Forum Replies Created

-

AuthorPosts

-

After a day of news headlines and whipsaw price action, this article is worth your attention as you get ready for another headline day.

Do you ever wonder what is behind market reactions to headline news?

Robinhood Markets Inc. – HOOD

Is this frenzy coming to the end?

Robinhood posts record profit as post-election trading frenzy lifts volumes

Trading platform Robinhood HOOD reported a surge in fourth-quarter profit on Wednesday, fueled by frenetic activity in equity and crypto markets following Donald Trump’s presidential election victory.

Robinhood’s transaction-based revenue, or income generated from fees for facilitating trading in options, cryptocurrency and equities, in the quarter jumped 236% to $672 million from a year earlier.

Nearly half of those gains came from a 700% rise in revenue related to crypto trading as bitcoin continued its rapid march towards the $100,000 mark during the quarter on hopes of favorable policies under the new Trump administration.

OpenDoor Technologies Inc – OPEN

Morgan Stanley Cuts Price Target on Opendoor Technologies to $2 From $3, Keeps Equalweight Rating

Opendoor Technologies OPEN has an average rating of hold and mean price target of $1.77, according to analysts polled by FactSet

Technically OPEN might start having a chance for turnaround.

1.30 has to hold for the sunshine to come…

BTCUSD – Bitcoin

Has the time come for Bitcoin to surge again?

Supports: 96.610, 95.500 & 94.000

Resistances: 97.715, 98.550 & 100.200

Even the blind chicken would see that BTC has found a support above 95.000 and now only question that remains is if/when it is going to start rallying again.

Next 48h it should happen if nothing unexpected happens ( like someone talks in his sleep, someone else wants a world peace suddenly and so on – however it is not the news, but how the market will digest it…)

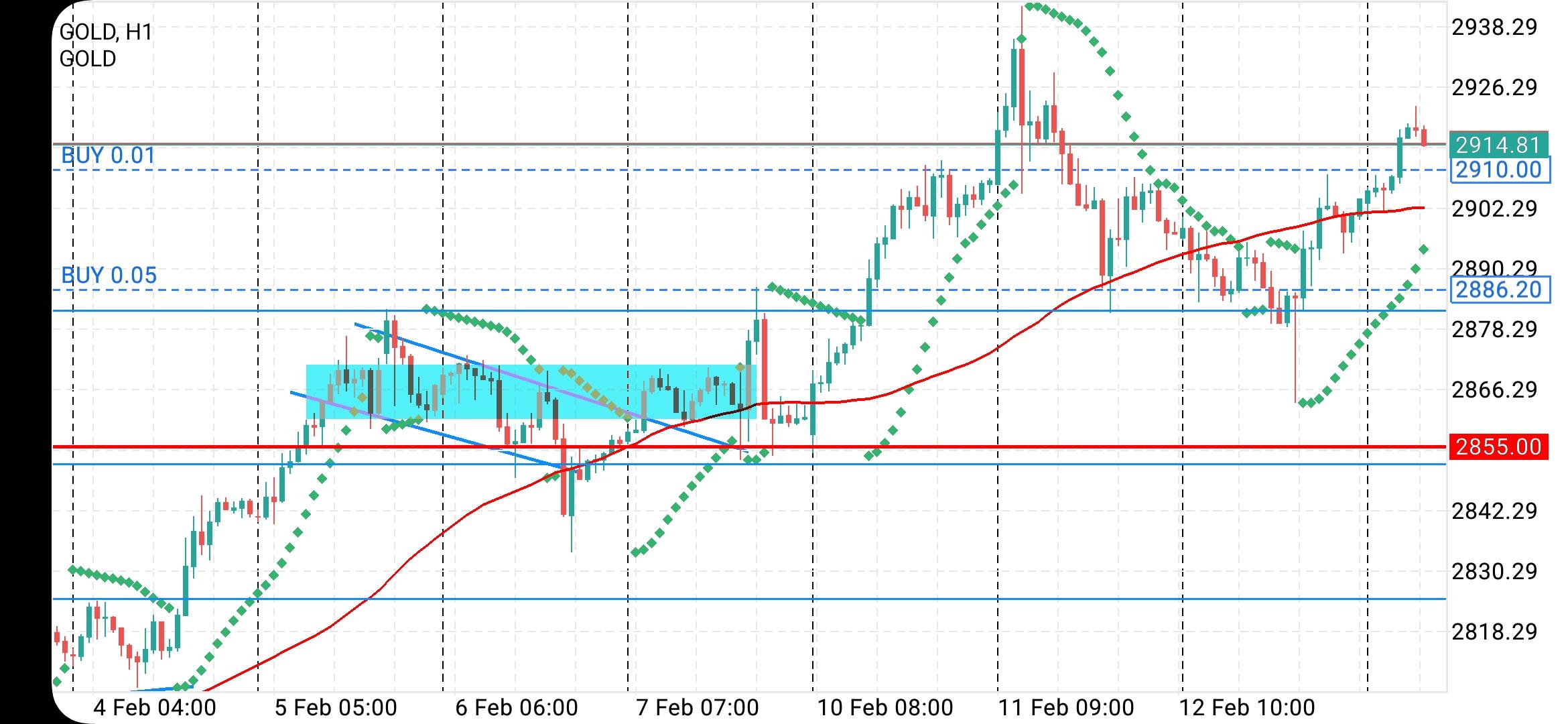

XAUUSD – Gold

Is Gold ready for a correction?

Supports: 2885.00, 2865.00 & 2835.00

Resistances: 2910.00, 2940.00 & 2965.00

Time wise – to be able to continue reaching new highs it has to go over previous high in next 4 days.

Pattern wise – it might be ready to go into correction – depending on fundamentals/news in coming days correction can be shallow – till around 2825.00 or a deeper one all the way to 2750.00

I swear I had no idea Modi’s visiting the USA… I’ve put myself on a self-imposed media blackout esp when it comes to Indian media… the things they publish are just too darn bizzare and outright vulgarity!! I heard today from an acquaintance that some youtuber is under the scanner for asking someone an offensive question about the privacy of parents and the whole of India is up in arms about that matter.

I came across a headline yesterday in which the USA is considering a sovereign wealth fund,… well call me late… but just the other day I was considering saying they should have a sovereign wealth fund along the likes of other countries such as Norway and my dear Saudi Arabia etc… But then in order to start that fund the USA wants to offload gold which they purchased at 42 bucks each. Ditching an asset which gives capital appreciation, and superior returns above inflation which stocks have not been able to give. Gold existed ever since the beginning of time even centuries before the USA was even discovered, as a matter of fact that is why they were discovered, it was because of an explorer’s search for Gold and Spices… Trump wants to bail out tiktok and do crypto by dumping money into Moore’s law? He should be negotiating treaties to buy as much gold as can be produced in the world for the next 50 years.

If the FED invests in bond yields then that would fill the void left behind when USAID was dismantled. Bonds are indirect investments into the welfare systems of countries… They got some great non-calleable bond deals going on somewhere in the world. And last I heard on 1 year paper was 6.55%+.

Gold and Bond’s are the only 2 bets for that kind of money.,.. and no other countries know the world like the United States does. What was all that spying done for?

Stock investments are limited by the amount of capital which can be invested in companies. under performance of stocks causes capital erosion which is counter intuitive. Companies won’t last as long as Physical Gold and the countries obviously. eg. India has been around for 5000+ years and which company in the world has been doing business for even 10% of that time?. Additionally, in how many companies in the world can an investor buy 75 billion dollars worth of stock for a 5% stake and be confident that the money is safe,… only maybe 3 or 4 companies if that many.

Hedline whipsaq continues… out a little while ago and will have everyone glued to the TV and headlines on Thursday.

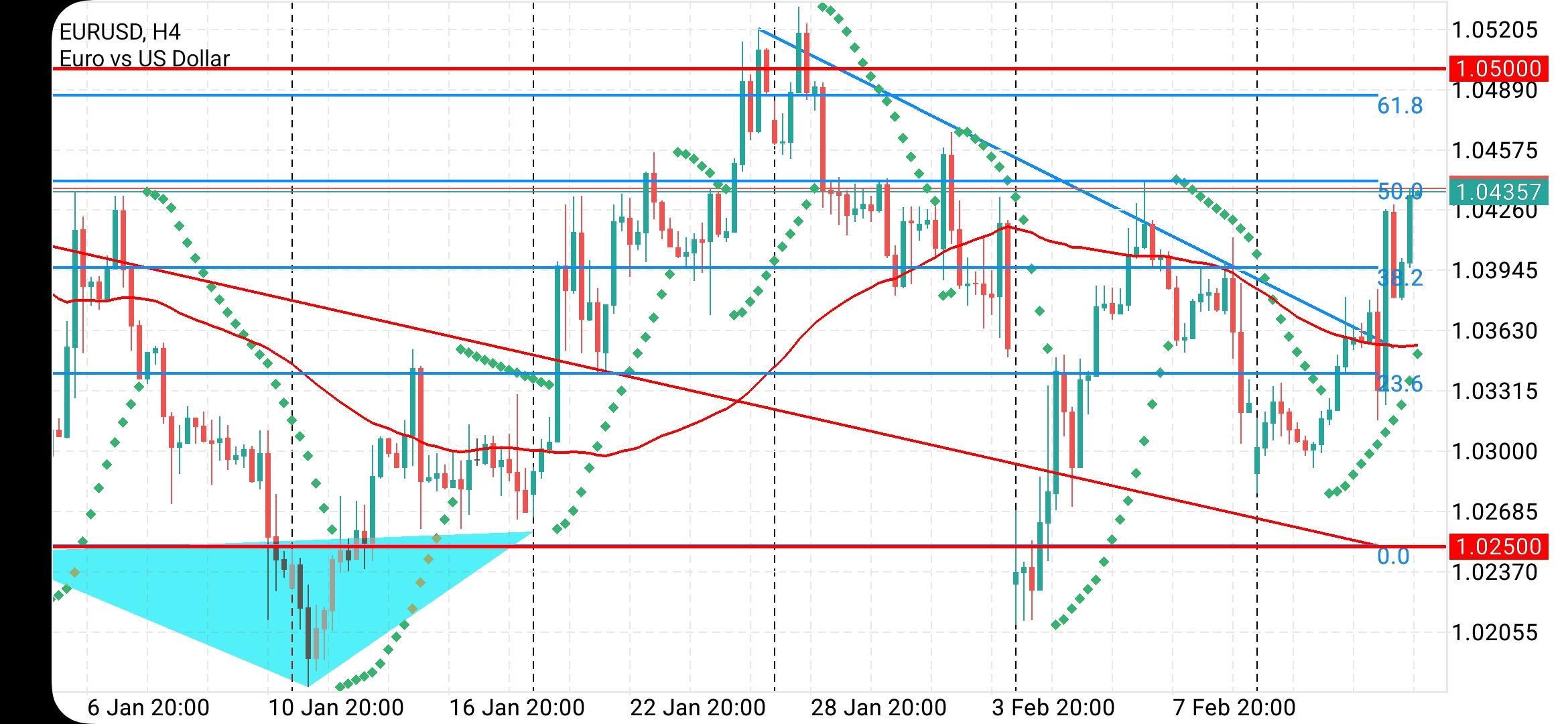

It also cyt short the EURUSDF rally that paused just below a key AT level at 1.9432 (high 1.0430, lasr 1.0389)

Source: Newsquawk.comXAUUSD ONE HOUR CHART – Retracement contained for now

Pause above the 2852 level cited earlier (low 2863) contained the retracement but would need to regain 2898_ to put the 2942 and talk of 3000 back on the table.

So far XAUUSD has not suffered from hopes of easing geopolitical tensions but bears watching.

There has been enoiugh news today to last a week. In the end, it is the reaction that counts.

This came out earlier but we need to hear it from Trump.

Source: Newsquawk.com

-

AuthorPosts

© 2024 Global View