Forum Replies Created

-

AuthorPosts

-

US OPEN

US equity futures & DXY lower, Bunds continue to slip ahead of ECB

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are mostly lower, Autos benefit following tariff reprieve; US futures in the red with NQ underperforming.

· DXY remains on the backfoot, EUR underpinned by stimulus hopes as attention turns to ECB.

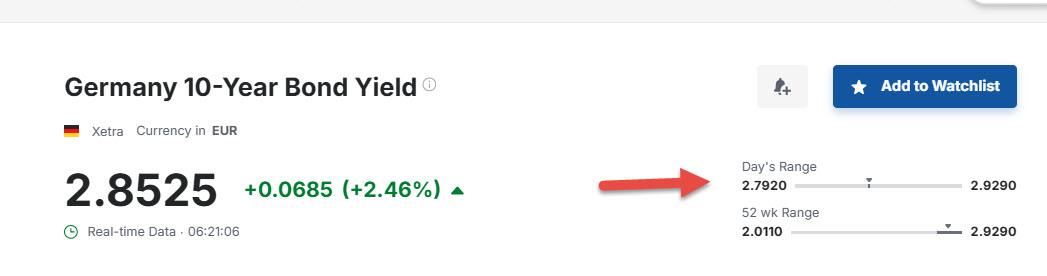

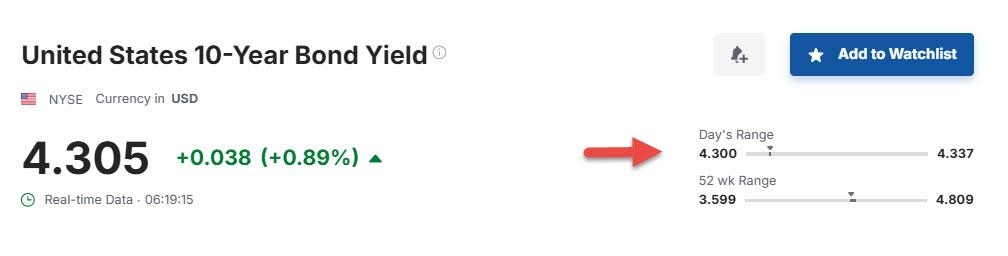

· Bunds continue to slump on the latest fiscal reports pre-ECB, USTs await data

· Crude attempts to claw back recent pressure, XAU sits around USD 2.9k/oz.

EURUSD 4h

Resistance 1.08300 – just above the head

Supports: 1.07800 & 1.07250

Correction is overdue.

But – ECB is coming in about 1h 20 min – Economic Data Calendar

I’ll wait and see how it goes…

EURJPY 4 HOUR CHART – Holds major resistance

With EURJPY one of the drivers of the EURUSD rally (among other crosses), it pays to take a look as the cross has backed off after a test of the major 161.17 level (see chart).

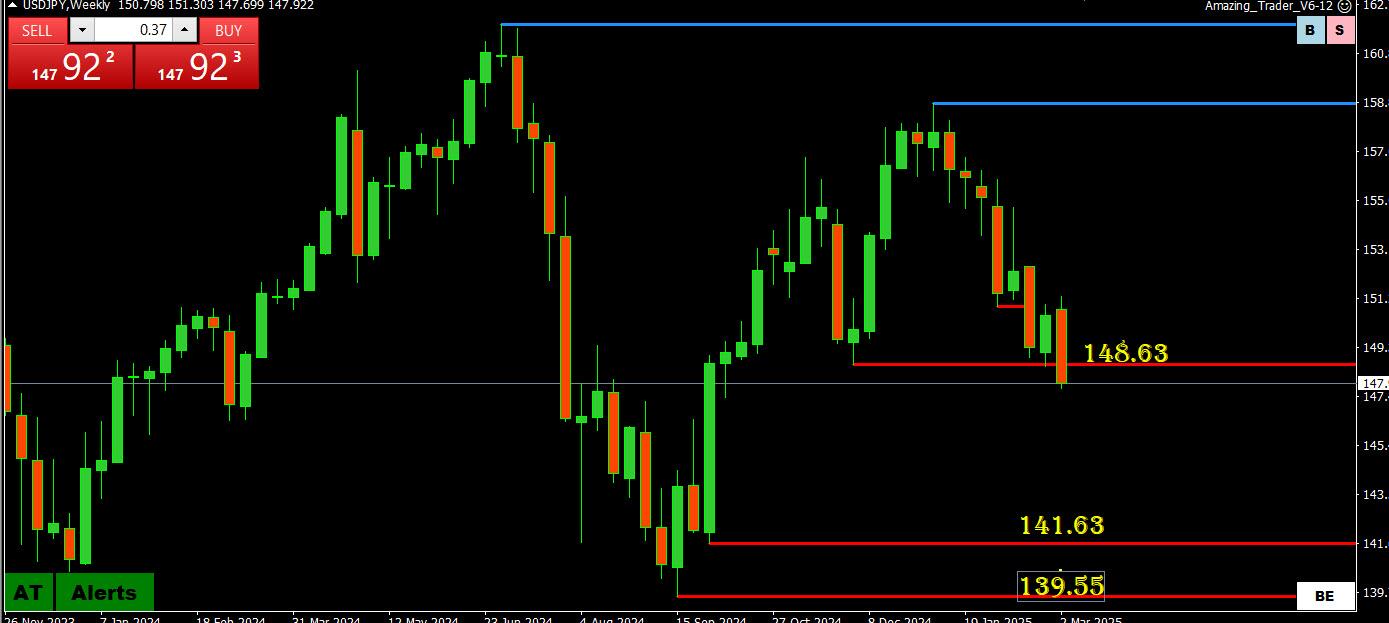

This has helped steady EURUSD while USDJPY slipped below 148.

Minor support 159.40 and 158.70

USDJPY WEEKLY CHART – Black hole

After lagging and at times diverging the past few days vs the EUR, JPY has firmed, both vs the dollar and on its crosses,

As you can see by this weekly chart, there is a large black hole on the downside, leaving the focus on the pivotal 148 level to set the tone and dictate whether it can make a run at 146.50 and 145.00 or not..

As I have noted, when you see a big move in USDJPY, especially when it diverges with what others are trading vs the USD, it generally involves a real money cross flow.

Intra=day range: 147.70-149.33

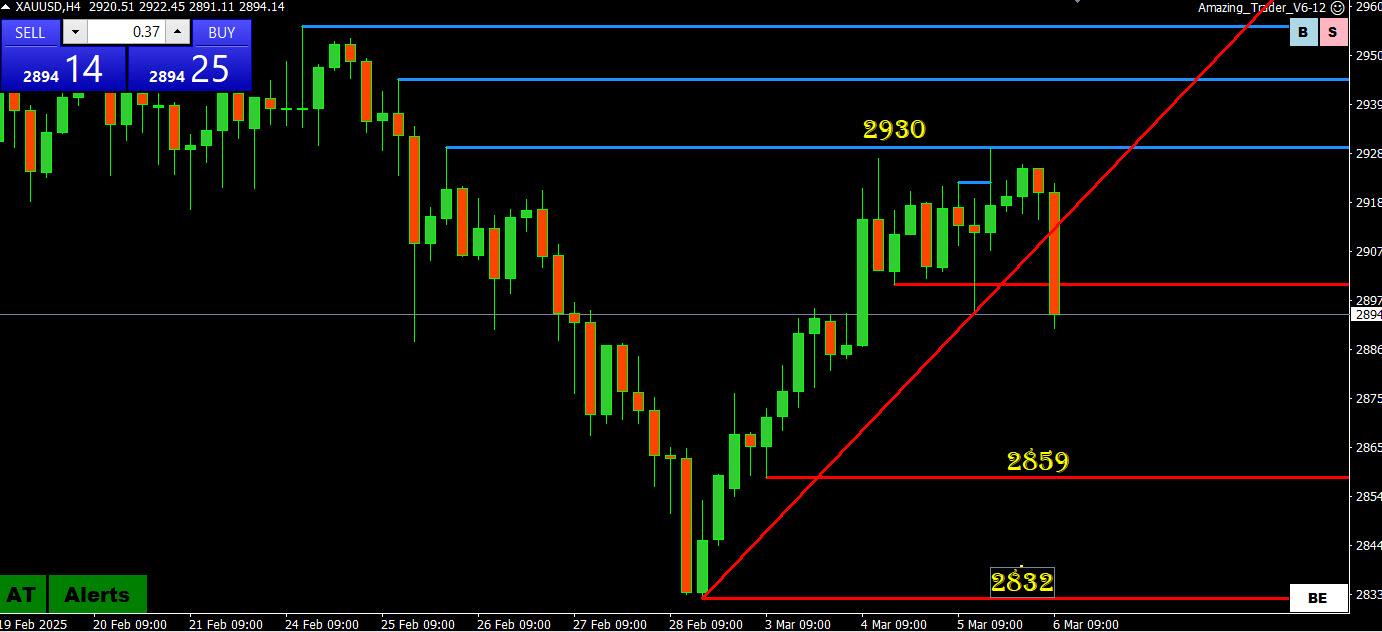

XAUUSD 4 HOUR CHART – Resistance holds

The best I can say at this time is the upside is limited unless 2930 is taken out.

There is some risk on the downside with the trendline broken but only back below 2859 would expose the 2832 low again.

Midpoint of the 2832-2930 range is 2881.

Fundamental factors:

Glimmer of hope for an eventual Ukraine-Russia peace deal

Higher global bond yields

EURUSD DAILY CHART – Watch 1.08

With the breakout through 1.0630 leaving little until the next target at 1.0936, 1.08 is one of those pivotal levels that will dictate whether the market can build further momentum to make a run at it.

Next focus is on the ECB meeting where a 25bps rate cut is a done deal. Key will be forward guidance in light of the sharp rise in bond yields following the increased government spending plans on defense announced this week.

In any case, while 1.08 will set the tone, there should be support on any decent dip as long as it trades above 1.0630.

Intra-day range so fat 1.0780-1.0822 (almost a symmetric 20 pip range around 1.08),

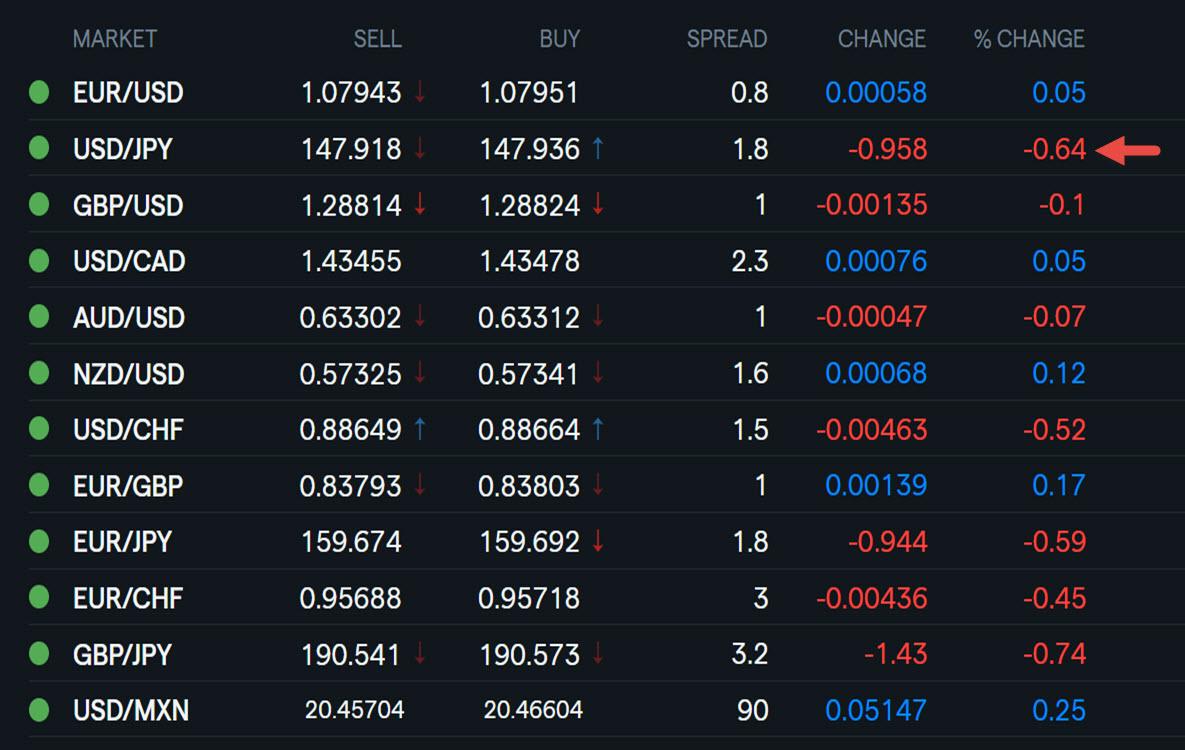

Using my platform as a HEATMAP shows

The dollar traded softer overnight before some caution set in ahead of the ECB decision. Most currencies are currently showing only modest changes except the JPY, which has been the outperformer (extended low below 148).

Key focus is on the bond market where higher German yields are pulling other country yields higher as well.

Pivotal levels to watch end in 8: EURUSD 1.08, USDJPY 148.

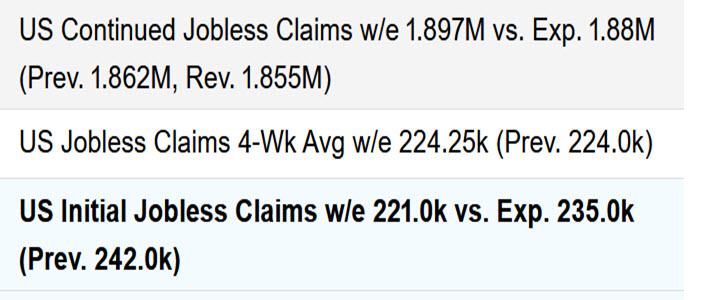

Light U.S. calendar (weekly jobless claims) ahead of the key .S. jobs report on Friday

US stocks currently down, bond yields up…not a good comination

Keep on eye on headlines, specifically tariff replayed

-

AuthorPosts

© 2024 Global View