Forum Replies Created

-

AuthorPosts

-

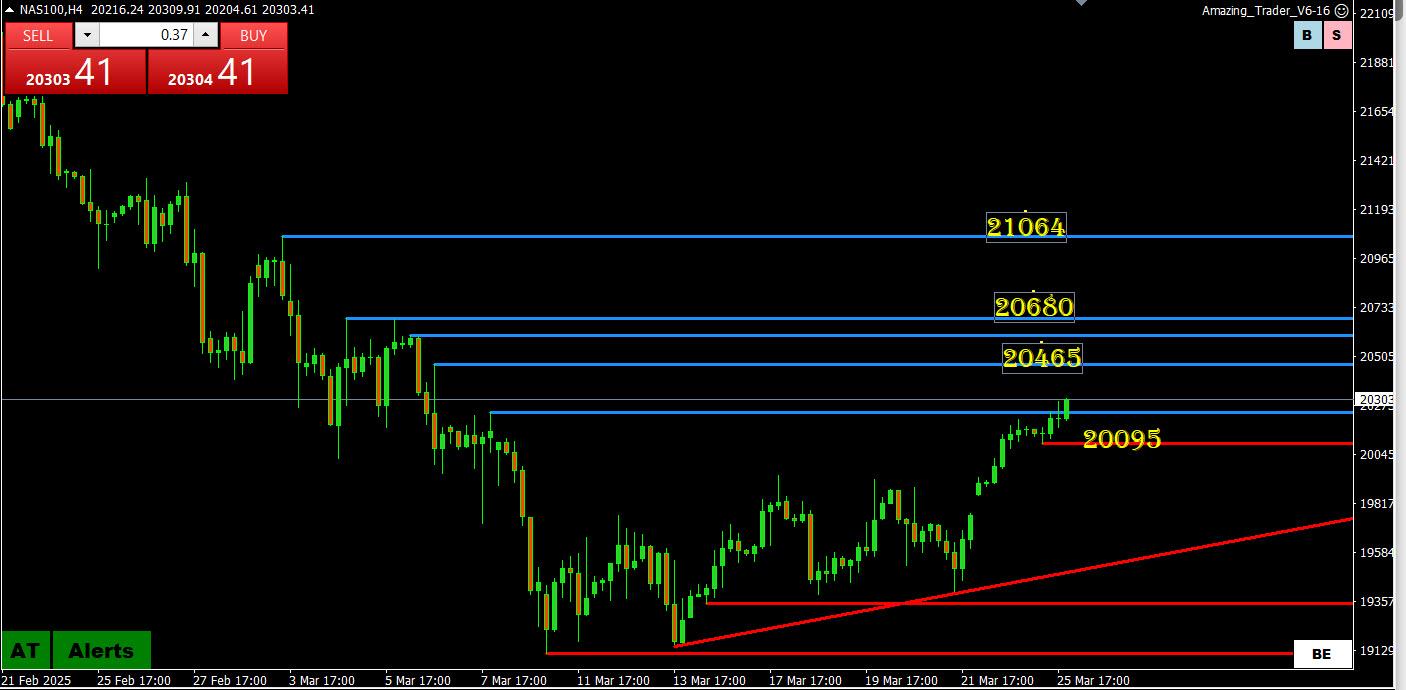

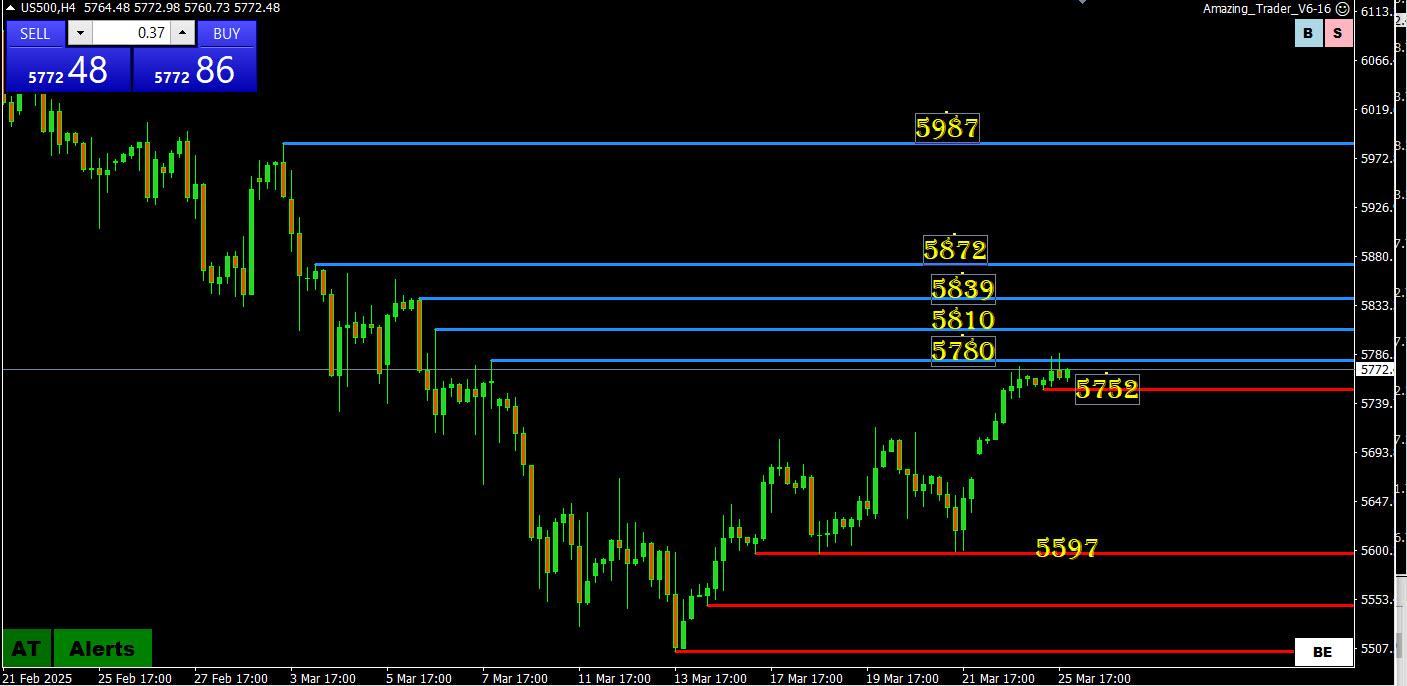

US500 4 HOUR = Wants to go higher but…

Creeping higher (.5788 high) but as this chart shows, it has stay above 5780, then get through 5800-10 and layers of resistance to put 6000 in play again.

On the downside 5750 needs to hold to keep a bid focused on 5800+. .

If 5800 fails to break, then 5700 = neutral within a 5600-5800 range.

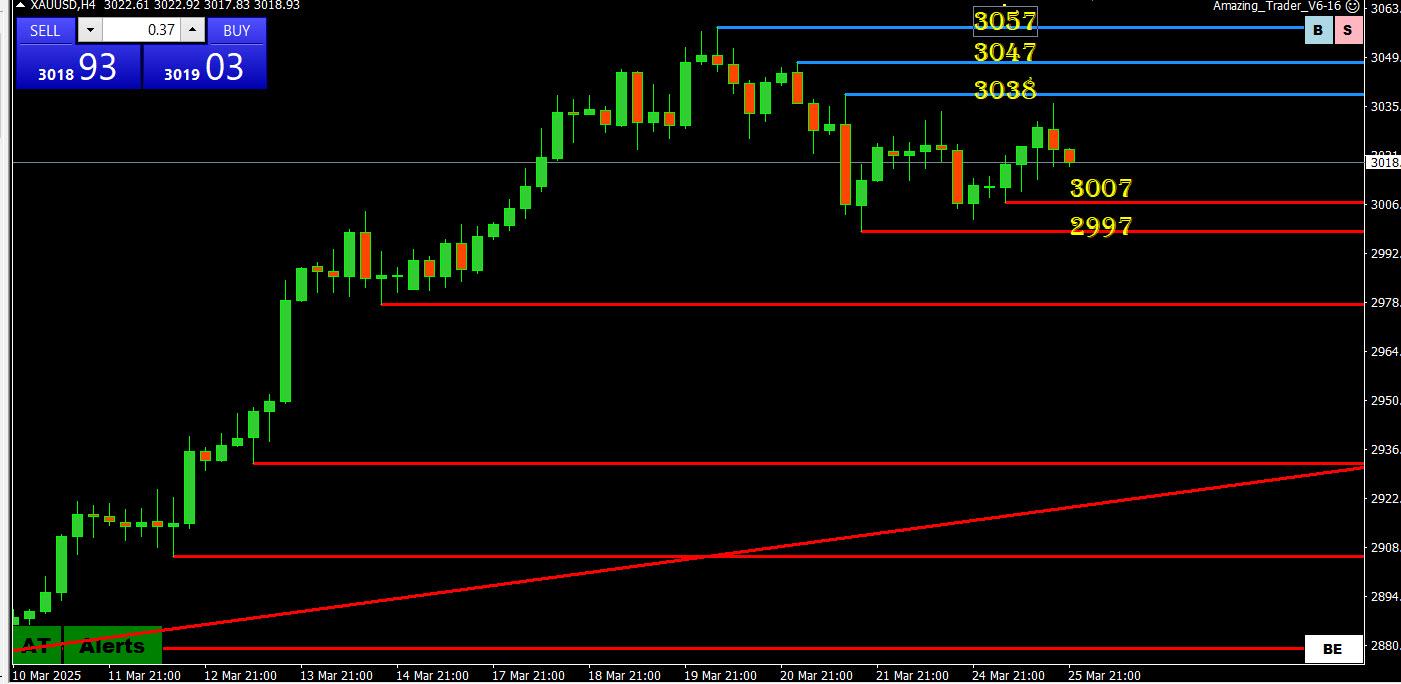

XAUUSD 4 HOUR CHART – The Power of AT

You can see the power of The Amazing Trader (AT), both its levels and logic by this earlier post, which is still valid (note the high was 3035).

Still consolidating between 2999 – 3038, seemingly biding its time for another run up unless 3000 is firmly broken.

Break of 3038 would cool lingering retracement risk

Break of 2999 would expose 2978, which is the key level to maintain the daily uptrend. .

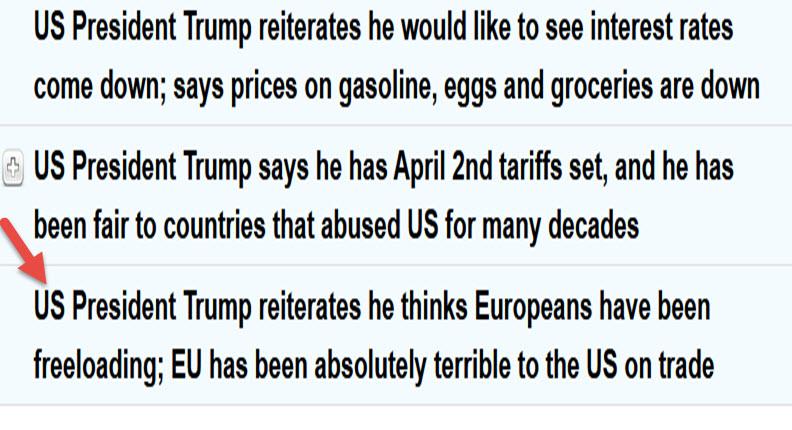

Another day, another set of Trump headlines

Talking down interest rates, singling out EU

Stocks edge up, US dollar dips as tariff uncertainty weighs

Dollar dips after hitting three-week high

Stocks rise modestly after strong rally

German business sentiment improves

Global stocks were slightly higher on Tuesday, after a sharp rally in the prior session on hopes U.S. President Donald Trump would take a more measured approach on tariffs than feared, while the dollar eased from a three-week high.

European shares paced the advance, while stocks on Wall Street oscillated between modest gains and declines in the wake of a sharp climb on Monday after Trump indicated that not all of his threatened levies would be imposed on April 2 and some countries may get breaks.

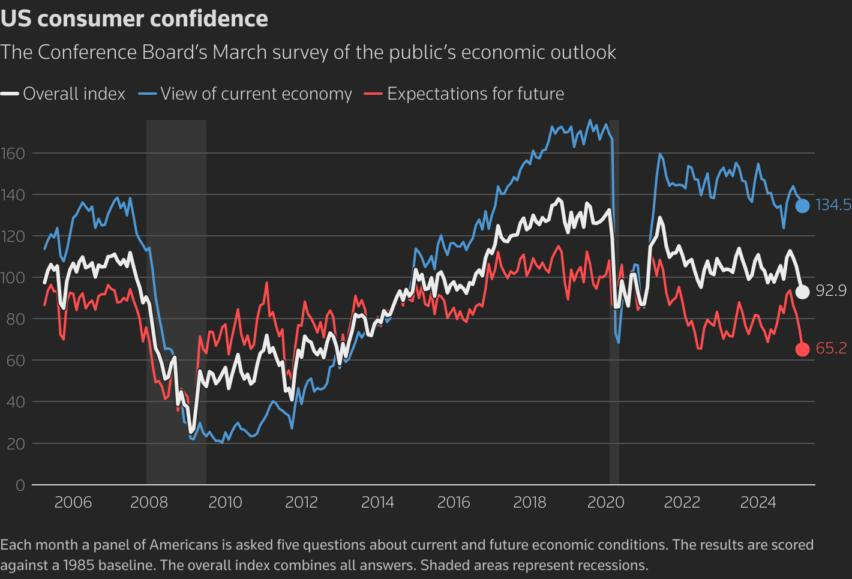

After initially opening higher, U.S. stocks lost ground after a reading on consumer confidence from the Conference Board fell 7.2 points to 92.9 in March, below the 94.0 estimate, the latest in a string of sentiment readings that have shown cooling.

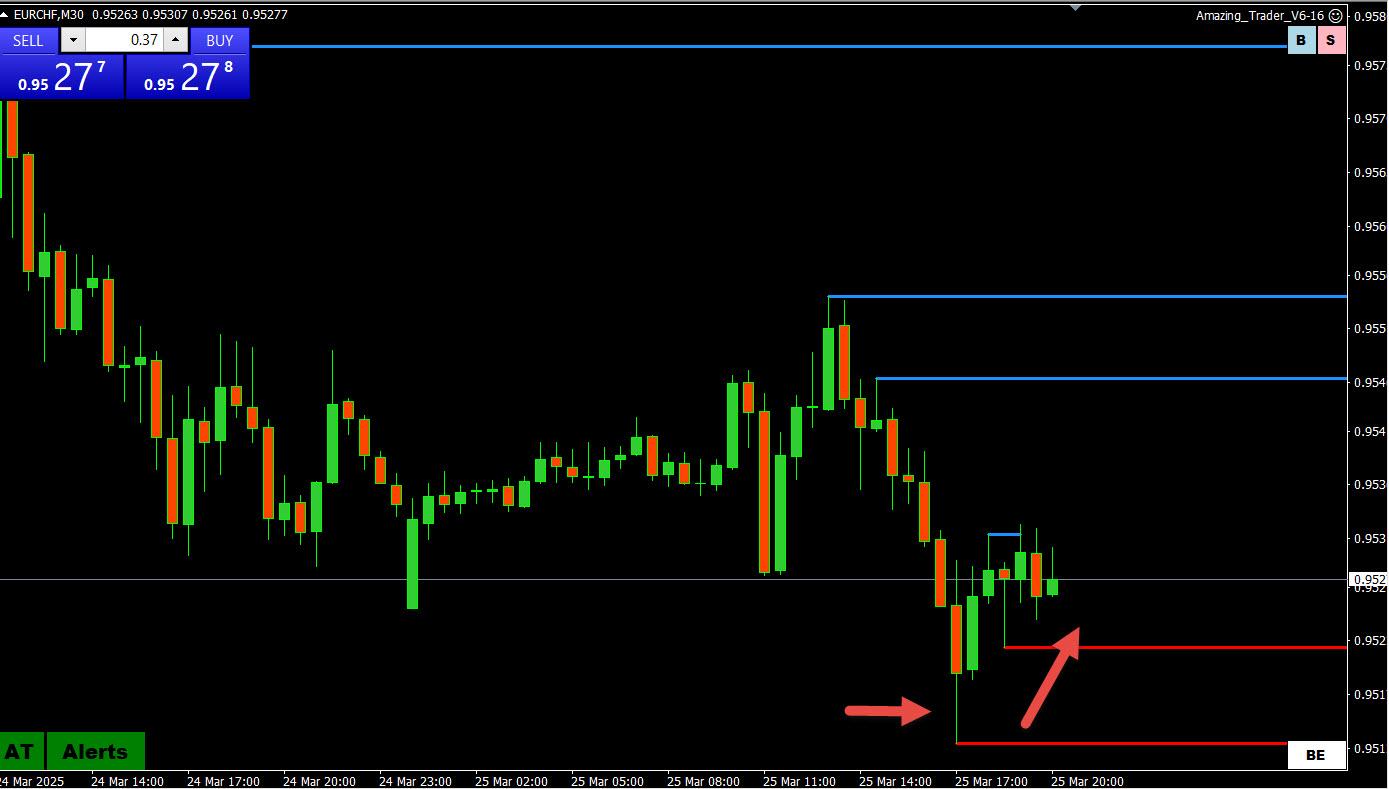

EURJPY 30 MIN – Dominant flow today

Note the price action in EURUSD 1.0810 ( vs. dip to 1.0799) and USDJPY 149.80 (vs 149.53 low) after whatever real money sell order was apparently filled and EURJPY bounced off its low.

As I have also noted, when USFJPY makes a sharp move and another currency lags badly or diverges, it is more often than not the result of an offset from a JPY cross.

Feel free to ask if this is not clear.

-

AuthorPosts

© 2024 Global View