Forum Replies Created

-

AuthorPosts

-

How Do Leads and Lags Impact Currency Trading?

I remember the term leads and lags from my studies in economics but it is not a term I see these days. While I am not privy to the way corporates hedge currency risk, leads and lags are important to understand as they can have an impact when a currency is trending as a business looks to hedge risk or take advantage of it. .

A MISTAKE boyz n gurlz …

–

US 10-YR 4.478% -0.047

“Treasury yields fall as investors weigh the state of the U.S. economy” – cnbc

and earlier this morning: “Fed’s Bowman says more progress on inflation needed before further rate cuts” – cnbcPOOF! confidence in “on sustained path towards 2% inflation target”

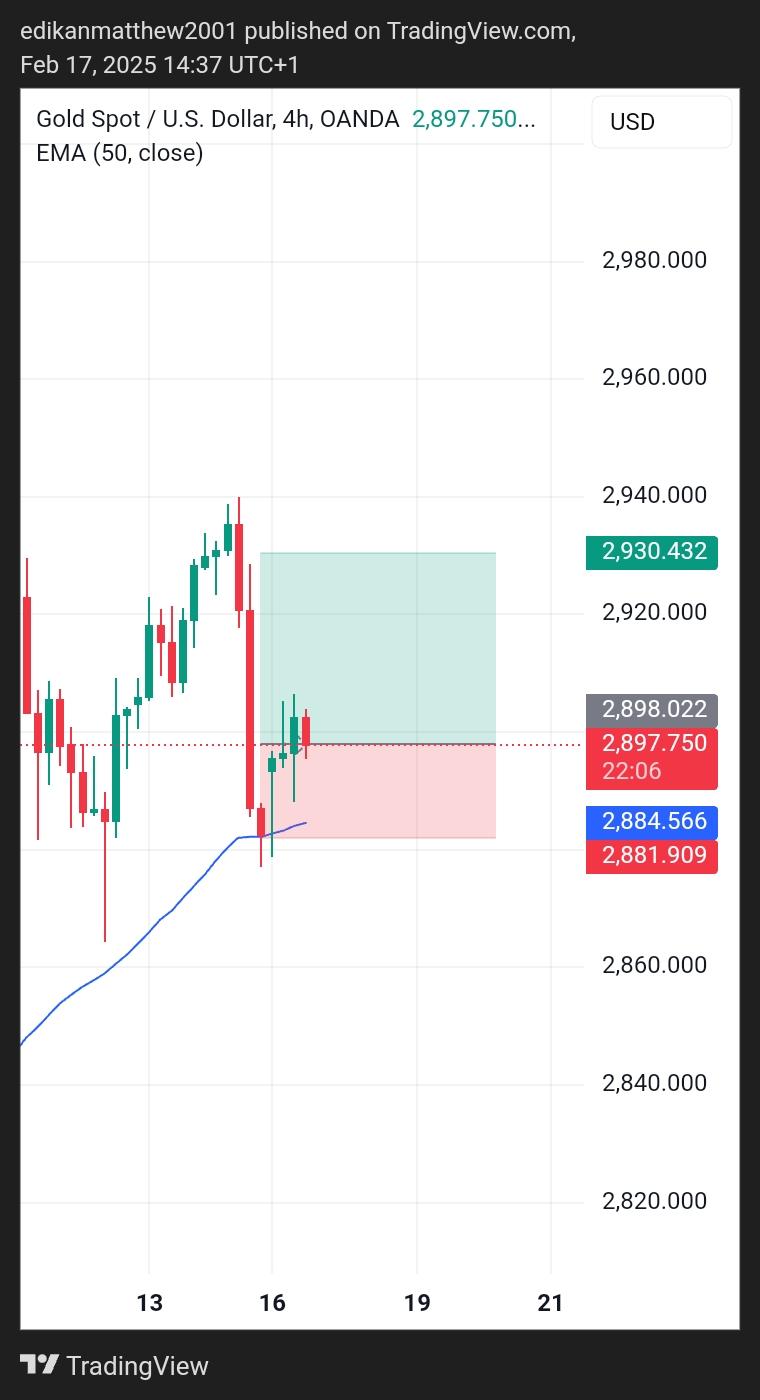

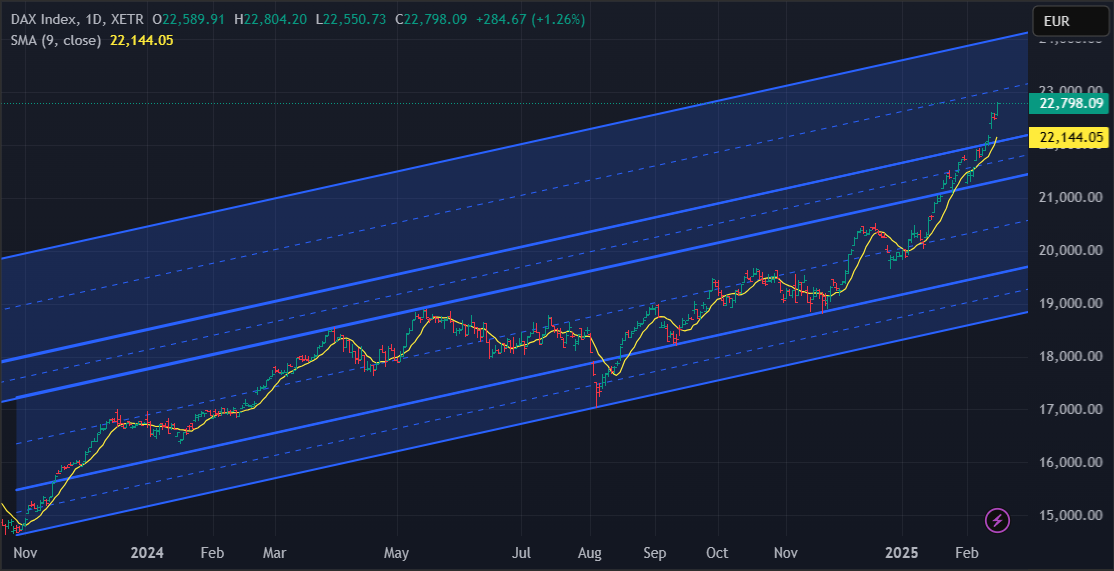

DAX – GER 30

The DAX Index Closes 1.26% Higher

In Frankfurt, the DAX Index went up by 285 points or 1.26 percent on Monday.

Top gainers were Rheinmetall (14.67%), Siemens Energy (3.74%) and Munich RE (2.50%).

Now headlines aside, what can we expect next?

Frankly, this is an uncharted territory and so far it behaved very technical.

Having that fact on mind, now we have to use something that many would laugh at – Thumb analysis…after you laughed long and loud, pay attention :

– Whenever I want to avoid that laughing I call it Time-Space analysis, and so far it worked like a charm

– No rally can go on for ever

– Without a decent correction, we have to assume that any instrument that goes so sharply Up will go down the same way

– So either a correction soon or it is going to be a classic Blow of Rally

I would like to see DAX testing 22K again

I wouldn’t like to see Savage Profit taking that might end up changing the trend at the end.

How Do Leads and Lags Impact Currency Trading?

I remember the term leads and lags from my studies in economics but it is not a term I see these days. While I am not privy to the way corporates hedge currency risk, leads and lags are important to understand as they can have an impact when a currency is trending as a business looks to hedge risk or take advantage of it. .

The Amazing Trader (AT) — all you need to trade

Real time charting lalgo , amazing trading linesa that form patterns to trade.

AT identifies imbalances in a market where one side is having trouble absorbing the flows. It then shares a strategy to take advantage of these patterns to execute “high probability” trades.

Illustration:

One-hour USDJPY chart

Blue at lines indicate an Imbalance to the downside

Sell with stop above a blue line.

Ride the trend down.

-

AuthorPosts

© 2024 Global View