Forum Replies Created

-

AuthorPosts

-

I should qualify my earlier statement. My recommendation is strong, I am the furthest thing from stupid. There was a time THE Vice President of a national title company would drive me all over California, and I was given VIP status where the order was “Ay time Mr. ___ shows up at your office you give him whatever he needs. I went from broke to having the trust of major banks. I called THE Vice president of a major bank and said “Rob its Tom I have another one, GMAC has it the numbers will work, and he called the courthouse steps to stop the foreclosure, and the Widow calls you up crying thanking you and your wife is crying saying I love you … and I didn’t charge that widow a penny. That is they type of person you should be working with. I have spoken with Jay. He is one of them.

Not to hog the foum but I also have a recommendation, as someone who has dealt with bank traders across the globe, and in person in various cities. There was a rule in my office, when I literally was doing so much business I took over an entire building and everyone in that building ended up working with me. They had a home and loved the vibe. We burned out 3 fax machines in one month we were so busy. The unspoken rule was that if you are a sour person you would simply not last in that office. They would just evaporate on their own, the nice people stuck. I did not tolerate sour attitudes. Surround yourselves with nice people like Jay at Global View.

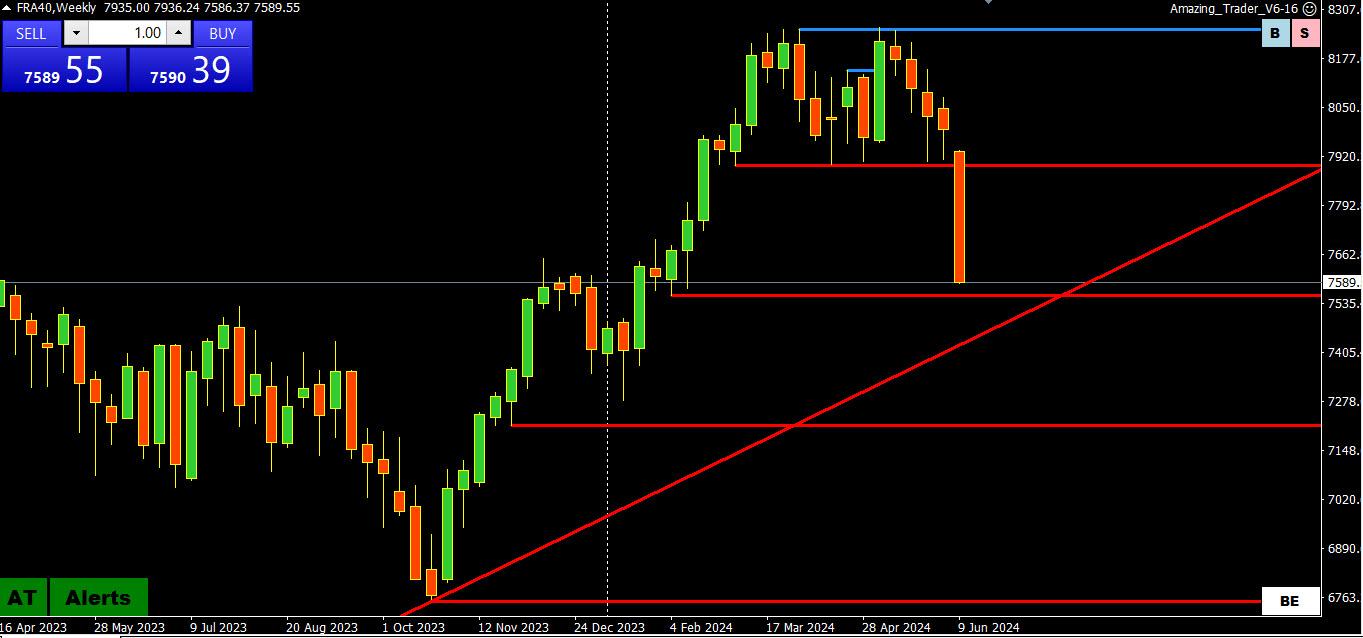

I dedicated time to studying Amazing Trader and comparing to some things. I found it to be quite useful. As a former CTA I find no problem recommending it to anyone either as a main tool or complimentary to what you do. The method is very similar to the way I used to participate. I do things much differently now but definitely pay attention to what Jay is providing.

June 14 (Reuters) – A look at the day ahead in U.S. and global markets by Alun John.

How U.S. consumers are feeling is the question for today, though it could be one of those relatively rare occasions when it’s developments in Europe and Asia that are driving the macro picture.

The University of Michigan’s consumer sentiment survey is due and last month’s reading was at a six-month low.

Morning Bid: Consumer check, but don’t forget France and Japan

This is one of our most popular articles and after reading Knez’s post about 1.0850 it is worth showing again, both for those who have not read it and as a reminder for those who have read it as well.

My Favorite Trading Secret: The Power of the “50” Level

My Favorite Trading Secret: The Power of the “50” LevelI’m

-

AuthorPosts

© 2024 Global View