Forum Replies Created

-

AuthorPosts

-

UsdMexicanPeso is a screaming buy due to uncertainty with Mexico’s 1st female President voted in the other day. Not to mention an historic 37 candidates have been assassinated. Perhaps we can factor in, as one official pointed out, “she is also a mother and used to dealing with tantrums and meltdowns.” Nice outlook.

It is a new quarter. There has been a bit of disconnect between yields and Dxy of late in some sessions, and quite a bit of adjusting convictions in everything including commodities. Some pivotal areas at question. My stake is back to the dollar overall until proven otherwise albeit facing rate cut expectations.

XAGUSD DAILY CHART – $30 AND 10%

XAGUSD fall from a 32.50 double top reached around 10% to today’s low.

The break of $30, meanwhile, makes this the pivotal level that will determine whether the retreat has farther to fo go.

Similar to XaUUSD, I would not be suroprised to hear JPY cArry trades being unwound.

XAGUSD DAILY CHART – $30 AND 10%

XAGUSD fall from a 32.50 double top reached around 10% to today’s low.

The break of $30, meanwhile, makes this the pivotal level that will determine whether the retreat has farther to fo go.

Similar to XaUUSD, I would not be suroprised to hear JPY cArry trades being unwound.

XAGUSD DAILY CHART – $30 AND 10%

XAGUSD fall from a 32.50 double top reached around 10% to today’s low.

The break of $30, meanwhile, makes this the pivotal level that will determine whether the retreat has farther to fo go.

Similar to XaUUSD, I would not be suroprised to hear JPY cArry trades being unwound.

US bond yields still slipping (10 year 4.35%)… cautioius FX so far but off earlier highs… next up US JOLTS report

re yen 155 market trying to figure out

there is nothing to figure. mof / boj happi slapping backs and high-fiving:

–

The Japan Times

Japan spent record ¥9.8 trillion to prop up yen in past month

The record spending on intervention shows the government’s resolve to push back against speculators betting against the yen.got that speculators ?

Well I came in yesterday saying I am a Dollar bull for the week overall and caught some heat for it in the background due to initial selling but here we are thankfully. I am short Cable and Germany vs Dollar, long UsdSgd (Singapore), and not yet long Dollar vs Franc due to rate decision proximity. Canadian Dollar pending (rate). I think rates are consistent in Australia for a while and due to event risk and the gold effect am hesitant to be on the offer with that and am more focused on seeing selling begin to abate.

A look at the day ahead in U.S. and global markets from Mike Dolan

With a still-powerful “buy the dip” instinct in stocks, U.S. markets are having a rare bout of jitters about a slowing economy – with Treasury yields, the dollar and oil prices all swooning over the past 24 hours.

Morning Bid: Wall Street’s growth gasp as rates, dollar, oil skid</strong>

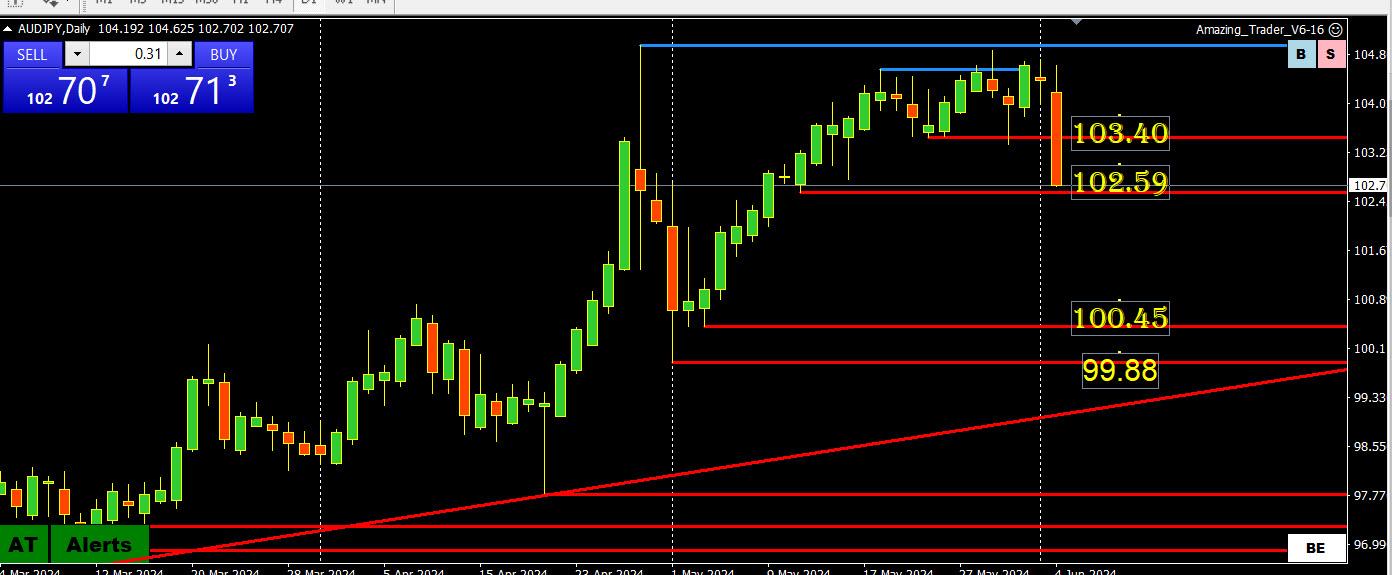

AUDJOY DAILY CHART – JOY THE OUTPERRFORMER, AUD THE UNDERPERFORMER

You can see why AUDJPY 102.59 is important as there is a void below it.

On the upside,stays offered as long as it trades below the 103.50 former support.

Should 102.59 be broken, 102 (psychological) is a poyential suppoty or pause level.

-

AuthorPosts

© 2024 Global View