Forum Replies Created

-

AuthorPosts

-

EURUSD 4 HOUR CHART – Out of steam

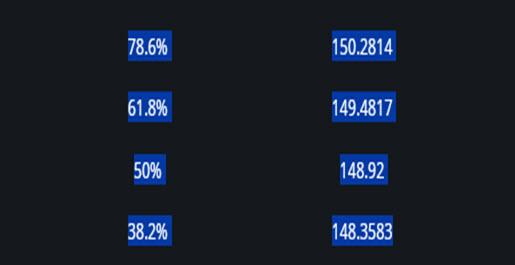

What caught my eye is the failure to trade above 1.09 (high 1.0897) after past two days testing above it.

This chart shows a classic AT (Amazing Trader) down ladder pattern (falling blue lines) with a risk for 1.0800-35 while below 1,0875. BUT would have to first get through the pivotal 1.050 level first.

Back above 1.09 would be needed to restore the BID.

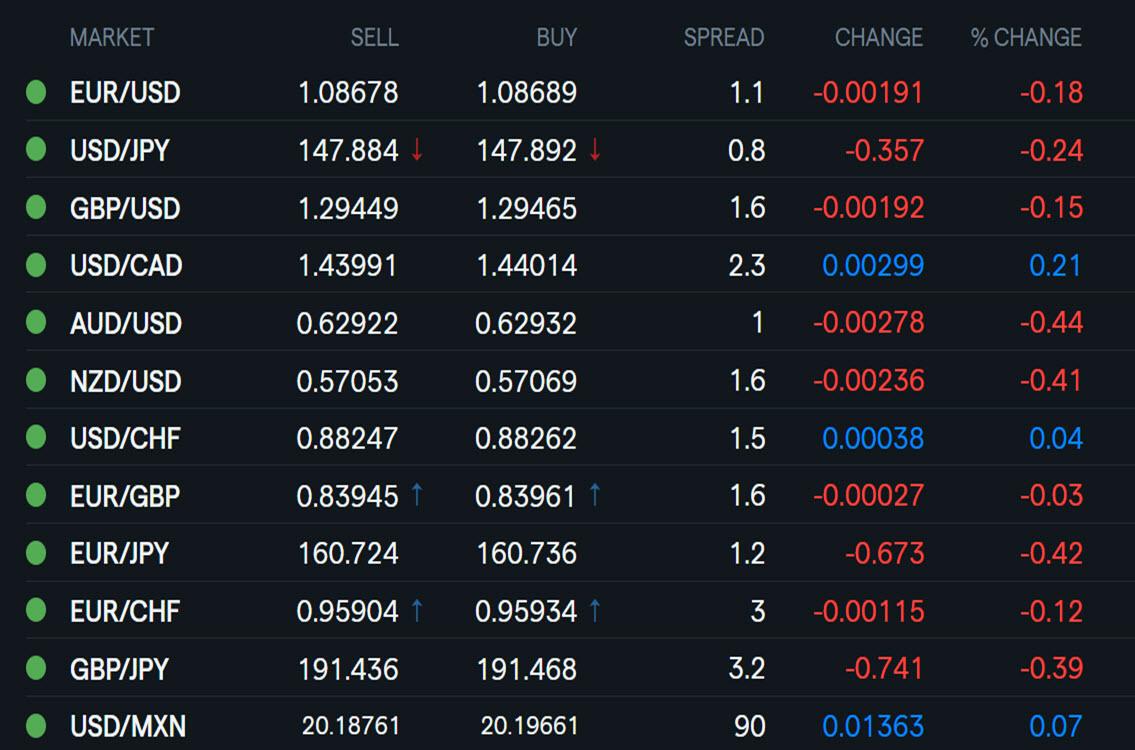

Using my platform as a HEATMAP shows

A reversal of fortune from this time yesterday

JPY firmer, both vs the dollar (USDJPY back below 148) and on its crosses (note EURJPY weaker) as mood turns back to risk off.

Dollar a touch firmer elsewhere. EURUSD so far failed to trade 1.09+ after 2 days testing above it Commodity currencies trading weaker.

Looking ahead

US PPI and Weekly jobless claims

G7 foreign ministers meet in Quebec amid rising trade/tariff tensions

Looming U.S. shutdown at 12:01 AM Saturday unless there is an agreement to extend funding the government

With stocks bouncing from the lows, bond yields following, the FX market is not sure whAT PATH TO FOLLOW while USDJPY remains well of the 149+ high but still up on the day above 148.

EURUSD is back to about unchanged on the day in what seems to be setting up to be an FX range afternoon with the focus mainly on US rquities.

Trading Tip

When in a strong trend, there often needs to be a correction to shakeout the weak longs (or shorts), which in turn sets up a run at a new high (or low) as the market has less capacity (fewer longs or shorts) to absorb fresh buying (or selling).

See if this proves to be the case after the earlier stock market shakeout.

US500 4 HOUR CJART – 5500 PAUSE but…

As I noted, 5500 looks like an inviting target that has potential for a pause.

While the move back above 5645 ran some stops,, it would need a firm move above it to confirm it was anything more than a dead cat bounce. .

Otherwise, to slow the downside,, big figures like 5600, 5700, 5800 would need to be regained and become support.

Back below 5571 would put the 5527 low in oplay again.

. -

AuthorPosts

© 2024 Global View