Forum Replies Created

-

AuthorPosts

-

Chicago PMI beat confirmed… See our Economic Data Cakendar

EURO 1.0812-ish (after unably breach N of 1.0850)

I am biased. currently indifferently.

German CPI was almost comical, BUT … got to trade the numbers offeredin just a little bit bigger windowframe , the puppy is bounded by 1.0750 and 1.0850

current pricing dynamic suggests playsr are loath comitting bigtime one way or the otherfears … worries … LoL

and degenarte traders ask: where and how to profit

my version of DLRx is at 103.75

and chart signal suggest puppy needs to hold the level

if not the construct would go “bearish” from current consolidationthis first week of the month, outside of tariffs, will see some incoming data fpr players to consider:

ISM, PMI, NFPStocks slide. Bonds, gold buoyed as tariffs stoke recession fears

STOXX 600 falls 1.7%, U.S. futures lower

Nikkei dives over 4%

Trump says US tariffs to cover all countries

Flight to safety buoys bonds, gold hits record

Major global share markets fell sharply on Monday and gold surged to another new record after U.S. President Donald Trump said tariffs would essentially cover all countries, stoking worries a global trade war could lead to a recession.

Seeking any safe harbour from the trade storm, investors piled into sovereign bonds and the Japanese yen and pushed gold prices to another all-time high.

Brent BRN1! rose 0.8% to $74.24 a barrel, while U.S. crude CL1! added 0.4% to $69.65 per barrel as U.S. President Trump has threatened secondary tariffs on buyers of Russian oil if he felt Moscow was blocking efforts to end the war in Ukraine.

“For the first time in years, we find ourselves genuinely worried about risk assets,” said head of rates markets at Barclays.

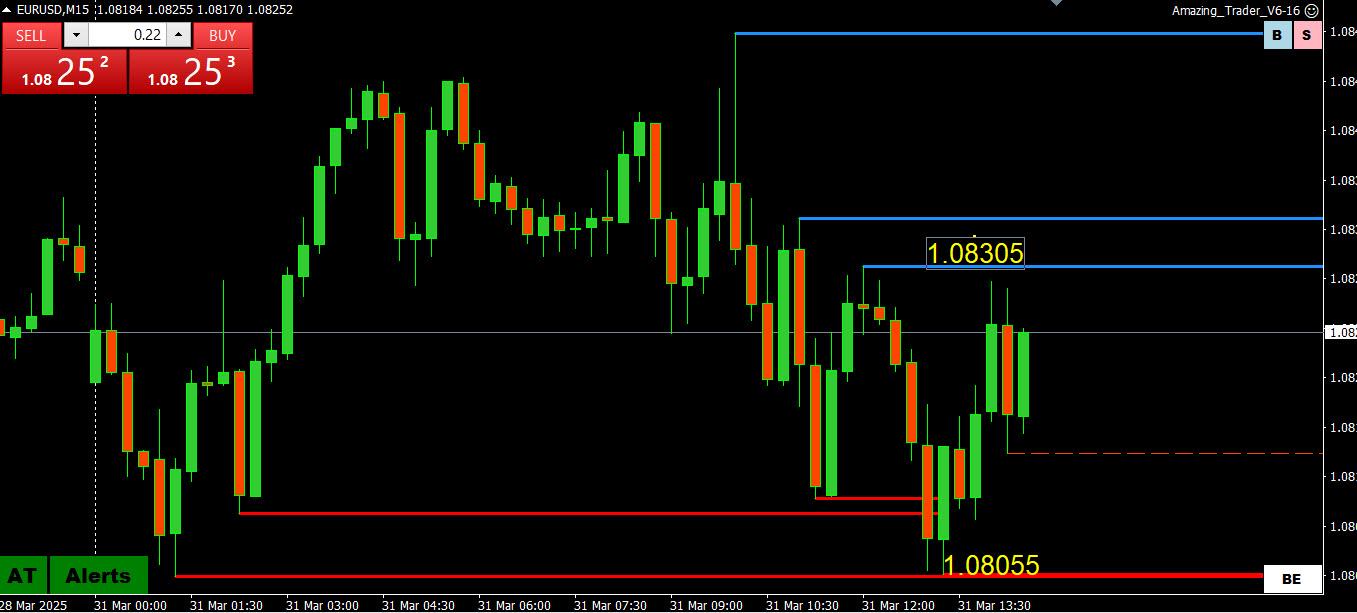

EURUSD 15 MINUTE – NO COINCIDENCE

Anyone who used the Amazing Trader (AT) knows the bounce off 1.0805 (double bottom) is not a coincidence. Not only are the patterns formed by AT lines amazing but so are the levels on its charts.

Looking at this chart, using AT logic, to confirm the low is in and downside risk negated, 1.08305 would need to be broken.

Note, a 30 day free AT trial (and half price subscription after, cancel any time, is available to GTA members.

Sign up for GTA (free) and look in the member benefits section.

Gold Soars Above $3,100 on Tariffs, Geopolitical Turbulence

“Gold is one of the best-performing major commodities this year, driven by trade frictions, economic uncertainty, central bank buying, and inflows into ETF [exchange-traded funds] holdings,” ING commodities strategists Ewa Manthey and Warren Patterson said. “We see uncertainty over trade and tariffs continuing to buoy gold prices.”

Major banks have raised their price forecast for the yellow metal this month, with Goldman Sachs saying it now sees it at $3,300 an ounce at the end of the year from $3,100 previously on stronger-than-expected ETF inflows and sustained central-bank demand.

-

AuthorPosts

© 2024 Global View