Forum Replies Created

-

AuthorPosts

-

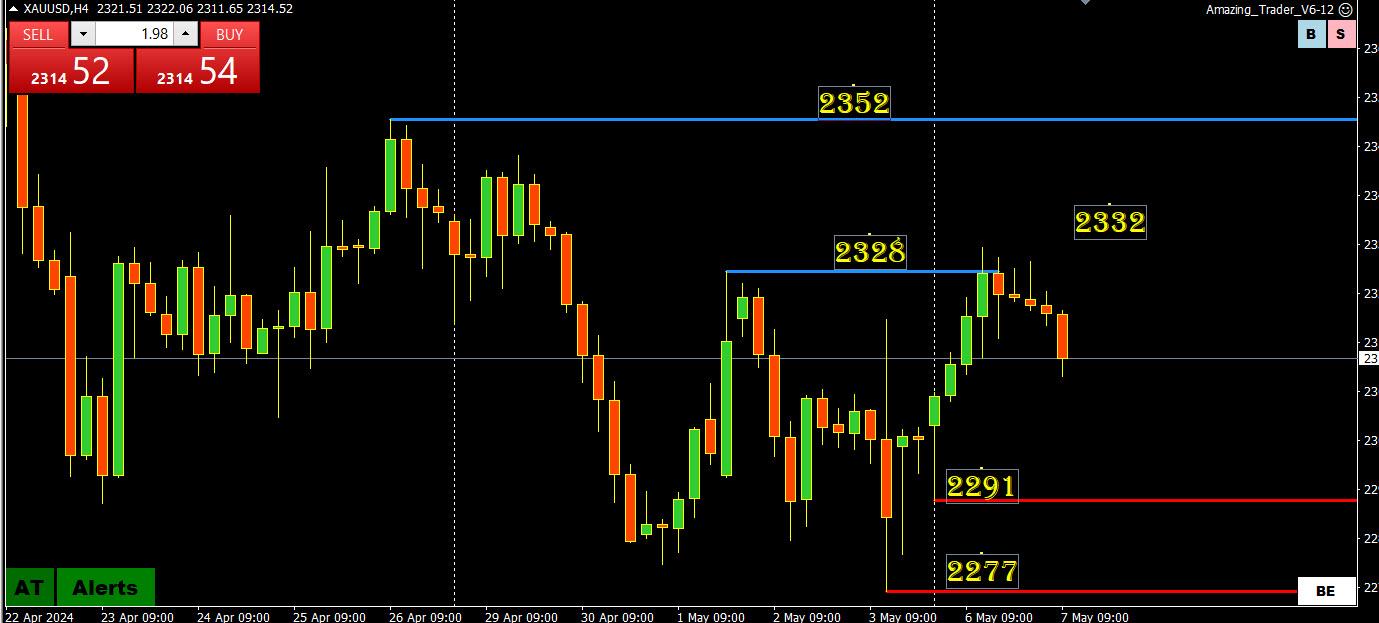

XAUUSD 4-HOUR CHART – CUP HALF FILLED OR HALF EMPTY?

XAUUSD struggling to regain momentum, after a brief blip above 2328 failed to hold.

This leaves the ranges at 2291-2332, broader at 2277-2352

Taking a cup half-empty or half-filled approach,

– Finds support as long as 2300+ trades

– Limited upside as long as it trades below 2350ish

-Revert to shorter time frame charts while within these ranges.

USDJPY 4 HOUR CHART – WHAT THE SAVVY TRADER IS SAYING

I have passed on the view of what I call the “savvy trader” (long-time GV member) and here is another one just emailed to me (note I am only acting as the messenger)

155.66 – 155.92 could be a good area to start a strategic campaign short

closes below 153 on a daily basis would not be good for the bulls

and anticipate an acceleration below 152 and 151

1st target 147.xx from which anticipate a bounce before eventually drilling for much deeper targets.

I suspect that the maximum it can drop is around 126 and then it will range back up

everything must be done with patienceSEE WHETHER YOU SAY YES/NO TO ANY OF THE QUESTIONS ON THIS SELF-EVALUATION TRADING CHECKLIST

Help! Why Can’t I Make Money Trading?

XAUUSD 4 HoUR CHART

On this chart, 2291 NEEDS to hold as support followed by a firm break of 2328 would be needed to put 2352 in play again

On the downside, 2291 needs to hold to keep a bid under the market, and thoughts of the 2277 low at bay.

The bottom line, the low is not yet confirmed and only would be if 2328 is firmly taken out.

Tom Barkin

Navigating Data Whiplash

https://www.richmondfed.org/press_room/speeches/thomas_i_barkin/2024/barkin_speech_20240506For novices – there is a nice trendline from last weeks low in AudUsd that value is resting on at around 6620, and since Aud has good fundamental one might argue it would move higher. You must pay attention to the bigger picture though. If you look at larger time frames of analysis, 6660 could end up being a solid resistance area for bulls. AND it has the mark of the beast on it!

EURJPY 4 HOUR CHART

EURJPY correcting off the 164.00 intervention led low. This is the key level on the downside but only a move back above 167.38 would confirm a near-term low is in.

These are the key levels on this chart, anything in between is just minor.

Note, BoJ interventions, at a minimum, have restored a two-way risk although it has been in USDJPY and not on JPY crosses.

-

AuthorPosts

© 2024 Global View