Forum Replies Created

-

AuthorPosts

-

US OPEN

US futures modestly lower amid tariff reports, GBP lags & EUR/USD attempts to reclaim 1.08

Good morning USA traders, hope your day is off to a great start!

Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

Tariffs in focus amid reports that Trump could implement copper tariffs in weeks, elsewhere reports that Canada could find some reprieve

European bourses opened firmer but have since slumped, US futures are in the red but only modestly so

GBP lags after UK CPI, EUR/USD attempts to reclaim 1.08, USD/JPY rebounded overnight but is off highs

Gilts gapped higher on data and extended but have retreated to opening levels into the Spring Statement, USTs softer while Bunds are firmer but only modestly so

Crude continues to inch higher with a handful of factors underpinning, TTF slips as talks continue, Copper soared on tariff updates but has since pulled back

Market Could Be Underpricing U.S. Tariff Risks For Euro

The market is underpricing the risk to the euro from U.S. reciprocal tariffs set to take effect on April 2, ING’s Chris Turner says in a note. “The EU (led by Germany) runs a large trade surplus with the U.S. and will likely, alongside China, be at the forefront of Washington’s reset on global trade.” The euro last trades flat at $1.0793 and ING expects it to fall to $1.05 by the end of the second quarter due to U.S. tariffs.

DAX – ger30 4H

Resistance at 23.200 held firmly and sent DAX towards supports : 22.950 & 22.700

So far they are holding.

Next 4h bar opens in cca 50 min, and depending on the close of this one we’ll have following:

– Above 22.970 will give a chance for DAX to try Up again

– Below 22.950 DAX might dive seriously

Last support is at 22.725 – loss of opens a way for 22.425

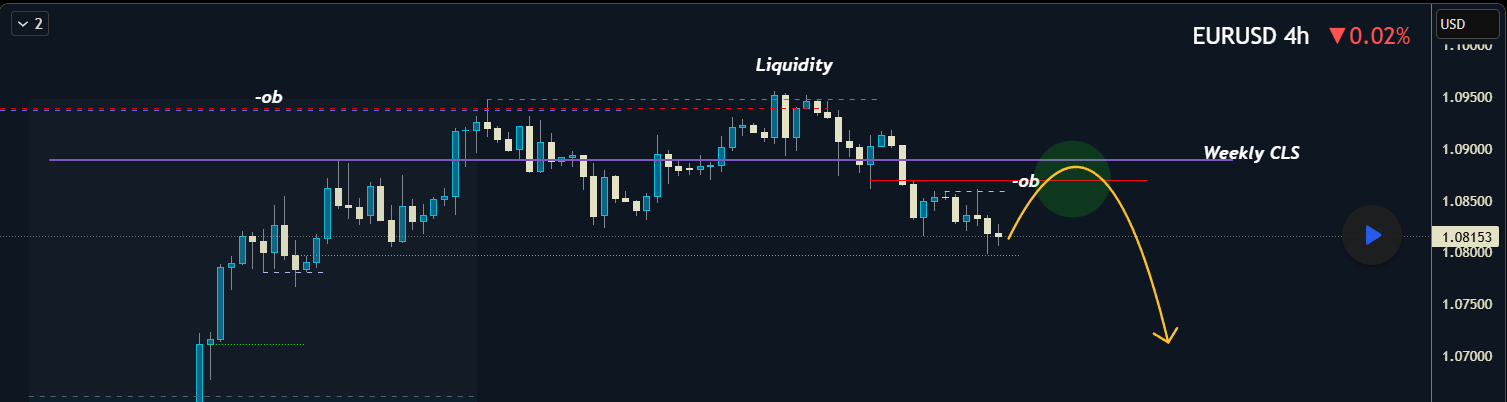

EURUSD DAILY – 4 DAYS IN A ROW

1.08 has printed 4 days in a row… the longer this pattern goes on the greater the risk of a directional move once it is broken (note what happened at 1.09).

Key supports: 1.0777 (double bottom) , 1.0765

Key resistance: 1.0830

See JP’s timely post about EURGBP topping out and how EURUSD lost its bid after.

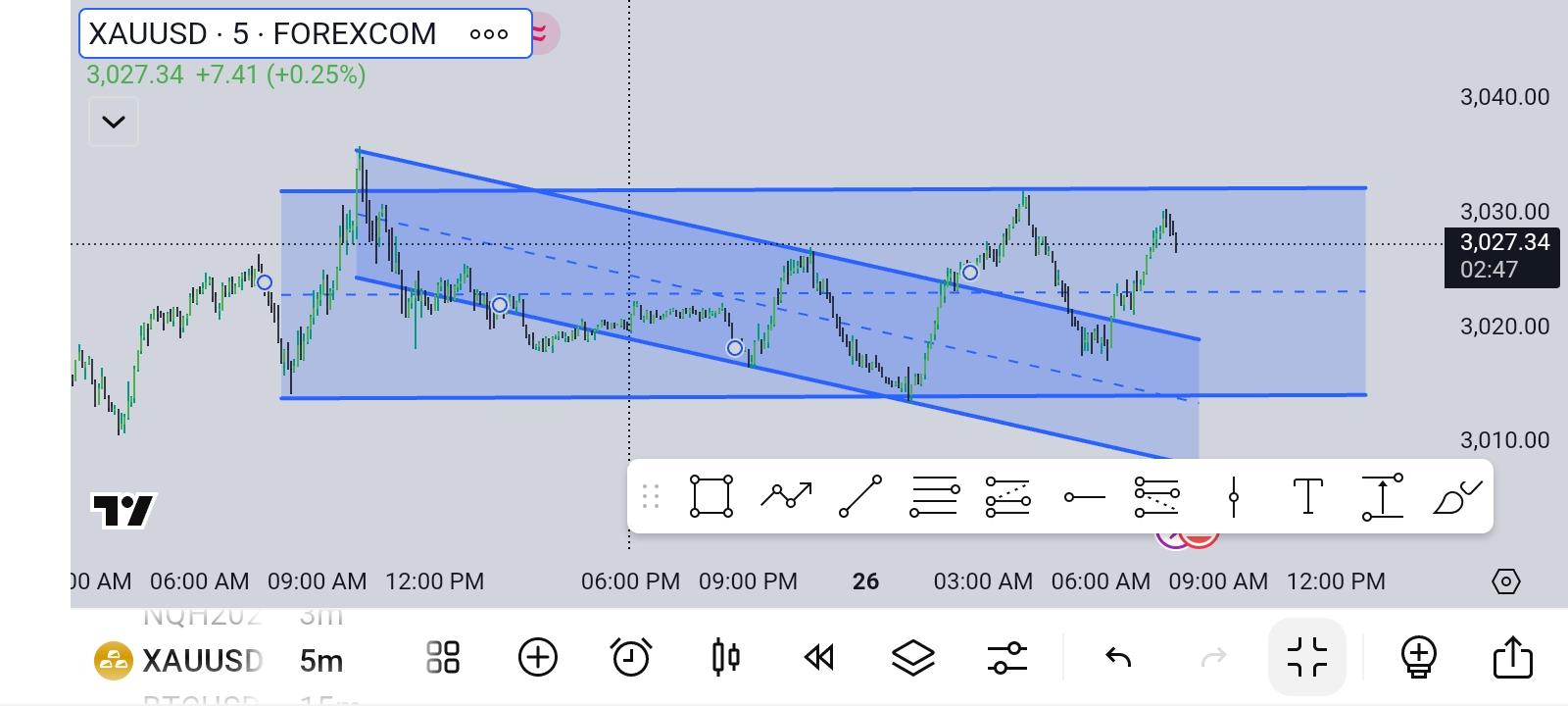

XAUUSD 4 HOUR CHART – Glass half empty or half filled?

Continues to consolidate between 2999 – 3038,

Glass half fllled: biding its time for another run up unless 3000 is firmly broken… above 3038 would be needed to end lingering retracement risk and put 3047-57 in play again

Glass half empty: lingering retracement risk while below 3038… would need to break 2999 to extend it

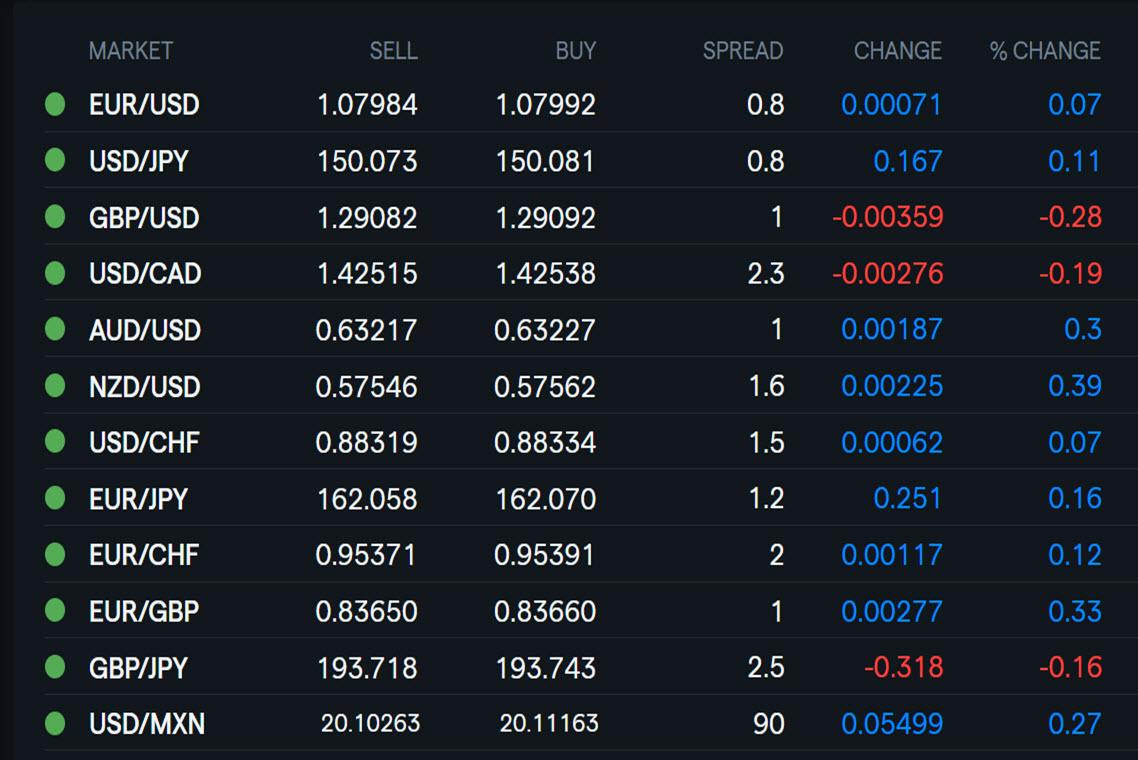

Using my platform as a HEATMAP shows

… uncertain markets looking ahead to quarter end and reciprocal tariff day on April 2

Mixed USD

EURUSD focus still on 1.08 after another test of 1.0777 (2-day double bottom)… support coming fro a firmer EURGBP and lesser extent EURJPY

GBPUSD lower after cooler UK inflation (EURGBP firms)

USDJPY back above 150 after holding above 149.49 yesterday

USDCAD a touch weaker dezpite tariff uncertainty

U.S. stocks a touch weaker

XAUUSD in a wait and see mode

Looking ahead… light US data calendar, awaiting next Trump headline

USDJPY 4 HOUR – WHY LEVELS MATTER

This chart was posted early on today and see how USDJPY came down just above 149.49 key support (low was 149.53)

This is no coincidence… Levels and patterns formed by the Amazing Trader charting algo matter

If you would like a 30 day free trial, go to the member benefits page in GTA (if not a member sign up, free)

-

AuthorPosts

© 2024 Global View