Forum Replies Created

-

AuthorPosts

-

9208, high 9244ish

new day after yesty’s month end rebalancing fx hedgesLooking just at USDCHF price action and concidering that most rebalancing occurs +/- 5 minute window around the fixing time and only a small portion starting maybe an hour prior, there should be something else / more than month end rebalancing of fx hedges that continued to drive the DLR up

Which makes me think … about what would be needed to push the dollar higher still

SEE THE CHART BELOW AS ANOTHER EXAMPLE OF

My Favorite Trading Secret: The Power of the “50” Level

EURUSD 30-minute chart – Low of the day (so far) at 1.0649

While we wait for the Fed, there are US data releases that could spark some volatility.

ADP EMPLOYMENT’

JOLTS

ISM PMIBTC DAILY CHART – BREAKDOWN?

BTC is down over 5% today and if this was a traditional currency, headlines would be going nuts. But this is a crypto, not a currency so it is just another day at the office.

I prefer to look at 10K ranges for BTC although as the chart shows, it does trade technically.

In this regard, the key focus is on 60000 for if stays below, it will break a pattern of closing within 60-70K.

As the chart shows there is now a void until around 50000 so for me the question is whether the new range is 55-65K or 50-60K.

To be clear, I don’t trade BTC but keep an eye on it as it can be indicative of a general mood.

A look at the day ahead in European and global markets from Kevin Buckland

The marquee markets event for the week is almost upon us, and needs little introduction: The outlook for U.S. interest rates continues to be the elephant in the trading room for all asset classes, responsible not only for recent peaks in Treasury yields and the dollar, but also forming the backdrop for record runs and subsequent declines in the likes of gold and bitcoin.

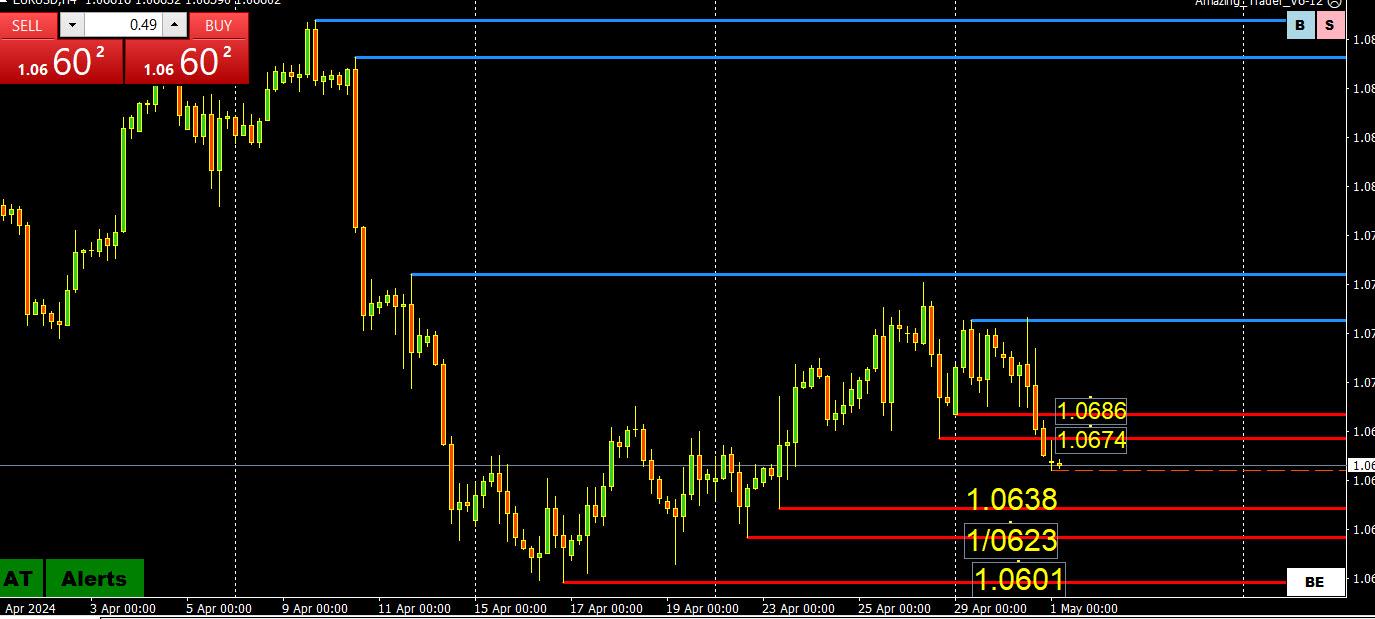

EURUSD 4 HOUR CHART – CLASSIC EXAMPLE

MONDAY-EARLY TUESDAY WAS A CLASSIC EXAMPLE OF A CURRENCY FEELING BID IN AN OFFERED MARKET.

EURUSD BREAK OF 1.0674-86 MAKES THIS THE INITIAL RESISTANCE,

ON THE DOWNSIDE, SUPPORTS AT 1.0638-23-01 ARE TARGETS WHILE BELOW 1.0674-86.

LOOKING AHEAD, LONG WAIT UNTIL THE FOMC DECISION… SHOULD KINIT THE DOLLAR DOWNSIDE AHEAD OF IT..

AFTER A DAY LIKE TUESDAY THIS ARTICLE HAS A TIP YOU SHOULD PAY ATTENTION TO

Global-View Trading Tip: Change Muscle Memory and See the Difference in Your Trading

Global-View Trading Tip: Change Muscle Memory and See the Difference in Your Trading

EURUSD 30 min chart — which side is dominating?

More than half the battle in having winning trades is to be able to pick the side to trade from. I could go on a limb and say it can be as high as 75%.

All I can do is share what I use and that is my Amazoing Trader charting algo.

Notice how the blue lines are dominating. As long as the most recent one stays untouched the risk in this case is on the downside. It is visual and tells you what side is most at risk and what side to trade.

It is more than half the battle and no program I know identifies it better than…

EURUSD 30 min chart — which side is dominating?

More than half the battle in having winning trades is to be able to pick the side to trade from. I could go on a limb and say it can be as high as 75%.

All I can do is share what I use and that is my Amazoing Trder charting algo.

Notice how the blue lines are dominating. As long as the most recent one stays untouched the risk in this case on the downside. It is visual and tells you what side is most at risk and what side to trade.

It is more than half the battle and no program I know identifies it better than…

-

AuthorPosts

© 2024 Global View