Forum Replies Created

-

AuthorPosts

-

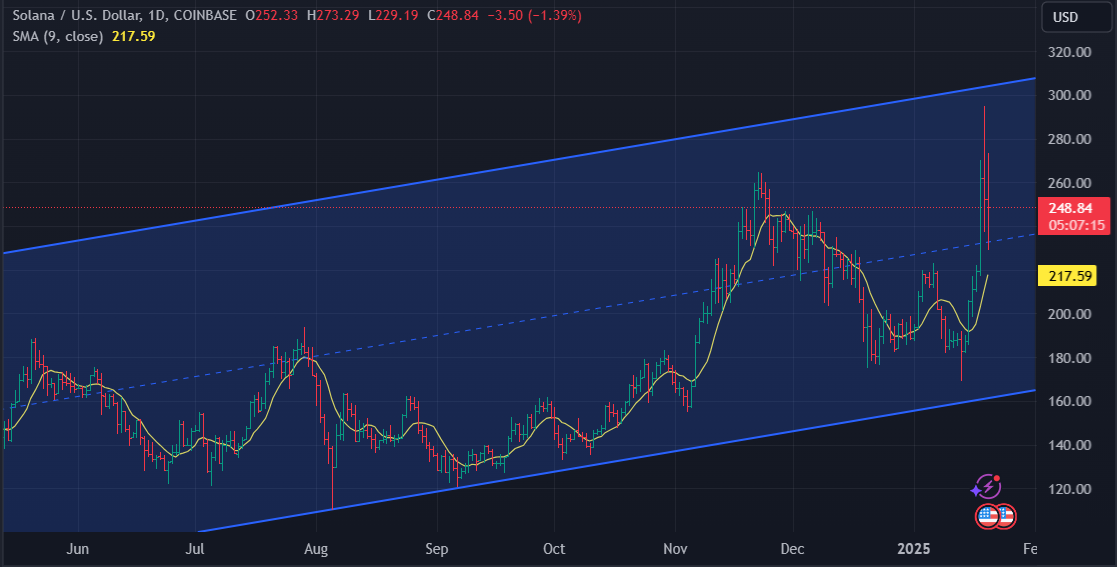

SOLUSD

Solana Bulls Counter Bearish Pressure To Keep Price Above $240

Solana price action is heating up as bulls show efforts to fend off bearish pressure and maintain the cryptocurrency above the vital $240 support level. This threshold has emerged as a key marker of market sentiment, serving as a critical point of defense for buyers aiming to keep the uptrend intact.

Stanley Druckenmiller says ‘animal spirits’ are back in markets because of Trump with CEOs ‘giddy’ – cnbc

Druckenmiller believes Donald Trump’s re-election renewed a jolt of speculative enthusiasm in the markets and surging optimism within businesses.

“I’ve been doing this for 49 years, and we’re probably going from the most anti-business administration to the opposite,” Druckenmiller said on CNBC Monday. “We do a lot of talking to CEOs and companies on the ground. And I’d say CEOs are somewhere between relieved and giddy. So we’re a believer in animal spirits.” …

BTCUSD

110 K – almost – 109.547…

110.850 is exact number of given target– BTC can pause for awhile below it, but if taken in next 24h – next target is around 123 K

Fact that the Channel trendline held firm and launch the Bitcoin straight to the new all time high , makes me believe so.

Only close tonight Below 103 K changes this picture and negates continuous Bullish sentiment.

Euro 1.04 (HoD 1.0430 so far)

DLRx 1.08 (LoD 1.0775)I have not seen anything from donald that should change the rotation of plant

What I am looking at is … how stacked long dollar is the market

with the puppy below 108.90 market suggests, to me, some pricing correction is happeningDegenerate traders in a bit of teasing mode atm and imo.

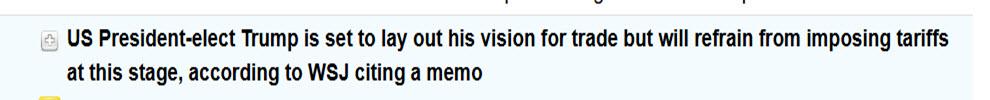

Nothing tragic about the dollar just yet.That’s the second time a tariff relief headline has whacked the market…As I noted earlier press reports were not talking about tariffs as part of the executive orders… reaction to news, as always, is what counts but … big moves today in thin liquidity and all this means so far is no tariff announcement on day one.

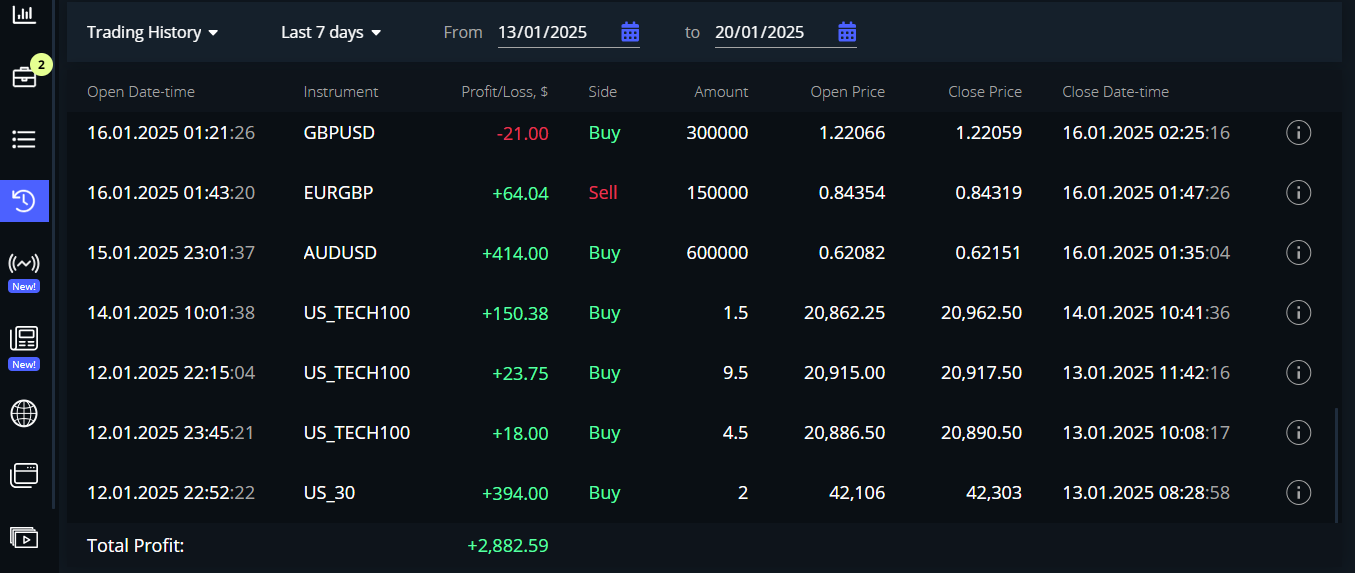

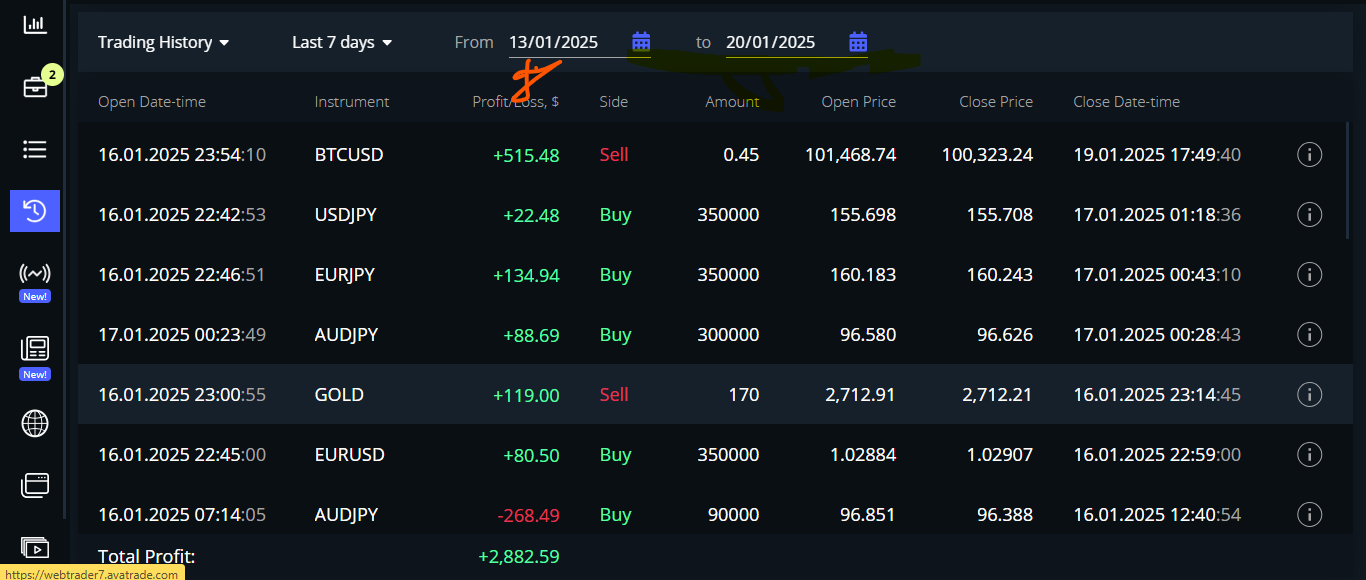

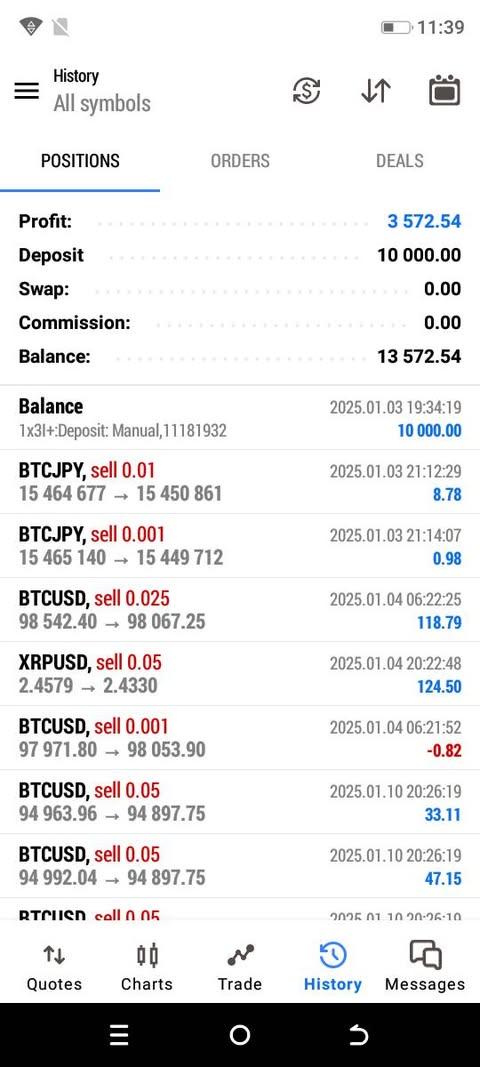

Final Decision on the Winner of Round 2 – 13.01-20.01 2025.

Idris Sagamu – 2882.59 $ Profit

Edikan Matthew- 2.537.57 $

This was a tight race after all 😀

I would like to Congratulate Idris first, and to remind everyone not to start trading before the Starting Date of the Challenge next time.

Round 3 starts at 27th January

I wanted to bring up a concern regarding the trading competition. As you know, I’ve shared all my trades openly in this group, aligning with the purpose of sharing knowledge and insights to benefit everyone.

However, I noticed that Idris has reportedly made $3,500 without posting the majority of his trades (over 70%) in the group. This lack of transparency raises questions about fairness in the competition.

Since the group’s objective is to collectively learn and profit from shared experiences, it seems counterintuitive to allow private trading without disclosure.

I hope the administrators can address this issue to ensure the competition remains fair and transparent for all participants.

Using my platform as a HEATMAP shows

A market on hold waiting for the inauguration of President Trump and a slew of executive orders to follow.

For the FX market, the focus will be on anything related to tariffs but I have not seen any talk of it in the press.

The heatmap, meanwhile, shows the EURUSD as an outperformer with the GBP and JPY lagging out of respective EUR crosses.

The main action has been in cryptos with BTCUSD surging higher to a new record high (marginally so far). The $Trump memecoin has been the talk of the press but I will leave my opinion on something that has no intrinsic value for another time.

Otherwise US markets are closed today, liquidity is thin and it is now just a wait until the new Trump era begins.

-

AuthorPosts

© 2024 Global View