Forum Replies Created

-

AuthorPosts

-

A look at the day ahead in U.S. and global markets from Mike Dolan

As the week’s tariff rollercoaster levels out a bit, Wall Street stocks are tilting lower again – clouded by a poor reception for Alphabet (NASDAQ:GOOGL)’s results, lingering China tariff hike plans and fresh interest rate rise speculation in Japan.

U.S. stock futures were back in the red ahead of Wednesday’s bell as shares in megacap Alphabet plunged 7% overnight. The drop came amid doubts about the Google parent’s cloud computing business, much like Microsoft (NASDAQ:MSFT) last week, and anxiety about its huge investment in artificial intelligence – especially in the light of last week’s DeepSeek news.

NEWSQUAWK US OPEN

USD lower and Bonds gain ahead of ISM Services, NQ hit as China mulls a probe into AAPL, GOOGL -7% post-earnings

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly lower; NQ underperforms with GOOGL -7% & AMD -8% post-earnings, AAPL -2.5% as China mulls a probe on its App Store.

EU prepares to target US big tech if US President Trump pursues tariffs against the EU, according to FT.

Dollar dragged lower again, JPY is boosted by wage data, EUR/USD above 1.04.

Bonds bid as AAPL reports hit sentiment and into Bessent’s first Quarterly Refunding.

Gold continues to print record highs on lingering uncertainty; crude on the backfoot despite the firmer Dollar.

GBPUSD DAILY CHART – Not on the hit list

Outside week

GBP benefiting from not being on the US tariff hit list and so far ignoring an expected 25bps rate cut tomorrow by the BOE.

To keep a strong bid, needs to stay above 1.2500-23

Chart shows resistance at 1.2575-1.2610 but 1. 2550 is likely to be pivotal if it makez a run at it or slips back towards 1.25.

Using my platform as a HEATMAP

USD is down across the board, led by the JPY (breaka below 153.70 and 153.14)

Outside week in USDCAD but still above 1.4260

Outside week in USDMXN by just one pip (double bottom around 20.29-30)

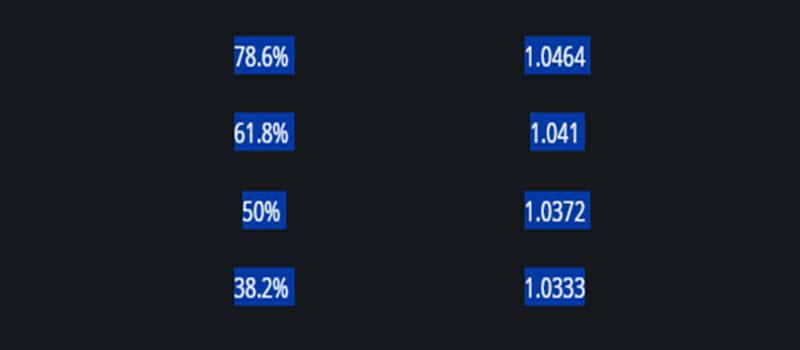

EURUSD completes 61.8% retracement at 1.0410 (high 1.0417), next res 1.0434

Gold continues its march into record high territory

Trade war with China heats up, EU threaten retaliation against tech

US stocks slip

US 10 year currently below 4.50%

This an all buy time for GOLD (XAU/USD) as it is not relenting in its continuous buying power. This week Friday 7th February 2025 is NFP (Non farm payroll ) release date and market is set to be volatile that day. Even days before we will see abnormal market behaviour. We saw a gap of 50-100 pips in some currency pairs upon Market opening this week.

This is testament to the volatility we are about to experience this week and beyond. The gold went on the lowest at price 2806 this morning and ever since went on a buy. It has ever since been buying and it got to a high of 2845. I see market reching around 2853 and beyond today. The upward movement does not seem to want to wane so soon. I see a continued buying power of the gold.As i said earlier gold has been buying since 1996, go and check your hourly chart on the gold to confirm this.

However, let us tread with caution and let’s place minimal trades with strong SL and TP. Don’t Trade more than 2-5% of your capital. A word is enough for the wise.

Thanks

TOPNINE. -

AuthorPosts

© 2024 Global View