Forum Replies Created

-

AuthorPosts

-

DAX – GER 30

Dax continues to hit new highs – trend that started in late 2024.

And it goes stronger and faster.

So what might be behind this latest run – last 8 days?

Reuters claims : European stocks hover near record high on defence boost

European shares hovered near a record high on Monday, boosted by defence stocks amid growing U.S. calls for the region to amplify military spending for security.But in my own view – this was all “written” on charts months ago, and especially after DAX broke above 22.000

So Targets are at 23 & 24 K

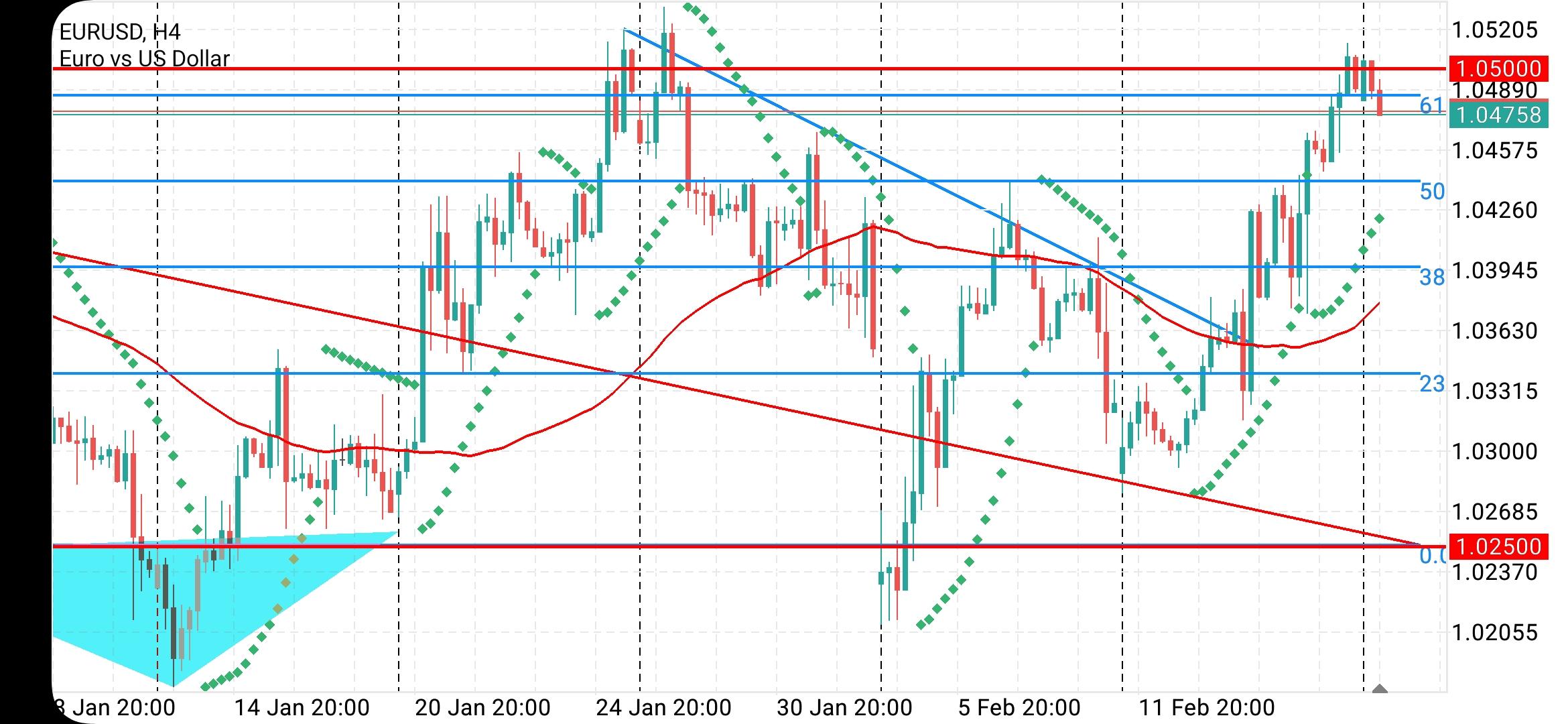

EURUSD Daily

Supports: 1.04350, 1.03950 & 1.03650

Resistances: 1.05050, 1.05150 & 1.05500

Aside of my previous statement that this is a Correctional angle ( current uptrend) , let’s avoid any predictions right now.

Test of Supports is on the cards and 1.04350 is a level to watch – if taken out this move Up is over.

GOLD (XAU/USD) opened at around price 2881 early this morning. It then went long (bullish) to the area of 2906, the highest point it ever got to till this moment. We see a retracement to the area of 2895 after which it went a bit long to its former position. The time is 1pm Nigerian time this Monday afternoon and the mood is good.

The price at 1pm is 2901 now. I forsee a small sell to tje price of 2895 to form a support level before a return to its former buy position. Happy Trading.

Please do not overtrade as it might ship wreck your Account. 2-5% of your Capital is what I recommend. Aword is enough for the wise.

Thanks,

TOPNINE.THIS WEEK’S MARKET-MOVING EVENTS (all days local)

On Monday, Canadian housing starts are expected to recover to a 250,000 rate for January after slipping to 231,468 at an annual rate in December from 267,140 in November.

On Tuesday, look for the Reserve Bank of Australia to kick off its rate cut cycle with a 25 basis point move to 4.10 percent. The UK Labour Market report is expected to show unemployment ticked up to 4.1 percent, and average hourly earnings are seen up a tidy 5.9 percent on the year.

Germany’s ZEW economic sentiment index is seen up to 17.5 from 10.3 in January. The consensus sees Canada’s CPI up 0.1 percent on the month and up 1.8 percent from a year ago versus minus 0.4 percent on the month and 1.8 percent last month.

In the US, the Empire manufacturing index is expected to improve marginally to minus 0.5 in February after dropping to minus 12.6 in January from 2.1 in December. The NAHB housing market index is seen at 47 in February after firming to 47 in January from 46 in December.

On Wednesday, Japanese export values are forecast to post a fourth straight year-on-year rise in January, up 10.4 percen, after hitting a record high in December with a 2.8 percent gain. The trade balance is forecast to post a large deficit of ¥2.15 trillion after a ¥132.46 billion surplus in December, its first positive figure in six months.

The Reserve Bank of New Zealand is expected to announce another 50 basis point rate cut in the official cash rate to 3.75 percent after a 50 bp move to 4.25 percent in November. In the UK, annual inflation is seen at 2.8 percent in January versus 2.5 percent in December. Meanwhile, US housing starts are seen at a 1.397 million unit rate in January, down from 1.499 million in December. Permits are seen at a 1.470 million unit rate versus 1.483 million.

On Thursday, jobs in Australia in January are expected to show a 20,000 increase on the month. The jobless rate is expected to tick up to 4.1 percent from 4.0 percent in December. The US Philly Fed index, which rose to 44.3 in January from minus 10.9 in December is seen at 22.7 for February.

On Friday, consumer inflation in Japan is expected to accelerate further in January, with the core reading (excluding fresh food) up by 3.1 percent on year after rising to 3.0 percent in December. UK retail sales are expected to post a moderate 0.3 percent rise on the month with a gain of 0.9 percent on year.

In the US, existing home sales are seen down to an annual rate of 4.16 million units in January after rising to 4.24 million in December from 4.150 million in November. Finally, US consumer sentiment is expected at 68.0 for the final February reading after dropping to 67.8 in the preliminary February report from 71.1 in January.

Econoday

-

AuthorPosts

© 2024 Global View