Forum Replies Created

-

AuthorPosts

-

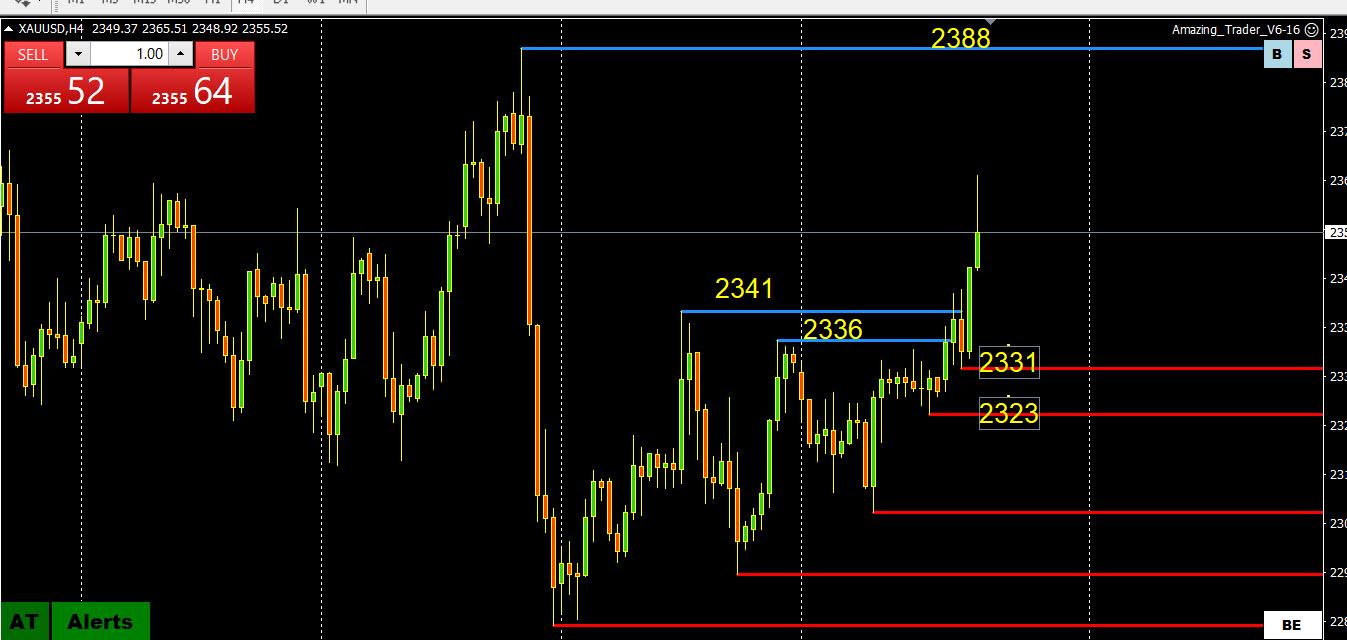

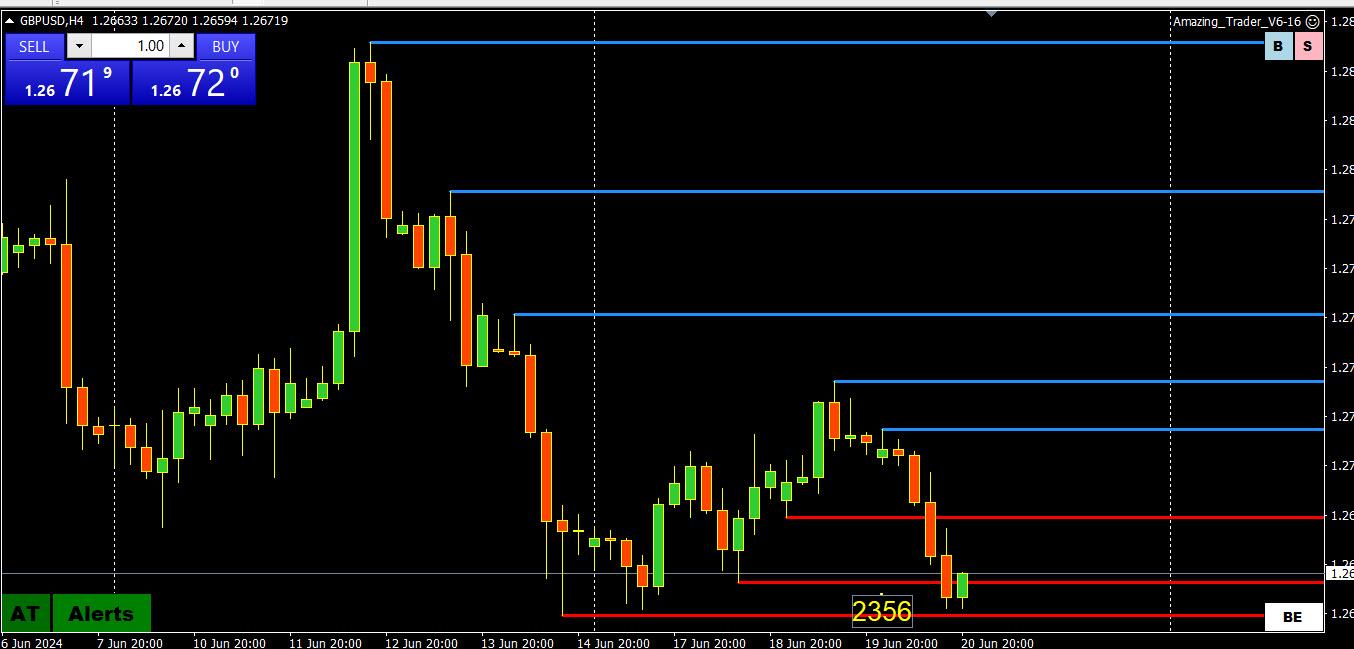

GBPUSD 4 HOUR CHART – PAUSES ABOVE SUPPORT

It still amazes me how uncanny The Amazing Traders can be with its chart levels and this chart shows the 1.2756 level what I posted much earlier.

Note how GBPUSD paused above 1.2656 and after a period of going sideways, has given up and staged a bounce.

Some moods swirling around markets

–

Yahoo Finance

Fed will ‘join the party,’ cut rates at some point in 2024

… the debate rages on over when the Fed will cut rates(WSJ) EU Recommends Disciplinary Action Against France for Excessive Deficit

The Commission also backed action against Italy, Belgium, Poland, Hungary, Slovakia and Malta for the same offenseThe Commission, which polices the European Union’s budget rules, also backed action against Italy, Belgium, Poland, Hungary, Slovakia and Malta for the same . Its recommendations will be considered by EU governments at a meeting next month.

(CNBC) And a message European peasants from IMF’ s kristalina:

Your productivity sucks: prepare to work ! and work harder !!https://www.cnbc.com/2024/06/20/imf-chief-says-europe-looks-like-an-ideas-supermarket-for-the-us.html

IMF chief says Europe looks like ‘an ideas supermarket’ for the U.S., calls for further integrationUSDCHF Daily

Supports at 0.88750 & 0.88450

Resistances at 0.89150 , 0.89400 & 0.89750

That support line you see is a Clone – historical angles that are used when the pair is moving Up .

So it is only an indication of what might serve as a support.

Also, it is now wide enough to expect it to hold for awhile.

SNB comes thru

– Recent meetings Jordan referenced the role a strong CHF plays in fighting inflation.

– Current meeting Inflation forecasts lowered, significant chf strength noted, current inflation pressures are domestic service driven, int rates lowered with room for another cut in Q3.

That said, against a backdrop of global tensions not going away anytime soon probably implies the CHf won’t run away to the downside but imo has room to walk in that direction, and favorite liability ccy play.

A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street returns from its midweek break to find record high stocks still chomping at the bit, with overseas monetary easing in focus as the Swiss cut interest rates for the second time this year and the Bank of England decision now awaited.

Morning Bid: Stocks up as Swiss cut again, BoE eyed; yuan slides

Gold 2338

Crude 85

Euro 1.0729bla bla bla bla bla

Israeli Foreign Minister Israel Katz to warn of an “all-out war” in which “Hezbollah will be destroyed, and Lebanon severely beaten.”

“The enemy knows that no place in the entire (state) is safe from our missiles, and it won’t be arbitrary. Everything will be deliberately targeted,” Nasrallah -

AuthorPosts

© 2024 Global View