Forum Replies Created

-

AuthorPosts

-

To add a few more lines to the picture usd/cad looks like range. Trapped between the upward sloping trendline as resistance and the 200 period mov avg (the yellow line) which it seems to show a good degree of respect for. The upward sloping nature of everything leaves me biased towards upside. Until it’s not (below yellow line)…

USDCAD Swings Lower: Range Trading or Downtrend Resumption?

USDCAD has experienced some volatility recently, breaking above resistance, pulling back, and now testing support. Let’s analyze the technicals to understand what this means for the pair’s near-term direction.

From Breakout to Range Trading?

Resistance Breached: USDCAD initially broke above the key resistance level of 1.3543, suggesting potential upside.

Pullback and Support Test: However, the pair has since pulled back and broken below the 1.3510 support level.

Range Trading Possibility: This price action suggests a potential range trading scenario between 1.3358 and 1.3585.Further Downside or Bounce in Sight?

Next Support Level: If the downtrend continues, the next potential support level to watch is 1.3412.

Breakdown Implications: A breakdown below 1.3412 could signal a resumption of the downtrend from 1.3176, with targets at the key support of 1.3358 and potentially even lower at 1.3300 and 1.3176.Hope for Upside Rebound?

Initial Resistance: If the sellers lose momentum and buyers step in, the initial hurdle to overcome is the 1.3520 resistance level.

Upside Potential: Reclaiming this level could trigger a retest of the previous resistance at 1.3585.

Overall SentimentThe technical picture is mixed for USDCAD. While the breakdown below 1.3510 suggests potential downside, the possibility of range trading within a defined range cannot be ruled out. Monitoring the price action around the mentioned support and resistance levels will be crucial to confirm the pair’s next move.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Please conduct your own research before making any trading decisions.

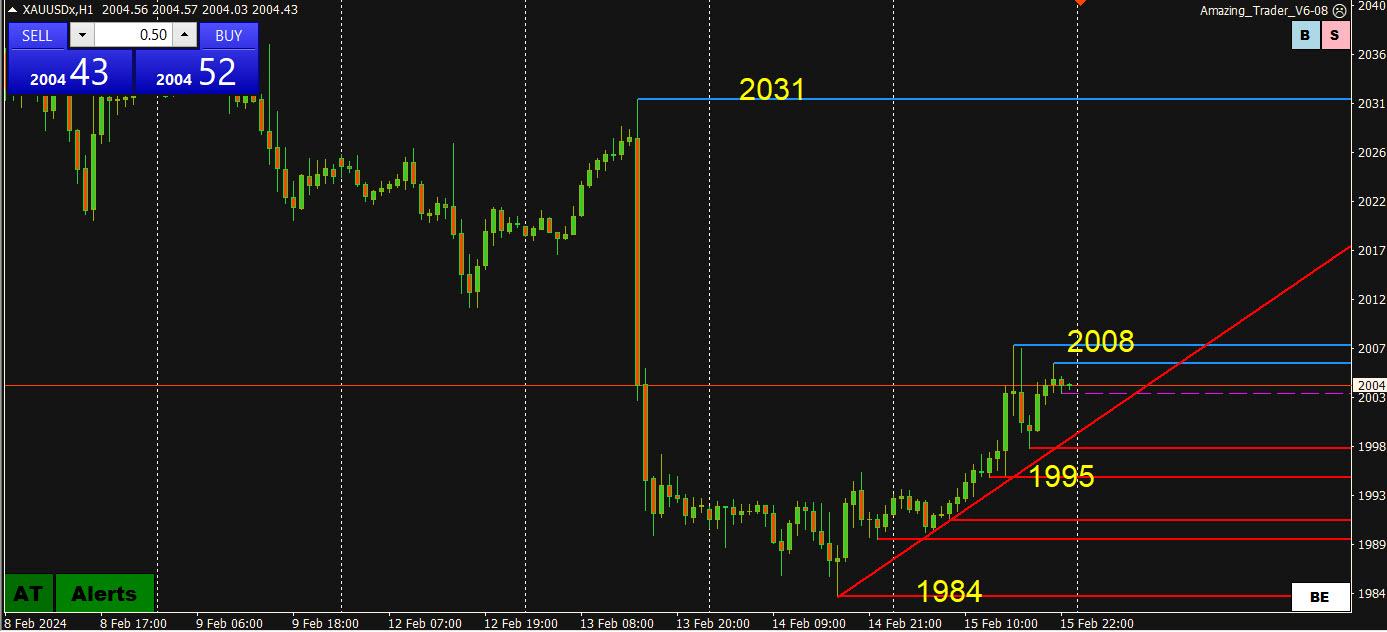

XAUUSD 1-HOUR CHART

Similar to FX pairs, XAUUSD is trying to correct (note rising red lines)

1984 = Key support

2031 = Key resistance

To keep the upside at risk, XAUUSD needs to hold 1995-2000, stronger if the trendline holds

2008 = minor resistance

Note the trendline will be at 2000 at Friday’s open

The best way is to shop with local stores in the vicinity, let them know you as a regular…

The other way is simply to pay cash for everything but build up a truthful profile for yourself with the stores, that is just in case so the cops can catch the crooks and ensure your personal safety.

or

Pay by card for regular purchases below a certain amount using a card/account which you can close if required and pay cash for large purchases above a certain amount.

Here is what people do, and why they get scammed/defrauded. They pay cash for small purchases and use their card/bank account(where there is a lot of cash) for large purchases.

How in the past did scammers get your details? Dishonest merchants through whom they did their business…

So if you pay cash then the merchants have to tell the crooks the serial number of the notes you paid and the amount which you paid which means the scammers will ask the merchants to share the proceeds but merchants won’t do that, instead they’ll turn on em’ and expose themselves to legal action for being involved with scammers too… and if it goes the other way then the scammers will rob the merchants and get accosted by cops… Scammers can be remote in other locations behind the screens or also can be the types of merchants who do run a bonafide business but also are on the lookout and in the business of robbing other merchants meaning masquerading and watching who collects how much money so the robber merchant can hire robbers to carry out armed robberies at their behest whether their victim is locally based or based in another country too then the robber merchants share in the proceeds with the robbers. However, in many cases (eventually) the robbers don’t share their loot and make threats on the merchants in which case the merchant reports them to his henchmen or the cops which leads to the gunmen being taken out or accosted by even more heavily armed policemen…

Cash looks like it supports crime but the effect of paying cash is that the merchants don’t want anyone to commit an armed robbery on them so the precautions which they take forces crime levels to remain very low… Crime levels were very low in the USA for decades, why? … Cash is King… but now we got creit cards and computers on which we can use em’, well so can the scammers dot dot dot…

USDJPY

To be able to continue to the new highs , Yen has to close above 150.200 tonight ( any close above 150.000 awakens the attention )

Otherwise, the risk is to the downside, with the first support at 149.550, followed by 148.500

It might all come to the USA Data tomorrow– Economic Calendar

From our friends @GTWO3 : March Euro futures are bullish under 107.50; the decline from 12/28 high has been long liquidation rather than new selling.

I am on record that the bond market is THE king

Looking at the prancing since last Fr’s reaction to CPI (notably most CB’s now singing from the same ‘dependant on incoming data’ page in the hymn book) – 4.15 to 4.3320 and current approx 4.20 off the peak suggests players would love to place directional bet BUT … are unsure currently.

Imo IF I had to go out on the limb I d say the next direction (for yield) will be prudent tentative down.

fwiw re today’s yakkers: both are voters (if it means anything)

9:30 ny

DLRx 104.19 (somewhat down a bit) / 10-yr 4.212 / euro 1.0780observation: dlryen and us yield appear correlated

Looks like players are not done selling the dlr just yet

—-

13:15 – fed’s waller yaks – on dlr’s int’l role (hello janet, hello putin)

19:00 – bostics yaks on outlook and policy (yeah !, lol) -

AuthorPosts

© 2024 Global View