Forum Replies Created

-

AuthorPosts

-

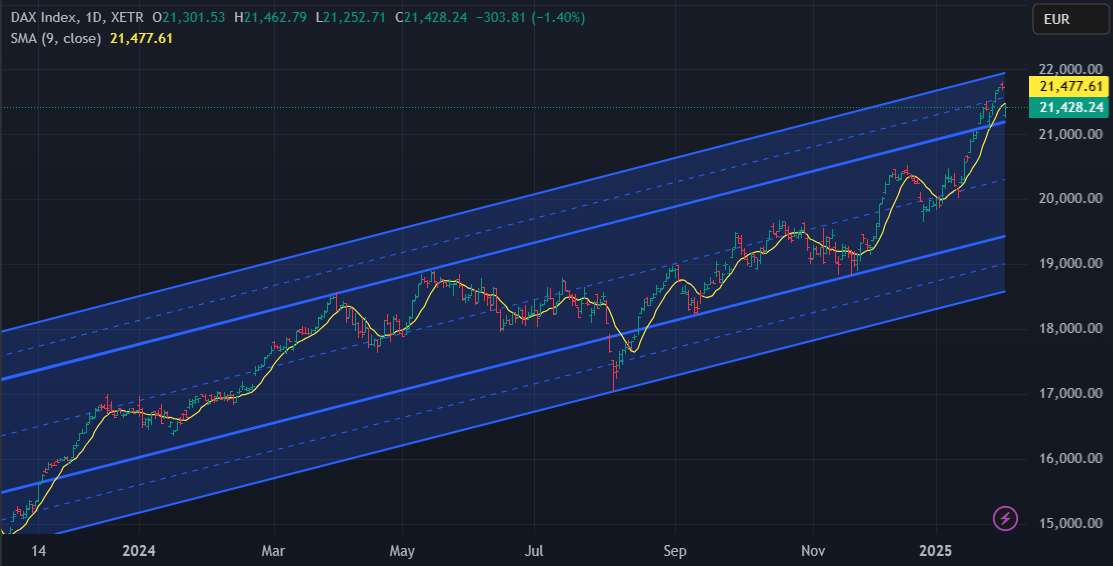

NAS100 4 HOUR CHART – Mind the gap

Same as I wrote in US 500

I would like to say charts matter but in a news driven market they take a back seat ti the latest headline.

Charts, meanwhile, show the freefall paused above key support. It now needs to fill the gap and beyond at 21382 (came close) to ease the risk or the downside.

USS500 4 HOUR CHART – Charts vs News

I would like to say charts matter but in a news driven market they take a back seat ti the latest headline.

But looking at charts,6000 remains pivotal after the freefall found support just below the 5907 bottom of the range. Only below it would fuel a greater sell-off.

On the other hand, the opening week gap (.6021) has yet to be filled… caps the upside unti/unless it is filled and beyond.

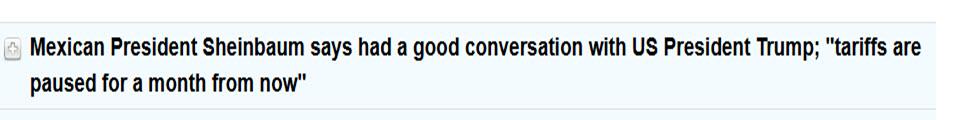

XRPUSD

Yet another victim of Trump’s yapping – I don’t think so…

XRP lost its momentum and lost the Major support trendline, so technical after all.

Now this return from the low might be an interesting sign of significant interest in it.

Needs to overcome 2.9400 and go back above that line and if so, we’ll be watching another rally and probably to the new high.

But before it happens ( if at all) XRP is on defensive.

XAUUSD 4 HOUR CHART – New record high

Besides the dollar, XAUUSD was the outperformer, extending its record high to 2830 before backing down to its prior record high at 2817.. .

For the next target to be 2850 if it can establish 2817 as support

In any case, expect a bid below the market a3 long as 2800+, only below 2772 would indicate a top.

The population inside of the United States would need to live frugally and save their money, buy what is essential. It’s no wonder when the elders say that money saved is money earned, don’t waste it on useless things, instead invest wisely and see for yourselves how money makes money.

Buying treasuries is a way to start and is like a karmic blessing from the central bank, and you’re bound to do well in life just because of that one virtue, it’s like blessings of grandparents and great grandparents. There is absolutely no way to fail in buying treasuries.

Case in Point: I reckoned I could buy another brand new ride but then my parents reminded me of the above principles, and I followed the advice to the T simply by following the principle of delayed gratification, and I don’t regret it one bit. I can buy another one later down the line but then at that time I’d postpone it again and use that money to buy stocks…lol

My Logic to buttress their point: A new vehicle is parked in a parking slot for 85% of the time but yet depreciates 20%-30% per annum considering wear and tear which takes place while it’s being used for only 15% of the time, exceptions being the luxury cars (Ferrari etc) which cost many times more than the cost of many mid to high-range vehicles and cost the same amount as a mid-range vehicle to maintain on a per annum basis…

GL GT

Beware of headline news roulette.

This set of comments from Trump saw a 104 pip whipsaw range in USDCAD (1.4586 => 1.4624 => 1.4520 => 1.4572)

Source: Newsquawk.com

USDCAD 15 MIN CHART – GAPS

While the gap to last Friday’s high (1.4560) has not been filled, the gap to last week’s high (1.4595) was filled on that air pocket drop earlier.

Key day is Tuesday when the tariffs kick in and Trudeau would need to throw a Hail Mary (i.e. in American football it means a last second desperation pass) to avoid them.

Wide range now 1.4588-1.4793.

-

AuthorPosts

© 2024 Global View