Forum Replies Created

-

AuthorPosts

-

EURUSD Daily

Well, day dreaming aside, EUR succeeded in holding above 1.04000 and even briefly went all the way till 1.03824 , but it will most probably close the day above.

Any close above 1.04250 will leave a chance for tomorrow to make another straight leg Up.

This is not a full blown Up trend, so we have more of a 50-50 situation on our hands.

Watch for overnight unfolding…

NIO Inc.

Nio is biding its time so far, and we might be in for another test of 4.00

Shares of the company witnessed a loss of 4.24% over the previous month, beating the performance of the Auto-Tires-Trucks sector with its loss of 8.85% and underperforming the S&P 500’s gain of 1.08%.

Investors will be eagerly watching for the performance of NIO Inc. in its upcoming earnings disclosure. On that day, NIO Inc. is projected to report earnings of -$0.40 per share, which would represent year-over-year growth of 11.11%. At the same time, our most recent consensus estimate is projecting a revenue of $2.85 billion, reflecting a 18.31% rise from the equivalent quarter last year.

Opendoor Technlogies Inc. – OPEN

Close above 1.45 tonight will give it a chance to try another leg up tomorrow.

Still, it doesn’t mean that overall downtrend will change just like that.

Lots more fighting is needed to confirm that we saw a bottom and that we should be seeing upwards in coming weeks.

Another headline reads as:

UBS Upgrades British American Tobacco p.l.c. – Depositary Receipt () (BTI)

There are 720 funds or institutions reporting positions in British American Tobacco p.l.c. – Depositary Receipt (). This is an increase of 45 owner(s) or 6.67% in the last quarter. Average portfolio weight of all funds dedicated to BTI is 0.31%, an increase of 2.21%. Total shares owned by institutions increased in the last three months by 16.45% to 242,907K shares.

https://www.nasdaq.com/articles/ubs-upgrades-british-american-tobacco-plc-depositary-receipt-btiTalk about kissing a mermaid in front of the children…. I was looking at this just a few days ago… and……

UBS upgraded British American Tobacco on Monday to ‘buy’ from ‘neutral’, hiked the price target to GBP3,900 from GBP3,000 and made the stock its ‘top pick’.

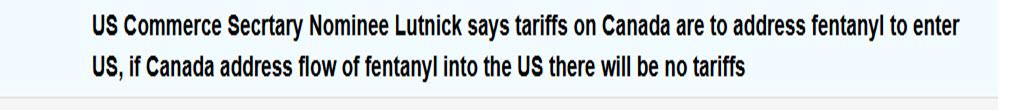

https://www.sharecast.com/news/broker-recommendations/ubs-upgrades-bat-to-buy-shares-spark–18661778.htmlMore hawkish than dovish… Powell/s presser next

Press Release January 29, 2025

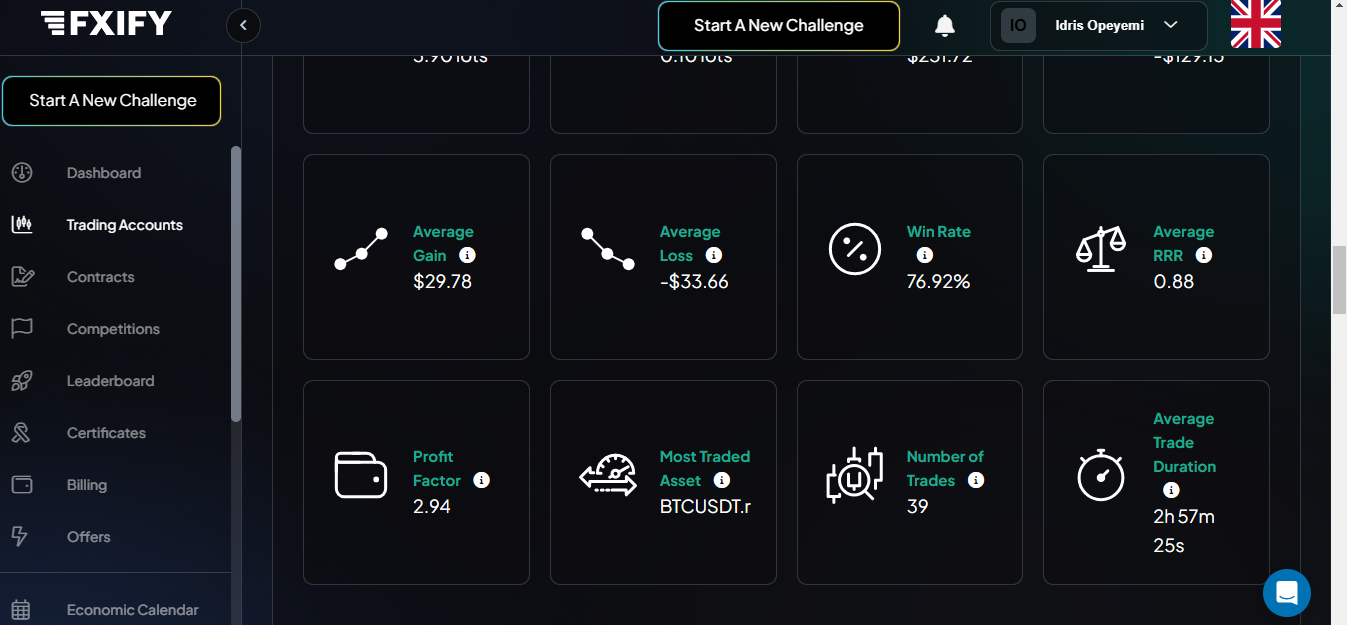

Idris – Retail Traders are all those that trade for their own account , using retail brokerages.

Doesn’t matter the size of the account – from 1$ to millions.

So individuals like you and me.

And for the strategy – it depends on many aspects of one’s trading.

It includes R/R , Probability, Size of trade, stop loss positioning, time frame on which you trade…

We’ll talk more on this issue and I am going to write several examples on Strategy that suits our needs

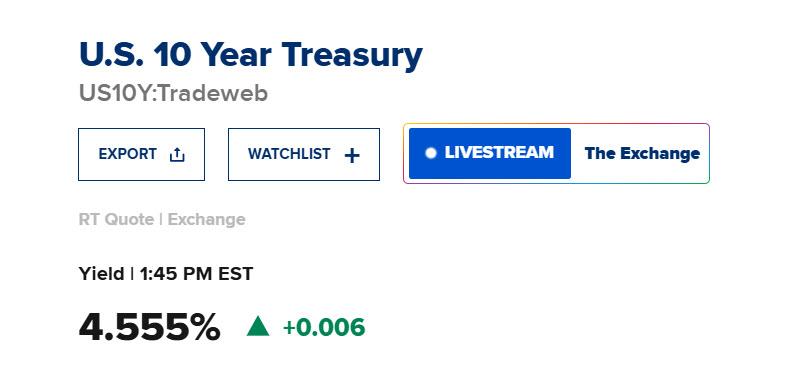

Reading the tea leaves there are some ordinarily potent conditions in some of the more important barometers which show the likely behavior of Sterling, Euro, stocks, bonds, USD. Right now they point toward a drop in stocks, some bonds, and Euro and Sterling. It would take one of those manic two way shock and awe flows post-Fed or something else significant to change that.

This is 6pm nigerian time and the weather is good. Market is not as volatile as it was between 3:15 and 3:45 pm when some news came out and Market was volatile. The usd/jpy has consolidated and is ready for an upward move. This may not be a long move based on my analysis.

The usd/jpy is st price 155.120 as we speak. It rose to an all high today at 155.524 before declining to 154.915, the lowest point as at today.

Based on technical Analysis on Price Action. On the 1 hour candle, we see the latest being a BUY candle, with the former candle which formed at 5pm , being a sell candle. The candles are of similar length, which may signify further movement in the later candle (the buy candle that formed at 6pm)Therefore I have taken a buy bias with expectation of price rising to around 155.378 before I close it off in marginal profit.

Let’s see where market go now.Thanks,

TOPNINE -

AuthorPosts

© 2024 Global View