Forum Replies Created

-

AuthorPosts

-

while waiting for one side to stomp over the other

some boredom relief : a Waffle Stomp – Joe Walsh

at thy discretionJP – The Fed cutting rates any time soon is amounting to a window into how confused people are, even analysts.

From Moody’s Analytics: “While inflation has fallen considerably from a peak of 9.1% notched during June 2022, it remains well above the Federal Reserve’s 2% goal. Additionally, when compared with January 2021, prices are up a stunning 17.6%.”

“The cost of necessities like food, gasoline, rent and child care remain far more expensive than they were just one year ago. Chronically high prices are forcing Americans to spend about $650 more per month than they did two years ago, according to a recent estimate from Moody’s Analytics.”

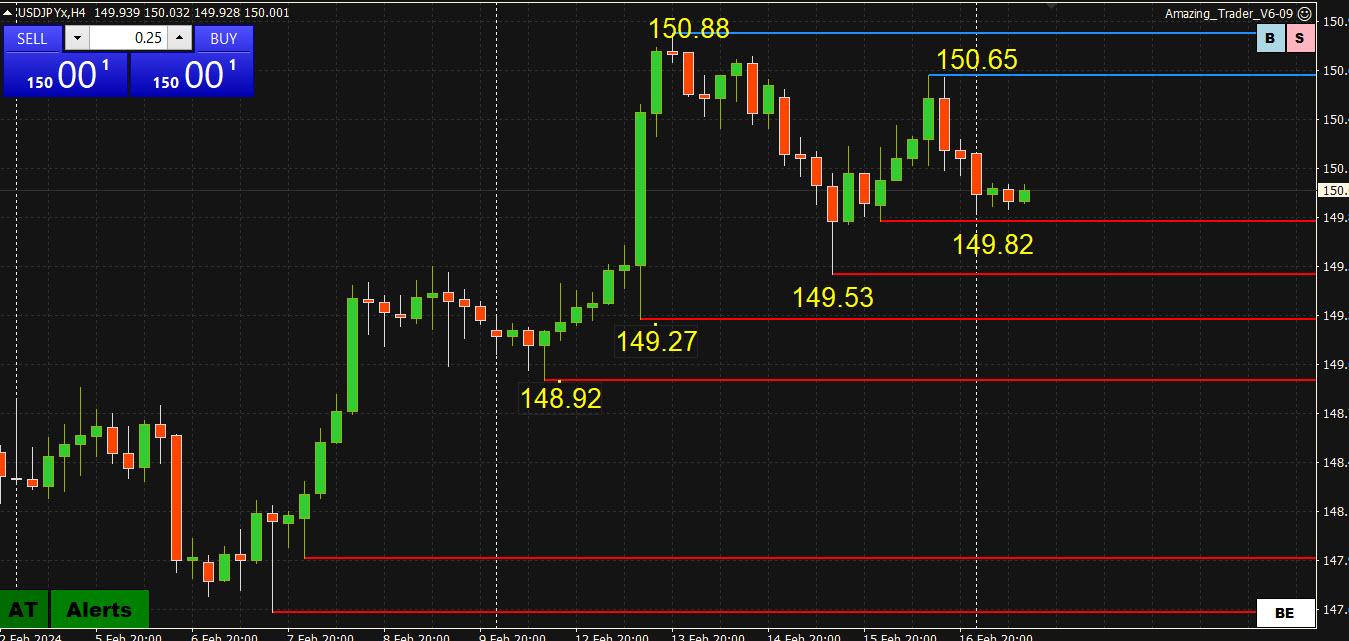

USDJPY 4 Hour Chart – Uptrend consolidating

150.00 is the bias-setting level going forward.

4-hour Levels are very clear

Sup: 148.92/149.52/149.82

Res: 140.65/150.88

Note, USDJPY tends to be most sensitive currency to moves in US bond yields

Scross down the forum to see USDJPY analysis from ForexCycle

EURUSD

From yesterday’s Week Ahead :

EURUSD Week Ahead

Resistances at : 1.07900 , 1.08350 and 1.09250

Supports at : 1.07400, 1.07200 and 1.06950

Pattern wise, Resistance at 1.07900 should Hold, and Down move should continue…

They came, they touched and they bumped ( 1.07894)

We need it to go through 1.07500 to confirm the pattern and continue down.

Let’s see how it’s played…

gooddy gooddy … just like the FED likes it:

–

CNBC Daily Open: Fears over yet another hot inflation gauge

sofar quiete on the trading front

–

Trump says truckers boycotting driving to New York City are great patriotsThis article is worth trading as it covers the week ahead

Morning Bid: China markets look like they need another holiday

USDJPY Analysis: Uptrend Continues, Resistance and Support Levels

The USDJPY pair is currently within a rising price channel on the 4-hour chart, indicating that the pair remains in an uptrend from 145.89.

As long as the channel support holds, the upside move is likely to continue. A breakthrough of the 150.88 resistance level could potentially take the price towards the 151.90 resistance level.

On the downside, a breakdown below the channel support could bring the price to test the 149.52 support level. If the price breaks below this level, it would indicate that the upside move has already completed at 150.88, and the next downside target would be around the 147.50 area.

player sentiment heading into new week

–

Just one of a number of a gathering of similar takes I have read over last few days about the market:

‘Peak Euphoria’ Warning Blares as Stress Vanishes on Wall Street

(Bloomberg)…Fed officials seem sanguine about it all, and indicate that the next move is a cut, just further out. … “A hot CPI woke markets up to the fact that risks are two sided. But still, mindsets are hard to change, as most people anchor to recent history,” the firm’s team including Christopher Metli wrote in a note.

Technically, there a number of instruments in the “overbaught” territory. In itself not a strong sell signal, just a prescient one without a precise timing.

EURUSD daily chart – major trend down but consolidating

EURUSD daily chart – major trend down but consolidating1.0805 is the key level as it appears not just on the daily but on multipole time grant charts

There is a trendline at 1.0793 but 1.0805 is the key on top.

Only a firm break and 1.08+ then being established would suggest the low (1.0696) is ion for now.

Take your pick of support within 1.07-1.98 with 1.0730 being the only one worth noting ahead of the key low.

-

AuthorPosts

© 2024 Global View