Forum Replies Created

-

AuthorPosts

-

Europe is right now in the middle of Russian aggression on one side, self imposed sanctions on Russian gas and oil , lost in space after Trump became a President again, some crazy ideas on Green energy….just to mention a few….Member countries are having second thoughts on everything , Germany and France cannot solve the inner political situations…that mess.

Mr Bobby, First of all, you can never lose 5 trades in a row with a 90% win rate, do the maths yourself, it’s 1 out of 10,000 (0.01%)

Or to put it in better perspective, there’s a 99.99% chance that you won’t lose 5 trades in a row, if you understand probability, you know how difficult this is.

Secondly, yes you need 9 wins in a row to cover one loss, but you can go on insane winning streaks, there’s almost a 10% chance of winning 22 trades in a row, do the maths yourself, that will also help you curb the losing streaks, should you lose 2 in a row, as for risking on prop firms, I use something called Kelly Criterion for my stake sizing, the optimal risk for me is 1/4 of the Kelly,The formula for Kelly is (F=BP-Q/B)

F is the optimal amount you should risk to get the maximum returns possible.

B is the reward for every one dollar risked,

P is the winning probability

Q is the losing probability

For my own strategy, the 1/4 Kelly recommends 6.25% risk, which translates to 0.625% risk per trade, according to my calculations, if you have an inverse risk to reward of $5 to $1, with an 87.5% win rate, (7/8) on average. And you take 4 trades on average a day, you will make a guaranteed, 5% after 30 days, with initial risk of 0.625% because of compounding, in 3 months, you should be done with both phases very conservatively, so by risking 0.625% per trade, you will need 8 losses in a row to hit ur daily drawdown, with a 90% win rate, the probability of you losing is 0.000001% (which is approximately 1 in 1 million, that’s totally impossible) win rate really affects drawdown, most traders are used to the drawdowns that comes with a 40% win rate, because most traders use a positive RR, they are more like to lose 4 in a row than they will win 4 in a row, that’s why they really need to risk 1% to 2%, with a higher win rate you can risk 5% to 10% and still be very okay

To join you in your biased view Mtl :

EUR has to go straight below 1.03 first, rebound to 1.04500 and fail , and then we go for a jugular – below 1.01800.

Otherwise we might be just day dreaming…even it is only logical – how can EUR get stronger in such a geo political mess we have right now , and all the problems each EU member country has….

The Swiss to End EU Stock Market Measures as Relations Improve

souds similar to donald’s relation’s improvement with colombia

Switzerland to Lift Protective Measure for EU Stock Exchanges in May

Switzerland will remove the European Union from its stock exchange protection list aimed at safeguarding the Swiss stock exchange infrastructure, effective May 1.With the EU revising the relevant legal basis in 2024 and lifting the restrictions on EU securities companies trading Swiss equities, the Swiss Federal Council deemed the protective measure no longer necessary, according to a Wednesday release.

EURO 1.0413 as I type at 10.40nyt

–

with jerome having gotten himself into the corner ropes with his alleged dependence on data and his of fear of trump policies, the aggregate market view seems to be FED to remain flat AND that if any rate cutting is to come sometime long long time in the future would be slower than slow in light of FED’s magicianipulation to bring it to their 2% target not working swimmingly.Trade idea:

I am biased to go long DLR if n when it should spurt uP on Jerome’s wishi-washi unenthusiasm for cut and some yakiing about prudent for longer AND therefore relatively hawkish to other rate-cutting themed CBs.DAX – GER30

DAX Hit New Record Peak

Stocks in Germany Hit All-time High

The DAX rose toward 21650 on Wednesday, hitting fresh record highs, in line with other European indices, fuelled by strong quarterly results from ASML. Market sentiment was also helped by easing concern over the impact of DeepSeek on AI demand.

Interesting technical fact : Previous Resistance line acted as a perfect Support to underpin this renewed Rally.

Now the sky is the limit – 22.200/400 might be in reach.

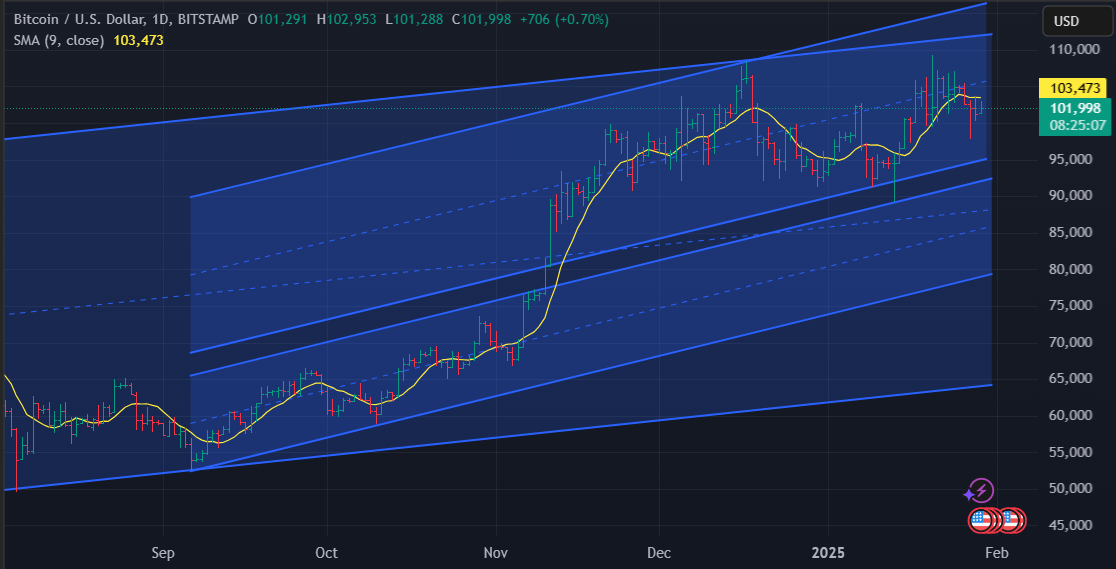

BTCUSD – Bitcoin

Bitcoin Whales Resume Accumulation: Is a Rally Imminent?

The crypto market is recording a surge in bitcoin (BTC) inflows to whale wallets, indicating that this cohort of investors has begun to accumulate the digital asset again amid the recent downturn.

Sudden break of 104K upwards would be the first signal that the wave is starting.

However, this current consolidation might take few more days with a visit to 95K

OK Edikan – I thought that’s the way you look at it , and I did find some sense in it.

Problem is that it is enough to be wrong once to be screwed up – you need to be right 9 times in a row just to cover that loss.

But I do understand what are you talking about – I know that even 5 pips (5$) is enough to hold your position to make 3$ ( so even more then 1).

Real suffering comes from the fact that once your stop is hit, you rush in another one and easily you can roll 5 losses in a raw….and then it is game over.

And we are trying here to explain to the people ( most without much experience) what will secure their existence in this game.

On the other hand, going with the Prop , with their extreme rules ( like never below 5% of the peak ) this is suicidal ….Or you have to go with a very low leverage…so again : how to make their targets?

Mt. Bobby, I read ur article on risk to reward, it still doesn’t change my view, I’m of the strong believe that win rate is heavily linked to RR, someone who risks $9 to make $1, on default has a win rate of 90%, you can prove this by yourself by taking random trades with a $9 to $1 inverse RR and track ur win rate, if you have an edge, u will easily win above 90%

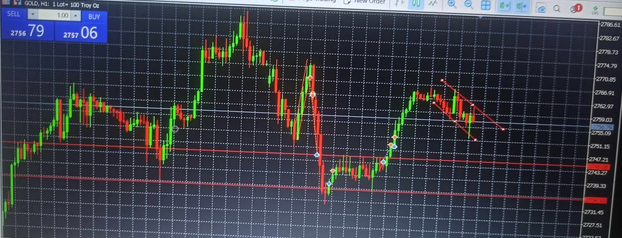

THIS IS EXACTLY 3PM NIGERIAN TIME AND GOLD (XAU/USD) IS AT PRICE 2758.80 ON THE 30 MINUTES CHART IT CAN EASILY BE SEEN THAT THERE IS AN UPWARD CONSOLIDATION. AS A PRICE ACTION TRADER WHEN TWO CANDLES OF SIMILAR HEIGHT ARE FORMING NEXT TO EACH OTHER IN OPPOSITE DIRECTION ,THE LATER CANDLES’ DIRECTION IS WHERE THE MARKET IS GOING

ON THE 30′ CHART THE GOLD HAS A BUY CANDLE OF SAME HEIGHT AS THE PREVIOUS SELL (BEARISH) CANDLE. SO THIS IS MOST LIKELY A BUY MARKET. I WILL NOT GO FOR MUCH PIPS AS I WILL EXIT THE MARKET AT PRICE 2763.0 AREA.

I’VE BEEN USING THIS TECHNICAL ANALYSIS FOR AGES NOW AND IT WORKS SUPREME.SO I WILL BE BUYING XAU/USD AT 3PM NIGERIAN TIME FOR A COUPLE OF PIPS BEFORE EXITING THE MARKET FOR ANOTHER OPPORTUNITY. REMEMBER GREED IS NOT GOOD. SO RISKING A SMALL LOT SIZE OF 2-5% SHOULD SUFFICE FOR THIS TRADE.

THIS IS MY POSITION FOR THIS PERIOD.

THANKS,

TOPE AJALA

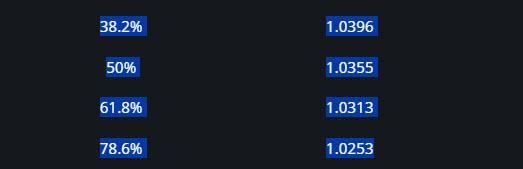

FROM NIGERIA.USDCAD 4 HOUR CHART – NEXT UP THE BOC

Focus will be on the BoC statement assuming there is a rate cut as expected. The reaction will be what matters and with USDCAD bid heading into the decision it would have to break 1.4516 and then stay above 1.45 to have a lasting impact.

On the downside, the bottom of the range is far away at 1.4261.

-

AuthorPosts

© 2024 Global View