Forum Replies Created

-

AuthorPosts

-

CHART OF THE WEEK – US500 WEEKLY

With the focus on equities to set the risk on/risk off mood, the current pattern in US500 is my chart of the week.

The current pattern is 4 weeks in a row down… lower highs/lowerxlows => 4 red candles

To break the pattern and reverse the risk it would need a higher low/higher high above 5750).

An inside week would suggest just a pause.

Extending the pattern would be bearish, which makes the 5504 low most important.

Trading tip 13: Stay Alert! Markets Move When There is a Surprise

It does not take a rocket scientist to quickly realize that global markets move when there is a surprise vs. expectations. This is true for key economic reports as well as other key market events.

Positions are often tilted to one side or the other based on market expectations ahead of a key event. You need to stay alert to consensus forecasts so you know how to react to a surprise, either one that exceeds or misses expectations.

As with any trade, you need to be aware of the overall technical picture in any decision to go with or fade a reaction to a surprise and whether there are any levels that would accelerate or reverse the prevailing trend. As always, it is the reaction to news that will tell you more than the news itself.

The key is not to become complacent before a key event as it is easy to get lulled into a feeling that it will be a non-event, especially when a market is trading in a tight range. While this may sound like an obvious tip, you would be astounded how many ignore it.

Tip: Stay in touch with market expectations so you know how to react in case of a surprise.

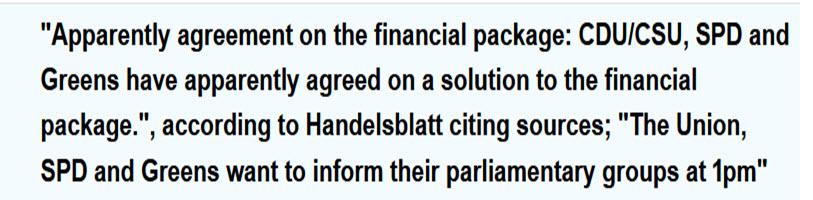

DAX Up Over 1% on Optimism from Fiscal Agreement

Frankfurt’s DAX gained ground to trade more than 1% higher around 22,890 on Friday, outperforming peers, on reports that Germany’s chancellor-in-waiting Friedrich Merz reached an agreement with the Greens today on a massive increase in state borrowing.This comes just days ahead of a parliamentary vote next week.

Meanwhile, trade continued to monitor trade tensions, geopolitical events and corporate news.

US Year-Ahead Inflation Expectations at Over 2-Year High

The year-ahead inflation expectations in the United States climbed further to 4.9% in March 2025, the steepest since November 2022, accelerating from February’s 4.3%, according to the preliminary estimate from the University of Michigan Consumer Survey.

This marks the fourth consecutive month of increases.

In the meantime, the five-year outlook quickened to 3.9% in March, from 3.5% in the previous month.

German stocks lead European shares rally after report of massive debt deal

Key points:· German debt deal needs two thirds majority for plans, vote slated for Tuesday

· STOXX 600 up 0.8%, Germany’s DAX set to erase weekly losses

· UMG falls after Ackman’s Pershing reduces its stake

· Kering plunges after Gucci appoints Demna as artistic director

· BMW falls on soft auto margin guidance for 2025

German shares led a broad rally in European stocks on Friday, after a report of a historic deal to raise state borrowing in the region’s largest economy.

The pan-continental STOXX 600 SXXP climbed 0.8% as of 1200 GMT, with banks (.SX7P) and defence stocks (.SXPARO) among the top gainers, jumping 1.9% and 2.9% respectively. Germany’s benchmark DAX DAX rose 1.9%, erasing its losses for the week.

Conservative Chancellor-in-waiting Friedrich Merz reached an agreement with the Greens on Friday on a massive increase in state borrowing ahead of a parliamentary vote next week, a source close to the negotiations told Reuters. A debt deal compromise was now being examined by finance ministry officials, parliamentary sources said.

Ugky U of M report…

Big miss on headline sentiment… inflation expectations up sharply

See our Economic Calendar

Gold Pushes Above US$3,000 for First Time as Trade Turmoil Spurs Safe-Haven Demand

Gold traded at a record high early on Friday, rising above US$3,000 for the first time, as falling stock markets and global economic turmoil spurred by U.S. President Donald Trump’s trade wars spur safe-haven buying.

Gold for April delivery was last seen up US$16.10 to US$3,007 per ounce, rising off Thursday’s record close of US$2,991.30.

The price of the metal has climbed 13% since the start of the year as investors turn to the metal as a store of value with global stock markets falling as Trump’s tariffs and threats upset international trade flows, while U.S. inflation eases, raising hopes the Federal Reserve will cut interest rates, lowering the carrying cost of owning gold.

“Gold continues to price uncertainty, specifically tariff uncertainty. While economic uncertainty is rising, vibes and sentiment are deteriorating, and recession probabilities have risen well above 30%, we still view gold’s price patterns as tied to tariffs. While inflation data showed prices rose at the slowest pace in four months (leading some to think the Fed can ease sooner), we are reminded that, when tariffs hit, there will likely be inflationary impacts,” Christopher Louney, a commodities strategist at RBC Capital Markets, wrote.

A weakening dollar also offered support to gold. The ICE dollar index was last seen down 0.13 points to 103.7.

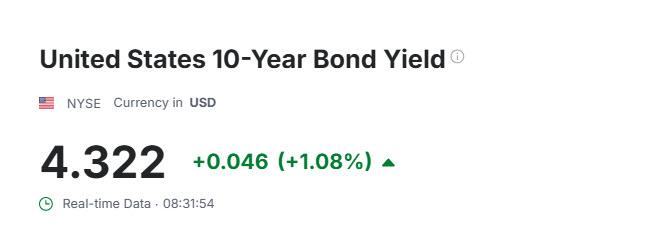

Treasury yields were steady, with the yield on the U.S. two-year note last seen up 0.1 basis points to 3.981%, while the 10-year note was paying 4.313%, up 0.4 points.

The event risk seems to be a positive “peace” related hewdline one of these days

XAUUSD – Gold Daily

I mentioned this possibility last night:

There is one possibility – for Gold to hold above 2980.00 overnight and continue straight up tomorrow – high risk trade.

It held and Gold hit a new high today.

Support is still at 2980.00 , followed by : 2955.00 & 2940.00

Target is now at 3105.00

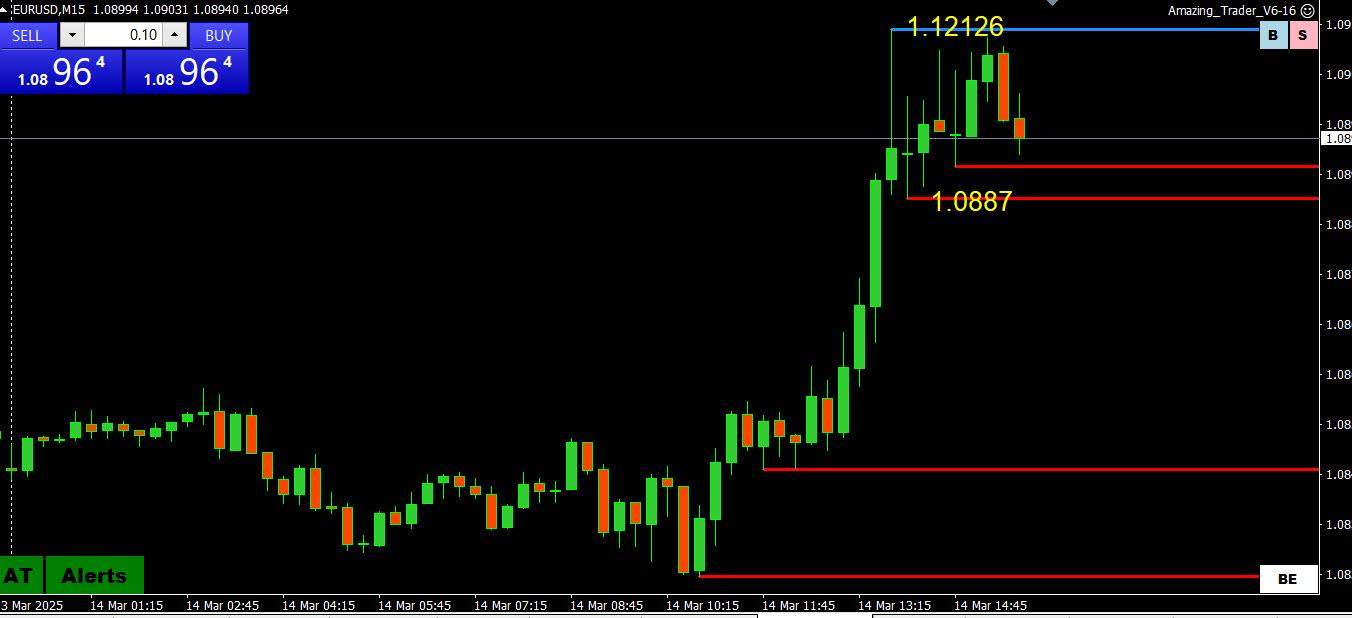

EURUSD 15 MINUTE – Symmetric range

Current range is around 13 pips either side of 1.09 (1.0887-1.0913) … should be some bids below the market by those caught out by the debt news spike BUT on the other side, as the chart shows, it hit a wall at 1.09126

Feels like one of those Fridays unless Trump throws us another tweetstorm comment.

US OPEN<

Spot Gold makes a fresh record high above USD 3000/oz & sentiment lifts ahead of Trump Executive Orders and UoM

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

Stocks gain with sentiment lifted after a strong Chinese session overnight and after the recent market turmoil.

USD mixed vs. peers, GBP soft post-GDP, JPY weighed on by Rengo data, which showed average wage hike less than demands.

Gilts gap higher on soft growth data while JGBs lift on Rengo.

Spot gold makes a fresh record high above USD 3,000/oz; crude oil and base metals benefit from the risk tone.

-

AuthorPosts

© 2024 Global View