Forum Replies Created

-

AuthorPosts

-

Yes, German Elections is another important moment, but I don’t think that the fate of EUR is in their hands…any more…Trumps dealings with Russia / Ukraine is way more important.

Aside feelings of honourable European politicians ( finally someone to make them sweat and lose some sleep) , if Trump manages it till the end, Europe as a region/continent will get another chance.

It all falls back to question of Gas and Minerals coming from Russia- so Europe might ( will ) lose this one – as in the eyes of local politicians Piece is a loss…but Europe will win in many ways…

Of course waves will be felt for months to come, but we like to say : every miracle lasts three days…

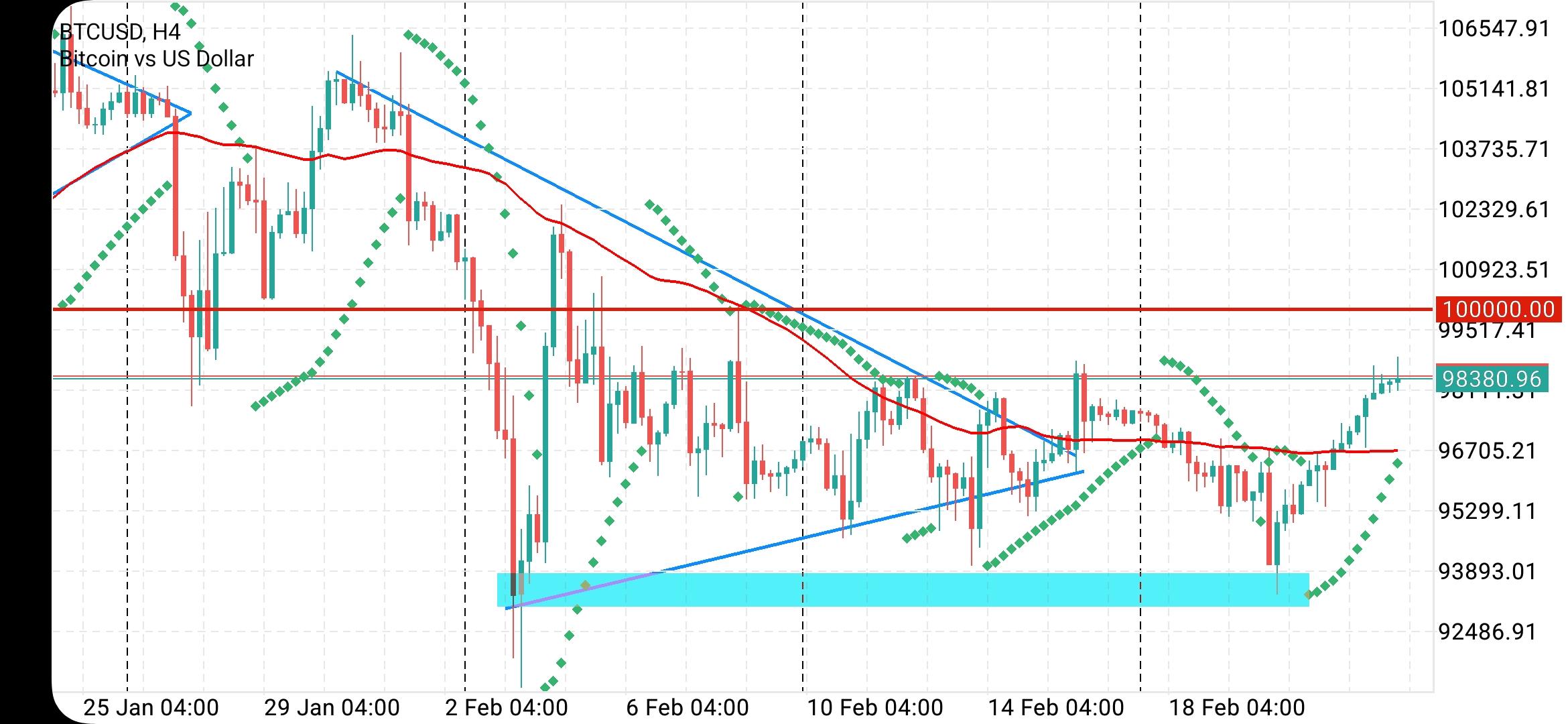

EURUSD Daily

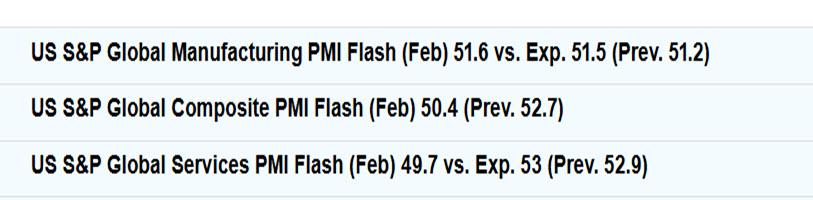

Is it going to be the decision day today for EUR?

Supports at : 1.04600 & 1.04350

Resistances at: 1.05050 & 1.05550

Data today should finally gives us a clue – Economic Data Calendar

Trading Tip 10: Treat Forex Trading as Being in Episodes Not Trends

Most technical traders refer to momentum moves as trends. I prefer to look at the price moves as trading in episodes.

Like a streaming television show, an episode has a beginning and an end. It is no difference in trading except that is where the similarity ends.

The Forex Market trades in episode

The forex market trades in episodes on all time frames. The longer the time frame, the longer the episode is likely to be and vice versa.

What I mean by an episode is a period on a chart where a currency, for example, is trading in an uptrend, downtrend or in a consolidation range.

Don’t get caught trading an old episode

This is a critical concept to understand for if you are trading an old episode when a new episode has begun then you will find yourself on the wrong side of the market.

Anyone who has traded in the forex market, knows how fickle the price action can be. By getting in sync with the current episode, you can take advantage of this knowledge rather than having it take advantage of you.

With that said, many traders find themselves trading the old episode as it is often hard to switch gears, even when charts tell you it is time to do so. An example is looking to sell a rally after a currency has bottomed or looking to buy a currency after it has topped out.

What a difference a day makes

Look at this chart and ask yourself whether you would have been able to switch gears from an up episode to a down episode.

It is important to identify when a new episode begins and when it ends. It is also important to be aware of the broader trend as counter trend moves (e.g. retracements) tend to end more abruptly than moves with the overall trend.

So, the question you should be asking is how to stay one step ahead of the market rather than one step behind.

Think if it this way. Getting in sync with the current episode will find you swimming with the current rather than fighting it by swimming against it.

Why You Should Treat Forex Trading as Being in Episodes Not Trends

For a further discussion, sign up for the Global-View Trading Club membership is free).

To get Your Free Trial of The Amazing Trader Charting Algo Click HERE

A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street nursed a bruising on Walmart (NYSE:WMT)’s downbeat results, casting a cloud over the U.S. consumer just as more buoyant European markets awaited the weekend’s German election.

Another blizzard of often conflicting influences from geopolitics, trade, monetary policy and corporate earnings barrelled into world markets over the past 24 hours.

But it was the retailing giant’s miss on its sales and profit forecasts – citing the turbulent political environment and trade uncertainties ahead – that cut deepest.

US OPEN

EUR weighed on by PMIs & JPY hit by Ueda remarks, Commodities are pressured by the firmer Dollar ahead of US PMIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly higher after paring initial pressure following dire French PMIs; US futures are modestly mixed.

DXY attempts to recoup lost ground, EUR weighed on by PMIs, JPY hit by Ueda remarks.

BoJ Governor Ueda said if markets make abnormal moves, the BoJ stands ready to respond nimbly, such as through market operations, to smooth market moves.

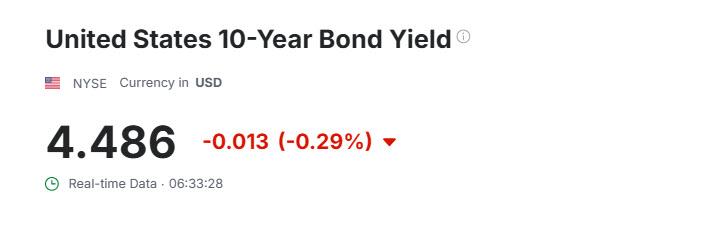

Bunds bolstered by soft PMI metrics; Commodities are pressured by the firmer Dollar.

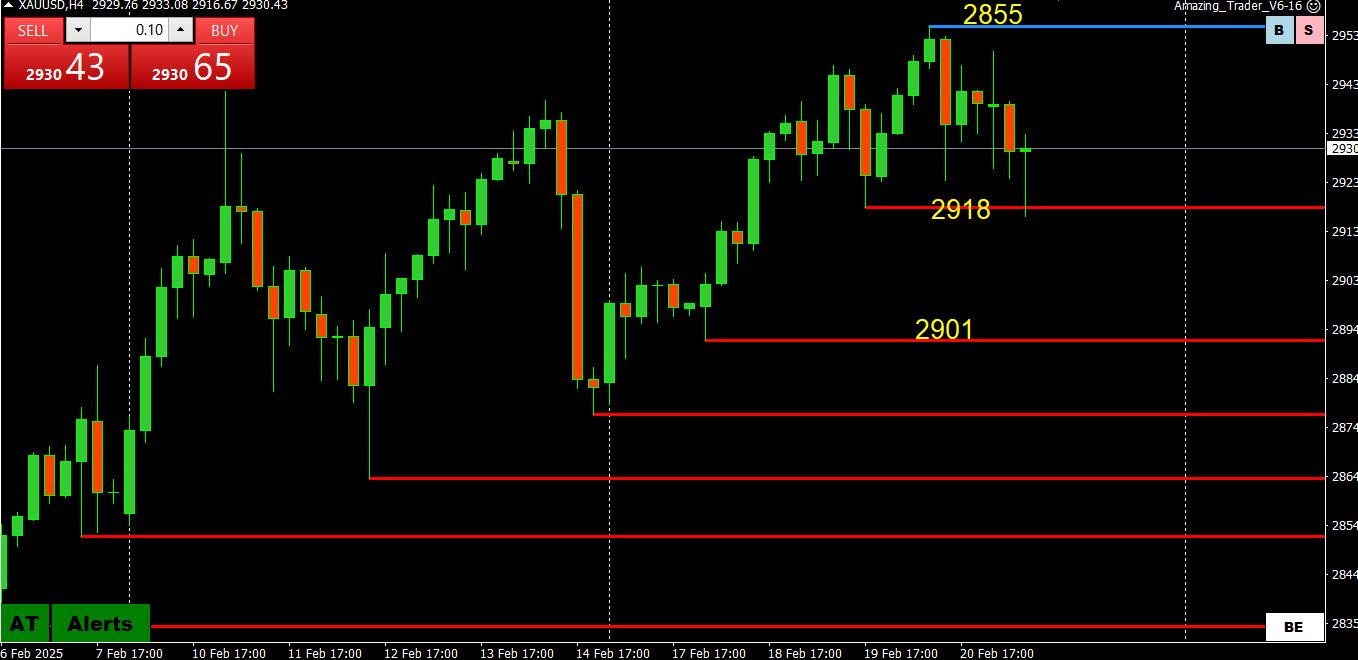

XAUUSD 4 HOUR CHART – Tests support

XAUUSD so far fighting off retracement pressure by holding (just) below support at 2918 cited yesterday.

This leaves it consolidating within a 2917-2950/55 range with a lingering retracement risk unless the upper end is taken out,

To repeat, betting on a retracement has been a losing bet and why I have been citing 2918 as the level hat needs to hold to contain the retrace risk

Using my platform as a HEATMAP

Dollar is firmer after yesterday’s sell-off

Led by USDJPY which had bounced back above 150 but remains below yesterday’s 150.91 breakdown level.

Only news I have seen is a pushback by several officials on rising JGB yields (10 year hit a 15+ year high)

EURUSD backed off from 1.05 awaiting Sunday’s German elections…. 1.0450 = neutral while within 1.04-1.05

Stocks steady after yesterday’s sell offs.

Gold extended its retreat from yesterday from a new record high but so far contained after testing 2918 support (low 2917).

Highlights:

Flash EZ and UK PMIs

Japan CPI (hotter but ignored)

See our Economic Calendar for upcoming US data

TGIF

-

AuthorPosts

© 2024 Global View