Forum Replies Created

-

AuthorPosts

-

WSJ – The most important global events likely to affect FX and bond markets in the week starting Jan. 27

Week Ahead for FX, Bonds: Fed, ECB Decisions in Focus

https://www.wsj.com/economy/central-banking/week-ahead-for-fx-bonds-fed-ecb-decisions-in-focus-c42d243b?mod=hp_major_pos2Predictions, promises, words, action, results

Which matters most ?At donald’s signing establishing working group to make murrica world crypto capital

donald: ” the interest rates will come down”

News chick to donald: “you said that you will demand that interest rates come down.

donald: “well …. I ll put in a strong statement”

news chick: “do you expect the FED to listen to you ?

donald: “yeah”1/25/2025

10-yr : 4.617

2yr : 4.263Gotta love Trump for banning CBDC. According to me, there ain’t gonna be a bitcoin stockpile, as time evolves they eventually will see the light, as Crypto has no value in real-life transactions but the dollar does…. It is better to make agreements with other countries which fully deregulate trading in the US dollar and which in turn would make it more accessible(online/offline) to the public and that would go even further to strengthen it’s hold as the reserve currency. Many countries via their banking mechanisms do not give citizens the freedom of choice.

Trump Bans CBDC, Forms Task Force To Regulate Cryptocurrency and Create Bitcoin Stockpile.

https://www.yahoo.com/news/trump-bans-cbdc-forms-task-074208266.html?guccounter=1

GBPUSD Daily / 4h

Cable broke the long term downtrend line ( from September 2024.)

Now the real hurdle is at 1.26050 – that was the channel support trendline and if it manages to break above it and stay there, new universe opens – leading all the way till 1.38.

But let’s focus for now on coming days…

It has to stay above 1.23350 to be able to form a real bottom.

With the current situation , you have to be aware that chances are 50-50 for tomorrow – it can continue with next leg up, but also it is very possible to retrace back to MA – 1.23850

It just doesn’t pay to play with that kind of probability, unless you entered the position below 1.23850 – then you can risk it – stop on zero and leave it be.

We saw new highs after long standing highs holding in some stock futures. This is about where the odds increase for a temporary pull back of non-dramatic proportion. I can see them lingering around current levels prior for a few days but we could just as well see a linear drop. Overall stocks in the US especially are receiving inflows. This of course will affect Eur/Usd behavior.

6: Trading Tip: Why the Hard Trade is Often the Right Trade

This is a great tip because this is one of the keys to trading. It is the most logical approach but in the heat of battle, often the most difficult to implement. Master this and you will see a difference in your trading.

I will explain why.

Many traders look to take the easy way out by looking to buy low or sell high but as I will show you, this is often the wrong way to trade. This is not a way to trade with the odds on your side and the way to become a successful trader.

Have you ever been sitting in front of your screen and all of a sudden a currency dips or spikes by 30-50 pips?

My gut reaction and I assume yours as well is to buy the dip or sell the rally hoping for a quick turn.

It is a gut reaction that I have to fight to this day, which is to take what looks like the easy trade that often turns out to be the wrong trade.

Have you ever had the right position, say in a downtrend, take your profits only to see the currency fall another 50 pips?

What do you do then?

Do you re-establish the short position 50 pips below where you just got out or look for a level to buy for no other reason that you cannot sell at the lower level?

Many traders look to do the latter, which is again the easy to enter but often the wrong side to trade.

In these cases, you may find out the hard (to find a good entry with a reasonable stop) trade is often the right trade.

What is the hard trade?

- The hard to find a good entry level trade

- The hard to find a trade with a good stop

- The hard for you to pull the trigger trade.

Markets rarely give you an ideal entry level and when in a trend, finding a good one may be even harder to find.

This lures many into buying or selling at what looks like a bargain price only to see it turn out to be a sucker bet.

Of course, there are exceptions but as a rule, the hard (to find a good entry) trade is more often the right trade.

Look at these charts. There was a nearly straight line move up with no obvious place to put a stop. The farther it moved from the low the harder it was to find an entry with a reasonable stop. The second chart shows a oine way move wiuth no retracement.

The easy trade would be to try and pick a top before there is a reason to do so.

This may sound simple but I believe it is one of the keys to trading. Master this and you will see a difference in your trading.In future articles we will discuss how to find an entry with the hard trade that in hindsight afterwards will in fact turn out to be the right trade.

Contact jay@localhost

S&P Global Services PMI misseson downside but not as important asa the ISM

Next final U of M consumer sentiment, Existing Home Sales

See our Economic Data Calendar

EURUSD Daily

Last night’s prediction : The pattern for tonight says : Up – so another leg up ( hope Mr. President doesn’t talk in his sleep…)

So Up it was…Pattern never ( or almost never) lies…

To explain something : when there is a proper angle of move, pattern hits it 96% of the time ( 4% someone talked in his/her sleep)

And how to spot the right angle and decide it is the Signal – well, that’s an art…

Resistance at 1.05350 is waiting.

Now another rule of the game : that broken trendline will act as a support from now on – yet again that 1.03500 is a level to keep in mind.

P.S. Am I gloating here ?? Nooo….not at all 😀

With Trump calling for lower interest rates and the Fed meeting next week, this article in our blog is worth reading as it was ahead of the curve.

The question for me is not if but when President Trump and Fed Chair Powell will clash over monetary policy

Is a Clash of the Titans, Trump vs. Powell, Inevitable?

https://global-test.financialmarkets.media/is-a-clash-of-the-titans-trump-vs-powell-inevitable/

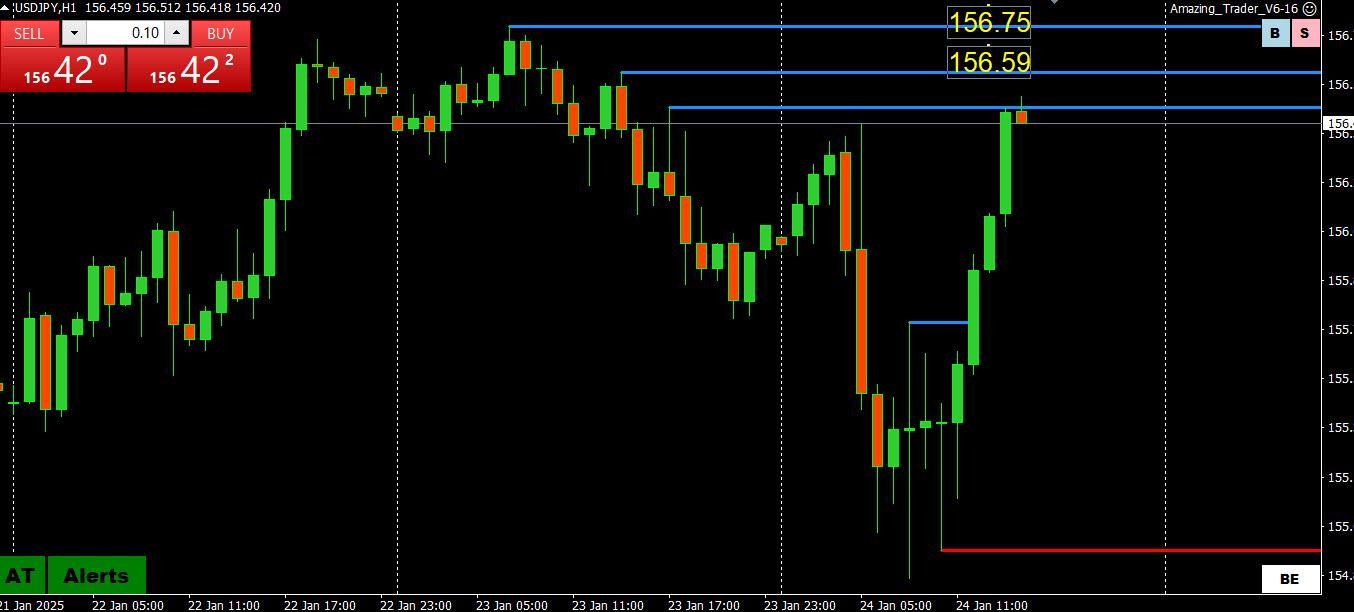

https://global-test.financialmarkets.media/is-a-clash-of-the-titans-trump-vs-powell-inevitable/USDJPY 1 HOUR CHAPT – Key level cited

As I noted earlier, support below 155 caught my eye but the extent of the bounce is a surprise. Key level is 156.75, then a void of key levels until above 158 (not a forecast but an observation).

IN any case, upside will be contained unless 156.75 is firmly taken out.

A look at the day ahead in U.S. and global markets from Mike Dolan

The dollar fell to its lowest of the year as the Bank of Japan delivered a long-awaited interest rate rise on Friday, euro business unexpectedly returned to growth and President Donald Trump’s latest comments gave China a lift.

Morning Bid: Dollar swoons as BOJ hikes, euro zone grows, yuan relieved

NEWSQUAWK US OPEN

DXY pressured by Trump remarks, EZ PMIs lift the EUR, BoJ hike as expected

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses mostly firmer, whilst US futures tilt a little lower; Burberry +15% post-results.

DXY in the doldrums as Trump waters down tariff rhetoric and calls for lower interest rates.

USTs a little firmer, Bunds pressured by EZ PMIs and BoJ Governor Ueda spurs JGB action.

Base metals soar amid Trump’s China commentary and a weaker dollar.

BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter. Governor Ueda said the Board has judged that spring wage talks will result in strong hikes again this year. No preset idea on future adjustments. No preconceived ideas around the scope/timing of the next rate rise.

Next rate hike will depend less on economic growth but more on price moves.

Not signed up to our squawk service yet?

Listen to our team of analysts broadcast the news that will impact the markets as it happens, and never be caught off guard again.

Cancel anytime – free for 7 days

-

AuthorPosts

© 2024 Global View