Forum Replies Created

-

AuthorPosts

-

DLRx N of 107 is positive for the dollar

JEROME is unlikely to surprise the market and is likely to oooh and aaah about further intentions about meddling with rates

I am guessing that the biggly loaded long dollars ahve not washed out in the recent dip but on the other hand it should also limit further dramatic dollar rise. I could see more dollar upside if donald comes out swingging more but .

10-yr N of 4.5% also lends support to the DLR

Euro is reacting to Treasury bonds lately fairly well. What looked like a possible breakout to the upside recently in Euro was not in the bonds. Various stock futures and indices have also been providing a clear window into flows. Stocks are up today but overall they are still experiencing sell side flows of weight. A bit stiff to not anticipate Euro sub 1.04 coming up even if temporary. Common sense might dictate pre-Wednsday positioning in play.

EURUSD failed to test 1.0444 let alone 1.0450/57 but downside contained after a pauwe above 1.0411.

USDJPY trading well above 155 on the pop in stocks

XAUUSD above 2650 after finding support in my 2725-35 zone but still just consolidating.

NASDAQ The UP 1.1%

Now the wait is on for CB meetings or next Trump tweet.

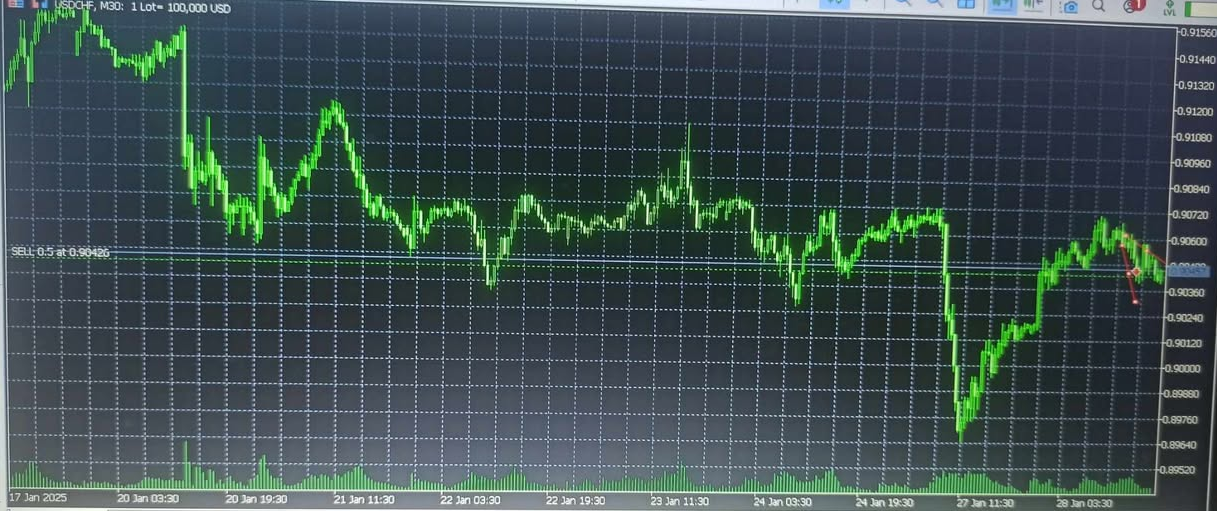

AT 3:30PM NIGERIAN TIME, USD/CHF CAME DOWN TO PRICE 0.90500 WHICH IS A PERFECT SET UP FOR A FURTHER BUY. IT WAS A DOWNWARD SLOPE WHICH SIGNIFIED FURTHER WEAKENING OF THE BASE CURRENCY AGAINST THE QUOTE CURRENCY CHF (SWISS FRANCS). THE MARKET WENT AS PREDICTED AND I SOLD UP TO 0.90401 WHERE I INTEND GETTING OFF THE GAS. THE MARKET WENT MY WAY AS I PLACED A0.5 SELL TRADE ON THE USD/CHF CURRENCY PAIR. THERE IS A CB CONSUMER CONFIDENCE NEWS COMING UP A T 4PM , A FEW MINUTES FROM NOW. THIS NEWS MIGHT SHAKE THE MARKET , BUT THE PREVIOUS WAS 104.7 WHILE THE FORECAST IS 105.9, IT REMAINS FOR MARKET TO REVEAL THE ACTUAL IN A FEW MINUTES. LET’S KEEP OUR FINGERS CROSSED.

I STAY AWAY FROM VOLATILE NEWS AS MUCH AS POSSIBLE BECAUSE PRICE CAN GO IN ANY DIRECTION. GOOD MONEY MANAGEMENT SKILLS IS REGUIRED HERE AND RISKING BETWEEN 1-3% OF TOTAL CAPITAL PER TRADE IS GOOD IF ONE DOES NOT WANT TO SHIP WRECK HIS ACCOUNT.

THIS IS MY CURRENT ANAYLSIS.

THANKS,

TOPE AJALA

FROM NIGERIA.Uncertainties around U.S. policies could slow global economic growth modestly in 2025, according to major brokerages. They expect U.S. President Donald Trump’s likely plan to raise tariffs to fuel volatility in global markets, raising inflationary pressures, which could limit major central from easing their monetary policy.

Following are the forecasts from some top banks on economic growth, inflation and the performance of major asset classes in 2025.

Forecasts for stocks, currencies and bonds:

Brokerage S&P 500 target U.S. 10-year yield EUR/USD USD/JPY USD/CNY

The euro could rise slightly if the European Central Bank delivers a cautious tone about interest rate cuts at Thursday’s meeting, Bank of America analysts say in a note. “The market is already pricing two cuts for the next two meetings, and the ECB is unlikely to commit to more cuts beyond that right now.” This potential caution could provide some modest support to the euro given short positioning that bets against the single currency, they say. However, BofA remains cautious on the euro in the near term due to the risk of U.S. trade tariffs, which could add to the case for further ECB rate cuts. The euro falls 0.6% to $1.0432.

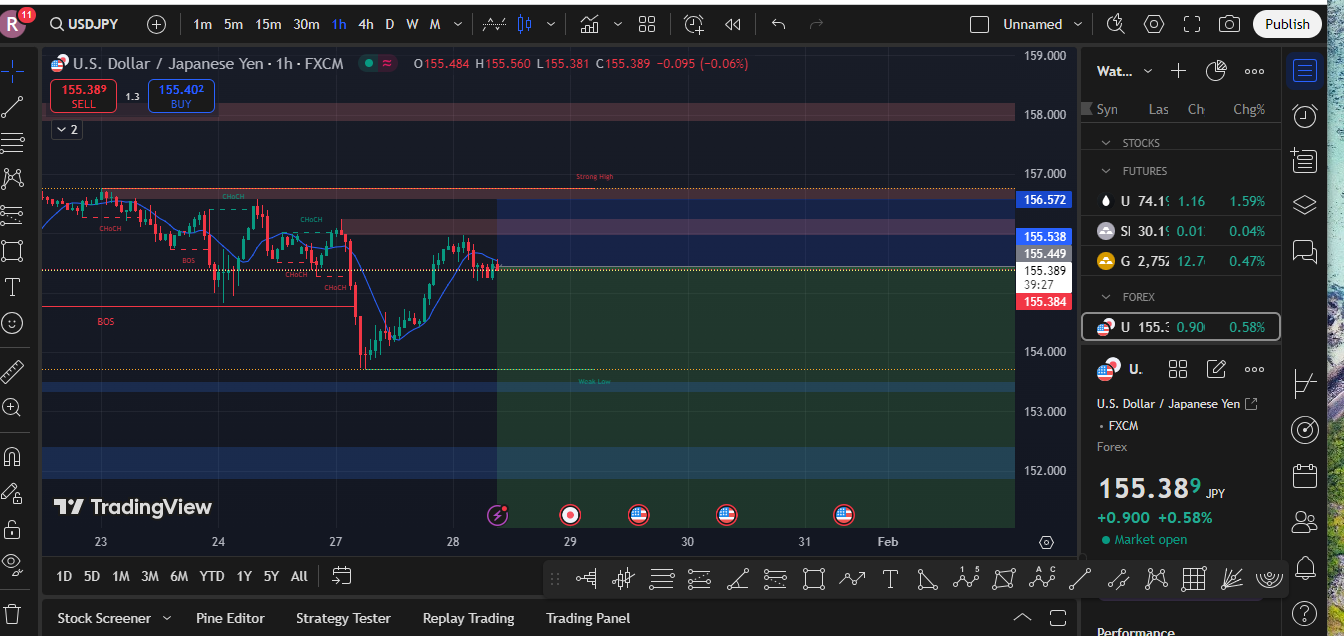

USDJPY 4 HOUR CHART – Key levels

Bounce from 153.73 would need to break the trendline + 156.25 to suggest the low is on for now.

Otherwise, keep an eye on 155 to set its tone (while within 154=156) and the risk tone as set by US equities.

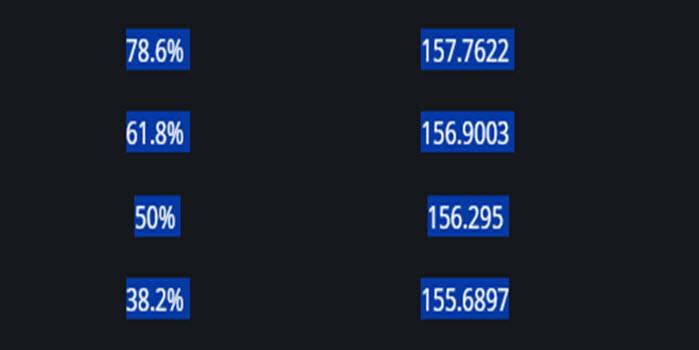

FIBOS for 158.86 => 153.73 using our Fibonacci Calculator

THIS IS 12:30 PM NIGERIAN TIME. GOLD HAS JUST CONSOLIDATED. THERE WAS A SELL DOWN TO 2734.77 THIS MORNINGWHICH WAS THE LOWEST POINT IT HAS REACHED SO FAR TODAY TUESDAY JANUARY 28TH 2025. IN THE LAST 3 HOURS GOLD (XAU/USD) HAS BEEN ON AN UPWARD TREND.

THE UPWARD TREND IS GOINT TO CONTINUE TO AROUND 2746.5 AT LEAST AS PER MY SPECULATION. PRICA HAS BEEN RANGING AROUND PRICE 2744 IN THE LAST 24 HOURS AND I EXPECT A BREAK AWAY FROM THIS LEVEL SOON. A LOT OF FAKEOUTS AND FAKE CANDLES WHICH PROMISED A STRONG BUY BIAS BUT LATER RETRACED CAN BE SEEN ON THE HOURLY CHART. MARKET WILL SOON BREAK THE RANGE ZONE FOR A STRONG BUY SOON.

THAT IS MY LATEST PROJECTION/PREDICTION ON THE GOLD.

THANKS,

TOPE AJALA

FROM NIGERIA. -

AuthorPosts

© 2024 Global View