Forum Replies Created

-

AuthorPosts

-

XAUUSD 4 HOUR CHART Logic prevails

There’s an old saying in trading, Markets can remain illogical longer than you can stay solvent.

I thought of this saying as the dollar sold off on easing tariff concerns and hopes for an end to the Ukraine war yet GOLD continued to press higher.’

Well, today logic prevailed after 2942 held for a double top.

Now XAUUSD needs to stay above 2863 as a break would negate the last leg to 2952 and expose a risk if a retracement.

What right does Trump have to decide for how much Walmart sells eggs?

He has all his presidential rights and authority however to implement a higher sales tax on imported eggs which would make them cost the same as locally produced ones.

The Prime Ministers of other countries will come to Trump and tell him to drop sales taxes for eggs sold by retailers? They can’t decide prices in their own countries then how will they do that in the United States? Who gives them the right and authority to do that here?

Then Trump can get busy negotiating deals on a sustainable future for the country mainly focused on being forward looking. You see how the Sheikh’s in the United Arab Emirates think 50-100 years ahead of time?… That’s how I look at things for the people too, even before I even knew a placed called Emirates existed…

Tariffs OR Higher Sales Taxes.

There should be no tariffs on imported goods because that will have the war effect…

The USA can however put in higher sales taxes on aaallll imported goods so they cost the same to buy as locally manufactured/produced goods.

Can’t deny consumers their right to buy whatever they want from which ever country it comes from…

What wins in this game is quality…

happy valentine’s vance

wsj – Vance Wields Threat of Sanctions, Military Action to Push Putin Into Ukraine Deal

In interview with The Wall Street Journal, vice president says Ukraine must have ‘sovereign independence’

By Bojan Pancevski and Alexander Ward,

Updated Feb. 14, 2025 8:00 am ETTHE GOLD (XU/USD) has retraced after days of a bullish run. The retracement started at price 2939 this early morning, and has steadily declined ever since then. it is now at price 2895…a long bullish retracement. There was a core retail sales m/m news release at 2:30pm this afternoon.

Market will soon start returning to it’s usual buy bias so Traders should beware not to be stuuck in the sell bias. A word is enough for the wise.

Don’t risk more than 2-5% of your capital on any Trade.

Thanks,

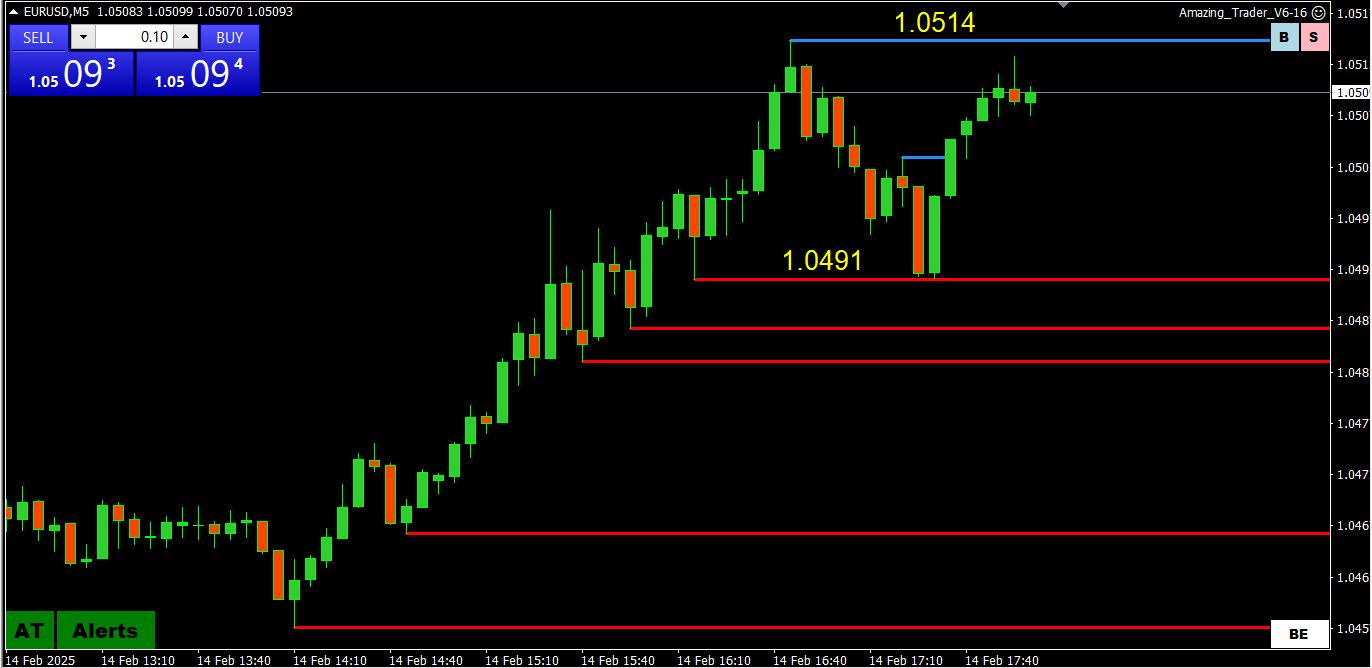

TOPNINE.I can’t resist posting this Amazing Trader 5 minute chart… what should stand out os the bounce off support and then a run at the high for a near double top- no coincidence if you are using AT)

re (10 yr last 4.457%) …

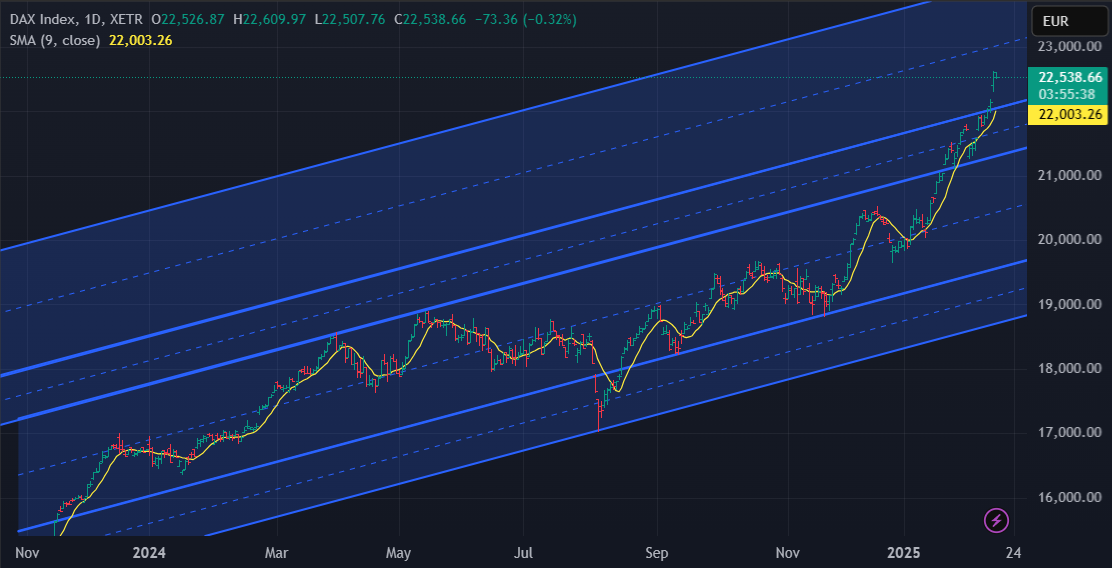

I am sensing that in the backdrop of trumps tariffs AND increasingly load voices screaming “inflationary” , the risk is that manufacturers are increasingly ably to pass along their increased costs and that without fear as , again me sensing, that “inflationary expectaions” are getting closer to becoming acceptable and run the risk of becoming anchored. with a non-chalant attitude.Trading Chart of the Week: EURUSD\4 Hour (scroll down for the Daily Chart)

I had my choice of charts to post as it is easy to look back in hindsight.

I picked out a EURUSD 4 hour chart, not because I trade that time frame but use it to help identify what side to trade on shorter time frame charts.

What do you notice in this chart in a week that was filled with news headlines that caused whipsaw spikes (up and down) on both sides. It wasn’t until later Thursday that upward momentum (i.e. rising red lines) took over.

The red lines are from my Amazing Trader (AT) charting algo and are like ladders, in this case, building to the upside. Only if the most recent red line that preceded a new high is broken, downside is limited and risk is still pointed up.

The strategy is explained and illustrated in the AT trading guide that comes along with a subscription. You can try to apply the same logic yourself but a lot better using AT as the pattern repeats in all time frames and with any instrument you broker has on its MT4 platform

Contact me at jay@localhost for details on a half price access.

EURUSD Daily chart, looking ahead

Pivotal level 1.05, will set the tone going forward

Key chart level: 1.0534, upsodee limited unless regained.

Not much on the downside so using shorter time frames,,,

1.0514 = double to

1.0447 (suggests using 1.0450) is pivotal … below it shifts focus ftom 1.05…. above it keeps te focus om 1.05

DLRx 106.50

puppy looks lets say softish. close around here or lower would portend lower still next week

looks like players are starting to be annoyed by donald’s tariff theatricks.

and , having watched early morning plebian news w / journos sticking a microphone in front of folks on the street about prices of eggs and most folks just shrugging “so-what” shoulders about inflation .. a danger for donald I suggestEurope to bat away U.S. tariffs, weaker currency to help

Another day, another story on tariffs.This time, U.S. President Trump has tasked his economics team with devising plans for reciprocal tariffs on every country that taxes U.S. imports, starting from April.

While that may look bad for Europe on the surface, Barclays is sanguine about the possible impact, especially as the delayed implementation opens the door for negotiation.

“The actual hit to growth is likely manageable and largely offset by weaker EURUSD,” Barclays says.

The staples, autos and chemicals sectors exhibit the widest tariff gaps, Barclays notes, so they would be most exposed to reciprocal tariffs, but these sectors have underperformed since the U.S. election.

“Some of the earnings downside is arguably priced in already,” Barclays notes.

-

AuthorPosts

© 2024 Global View