Forum Replies Created

-

AuthorPosts

-

No big surprises in the jobs data… EURUSD extending high after a brief hesitation,, post data range 1.0843-88… 1.0850 will set the trading bias

<p style=”text-align: center;”>Try Newsquawk for 7 Days Free

US AND CDA jobs repoRTA… see our Economic Calendar

Pre-data, market is pricing in 3 Fed rate cuts vs 2 priced in last week.

US 10-year yield 4.25%

ALERT

Jerome Powell, the chair of the Federal Reserve, will be the center of attention today as he speaks at the 18th annual U.S. Monetary Policy Forum in New York City on Friday.

The lunch keynote will be presented by Jerome Powell, Board of Governors of the Federal Reserve at 12:30 p.m. ET on March 7, 2025.

US OPEN

US equity futures trade modestly higher whilst the Dollar slips ahead of US NFP

Good morning USA traders, hope your day is off to a great start!Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European indices lower whilst US futures are modestly higher ahead of US NFP.

USD misery continues as DXY dips to 103.60 as EUR’s rally extends into Friday’s trade.

Bunds bounce off worst but remain over 300 ticks lower WTD, USTs await Payrolls & Powell.

Crude firmer with gas inflating on damaged Ukrainian infrastructure.

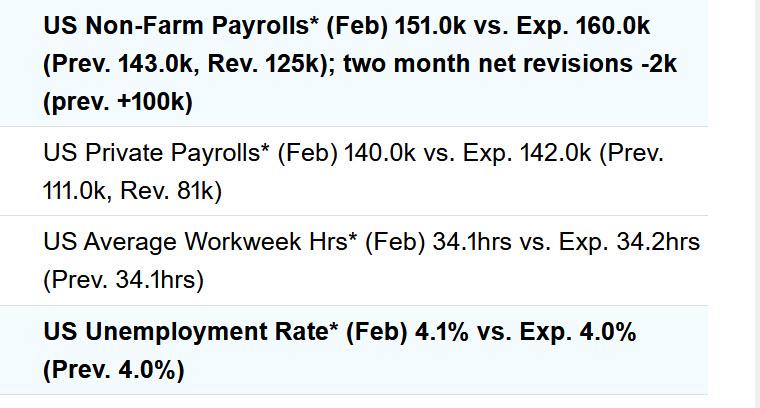

<p style=”text-align: center;”>Try Newsquawk for 7 Days Free</p>Re the US jobs report, some way it doesn’t matter much this time around but those who trade know it always matters in terms of a reaction.

This time,, a miss on the downsaide would seem to generate the strongest reaction given concerns over the economy.although it could be explained away by distortions from severe winter storms.

If what I heard is accurate, a stronger report would not necesssarily spell relief with the impact of DOGE job cuts yet to be reflected in the data and tarrifs hanging over the economy as a cloud.

Using my platform as a HEATMAP shows

The dollar trading weaker (except vs commodity currencies),

There was no apparent catalyst as markets await the US February jobs report (see detailed preview).

Regarding the jobs data, I heard yesterday that the DOGE cuts will not be reflected in this month’s report.

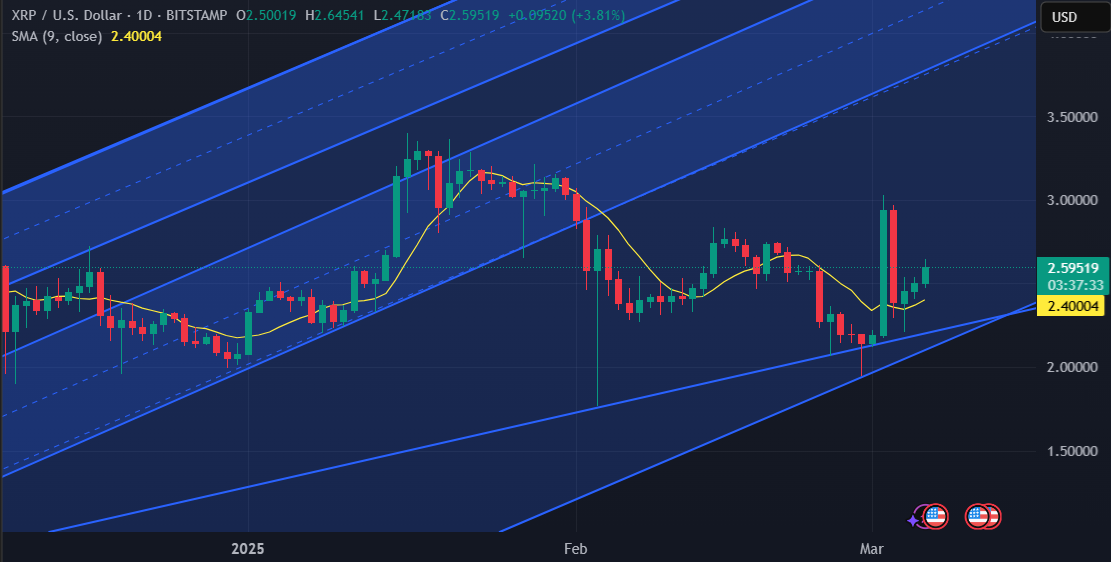

EURUSD 1h

1.08550 taken out – if it closes this week above it, road is open for test of long time resistance trendline at 1.11800

That much on the big picture, so let’s now concentrate on trading possibilities intraday.

In a bit over 2.5h data are coming, and in mean time this is what we have:

Resistances: 1.08750, 1.09000 & 1.09500

Supports: 1.08450, 1.08200 & 1.07750

I expect pull backs from here, and waiting for a chance to get Long – either on approach to 1.08200 or Pattern creation after some consolidation ( in case it goes sideways and never reach it)

In our bloig

From the Savvy Trader: Are the FX dynamics changing

The huge increase in EU defense spending coupled with The US tariffs may be changing the dynamics of the FX market from a responsive sell high buy low market to a trending market within a bigger neutral range.

If this is so then the extent of trend may surprise the complacent.

-

AuthorPosts

© 2024 Global View