Forum Replies Created

-

AuthorPosts

-

EURUSD brief black hole reaction to German news

EURUSS 15 MINUTE CHART — Headline risk

News Algo headline reaction then back to square one (1.0850)

EURUSD bounce just now from above 1.08 would need a solid 1.0850+ to shift the focus away from 1.08 and back to the 1.0888 high.

Bounce in EURJPY just now seemed to coincide with a modest bounce in US stocks off the lows.

In the current environment, look for stock market bounces to lack follow through, for exampole, as long as US500 stays below 5800

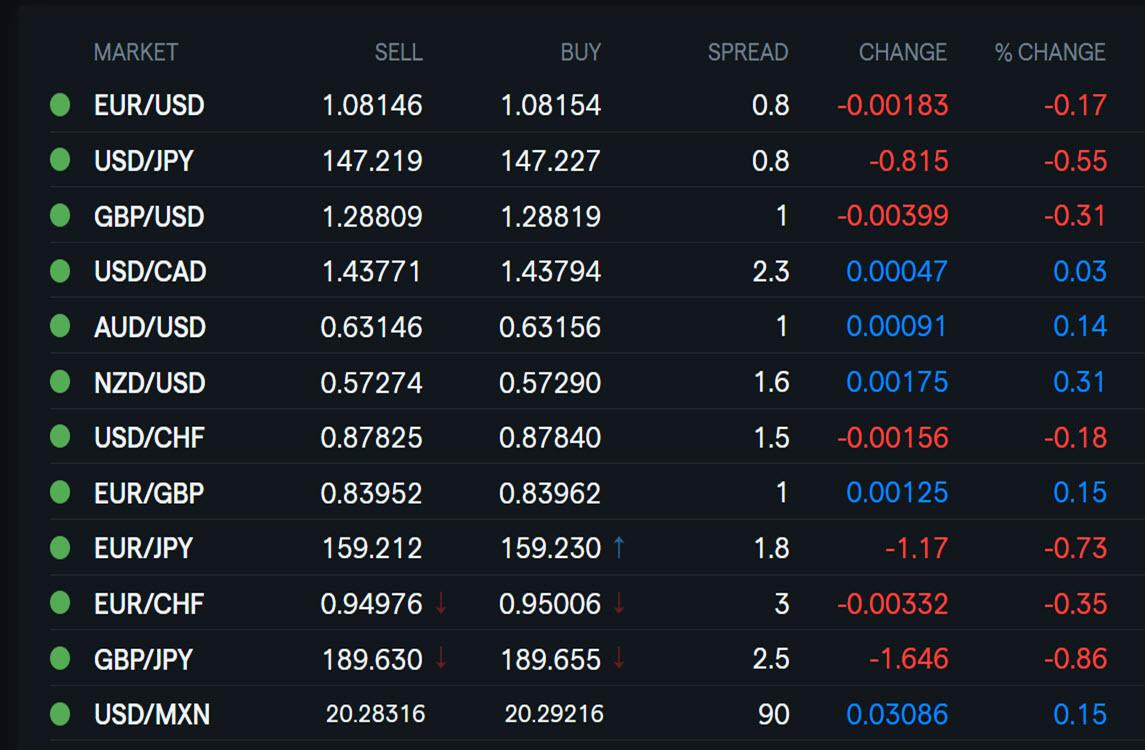

Using my platform as a HEATMAP

Mixed start to the week

EURUSD backing off towards (but still above) 1.08.… USDJPY weaker ==> EURJPY weaker (GBPJPY as well) asa JPY gets safe haven flows.

AUDUSD, NZDUSD a touch firmer, USDCAD about unchanged

Tariffs, trade war risk, recession talk weighing on US equities

The Savvy Trader was ahead of the curve when he wrote this article’

Is the U.S. headed for a recession by the Savvy Trader?

Light calendar so another headline watching day after Trump weekend comments (scroll below) added to a risk off mood

Early call on US stocks : lower

Recession fears: President Trump declined on Sunday to rule out the possibility that his economic policies, including aggressive tariffs against America’s trade partners, would cause a recession. In an interview aired on Fox News, Mr. Trump also told Maria Bartiromo, the host of “Sunday Morning Futures,” that he was considering increasing tariffs against Mexico and Canada. When asked if he was expecting a recession this year, Mr. Trump responded that “I hate to predict things like that” and that there would be “a period of transition,” but that eventually “it should be great for us.” Read more ›… NYT

Early call on US stocks : lower

Recession fears: President Trump declined on Sunday to rule out the possibility that his economic policies, including aggressive tariffs against America’s trade partners, would cause a recession. In an interview aired on Fox News, Mr. Trump also told Maria Bartiromo, the host of “Sunday Morning Futures,” that he was considering increasing tariffs against Mexico and Canada. When asked if he was expecting a recession this year, Mr. Trump responded that “I hate to predict things like that” and that there would be “a period of transition,” but that eventually “it should be great for us.” Read more ›… NYT

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

This week’s economic outlook focuses on key global trends. In Asia, China may introduce stimulus measures following its National People’s Congress, as policymakers shift to a “moderately loose” monetary stance. Meanwhile, India and Australia monitor inflation and confidence data for signs of economic shifts. In Europe, Germany’s struggling manufacturing sector remains a concern, though potential defense spending increases could offer future support. The Eurozone continues battling weak industrial output. In the U.S., recession risks are rising as job growth slows, inflation remains high, and consumer sentiment declines. The Fed is expected to hold interest rates steady as uncertainty looms.

Econoday

Trading Tip 12: Why News Matters!

News drives markets and it is the surprise in news or economic data that triggers the larger reaction. Most traders look forward to key news events as it more often than not is followed by some volatility.

While some technical traders say news does not matter anyone who trades these days knows better. So don’t trade with blinders on. You need to stay on top of what news is due and what is expected as markets move most when there is a surprise (i.e. miss vs. market expectations.

Tip: Remember, it is the reaction to news more than the news itself that gives us clue to a currency’s (or any instrument’s) strength or weakness.

Newsquawk Week Ahead: Highllights 10-14th March 2025

Highlights include US CPI, UoM, BoC, UK GDP and Norwegian CPI

-

AuthorPosts

© 2024 Global View