Forum Replies Created

-

AuthorPosts

-

Gold ETFs offer up to 40% return in 1 year. Are you a gold bug?

By Surbhi Khanna, Feb 20, 2025, 12:13:00 PM IST

https://economictimes.indiatimes.com/mf/analysis/gold-etfs-offer-up-to-40-return-in-1-year-are-you-a-gold-bug/articleshow/118409198.cmsGold ETFs turned Rs 10,000 monthly SIP into over Rs 9 lakh in 5 years. Did you miss the gold rush?

By Surbhi Khanna Feb 19, 2025, 01:23:00 PM IST

https://economictimes.indiatimes.com/mf/analysis/gold-etfs-turned-rs-10000-monthly-sip-into-over-rs-9-lakh-in-5-years-did-you-miss-the-gold-rush/articleshow/118381281.cmsMutual fund investors pour Rs 3,063 crore in largecap funds. Time to shift your portfolio?

By Surbhi Khanna Feb 19, 2025, 10:13:00 AM IST

https://economictimes.indiatimes.com/mf/analysis/mutual-fund-investors-pour-rs-3063-crore-in-largecap-funds-time-to-shift-your-portfolio/articleshow/118375563.cmsAs gold prices soar by Rs 8,300 per 10 gram in 2025, here’s how to buy jewellery via SIP

By Shivendra Kumar Feb 18, 2025, 12:45:00 PM IST

https://economictimes.indiatimes.com/markets/stocks/news/as-gold-prices-soar-by-rs-8300-per-10-gram-in-2025-heres-how-to-buy-jewellery-via-sip/articleshow/118349978.cmsRecently SEBI took action against registered advisors by implementing some kind of new rule and the result was that many have shuttered their businesses and exited the markets to the public, and then… well everyone has no choice but to turn to the newspaper and pay ONLY 2000 per year. when you multiply that by 150,000 extra subscriptions then it adds up to a considerable amount…

Oh… the investor is in the red by 25% or more perhaps by 2 million rupees or more so what is the comparison between that 2 mio rupees and ONLY 2000 rupees for a yearly newspaper subscription, a 3 year subscription would go at a cheaper price considering the per month cost of a newspaper. Wait I’ll post a a few articles and prove it. The large investors are holding losses of up to 81000 crore which is 81000*10million rupees divided by the USD/INR Exchange rate. They are the first ones to get suckered into buying a newspaper subscription.

Bamboozling markets?

First the newspapers took concerted steps to mislead and trap retail investors into doing SIPS into stocks, and MF’s… Now everyone is trapped and is stuck with having to hold losses of up to 2 million or more. Now reporters have started doing that same trick on retail investors by using XAUUSD as the bait. Just look at the writer’s name, the date and time… and most of all the wordings used in the headline topic. Talk about bamboozling markets… The media is causing retail investors to get trapped just in order for them to suffer fear and take a newspaper subscription at steep discounts of up to 40% off!!!

USDJPY DAILY CHART – Major level cited

JP, the stalemate was broken when 150 was firmly broken as stocks extended slide

Break of 149.34 exposes the major support at 148.63, the base of the move to 158.85

If you go to the weekly, it shows a risk for 139.50 if 148.63 gives way.

At a minimum, 149.34-39 needs to be regained to slow the threat but only 150+ would negate it.

a refresher from the Fed on “communication” (propaganda to some)

jefferson casting some light on past, current and future methods of bamboozeling markets of its intentions and ultimate market digestion and reaction goals

Reading between the Lines? Textual Analysis of Central Bank Communications

February 21, 2025

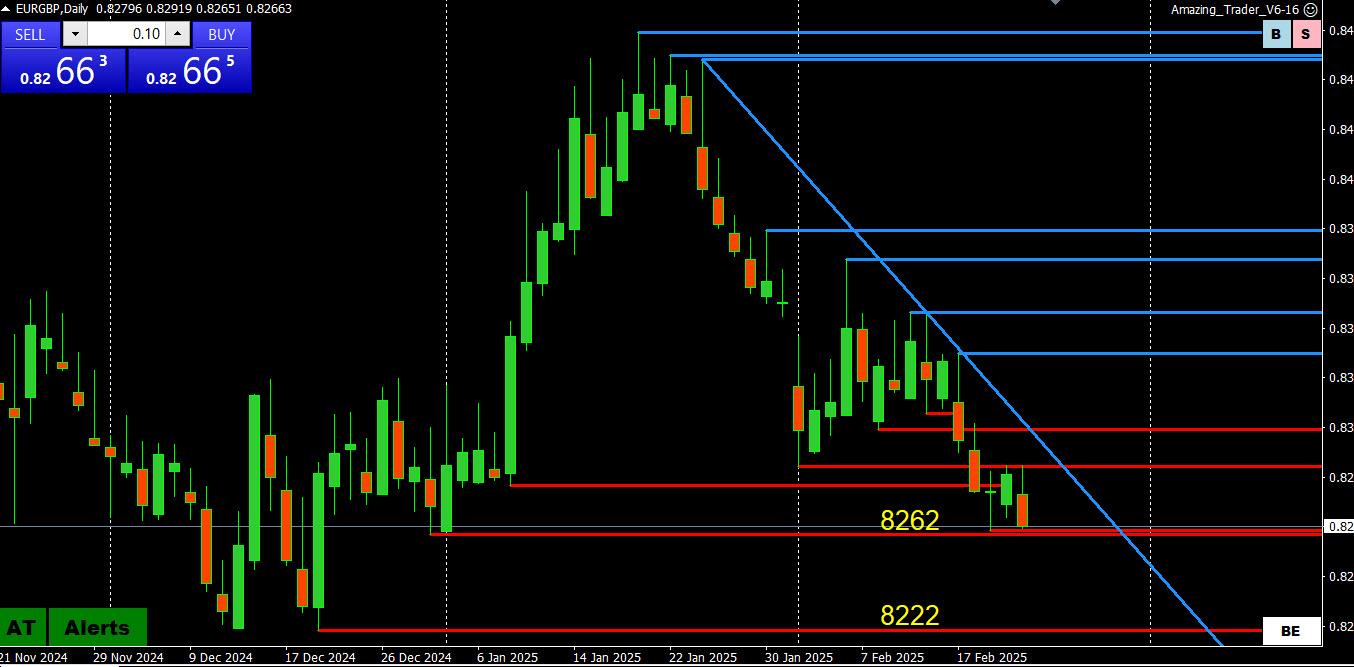

Vice Chair Philip N. JeffersonEURGBP DAILY CHART – Weighing on EURUSD

I got an email calling this Freaky Friday but there is some logic behind EURUSD falling (tests 1.0450, holding so far) despite weak US data1. EURJPY selling (biggest weight)

2. EURGBP selling (adding to it)

10-year bund is down 7bps while 10 year gilt is up 3bps

GER30 is down for the 3rd day after coming very close to 23000.

There could also be some flows ahead of the German election.

Whatever the case, .8262 is a key support with next level at .8222

Note, EURJPY selling is a greater weight on EURUSD

More downside misses in US data… risk off… yields dip… JPY getting the flows… USDJPY back below 150… JPY cross offsetsa lifting thr USD elsewhere… stocks down

Source data headlines: Newsquawk.com

-

AuthorPosts

© 2024 Global View