Forum Replies Created

-

AuthorPosts

-

I am using Daily charts when giving a general direction and sometimes even Clear signals, but for those you have to wait sometimes for days…

It is possible to trade DAX, Gold, Bitcoin on small time frames, but I use very small time frames…15 min and smaller.

But be aware that only high liquidity pairs are behaving nicely….

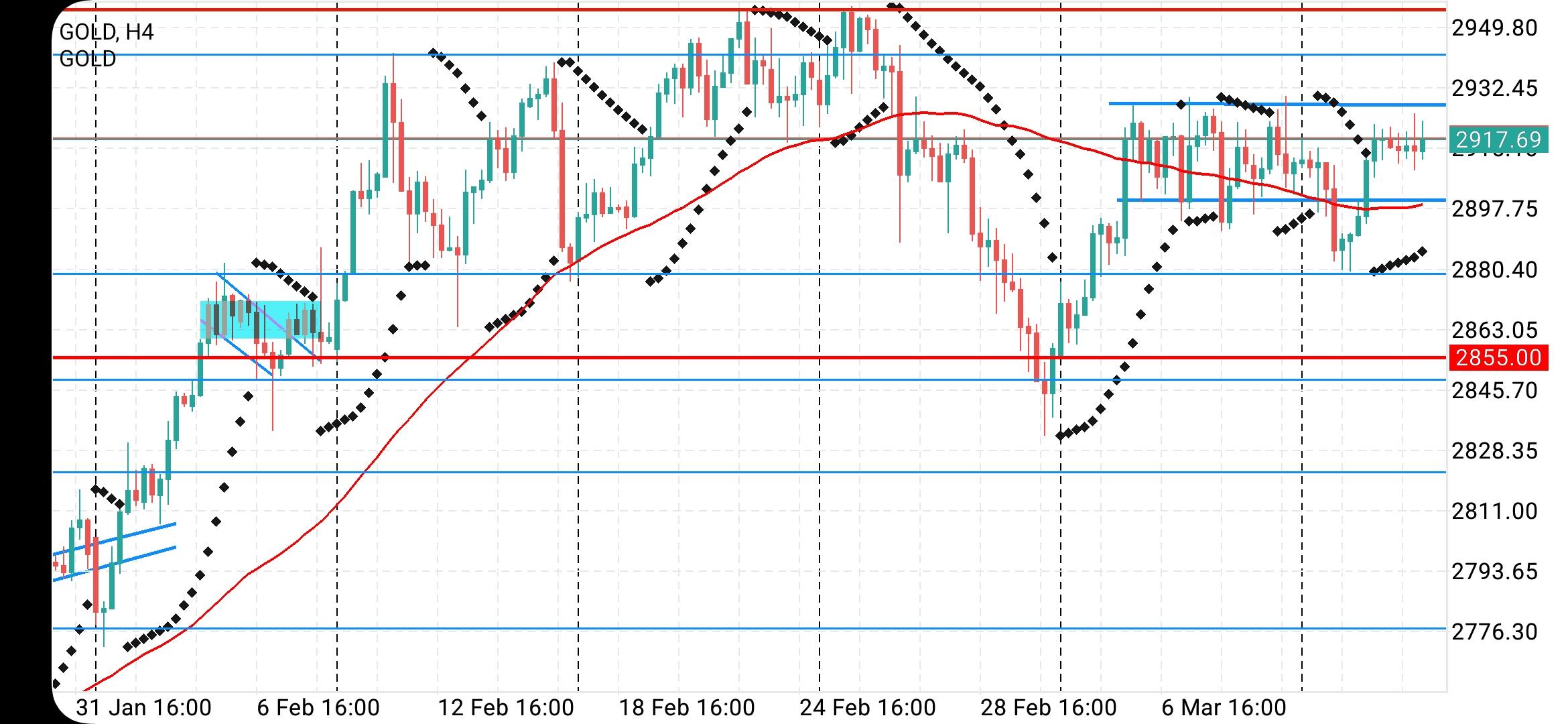

XAU/USD: Gold Sits Steady Above $2,900 as Focus Shifts to Looming Inflation Data

Key points:· Gold prices hug flatline

· Inflation report looms

· Where are rates going?

Gold prices XAUUSD held steady around $2,915 per ounce Wednesday morning with traders getting ready to be hit by the latest inflation report out of the US. Gold bugs can’t complain — their shiny stuff is doing numbers on the chart and the upcoming inflation data could stir things up even more.

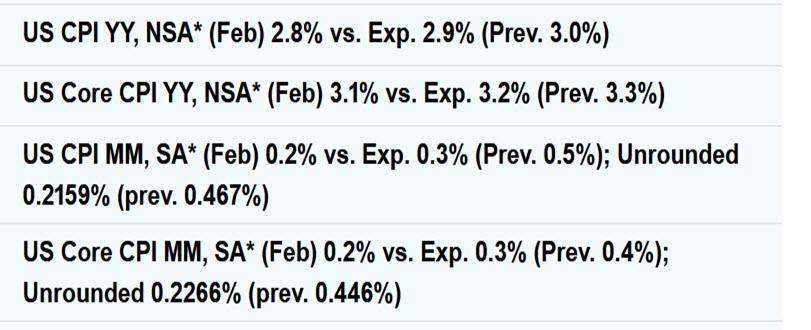

The consumer price index USCPI dropping today is expected to show prices increased 2.9% in February. Oddly, analysts expect to see a pullback as January’s inflation pace was 3.0%.

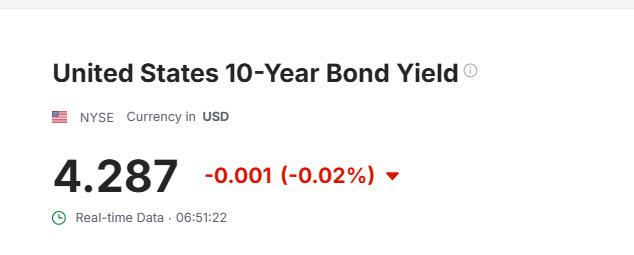

If inflation turns out to be higher than expected, then the Fed might reassess its plans of cutting borrowing costs. Some analysts go as far as to predict that inflation could soar so much the Fed could be prompted to hike interest rates.

Rates staying where they are or even possibly moving higher could be detrimental to gold, because it’s a non-yielding asset and it may lose its appeal as a safe-haven in a market environment of higher interest rates.ECB Facing ‘Exceptionally High’ Levels of Uncertainty, Lagarde Says

The European Central Bank is confronting a new, more volatile world in which it must combine agility in responding to shocks with clarity in outlining how it is likely to react to a range of possible outcomes, President Christine Lagarde said Wednesday.

Much of that new volatility was traceable to U.S. President Trump’s administration.

“Established certainties about the international order have been upended,” she said. “We have seen political decisions that would have been unthinkable only a few months ago. Our expectations have indeed been swept aside in the last few years, and in the last few weeks in particular.”

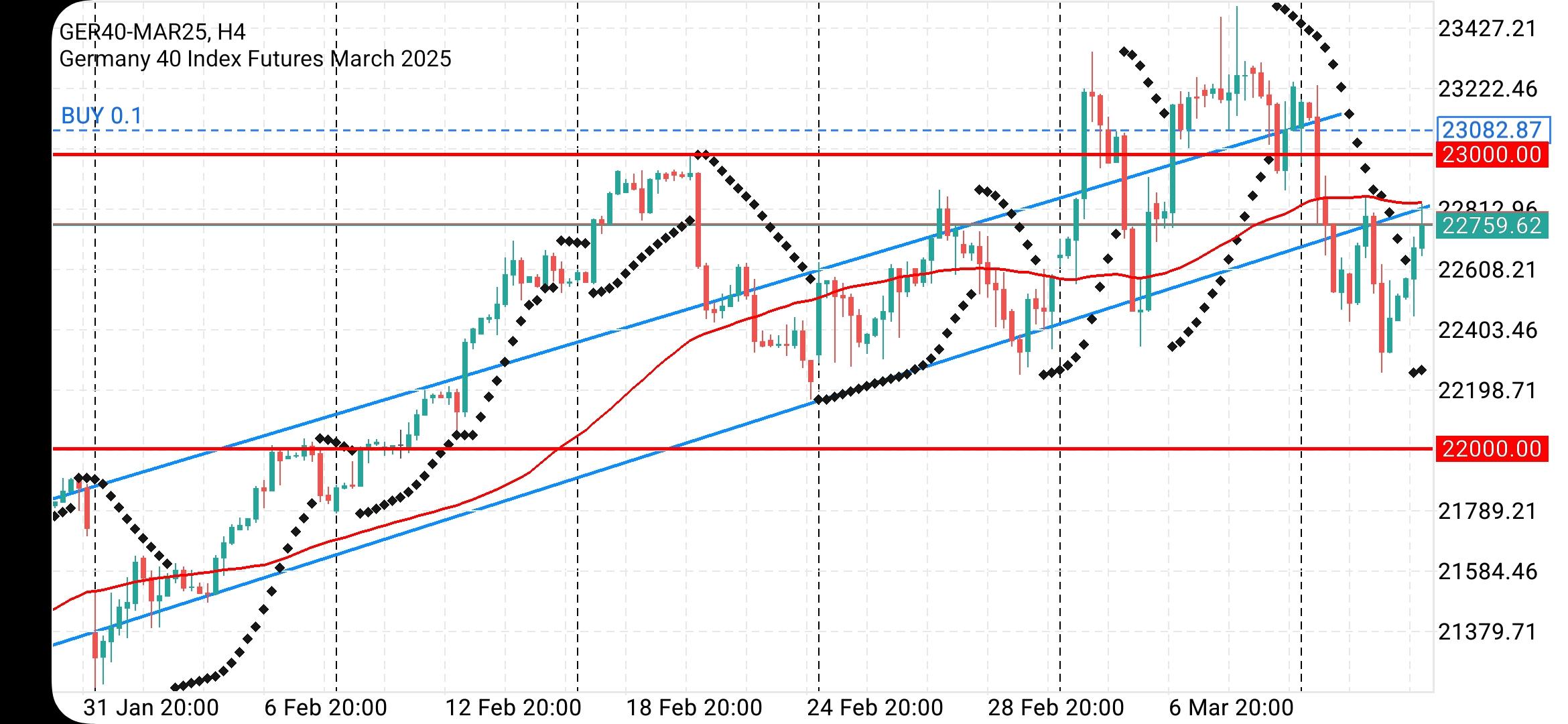

DAX – GER 30

DAX rebounded straight to the Resistance at 22.860 ( a bit short of it) and it is not out of woods.

To have a sustainable move, it has to test the support again at least , and if holds it can go Up.

Close below 22.860 will be Bearish and we should see that test of 22.250

If DAX continues to try Up , this is going to be one big Top, and then you know how it goes…down for weeks if not months…

So, I would like to see deeper correction in coming days, in which case it would be able to regain the strength and continue Up.

US OPEN

US equity futures higher & USD incrementally gains ahead of US CPI; JPY modestly lags

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

· European bourses are in the green as sentiment in the complex improves; US futures are also higher with the NQ slightly outperforming.

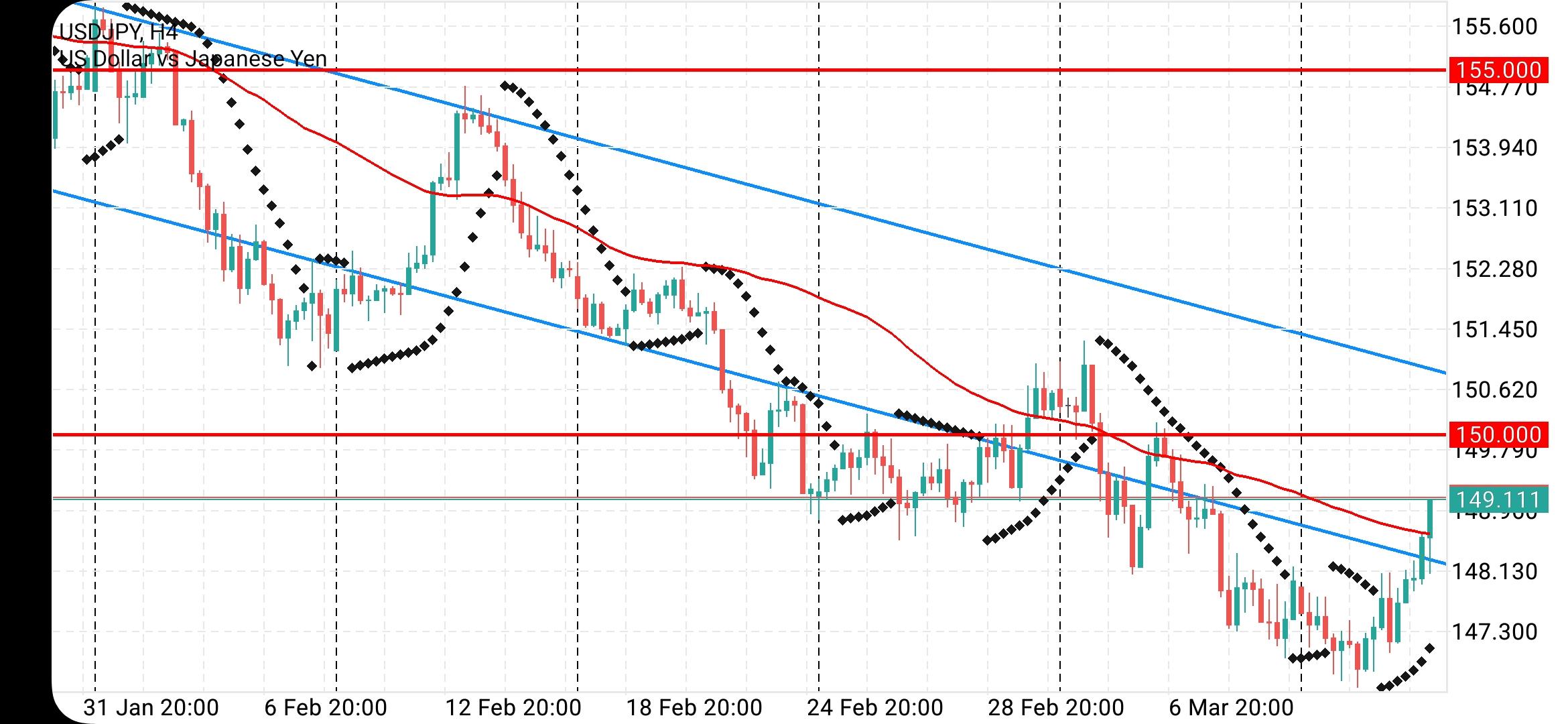

· USD is a little firmer ahead of US CPI data, JPY lags peers.

· Bonds are bearish overall amid supply, inflation updates & German fiscal developments.

· Oil and base metals firmer, gold trades sideways ahead of US CPI.

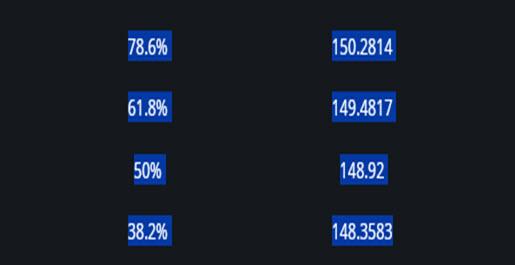

Thinking out loud— looking for reasons to explain the weaker JPY

Will the BoJ hold back on raising rated Given the chaos and uncertainty in global markets.

Aldo, March 31 is the end of the Japanese fiscal year, which used to be seen as an FX factor but I have not seem it talked about in recent years.

-

AuthorPosts

© 2024 Global View

still consolidating

still consolidating