Forum Replies Created

-

AuthorPosts

-

fwiw, from a post on ZH

“A Negative Surprise”: Goldman Warns Market Expectations For Trump’s April 2 Reciprocal Tariffs Are Far Too Optimistic“Trump plans to announce his “reciprocal” tariff policy on April 2. Recent media reports suggest a more benign approach, but we believe the risks lean toward an initial tariff announcement that negatively surprises markets, for two reasons.”

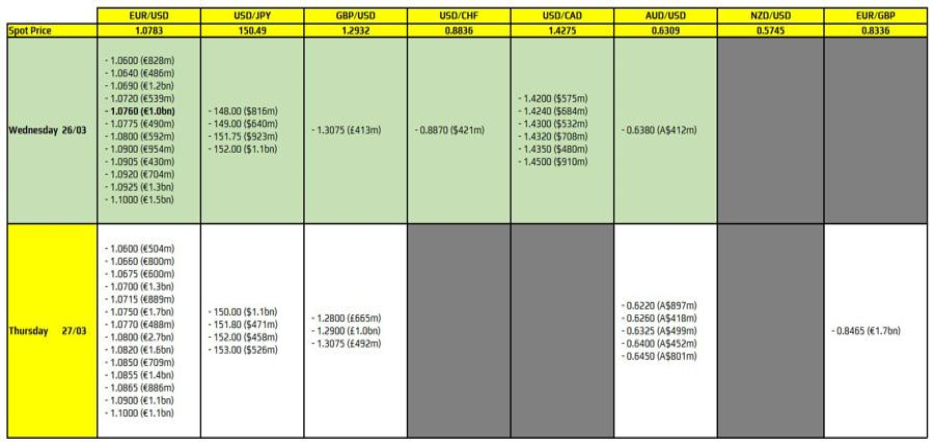

USDJPY Daily

Yen has to first take out that 151 – it is EMA 50 acting as a barrier.

Supports: 150.050, 149.300 & 149.050

Resistances: obviously 151.000, 151.250 & 152.450

Pattern wise – it looks good for tomorrows break above 151, as long as the day closes above 150.100

With so much fundamentals in front of us, it is not wise to try to predict so much in advance.

US Dollar Index

US Dollar index hasn’t been doing much lately. We just got the strong downward push triggered by the German defence spending news which saw EU-US yield differentials jumping in favour of the Euro. As a reminder, the US Dollar Index (DXY) is basically EUR/USD upside down as the Euro makes up for 60% of the index.

This is harder to square but the greenback will most likely be influenced by the risk sentiment following the catalyst as positive news should keep rate cuts expectations around two for this year, while negative news could push those to four or more.

The markets are setting up for big moves on April 2nd

The key date for the markets is next Wednesday when the US will finally unveil the tariffs plan. Trump has been calling it “Liberation Day” and that will likely be the same for the markets as uncertainty has been historically high.The expectations for tariffs rates is around 9% for universal and 50% on China. Q1 has been a tough quarter for the markets as the tariffs noise increased the volatility and sent markets into a spin. Uncertainty is not a good thing for the economy and we’ve been seeing that cited a lot across many business surveys.

Therefore, the best approach from a risk management perspective would be to just wait for the key date and start taking positions after the tariffs plan announcement as we will likely get some long lasting trends from there.

Durable goods orders report beats but volaitle data that is subject to big revisions.

See our Economic Data Calendar

UK Spring Statement due next

-

AuthorPosts

© 2024 Global View