Forum Replies Created

-

AuthorPosts

-

JP – To explain my position on Trump vs someone else, I communicate with people across the country from all circles…the real estate fraud prosecution has no merit. There were no victims, and every bank approved the transactions in question and none have complained. Trump will appeal, which will go beyond the election process. His base is very angry, millions of democrats have left the party. Biden’s administration is an economic and national strategic disaster and done. It will be someone else.

and IF you have too much idle boring time on hand …

–

Joe Rennison in New York Times posits that

“Wall Street Is Already Placing Bets on the Biden-Trump Rematch”

Traders and strategists are thinking about all the ways that November’s election could alter the mood in markets.anyone can point out the bets to me ?

tia!monedge – players appear more idle than not ahead of aft’s minutes and nvidia report AFTER the bell hahaha.

you have to appreciate player sentiment in face of streched run … like everyone in a theater eyeballing exits just in case the crowd starts to rise and head for exits . I love tentions like thisre DLRx … dlr has low steam pressure in the tank. imo for it to rally it ll need some more new awsome incoming data.

in the meantime minutes will be made to make players still think that yes rate cuts are coming, just not yet anytime soon aaka May, and just waiting for more convincing data. so tame your horse, ya hear ?

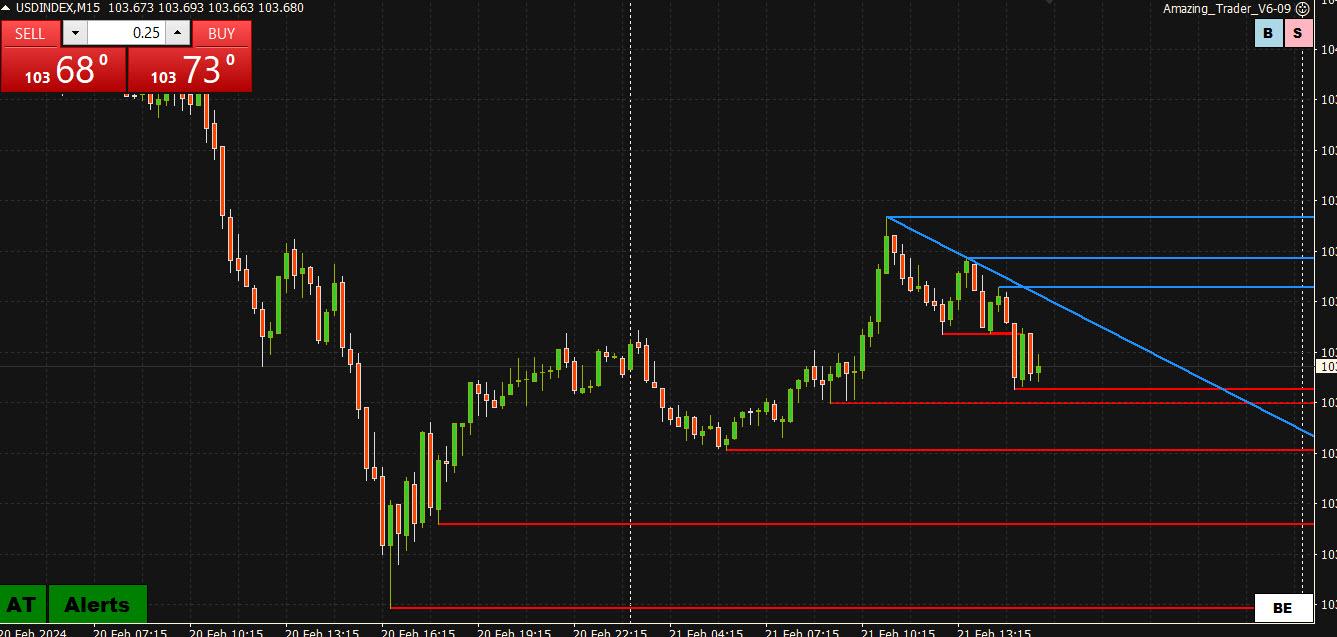

DXY 104.10. In our model today above it is strength and below it is weakness. Usd/Chf is the most extended on a percent basis and has been moderately under pressure. Everything else is in the middle and could bolt either direction so they are good for buy/sell stops or waiting for some strong moves to exhaust. Preference for us is the stops. So best R/R at the moment (6:05 Pst) is long that pair from lower (currently 8795).

Maybe for lack of anything better to do I kinda like adding to silver longs or at least opening with less than a full allocation here. Regardless of whether NVDA beats (or not) maybe stocks correct for a couple months, bonds go down for the wrong reasons, and well, at the end of the day there’s still a lot of liquidity, and its gotta go someplace… Maybe consolidation from May last year sees upside resolution towards 26.00 over the next few weeks/months. Maybe…

Newsquawk US Market Open: US futures are lower ahead of NVDA earnings, NZD bid & Crude softer; FOMC Minutes due

FX option expiries for 21 February 10am New York cut

The first being for EUR/USD at around 1.0778-80, which could help to limit any downside action in the session ahead. That also sits near the 100-hour moving average, seen at 1.0776 currently. As such, the expiries could double up as a supportive layer for price action before rolling off later.

Then, there is the one for USD/JPY near 150.00 again. The large expiries there should keep price action more limited and centered around the figure level still, as we have seen through the week so far.

-

AuthorPosts

© 2024 Global View