Forum Replies Created

-

AuthorPosts

-

As I look at the price action in EURUSD it reminds me of this article in our blog, which is worth a read

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

USDJPY 4 HOUR CHART – CARRY TRADES?

Break of 158.25 leaves a void until the major 160.16 high. Normally this would be a clear path hher but BoJ intervention risk cannot be ignored.

On the downside, expect a very strong bid if 157.25 becomes support although bids likely below the market as long as above 157.50

As I noted this week, putting the pieces of the puzzle together, affirmer stocks and a firmer USDJPY suggest the JPY could be a funding currency of choice for carry trades.

USDCHF 4 HOUR CHART – FX RATE PROTESTR?

The SNB decisiob to cut interest rates was proably partly in trsponse to the recent appreciation of the CHF/

As this chart shiws, .8992 is the key level that would need to be broken to break the downtrend (trendline as well).

In any case, the rate cut has restored a 20way risk

A look at the day ahead in European and global markets from Ankur Banerjee

British inflation may have returned to its 2% target for the first time in nearly three years, setting the stage for the Bank of England to cut interest rates – just not on Thursday.

June BoE MPC Preview:

Inflation still the stumbling block to rate cutsThe BoE’s May MPC meeting saw Deputy Governor Dave Ramsden join long-term dove Swati Dhingra in calling for an immediate 25 basis point cut in interest rates. The other seven members all again opted for no change. Approaching this month’s meeting, there has been a further, but less than wholly convincing, decline in inflation, while wages have remained stubbornly robust. Consequently, with the real economy having moved out of recession, the overall mix has left speculators expecting no change in Bank Rate and the first cut to be deferred until at least the first meeting after the summer break in August.

Econoday

CRWD (NASDAQ)

Missed Out on Nvidia? Here’s Another Top AI Stock to Buy Now.

CRWD stock has risen by 471.7% over the last five years. The company’s revenue has climbed from $249.8 million in fiscal 2019 to $3.06 billion in fiscal 2024. Analysts expect its revenue to grow by double digits over the next two years, and rate the stock as a “strong buy” overall.

3 CENTRAL BANK DECISIONS ON THURSDAU. THE KEY ONE IS THE BANK OF ENGLAND

SSEE NEWSQUAWK’S DETAIL PREVIEWS“

If you do not believe the Power of 50, look at this 5 minute EURUSD chart, see how your emotional bias changes when it trades above/below 1.0750

My Favorite Trading Secret: The Power of the “50” Level

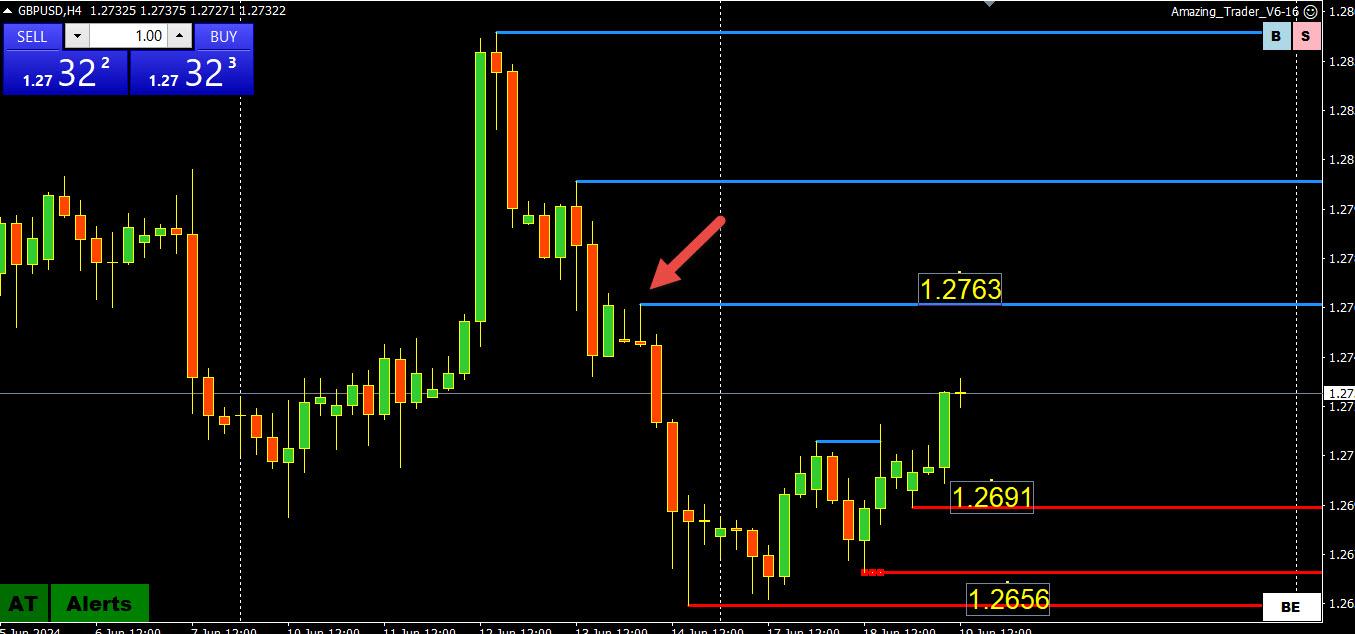

EURUSD 4 HOUR CHART- – WATCH 1.0750

EURUSD mirroring the USDX chart with momentum to the downside broken after the break of 1.0745 yesterday.

As noted earlier, a move above 1.0750-1.0760/65 would be needed to add legs to the move up. For day traders, a.0750 will set the tone.

The trendline on this chart is acurrently round Knez’s 1.0780 level posted yesterday.

Brian Swint at Marketwatch

European Stock Markets Slip, Asia Gains Amid Fed Rate-Cut Hopes. Treasury Yields Suffer.

The prospect of lower interest rates and the boom in technology stocks in the optimism that artificial intelligence will boost profits is helping markets worldwide. … . … “if conditions continue to ease as expected, an easing of policy later this year would be appropriate.”

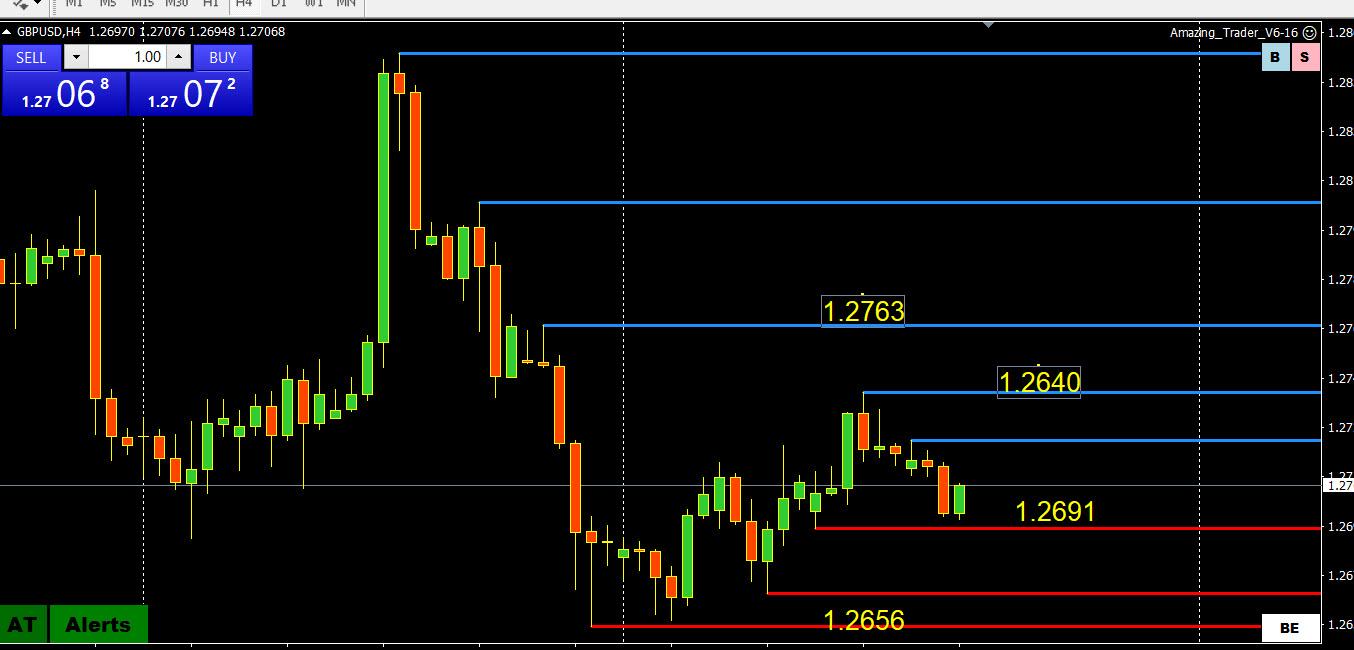

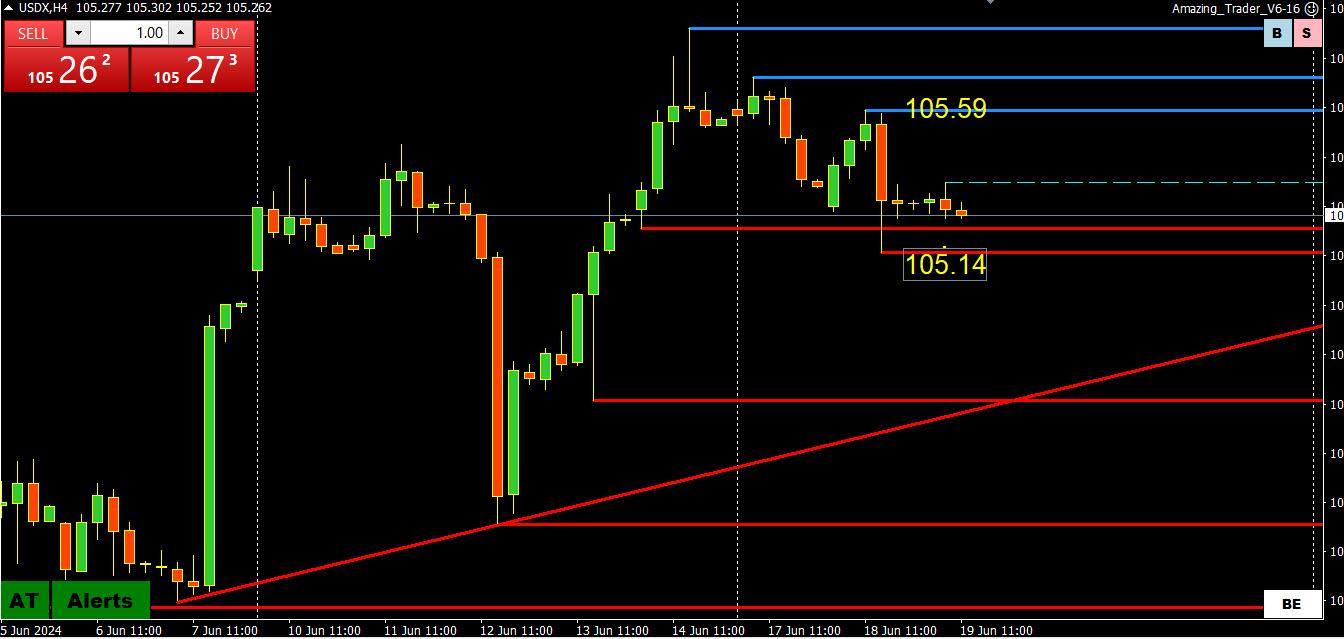

USDX 4 HOUR CHART – EURUSD PROXY (57.6% OF THE INDEX

Let’s start the day by looking at the USD INdex, where momentum has TILTED to the downside.

However, using USDX as a EURUSD proxy suggests EURUSD would need to extablish above 1.0750 (AND THEN 1.0760-65) to Put pressure on the USDX downside where 105.14 is THE FIRST LEVEL OF support.

OTHER CURRENCIES VS. THE DOLLAR

AUDUSD BID BUT HELD A TEST OF .6675 – SCROLL DOWN TO SEE CHART

USDJPY HIGH YESTERDAY WAS 2 PIPS BELOW THE KEY 158.25 HIGH

EURUSD CAN’T MAKE UP ITS MIND. BUT FINDS SUYPPORT WHILE ABOVE 1.0720.. RANGE WIDENED TO A PALTRY 1.0725-1.0742 (WON’T LAST)

EURGBP A TOUCH LOWER WAITING FOR THE BOE TOMORROW

US holiday clearly dampening trading activity

-

AuthorPosts

© 2024 Global View