Forum Replies Created

-

AuthorPosts

-

There is enough data this week to keep the market on its toes culminating with US PCE on Friday that coincides with quarter/month end.

The initial focus should be on USDJPY after it closed within spitting distance of 160 and the 160.16 high. I am not in the BoJ’s shoes but if I am serious about defending 160 I would let the market run through the high and then come in hard with intervention. However, this plays out, 159-50-160.00 is going to be the nervous zone.

A key event will be Thursday’s Biden-Trump debate where the focus will likely be more on performance than substance and mental fitness to hold office for both candidates. At this stage it is hard to gauge which candidate would be better or worse for markets in a race that seems filled with more negatives than positives.

This all comes ahead of Sunday’s first round of French elections where logic says should put a limit on the EURUSD upside ahead of it.

FOCUS OF THE WEEK AHEAD WILL BE ON INFLATION DATA. SEE DETAILED PREVIEWS IN THE FOLLOWING.

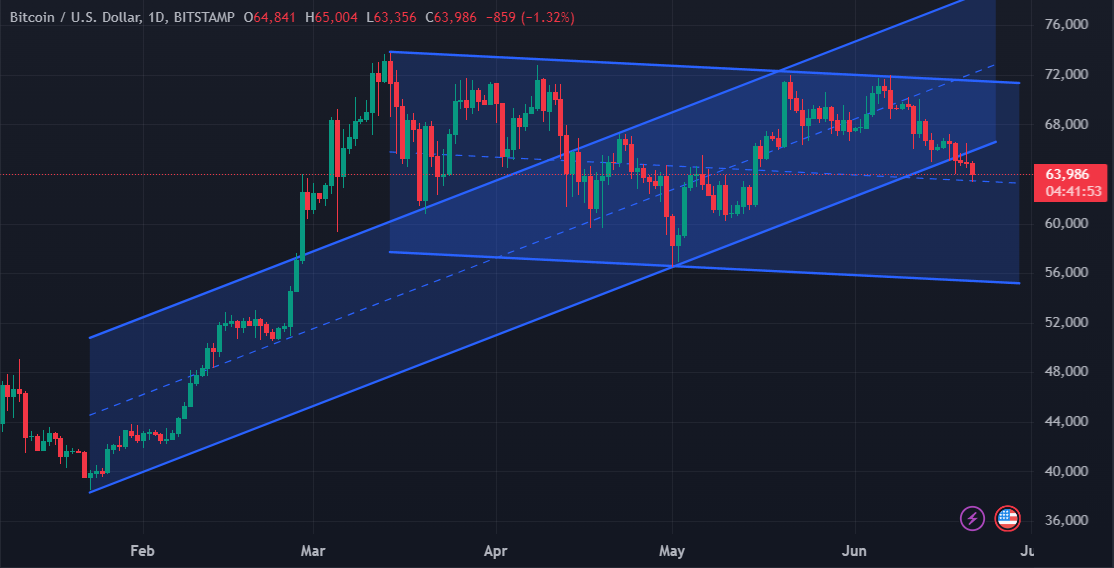

BTCUSD Daily

Bitcoin continues to slide further down and first support that might come handy is at around 60K.

Leave the dreams, hopes and good wishes out of this – we are talking strictly technical.

This is not a miracle toy, but just a commodity of a kind that lots of people got hot on…but some wants also to take their profits…

Reality is that it should be heading to 56K and then we can talk about changing the direction

BTC 4 HOUR CHART – 60K-70K?

BTC has turned soft below 65K but so far this is just a move within 60k-70k

I donlt expect bulls to give up on BTC unless sub-60K trades and major support is broken.

On the other end, the record high above 73K looks sade unless broken and as such dampens enthusiasm on the upside.

-

AuthorPosts

© 2024 Global View