Forum Replies Created

-

AuthorPosts

-

GER30 4 HOUR CHART – TAKING A PAUSE?

The DAX (GER30) has been a star performer, up each week so far this year. This winning streak will be a key focus this week.

In this regard, the record high set last week at 21946 had yet to be touched today so consolidation while below it.

On the downside, only below 21386 would dent momentum and suggest a pause.

Using my platform as a HEATMAP

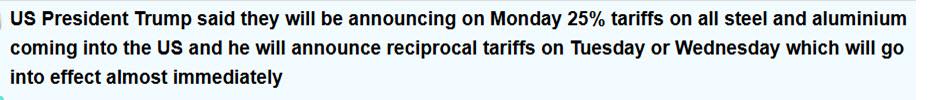

Another week, another set of opening gapd on tariff news.

All gap filled except for USDCAD

Mixed signs of angst over a global trade war

Stocks up and do far shrugging tariff concerns

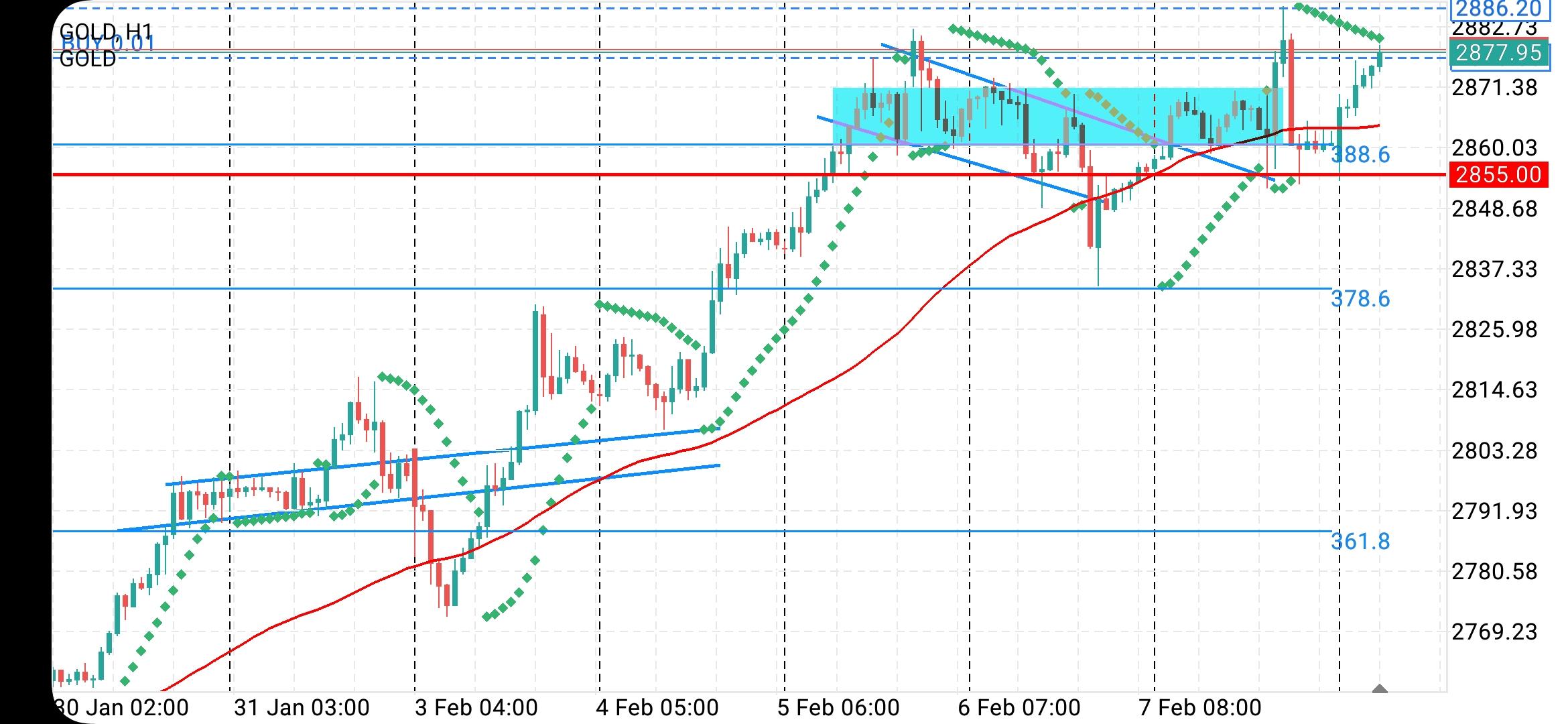

Gold surging to another record high on global trade war concerns

USDJPY the outperformer… JPY not getting safe haven flows (no sign of concern) vs weaker JPY )reflects global trade war concerns.

Every trading course I have ever took all say that if you trade on the higher timeframe, your win rate will be much better than if you trade on the lower timeframe, and I have seen that it is true for several reasons;

1.) YOU ARE WITH THE OVERALL TREND

2.) YOU ARE LESS LIKELY TO BE STOPPED OUT DURING VOLATILE PERIODS LIKE NFP AND OTHER ECONOMIC NEWS RELEASES

3.) YOU ARE LESS LIKELY TO BE MANIPULATED, IT TAKES MORE MONEY TO TAKE OUT LIQUIDITY ON A HIGHER TIMEFRAME THAN IT DOES ON A LOWER TIMEFRAME

4.) YOU ARE TRADING IN LINE WITH FUNDAMENTALS

5.)THERE IS MORE PRESENCE OF HIGH FREQUENCY TRADING BOTS IN THE LOWER TIMEFRAME, MAKING PRICE MORE CHOPPY AND TAKING ADVANTAGE OF SIMPLE PATTERNS THAT THE AVERAGE TRADER USES.

6.) PATTERNS ARE MORE RELIABLE, A BEARISH ENGULFING ON A WEEKLY TIMEFRAME HAS MORE SIGNIFICANCE THAN A BEARISH ENGULFING ON THE 1 MINUTE TIMEFRAME

FOR THIS VERY REASONS, I FIRMLY BELIEVE THAT IT IS WAY EASIER TO TRADE ON THE HIGHER TIMEFRAMES THAN ON THE LOWER TIMEFRAMES, I WILL BE WAITING FOR YOUR REASONS WHY YOU BELIEVE THEY ARE BOTH THE SAME

Mr. Bobby, thanks for taking out your time to reply me, I really do appreciate, but you lost me at the 96% win rate at 1 to 3 RR, was it a typo or you really meant what you said. That win rate means you lose on average once every 25 trades, that is incredibly high for a positive RR of above 1 to 3, you should literally be a billionaire if those stats hold true. And is there any sort of broker statement or any third party tracker you have connected to your account, to help me solidify my belief in you. Maybe Tradezella or myforexbook or any of them? Because truly I have never seen anyone win 96% of the time with a positive RR. I look forward to seeing the broker statement, Thanks so much in Advance Sir

Here are the main countries exporting steel to the U.S. include:

1. Canada – The largest supplier, benefiting from geographic proximity and trade agreements.

2. Mexico – Another major supplier, with strong trade ties through USMCA.

3. Brazil – A key exporter, particularly of semi-finished steel products.

4. South Korea – A significant supplier of finished steel products.

5. Japan – Exports specialized and high-quality steel.

6. Germany – Known for high-grade steel products.

7. Taiwan – Supplies a variety of steel products.

8. Turkey – A growing exporter to the U.S.

9. India – Supplies various steel products, including stainless steel.

10. Vietnam – An emerging supplier of steel to the U.S.(from the Internet)

Let me try to explain it all Edikan :

– Win rate has nothing to do with the time frame you trade on – It is directly connected to your system probability rate

– R/R- as long as above 1:2 you are winning

– R/R is not connected to your win rate : they serve the same purpose in unison , but saying that if R/R is higher – win rate is lower is not correct. It all depends on your trading system ( I will have to show all of you what I mean when I say “System” , but for now try to understand it as like set of rules that you follow even in your sleep when you trade.

– As for smaller time frames and choppy – in my opinion it is exactly the same as on big time frames, just it rolls way faster , so later on you get an impression that if you go with big time frame it is calmer and easier.

– Now about stop losses : if your system delivers 50% probability ( win rate ) , it means that out of 100 trades, you’ll win 50 and lose 50 – no matter the time frame…

– Depending on your R/R your profit will be different, but let’s take this R/R 1:2 and 50% probability = 50 x 2 = 100 ….50×1 = 50 ….so you win 50

– Most important part is actually what leverage would you apply :

– If you go with 1-30 leverage or you go with 1-100 leverage – this is where you start asking yourself how much you can afford to lose in one trade. With smaller leverage your stop can be bigger and still lose less when hit and vice versa – this is how you should look at it – not simply how to avoid a stop – as you can’t – stops are part of this game and if applied correctly no need to worry about it.

– Now to give you some facts : I trade on a very small time frames ( reason for it is lack of patience on my side and decades of not sleeping , waiting to close a position sometimes for months ) , but also because of a very small stop losses that gives me opportunity to trade on extremely high leverages . My stop is fixed at 1.5 pips ( yes, one and half ) , my R/R is minimum 1:3 , but in practice goes as high as 1:10 , my probability rate ( win rate ) is over 96%.

– You have to make a trading system first, check it in past performance and minimum data that you need is 500 ( so 500 system signals for trade) – I prefer 1.000 + and on daily for example it might be problematic to do, not to mention weekly or God forbid monthly …

– I fully understand the angle you are coming from with these questions, but for now just accept what I am talking about. I know why you think that if R/R is higher win rate is lower-but I have different approach to all of it – I’ll explain it all within time…

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

On Monday, Chinese CPI is expected to pick up to show a year on year increase of 0.5 percent for January, propelled by Lunar New Year demand, after barely rising by 0.1 percent in December. For Chinese PPI, no change in the deflationary trend is seen with wholesale prices down 2.4 percent in January after a 2.3 percent decline in December.

On Wednesday, headline and core US CPI are both expected up 0.3 percent on the month, not a pretty picture for an inflation-weary market. Food and energy prices have been rising, along with vehicles and shelter costs, the usual suspects. Total CPI is seen up 2.9 percent and core up 3.2 percent on year.

On Thursday, for German CPI, forecasters see no change in the final reading for January from the preliminary report at down 0.2 percent on the month and up 2.3 percent on year. For UK monthly GDP, the consensus looks for monthly GDP up a marginal 0.1 percent again in December after the same 0.1 percent rise in November. For UK quarterly GDP, no growth is the call for Q4 from Q3, with a 1.1 percent rise from a year ago in Q4. Eurozone industrial production is expected down 0.2 percent in December after a 0.2 percent increase in November. Output is expected down 2.7 percent on year.

In the US on Thursday, jobless claims are expected to fall back to 215,000 in the latest week after rising unexpectedly by 11,000 to 219,000 a week ago. For US PPI-FD, the consensus sees an increase of 0.2 percent on the month and a gain of 3.2 percent on the year. Ex-food & energy, PPI-FD is seen up 0.3 percent and up 3.3 percent on the year.

On Friday, US retail sales, the consensus looks for an unusual flat reading on the month, with sales up 0.3 percent ex-autos. Lower auto sales dampened the result along with nasty winter weather. For US industrial production, forecasters expect a moderate 0.3 percent rise after a good gain of 0.9 percent in December. Capacity utilization is seen ticking up to 77.7 percent from 77.6 in December. That rate remains about 2 percentage points below average

Econoday

Mr Bobby, I wanted to ask a question, is it possible for a trader to have an 80% win rate trading on the daily or a weekly timeframe?

You people are much more experienced than me. From your years of experience trading, what do you believe is the highest win rate possible, and at what risk to reward can someone easily achieve that, is it 1:1, 1:2 or higher?

I know that the higher your risk to reward, the lower ur win rate. And which timeframes do you think give the highest probability of not hitting your stop losses, is it the daily, weekly or Monthly? Because I know very well that from the H4 downwards are extremely choppy

-

AuthorPosts

© 2024 Global View

Australia is waiting for economic data from Wednesday till Friday coreCPi till retail sales

Australia is waiting for economic data from Wednesday till Friday coreCPi till retail sales