Forum Replies Created

-

AuthorPosts

-

ETHUSD – Ethereum

This coin behaved perfectly technical so far – after very sharp drop of almost 50% it bounced strongly of the long term support line .

Pattern still suggests more downward pressure and tests of the supports, but as long as 2.190 holds on there is a good probability of renewed Up trend.

I would like to warn you all that time wise it might take another month, unless some news/data sparks immediate interest.

DAX – GER 30

DAX Surges to New High

Nice move away from support at 22.000 and making it very clear now where it tends to go.First target in 23.000 area, next 24K

Market sentiment remained upbeat amid strong corporate earnings and optimism over a potential end to the war in Ukraine, though caution persisted over US trade policy.

Robinhood Markets Inc. – HOOD

Fundamentals at it’s best

Robinhood Stock Jumps as Earnings Blow Past Forecasts

Robinhood Markets Up Over 13%, on Track for Highest Close Since August 2021

Robinhood Markets, Inc. Class A (HOOD) is currently at $63.48, up $7.58 or 13.55%· Would be highest close since Aug. 4, 2021, when it closed at $70.39

· On pace for largest percent increase since Nov. 6, 2024, when it rose 19.63%

· Currently up four of the past five days

· Currently up two consecutive days; up 19.02% over this period

· Best two day stretch since the two days ending Nov. 6, 2024, when it rose 22.78%

· Up 22.2% month-to-date

· Up 70.38% year-to-date

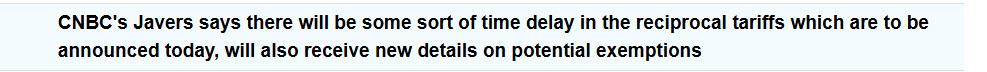

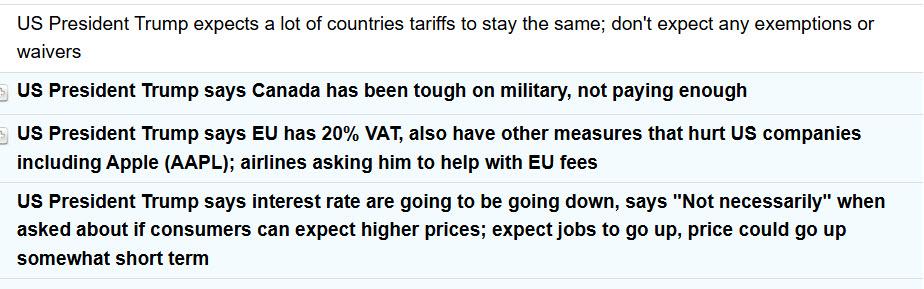

EURUSD spooked by VAT comment but has since bounced back. Here are some highlights

Source: Newsquawk.com

Trading Tip 9: The Monday Effect

This is a trading pattern I doubt you will find elswhere

This is a term I coined to identify a forex trading pattern that I watch out for each week. I call it the Monday Effect and when it plays it, there are usually significant moves in the market. So, you need to be aware of the Monday Effect, which I reveal in the following article…

The Monday Effect occurs when the low or high for a currency is set on Monday and the market reverses direction in the latter part of the week (i.e. Thursday-Friday). This “Effect” can be especially strong when the low or high is set in early Far East trading but it can work no matter what time of day it occurs.

Whatever the reason, Monday Effects do work. I jot down the highs and lows each Monday and leave it next to my platform as the week winds on. If the high or low is broken or occurs on a non-Monday, I cross off the risk of this pattern for the week.

If the market starts to distance from the high or low, I raise my alert as you often see stops build from those underwater. Think about it. The farther a market moves from a Monday low/high for the week, the less likely to see major stops being run unless those levels are taken out, leaving the other side more exposed.

Note, the Monday Effect is like a setup and as with any setup, you look for signs that it will materialize into a trading pattern

Classic Monday Effect Week

..

..Trading Tip 9: Change Muscle Memory and See the Difference in Your Trading

One of the obstacles any trader has to overcome if he/she wants to move to the next level is muscle memory.

For me, it is like trying to improve my golf swing. I take a lesson but have so much muscle memory built into my swing that trying to change is an uphill battle. I make a change in my swing but the more I play the more muscle memory takes over. I find myself reverting to what feels comfortable, which is my old swing. It takes commitment and discipline to make a lasting change.

It is no different in trading. You learn something new but have to fight muscle memory and old habits to put it into practice.

Now I can give you a list of tips or strategies you might use but let’s focus on just one It is a ‘tip” you may have seen me mention before but I cannot emphasize enough that it can make the difference between success and failure.

I call it the “hard trade is more often than not the right trade.”

What does this mean?

It means the nard to find a good entry forex trade (with the flow) is more often than not the right trade while the easy-to-enter trade (looks cheap/expensive so you buy/sell) it is often the sucker bet.

I am sure we have all been guilty of trying to catch a falling knife because it looks overdone only to see it continue moving against you. One reason is that the farther a currency or any asset moves, the harder it is to find a good entry-level where you can place a reasonable stop. Human nature then takes over, which is to try and pick a bottom or top prematurely, often with negative results.

How do you change muscle memory?

So, the question is how do you change muscle memory and start taking what looks like the hard trade in real-time but the easy trade after the fact?

One way is to take a deep breath rather than acting emotionally by trying to pick a bottom or top before there is some technical reason to do so. It is like taking a step back before acting so you can see the price action clearly.

I call it stepping out of body). You will be amazed at how losses from sucker bet trades (even if small but fatal if large) can accumulate and impact your P&L and capital.

Another step is to find a system or strategy that gets you in sync trading with the momentum and tells you when the move has run out of steam. If the purpose of this report is to publicize The Amazing Trader, I would be encouraging you to subscribe.

However, the aim is to make you aware of a trader’s tendency to look to pick bottoms or tops (most want to be swing traders) = the easy trade rather than fighting muscle memory to do so and take the hard (to find a good entry) trade.

Like my golf swing and breaking old habits, changing muscle memory is not easy but worth the effort to do so.

This only scratches the surface but if you find yourself with muscle memory as described above, the first step is awareness. The second step is to keep fighting the tendency and see if it makes a difference in your trading.

i can show yiu away using ny Amazing Trader charting algo.

Feel free to contact jay@localhost

-

AuthorPosts

© 2024 Global View