Forum Replies Created

-

AuthorPosts

-

EUR/USD (EURO) HAS CONSOLIDATED AND IS SET TO GO ALL THE WAY UP FROM ITS PRESENT PRICE AT 1.04024 AND IT WILL GO TO AROUND 1.0500, A MOVE OF OVER 100 PIPS. I SAW THIS PROPOSED MOVE YESTERDAY WHEN PRICE CAME DOWN TO 1.039 AREA.

MARKET CAME TO THAT SUPPORT AREA AND IS ABOUT TO RETURN UPWARDS. TODAY’S VOLATILE NEWS IS GOING TO PUSH THE EURO FAR UP. B.O.E GOVERNOR BAILEY’S SPEECH TODAY IS GOING TO SHAKE THE MARKET. WE ARE EPECTING THE ACTUAL OUTCOME OF THIS NEWS TO BE HIGHER THAN THE FORCAST AND THE PREVIOUS PREDICTIONS.

LET’S WAIT AND SEE AS TIME WILL TELL. THIS IS MY EURO PREDICTION FOR TODAY’S NEWS. THANKS, TOPE AJALA, FROM NIGERIA.

USD firmer, CAD undecisive into policy decisions, blockbuster ASML results lift tech

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses mostly firmer, with Tech surging after blockbuster ASML bookings; NQ slightly outperforms.

USD is a little firmer ahead of the FOMC, CAD awaits BoC, AUD softer post-CPI.

Bonds are bid into the FOMC. BTPs & OATs attentive to domestic matters

Crude slides and metals trade mixed ahead of FOMC.

Try Newsquawk for 7 Days FreeA look at the day ahead in U.S. and global markets from Mike Dolan

The AI-related stock shakeout seems to have calmed as investors turn to megacap tech earnings – with the Federal Reserve set to pause its easing campaign in its first policy decision for 2025 just as central banks in Canada and Sweden cut again.

Morning Bid: Tech bounces as eyes turn to ‘Mag7’, Fed meet and Canada cut

Mr.Edikan, my name is Bobby but if you insist , you can call me Lord of Belgrade by all means 😀

Please read what I posted yesterday on R/R issue…

I am reading again what you posted, and really can’t see the logic – taking into account real trades I am missing a point.

Elaborate this issue a bit, so we can all get to the point.

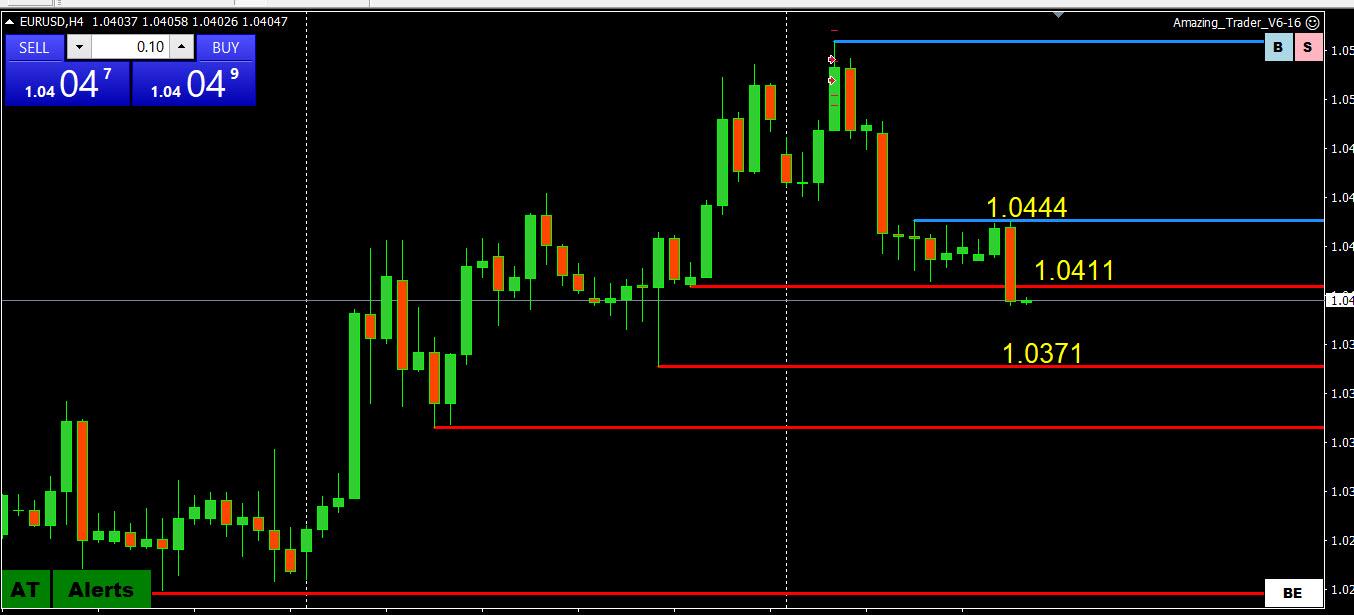

EURUSD 4H

Support – trend line taken out – important is how it is going to close this bar (in 2h).

Resistances : 1.04150, 1.04250 & 1.04400

Supports: 1.03900, 1.03700 & 1.03500 ( back to that pivotal level…)

As FOMC come tonight, levels can be breached, trendlines broken, but reaction of the market tonight is going to be wild…so everything is really possible at the end of the day.

I am treating it right now as a Bearish situation and unless I see decisive move back Up , I keep selling on smaller time frames.

Insights you might now find elsewhere

This popular article in our blog is worth revisiting after looking at a EURUSD chart today

I first heard the term “feels bid in an offered market” on the Global-View.com Forex Forum many years ago. It was posted by one of our professional trader members, LA Mel, who used the term mainly for the EURUSD. However, it soon became apparent that it could be applied to all currencies and on both sides of the market (e.g. feels offered in a bid market and vice versa). I soon added to my trader toolbox and still use it today

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

XAUUSD 4 HOUR CHART – CONSOLIDATING

No change from my last update…

The bounce from the midpoint of 2725-35 support, cited well in advance here, leaves 2771 as the key level, not only blocking a run at the 2785 record high but to keeping alive a lingering risk on the downside. .

In any case, expect support as long as it trades above 2730 and the trendline.

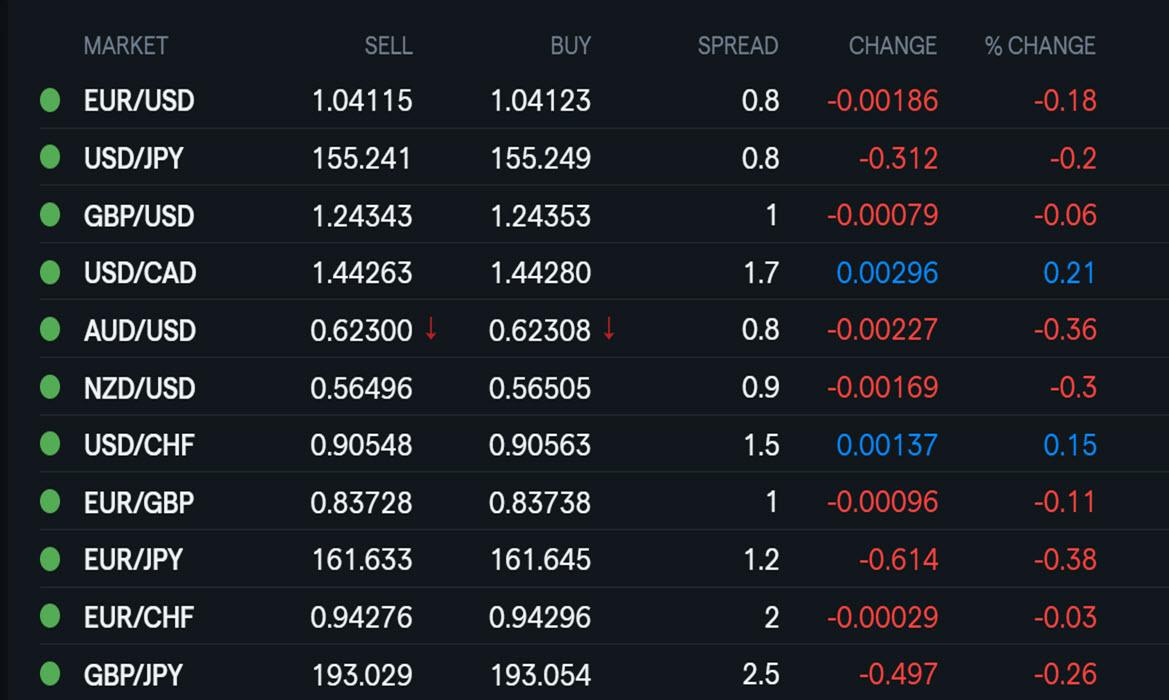

Using my platform as a HEATMAP shows

USD Is firmer (except vs JPY but USDJPY Is still above 155)) ahead of the FOMC (and BOC) rate decisions despite lower bond yields as market is showing little fear of the Fed.

USDCAD is firmer ahead of a widely expected BoN 25bps rate cut.

AUDUSD hit after CPI raised expectations of Feb rate cut.

-

AuthorPosts

© 2024 Global View

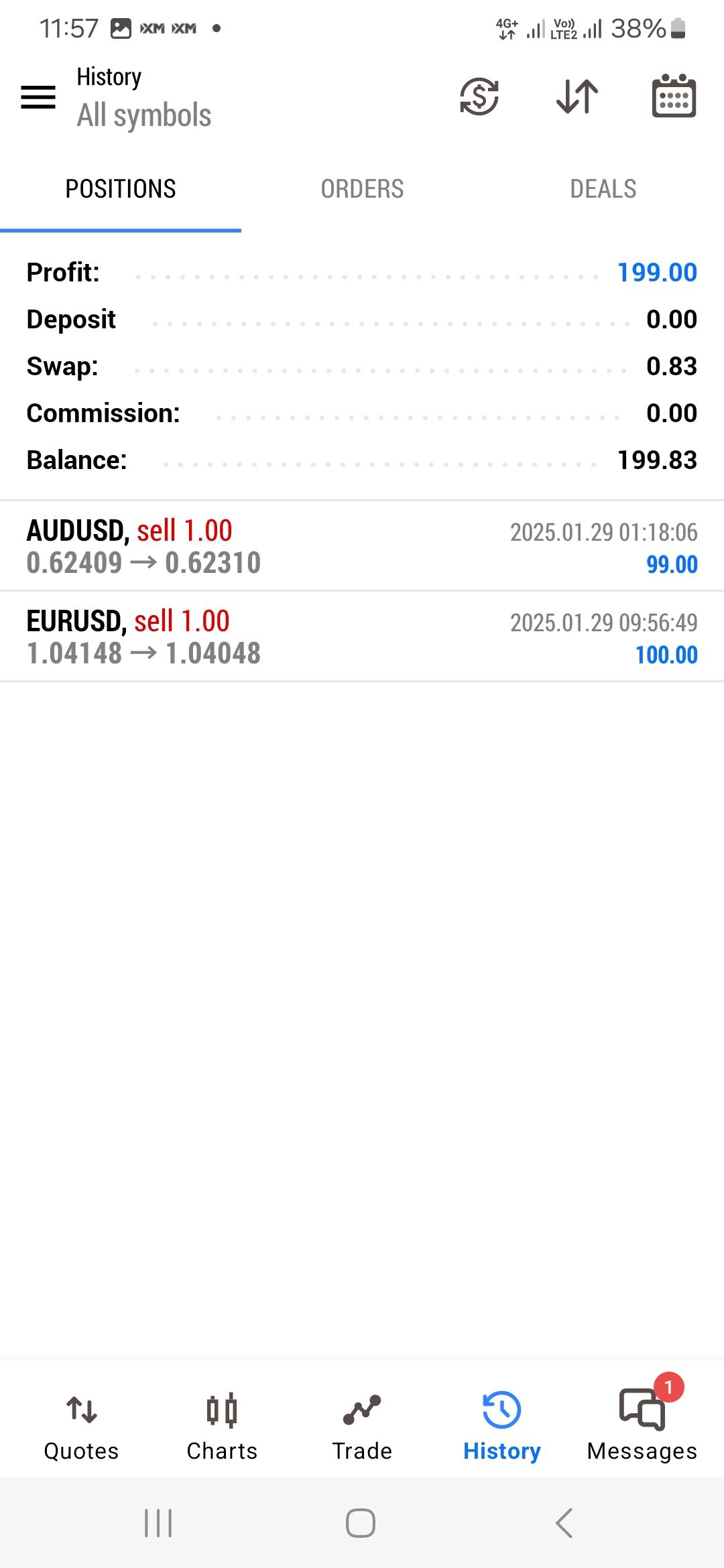

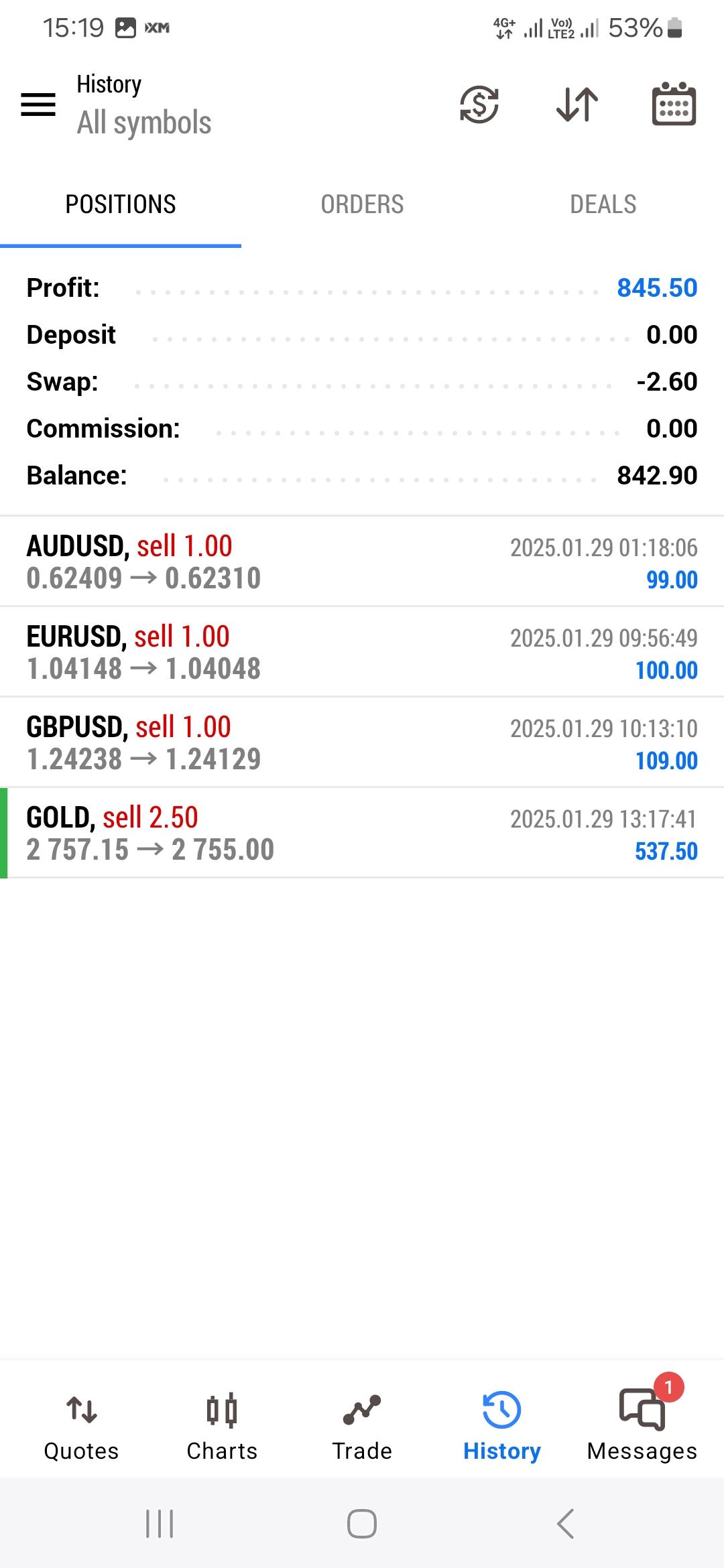

by next week I should start giving people signals

by next week I should start giving people signals