Forum Replies Created

-

AuthorPosts

-

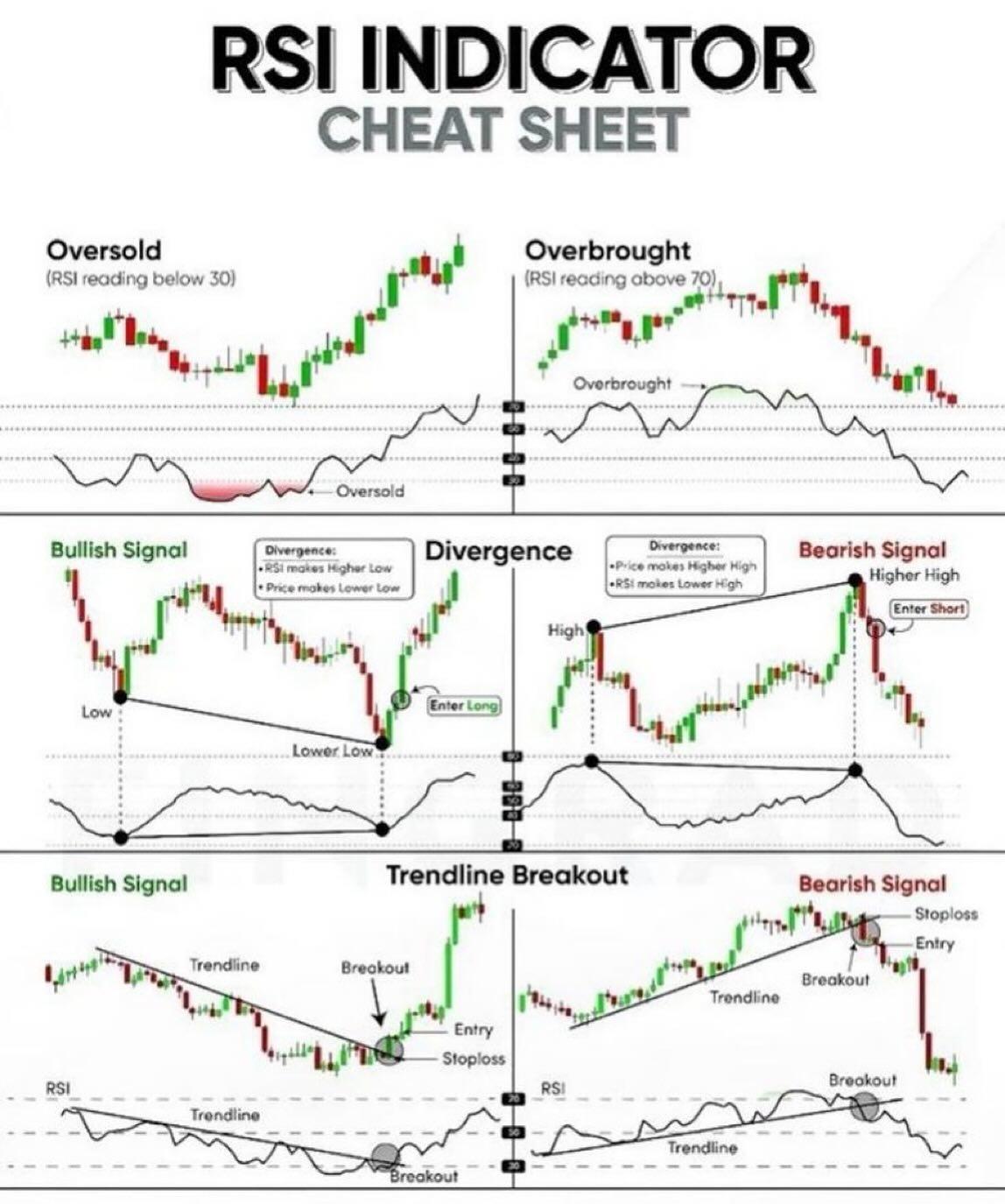

Robert – Re: RSI

I have been using it long ago, but never as exclusive Indicator.

RSI 9 was my favourite.

What I can see from your Cheat Sheet, idea to draw trend lines on it never crossed my mind to be honest 😀 And just by looking at it right now, I can see logic.

Let me give you some unorthodox view on RSI – my approach was the same as everyone else’s and it gave me hard time many times, until I had a chit chat with a friend of mine. At the time ( late 90’s) he was a chief dealer at one of the Central Banks.

He told me how they use it – and I was shocked :

When RSI gets above 100 or below 20 – so overbought or oversold, and hesitates to change the direction, it is a prime sign that market will continue strongly in the direction it was already in – so while we water rabbits were going contra, expecting it to change the trend, market ( and all those CB’s) were just using our stops and orders to continue their Rally.

Of course, after some time market changes the direction, but it is not the same when it does like 3-500 pips higher/lower: D

I am not saying that it always works, but just one interesting Tip for you…

good morning

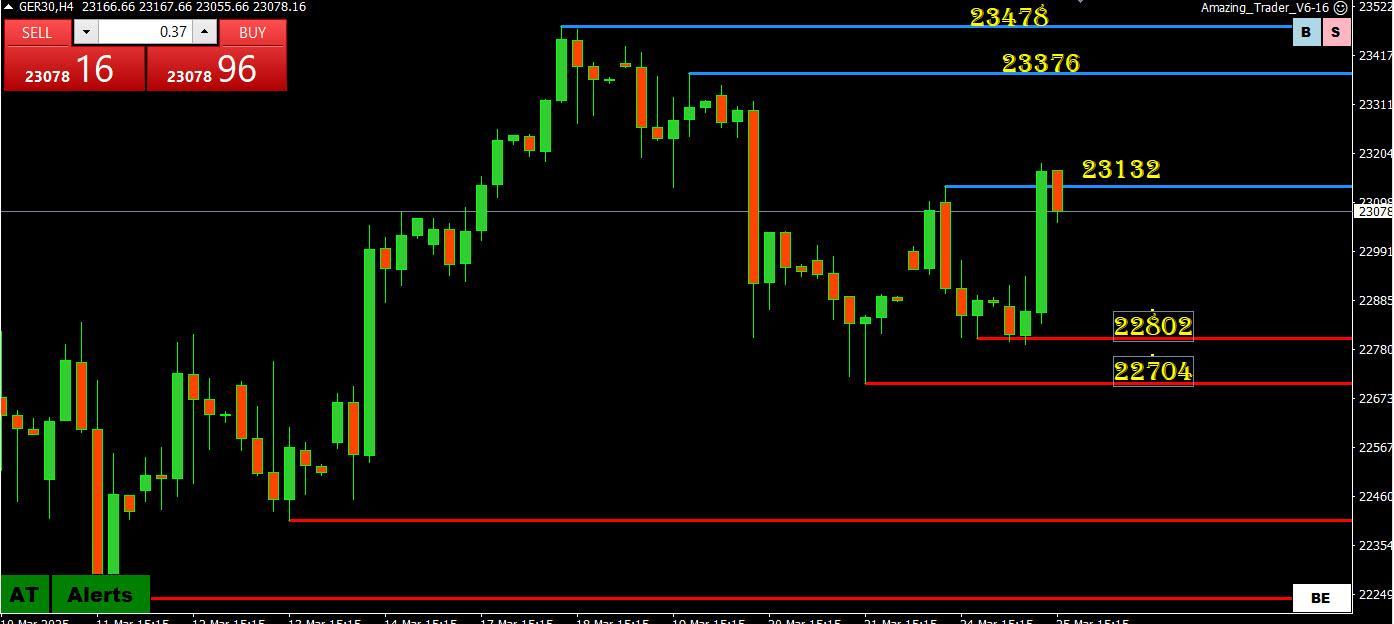

DLRx a bit on the backfoot this morning after failing to hold 104

Tariff morpho-dynamics still an issue for players.

Some squeakings from ECB gumflappers about possible “easing” pause in april

Other squeakings from US gumflappers suggested that relatively high dollar is contributing to trade imbalabce and that FX is a potential tool but not right away.

Trump repeated his wish for a lower dollar.The dollar has a nega-feel while under 104

FED yakkers kugler and williams on deck this morning

data-wise consumer conf and US housing numbersEuropean shares rise after German business morale improves in March

Baloise gains after results, lifts insurer sectorEnergy stocks track oil prices higher after Venezuela tariffs

German business sentiment rises in March, Ifo survey shows

STOXX 600 up 0.4%

European shares rose on Tuesday after a German survey indicated business sentiment improved in the region’s largest economy, days after a historic debt deal aimed at boosting stagnating growth.

The pan-European STOXX 600 index SXXP was up 0.4% at 0910 GMT. Most regional stocks markets rose, led by a 0.9% gain in Spanish stocks IBC, followed by an 0.8% advance in French shares PX1.

Energy stocks (.SXEP) jumped 1.1% as oil prices firmed for the fifth day on supply concerns after the U.S. announced tariffs on countries that buy Venezuelan crude.

Swiss insurer Baloise BALN advanced 6% to the top of the STOXX 600 after reporting a 60.6% surge in its 2024 profit. The broader insurers index (.SXIP) firmed about 1%.

A survey from Munich-based Ifo Institute showed the business climate index rose to 86.7 in March, in line with economists’ forecast, up from 85.2 the previous month.

Germany’s plans to invest hundreds of billions of euros in defence and infrastructure have led to upgrades for the euro zone economy, contributing to European equities outperforming their U.S. counterparts so far this year.

Investors are also keeping an eye on U.S. trade policy that has roiled global markets.

-

AuthorPosts

© 2024 Global View