Forum Replies Created

-

AuthorPosts

-

this peasant would like ideas on how trade this:

Reuters Explainer

–

Why huge European Central Bank losses matterFRANKFURT (Reuters) – The European Central Bank chalked up another large financial loss in 2023, burning through the last of its provisions, and said more losses are forthcoming as high rates push up interest payments to banks.

While the bank said it can operate effectively “regardless of any losses”, the accounts have broader implications – from reputation and independence to state finances. …/.

somehow, knowing my european princes, reputation and independence are not a part of their calculus.

and when it comes to state finances, again by my own understanding, for them it is “my way or a beating” dictatesTIA for ideas

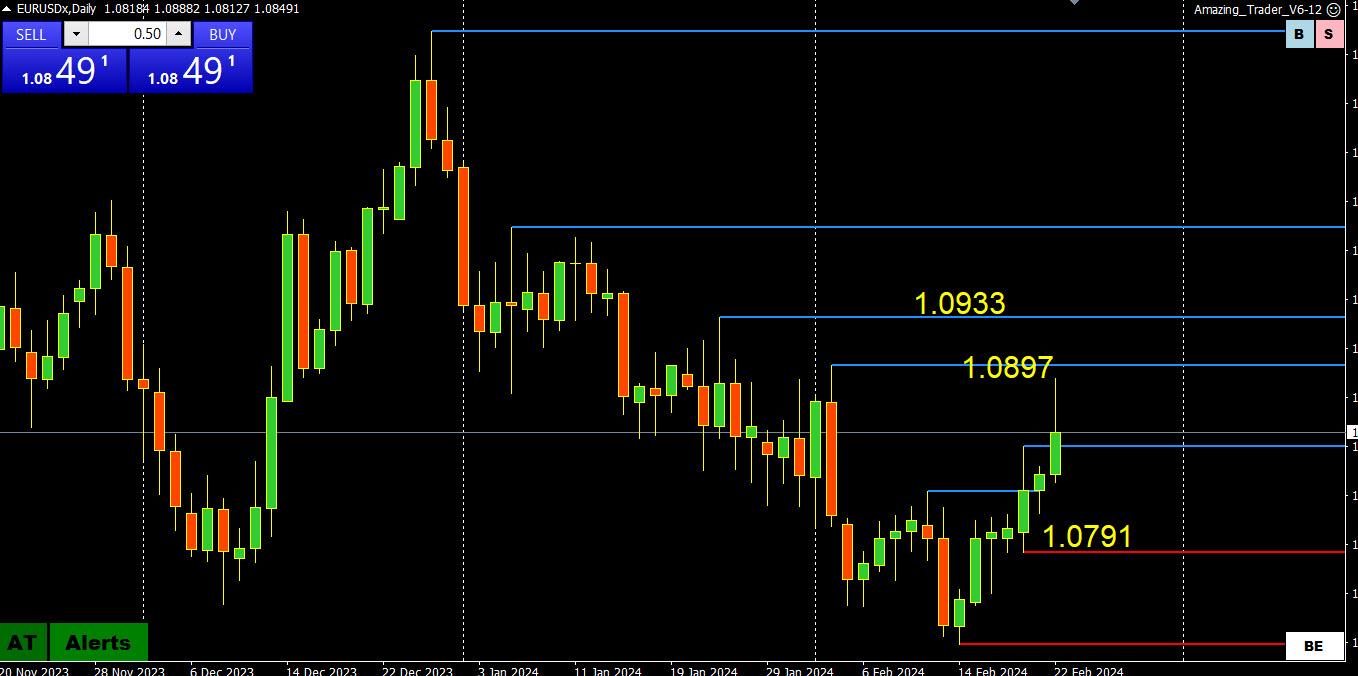

EURUSD Daily Chart

Flash PMI whipsaw day: Up on stringer French flash PMI, down on weaker German PMI

The solid break of 1.0805 saw a move up that came within 9 pips of the target at 1.0897

If 1.08=1.09 has replaced the 1.07-1.08 range then 1.0850 is the obvious bias setter.

Technicals are still positive, expect support if 1.0840 holds

If not then it is back to 1.0800-20

From yesterday/s A Day Ahead :

Buying at that level seems prudent, for the move to 1.08500 and even 1.08875.

FWIW today’s high has been 1.0888

So what now ?? Well, let see what happens after the US Data…

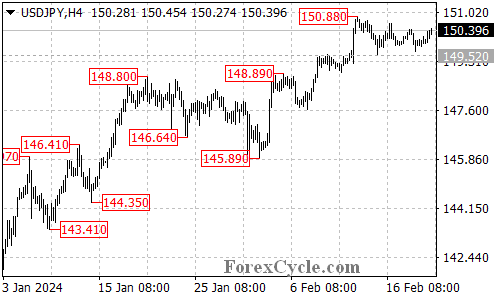

USDJPY Analysis: Sideways Movement Continues, Resistance and Support Levels

The USDJPY pair has attempted to break below the 149.52 support level but failed and has since moved sideways within a trading range between 149.52 and 150.88.

As long as the 149.52 support level holds, the sideways movement could be seen as consolidation for the uptrend from 145.89. A breakthrough of the 150.88 resistance level could trigger another rise towards the 151.90 resistance level.

On the other hand, a breakdown below the 149.52 support level would indicate that the upside move from 145.89 has already completed at 150.88. In this case, the pair would find support around the 147.50 area.

\EURUSD 4-hour chart: Inside day on Wednesday.

Good update Bobby. I will add my thoughts

I asked the question last week whether EURUSD is bid or bid in an offered market?

Looking at this chart technicals support the former but only if 1.0761 holds and 1.08+, trades, which would suggest there is more room on the upside.

Resistance comes in at 1.0824-39, the letter is the high for the week and then a void until 1.0897

‘EURUSD Day Ahead

Looking at the Daily chart, seeing a Pattern emerging that is calling for further Upside move.

Support at 1.07950 and it is quite possible to be revisited tomorrow, so Buying at that level seems prudent, for the move to 1.08500 and even 1.08875.

Tomorrow we have some important data – check Economic Calendar –

Maintain Stops , avoid being dragged into the data !

all I am looking at is price re-action of the 10-yr

https://www.cnbc.com/quotes/US10Y

1D 1M settings

fwiw

-

AuthorPosts

© 2024 Global View