Forum Replies Created

-

AuthorPosts

-

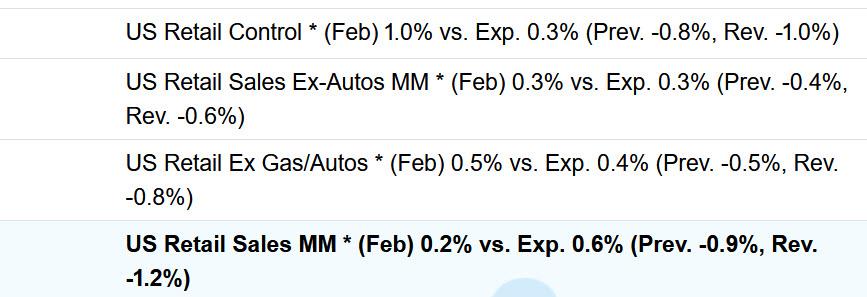

Mixed retail salaes… headline miss vs rest of the report…big miss in Empire manuf ignored … stocks, bond yields, dollar all tick up

US retail sales up next … See our Economic Data Calendar

US OPEN

US equity futures are softer & Crude bid after Trump orders strikes in Yemen; US Retail Sales due

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

• US Senate voted 54-46 to pass the stopgap funding bill to keep the government funded through September 30th.

• European bourses modestly firmer whilst US futures are in negative territory.

• USD is a touch softer ahead of a risk-packed week; Antipodeans benefit from Chinese data and as China unveiled a plan to boost weak consumption.

• EGBs bid with OATs leading after Fitch while Bunds await fiscal updates.

• Gas deflates after US President Trump said he will speak with Russia’s President Putin on Tuesday and may have something to announce on Ukraine-Russia talks by Tuesday.Guys, please do not ask me for straight forward trading advices – it is up to you to trade based on your own knowledge and trading strategies.

I am posting my view and general direction on different pairs on the Main Forum and will continuously do it.

This is a Challenge and once it is over we can continue with some advanced techniques and tips later on right here…but for now do the best that you can 😀

GBPUSD 4H

Is this a start of run to 1.32 ?

Supports: 1.29400 & 1.29300

Resistances: 1.29750 & 1.29900

We’ve been watching a consolidation from 12th March and it is starting Up again.

Now I don’t want to bother you with details, but one is very important – how Cable is going to close this bar – for more advances I prefer somewhere around 1.29500 and then for the new high.

Worst case scenario is if it closes close to the previous high – than expect a pull back towards MA’s

EURUSD DAILY CHART – 5 days in a row

Past 5 days trading around 1.09 except one day when the high was 1.0897 (close enough)

Range over this period has been 1.0822=-1.0947… midpoint is 1.08845 as a reference level.

Next directional move will be dictated by whether 1.09 becomes a solid support or resistance…. looking at this chart shows either uptrend out of steam so consolidting

Using my platform as a HEATMAP shows

A cautious start to what will be an event filled week with the dollar trading a touch sotter except vs a steady JPY..

XAUUSD is higher below 3000.

Trump to talk with Putin on Tuesday in ending the Ukraine-Russia war.

U.S. Retail Sales due…See a detailed preview.

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The March 18-19 FOMC meeting is the key focus of the week. Fed Chair Jerome Powell’s March 7 remarks aimed to maintain market stability, emphasizing that monetary policy decisions will be based on economic data rather than external policy changes.

Powell highlighted a steady labor market with moderate hiring and low layoffs outside tech and government. He stated that the U.S. economy is in a “good place” and that the Fed can be patient, keeping the fed funds target range at 4.25-4.50% since December 2024.

Markets do not expect a rate change at the FOMC’s March 20 announcement, but the release of the quarterly Summary of Economic Projections (SEP) will be analyzed for signs of a 2025 GDP slowdown, rising unemployment, or persistent inflation. Powell’s press briefing may address how White House policies have influenced forecasts.

Additionally, the Fed may consider ending its balance sheet reduction program, which has cut reserve holdings by $2 trillion since mid-2022. The current $6.5 trillion balance may now be considered sufficient, shifting from “abundant” pandemic-era reserves to “ample” levels preferred by policymakers.

Econoday

Interview with The Sunday Times Luis de Guindos, Vice-President of the ECB, 16 March 2025

…we need to consider the uncertainty of the current environment, which is even higher than it was during the pandemic.

You said the uncertainty now is even greater than during the pandemic. How would you characterise it? What are the big unknowns at the moment?

First, the policies of the new US Administration. There’s a lot of talk about tarif…

-

AuthorPosts

© 2024 Global View