Forum Replies Created

-

AuthorPosts

-

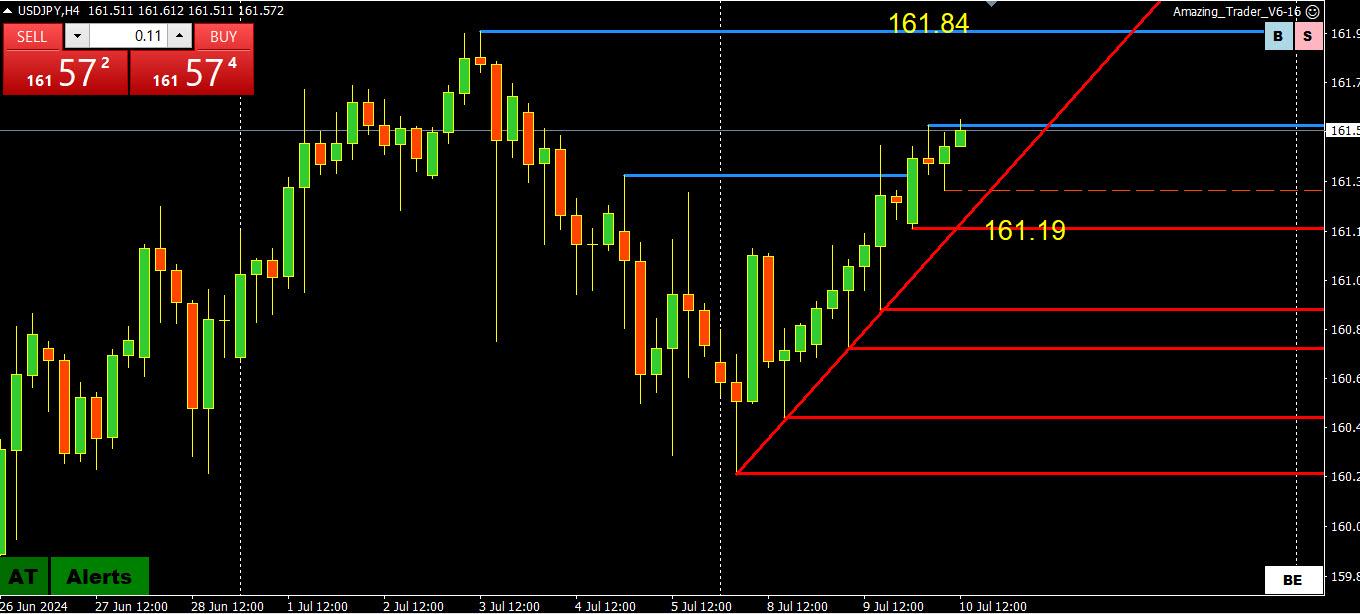

USDJPY 4 HOUR CHART – 162 LOOMS

Look at how the red Amazing Trader lines are dominating as USDJPY enters the 161.50-162.00 nervous zone.

If I was the BoJ I would hope to see a downward surprise to US CPI tomorrow to give USDJPY some breathing room.

Otherwise, 161.50 is clearly pivotal as above it puts 162 in play.

Key level on the downside is at 160.50

Question going forward is whether there is a line in the sand level for the BoJ.

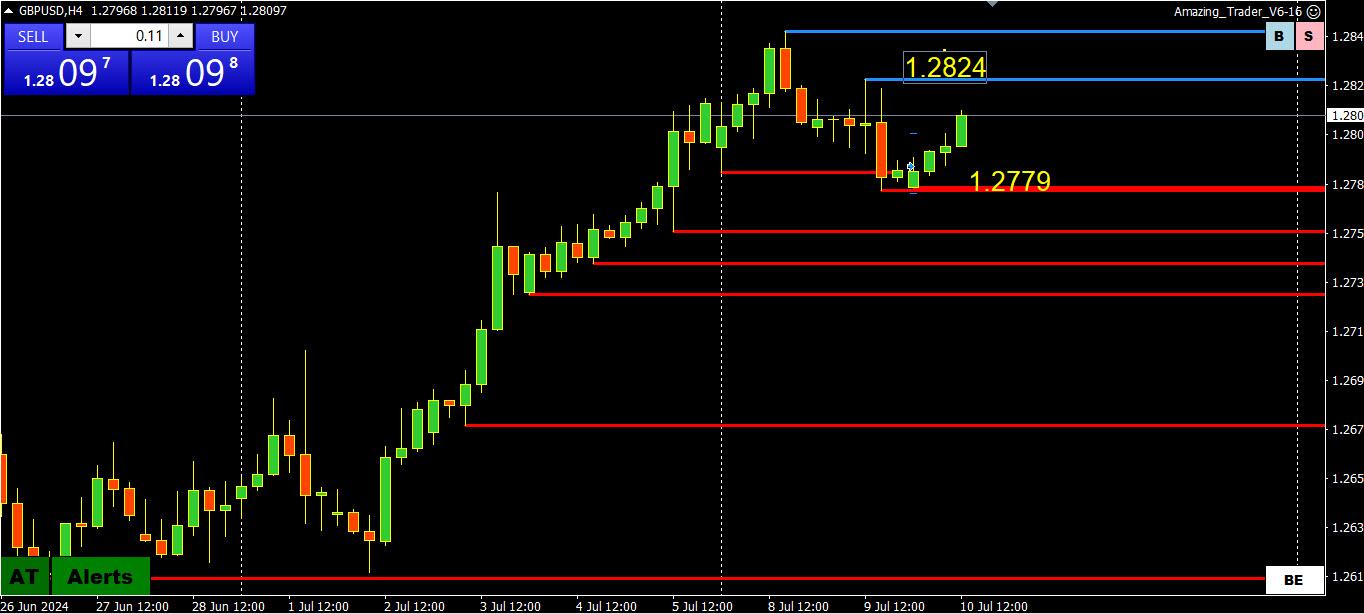

GBPUSD 4 HOUR CHART – WATCH 1.28

Whatever orders were behind the GBPUSD retreat seem to have run their course (look at GBP crosses, including EURGBP which has backed off after .8460 resistance held).

Key levels:

1.2824, above puts the 1.2846 high in play

1.2779, below it extends the retracement

1.2800, sets the tone

HELP anyone ?

Nick Timiraos – chief economics correspondent for The Wall Street Journal – in his Updated July 9, 2024 2:24 pm wsj:

one “that moved the central bank closer to lowering interest rates when he suggested Tuesday that a further cooling in the labor market could be undesirable.”

I have perused, searched and examined cnbc’s 2:13:35 worth of powell’s live video and transcript but could not find nick’s claim (hallucination ?) that Jerome said “that further cooling in the labor market could be undesirable.”

Comments ?

So far it makes me wonder what game nick is playing.

Mark down Monday’s USD lows and see how the market trades if it distances from them… and whether there is a Monday Effect week or not

This is a term I coined to identify a forex trading pattern that I watch out for each week. I call it the Monday Effect and when it plays it, there are usually significant moves in the market. So, you need to be aware of the Monday Effect, which I reveal in the following article…

Yes exactly – I can take a trendline drawn in past in my charting station and move it where I want – to present .

It keeps the same angle . If you don’t have that capability, just make a parallel one and move it with the mouse to where you want it.

This is not just a theory, but proven concept over decades.

Remember when EUR was born – we have used “synthetic “ charts based on USDDEM – well, angles didn’t change …same channels are working today as well.

Good David – you are watching for highs and lows , and I guess this is “Supply/Demand” style.

And it is all fine as long as it works for you, really.

But when you go with a position taking based on unknown factors ( you can’t really know where are the orders placed – that is what you actually see as Demand/Supply zones – that is only in hands of Higher powers like Central Banks and several Monster banks ) , sooner or later you gonna get hit, and hit hard.

Here we will go over different techniques and styles, and ultimately build trading systems that will make your job easier.

There are many tricks and tips that we are going to reveal, and test in real time conditions.

Trend Lines

Most of you already know how to draw the trendline : easy –connect two or more points on the chart ( two lows or two highs ) and you have it.

So what can I show you that you don’t already know ?

Well, the way I do it is with the twist, plus there are some untold rules , that no one so far said it out loud.

Look at the first chart – I know, it is a past performance and easy to pick up the trend and tops & bottoms – only two things I want you to pay attention to :

First is the clear rule – once the Support trendline gets broken, becomes a Resistance trendline

Second – every trendline can be penetrated, but to declare it Broken, at least two consecutive bars have to close Below / Above it

So I have found previous trendline – good for me….but how does it help you in your trading ?

Look now at the second Chart:

That Support trend line was there from June 26th – I had it in place the moment they hit that Low.

How ?? Do I have a crystal ball ?

Nope – That is exactly the same Support trendline from the previous chart – I have cloned it ( copied it ) and placed on that low.

I did that each time they left the low behind.

Once you find an appropriate trend line in past, check it out on different occasions – if it fits, you got your Psychic Trend Line – it is always under the same angle, and can help you greatly to predict future moves , or at least give you way more clear view of future events.

– Always under the same angle

– Great warning system

– Gives you the idea where the market actually moves – or can move

-

AuthorPosts

© 2024 Global View