Forum Replies Created

-

AuthorPosts

-

Trading Tip 8:A Warning to All Traders: Your Stop May Not Be a Stop

Anyone who has survived the forex trading wars and is still trading knows how important stops are to preserve capital and staying in the game.

As I noted in Use stops and Live to Trade Another Day

Stops are a necessary evil for any trader who wants to stay in the game. Some traders may try to avoid using stops but all it takes is one surprise headline and the game is over..

Stops are like an insurance policy to protect against a trade not working out. A stop is also protection against a surprise or an unexpected event

When a stop is not a stop

However, there are times when a stop is not a stop but an invitation to lose more than planned or even to see an account wiped out.

In the history of trading there are times when a currency, for example, gaps in a straight line and stops are executed far away from where they are placed. While not the norm, there are enough instances to have left the floor littered with blown accounts.

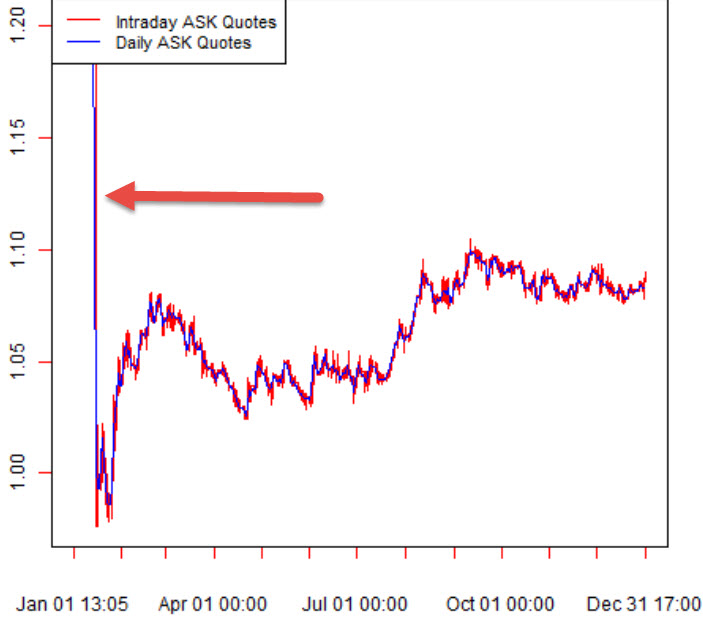

The one that comes to mind occurred on January 15, 2015 when the Swiss National Bank pulled its bid supporting EURCHF at 1.20 and what followed was a true black hole. No stop was safe and in fact many traders found themselves with negative margins when their positions were closed out, some as much as 20+% away from their stop level.. The range for that day was 1.2020-.8643 with most of the move occurring in minutes although there is a debate as to where the actual low was depending on the broker.

Source Quantitative Finance

While this was an extreme case to say the least it underscores when a stop is not a stop. Whether a stop is executed 50 pips, 100 pips, 200 pips or more from where it is placed, the results can be disastrous depending on the amount of leverage used

Time for traders to beware

This brings us to today’s market where attention is clearly focused on the results of the US election. As liquidity thins with trading driven by election headlines, even if you call the vote correctly you could easily get stopped out on a false start as news algos will rule the market. The issue is not getting stopped out but at what price.

A Warning to All Traders: Your Stop May Not Be a Stop

Now, to be clear, I am not suggesting to trade without a stop loss. Just be aware that the next few days will not be business as usual. There is a reason why implied options volatility has soared in currencies like the EURO and Mexican Peso to levels not seen since the 2016 U.S. presidential election.

So as a warning to all traders, especially those relatively new to the game, your stop may not be a stop as you are used to but don’t trade without one. Either reduce your leverage and widen your stop or sit back, enjoy the fireworks and look to trade once the dust settles.

Addendum: Feb 3, 2025

This USDCAD 5 minute chart is a good illustration of when a stop isn’t a stop in a news headline driven market.

Note, the last candle where stops were likely run on both sides.

Ask where stops were filled in this 5 minute candle.?

1.4584 => 1.4g24 _. 1.4520 => 1.4572 (close)

A Warning to All Traders: Your Stop May Not Be a Stop

Get Your FREE Trial of The Amazing Trader HERE

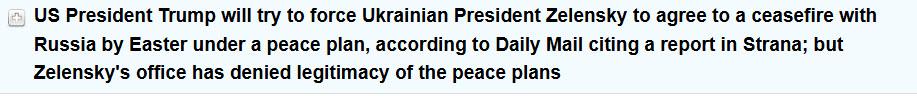

Newsquawk reported this a little while ago and it has since been doing the rounds,,, not ckear whether this is a factor but XAUUSD has retreated further from yesterday’s 2882 high

Source: Newsquawk.com

A look at the day ahead in U.S. and global markets from Mike Dolan

With tariff tensions easing a touch for now and price pressures coming off the boil, U.S. Treasury yields have plunged this week – defusing a tense January for bond markets and helping stocks find a foothold in the thick of a noisy earnings season.

Although they backed up a touch early Thursday, 10-year Treasury yields have sliced below 4.5% – dropping more than 10 basis points at one point on Wednesday to their lowest of the year as January ISM service sector readings showed a surprise drop in the prices paid by businesses.

NEWSQUAWK US OPEN

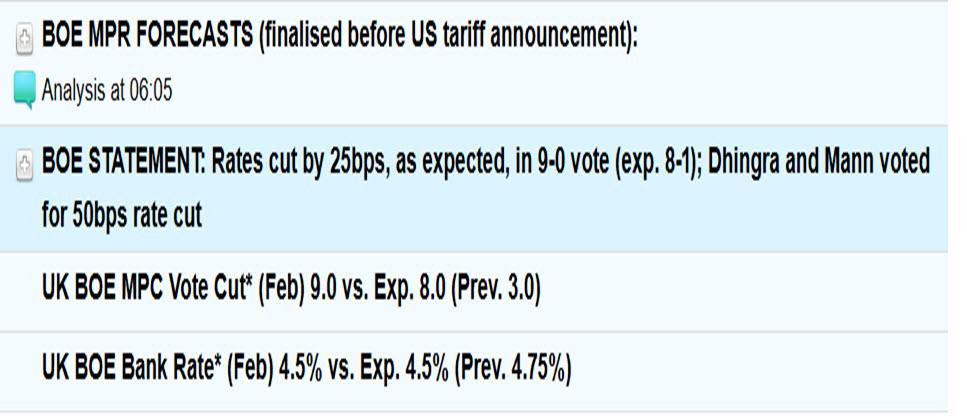

Stocks gain, USD bid ahead of jobless claims, GBP lower with the BoE in vieW

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses at highs; US futures edge higher ahead of a slew of earnings.

USD attempts to recoup lost ground, EUR/USD back below 1.04, GBP awaits BoE.

Bonds in the red but off lows via a strong French auction & stagflationary UK data amid reports of a UK Cabinet reshuffle.

Metals trade mixed amid the Dollar but crude holds an upward bias.

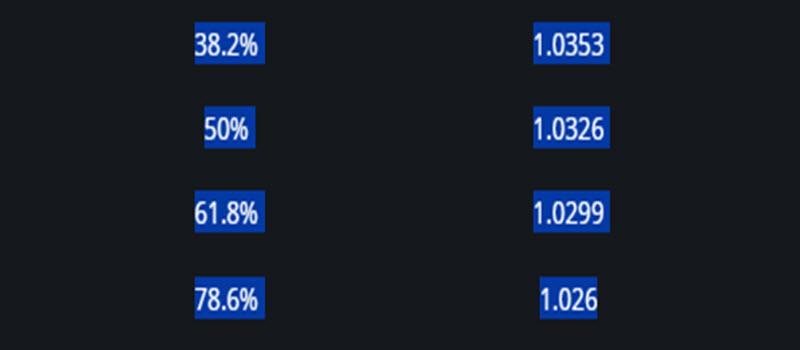

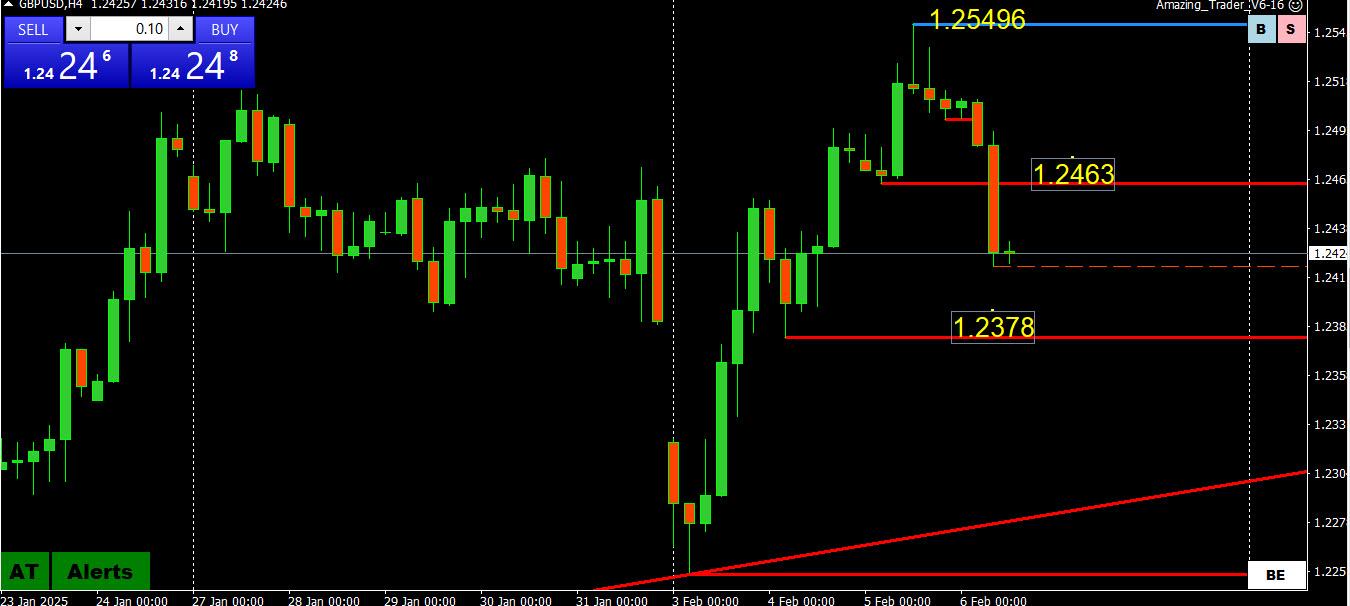

GBPUSD 4 HOUR CHART – Waiting for the BOE

My only question is why was GBPUSD bid at this time yesterday with a rate cut looming today.

What caught my eye at this time was the Power of 50 level after a high at 1.25496, so there is a method to my madness.

Note, a clue of a vulnerable GBPUSD, as I pointed out yesterday was GBP weakness vs the EUR and JPY, evident again today.

Back to charts

Move below 1.2463 breaks the upward momentum… back above this level would put 1.25 in play again.

Below 1.2378 would shift the risk back to this week’s low.

Re the BOE, a rate cut is widely expected and will not be a surprise.

Using my planform as a HEATMAP

Dollar is trading firmerm except vs JPY… but well within this week’s wide ranges

USDJPY back above 152 after brief dip below this pivotal level

GBPUSD softer ahead of expected BOE rate cut (note GBPJPY, EURGBP)

Bond yields are higher after plunging yesterday

Stocks are trading slightly firmer

Gold has backed off from yesterday’s record 2882 high… indicator of tariff sentiment?

GVI 11:39 – donald’s use of promise to apply tariff is akin to extracting information or some action from a counterparty you promise to drill their knee or pull their fingernail(s). It is just a tool to extract action from someone. No interest in actual trade war – only to bend to one’s desired bend-angle.

-

AuthorPosts

© 2024 Global View