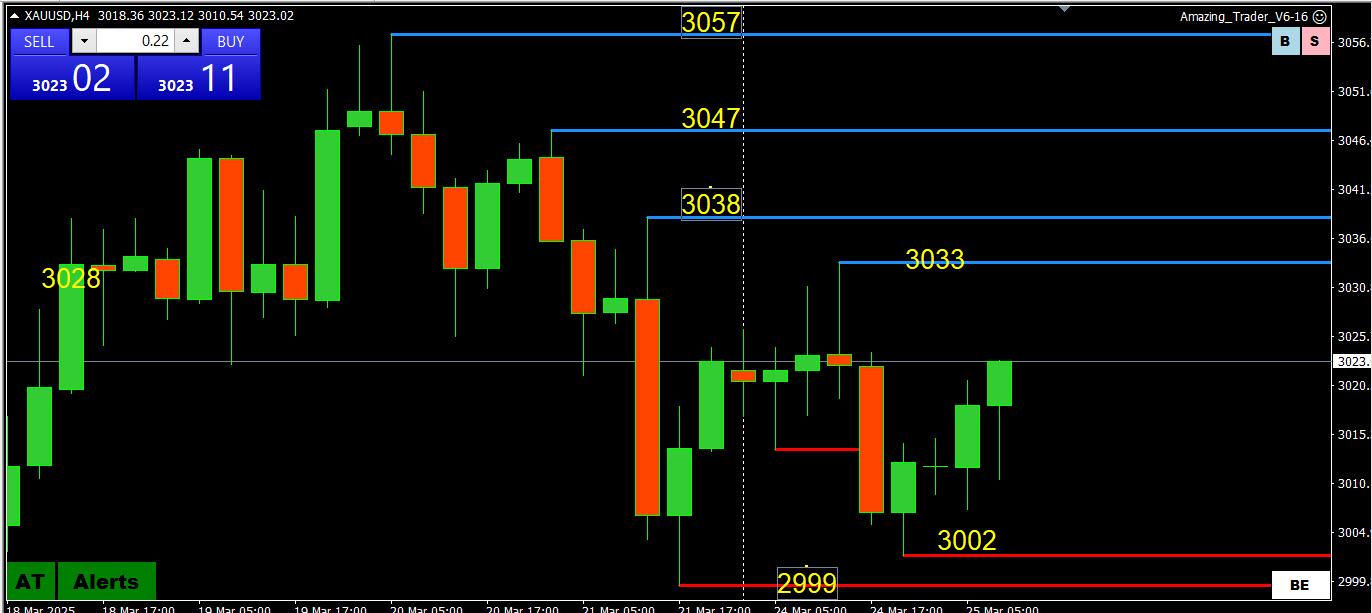

XAUUSD 4 HOUR CHART – Consolidating

I hate the word consolidating but with that said…

XAUUSD still consolidating between 2999 – 3038, seemingly biding its time for another run up unless 3000 is firmly broken.

Otherwise, break of 3038 would cool lingering retracement risk

Break of 2999 would expose 2978, which is the key level to maintain the daily uptrend. .

Using my platform as a HEARMAP shows

…the dollar trading close to unchanged after briefly extending its rebound overnight.

EURUSD 1.08 is the bias setting level…. what caight my eye is the low (1.0777) poauxed above the 1.0765 ley support/target. .

XAUUSD a touch firmer after holding iff another run at 3000

US equities consolidating and so far not following through on yesterday’s rally.

Light news day… headline watch remains on the next Trump tariff comment

Here it is 10am in Nigeria and gold (xau/usd) is looking up. it started from the price 3010.13 which was the lowest point as at yesterday and has slowly climbed up since then. Price is currently at 3021.74 and it is looking up for a further buy to the area at price 3025.91

Gold is a buy metal itself and has since being going long since 1996. I don’t think it is ready to stop buying as i see a further buying pressure. Let us use tight TP/SL and exit at the price 3025.91 as predicted. A 1-5% risk/reward ration of 1:2 should be used. A word is enough for the wise.

Thanks,

TOPNINE.US500 4 HOUR = Weekly down pattern broken

Last week, the 4 week down pattern was broken with an inside week… this week has started out with a higher high but as this chart shows, there are layers of resistance to get through from 5749-5871… at a minimum a solid 5800+ and then 5871+ would be needed to shift focus back to 6000.

On the downside, as pointed out last week, there is a double bottom at 5597 and only through there would shift the risk back to the low…. Keeps a bid if 5749 becomes support

Here we go again… Dollar dips on this glimmer of hope but note comment about more tariffs

-

AuthorPosts

© 2024 Global View