Forum Replies Created

-

AuthorPosts

-

In our blog

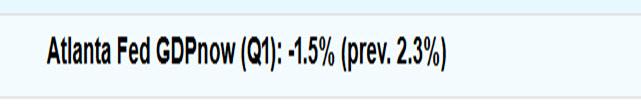

Maybe I’ve missed it but nowhere is anyone talking recession.

EURUSD 1 HOUR CHART – Upside capped

1.0418 AMAZING TRADER resistance so far capping the upside.

1.0400 former key support_is pivtoal

Beware of Trump headlines although focus today should be on Zelensxky’s meeting.

Trading tip 11: Take a Pause and Review: Stops as They Drive the Forex Market

Let me start by saying the forex market is on a never-ending quest to run stops. Master this concept and you can learn to beat the market.

Look at this chart and tell me whether you woud have been able to identify in advance where stops werel ying.

Ad in this chart you can see where there were stops (i.e. low of the day)

While there are stops in all markets, it is easier to identify those in forex and use that knowledge to your advantage.

One reason is that the only rate feed used by everyone is in forex. The only difference one might see is in the spread quoted by a broker. Otherwise, everyone involved in forex are essentially looking at the same chart levels.

The more who look at a specific level the more significant it becomes.

It is therefore easier to identify where stops might be lying vs.CFDs, where rate feeds can vary between brokers, ecen those uswing thw same symbol.

In this tip, I am going to refer you to previous tips: (scroll down)

Trading Tip 3: Use stops and Live to Trade Another Day

Trading Tip 3A: Watch Out for Stops and Use Them to Your Advantage!

And to this video, which I suggest watching or watching again.

If you then have any quextions, postask away.

It pays to take a moment to revisit this artice, especially given the sharp moves down in stockx this month

A look at the day ahead in U.S. and global markets from Mike Dolan

The S&P500 stock benchmark plunged into the red for the year this week as an Nvidia-led selloff, economic slowdown fears and re-ignited trade war fears jarred while the dollar surged anew.

Following Big Tech megacaps and small cap indexes into negative territory for 2025, the S&P500 plunged 1.5% on Thursday as U.S. jobless claims saw their biggest weekly jump in five months and President Donald Trump warned more tariff rises are coming as soon as next week.

Morning Bid: S&P500 in red for 2025 as trade war fears ratchet

US OPEN

ES/NQ gain ahead of US PCE, sentiment hit amid trade angst but off worst levels

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are in the red, but with sentiment off lows; ES/NQ gain ahead of US PCE.

USD remains underpinned by trade angst; Antipodeans lag given the risk-tone.

Bonds bid after Trump’s latest on tariffs & tech pressure, though benchmarks are off highs.

Commodities lower on month end and ahead of weekend uncertainty.

looking ahead … (at month-end)

US 10-YR 4.252% -0.035

8:30 – personal consumption expenditures price index — the Federal Reserve’s preferred inflation metric“Economists polled by Dow Jones expect the measure of price changes for consumers to rise 0.3% from December for an annualized gain of 2.5%. Excluding volatile food and energy prices, so-called core PCE is expect to increase by 0.3% month over month and 2.6% year over year.”

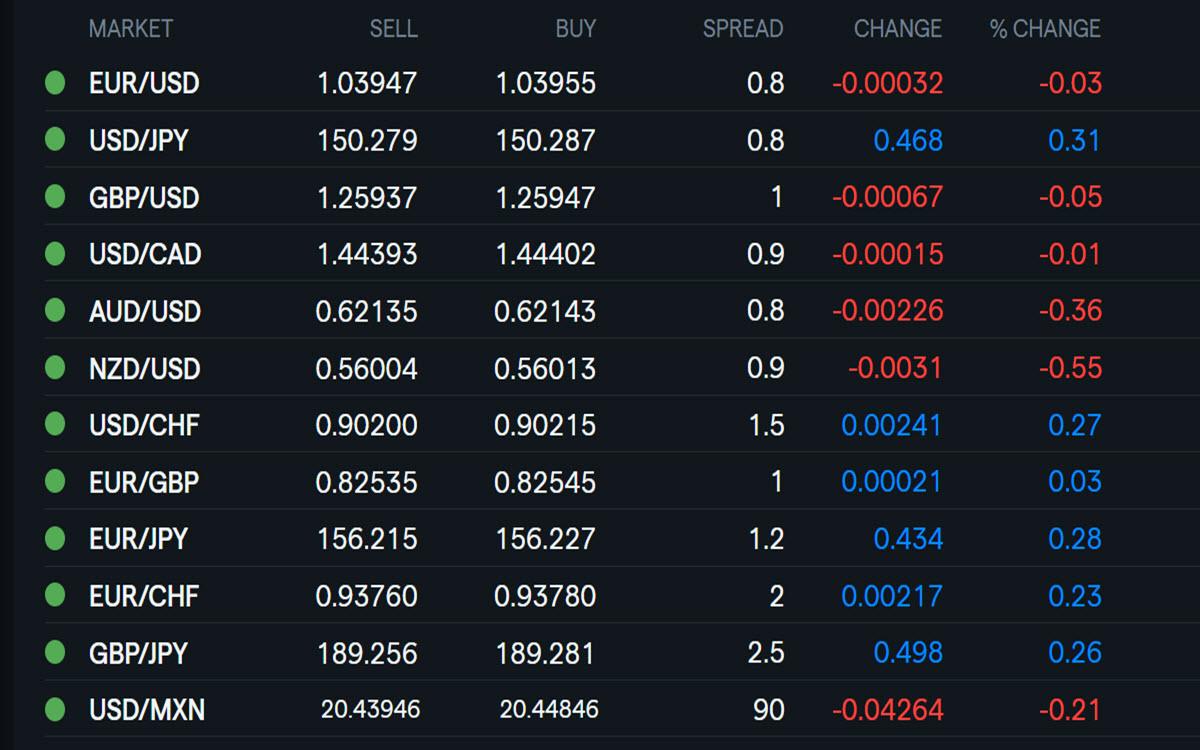

eurdlr 1.0390-ish, dlrchf .9029 gbpdlr 1.2590

tuesday march 4th = d day for President Trump’s 25% tariffs on things Canadian

dlrcad 1.4437XAUUSD 4 HOUR CHART – Outside week

At a minimum, the 8 week pattern of higher lows/higher highs was broken by an outside week. This leaves the focus on last week’s low at 2877 to see iit finishes the day below it for an outside week key reversal.

So far, 2852 support has held, which is close enough to the pivotal 2850 to make this level the one to watch on the downside (I always pay attention when the “50” level is involved). Below that is 2834 and then a void to aub-2800.

On the upaise. A close above 2777 and a move above 2888 would be needed to ease the risk

Using my platform as a HEATMAP

Liquidating markets across asset classes taking no prisoners.

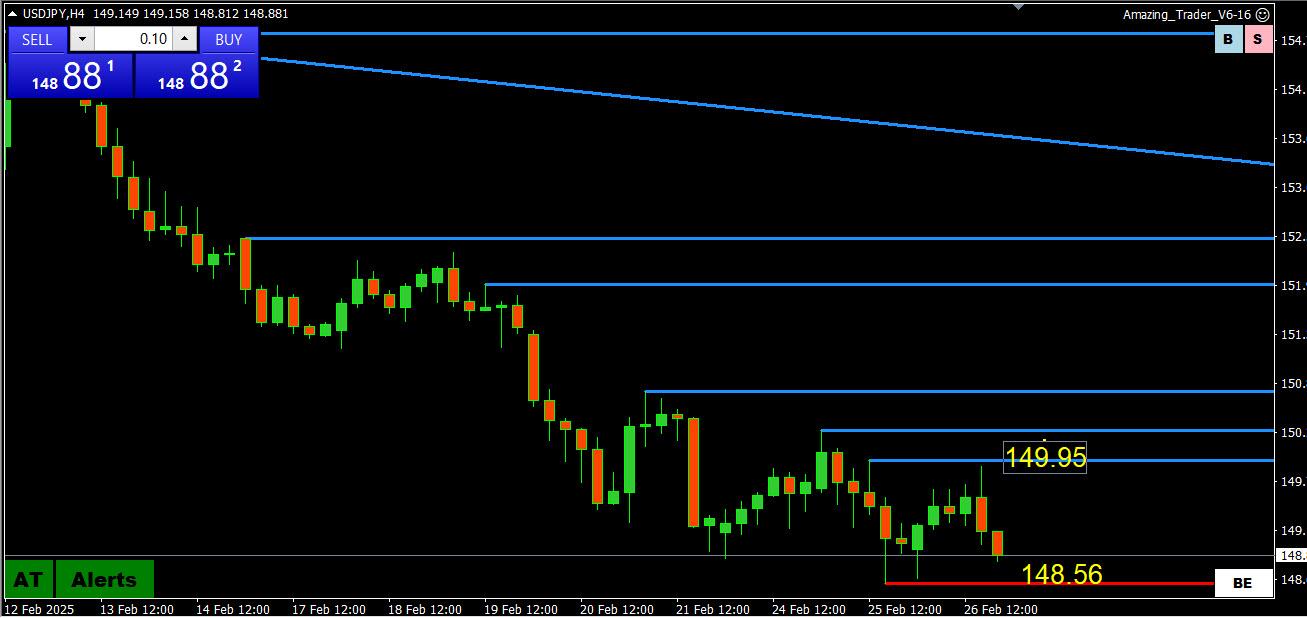

The dollar holding firm at month end with USDJPY back above 150 and AUD and NZD underperforming. .

Watch month end rebalancing flows to see whether a risk of dollar buying (hard to say how much has already taken place) given weaker stocks. I read bank report earlier in the week indicating it expects EURUSD selling given the underperformance of US stocks relative to European stocks

This is not an exact science so keep an eye on what looks like real money flows, especially ahead of the 4 PM month end London fixing

Elsewhere;

Golfdextending its retreat.

Cryptos down sharply

US bond yields falling further but off earlier lows.

US stocks finding some support but the day is young.

Looking ahead

US PCE (watch the core reading) is the key data release… See a detailed preview

Watch for Trump comments, especially after the carnage triggered by his tariff comments yesterday.

-

AuthorPosts

© 2024 Global View