- This topic has 78 replies, 4 voices, and was last updated 6 months ago by Idris Sagamu.

-

AuthorPosts

-

February 18, 2025 at 7:06 pm #19748February 18, 2025 at 6:30 pm #19746

Idris did you read this aeticle?

https://global-test.financialmarkets.media/how-you-can-trade-opening-week-gaps/

February 18, 2025 at 5:53 pm #19744February 16, 2025 at 5:52 pm #19631thanks for making that clear to me , however while im off here im doing little research about informed trading and how to used some other statics to back up trading decision like the london and us cash market open ,that create opportunity in the market volatility during that minutes and some of those information are kept from retail trader ,i know you know much about all this and i will like to have much data too sir

THANKS

MR BOBBYFebruary 16, 2025 at 3:19 pm #19630February 16, 2025 at 10:54 am #19607February 10, 2025 at 1:59 pm #19284Hi Edikan 😀

You read it right – it is exactly what I meant.

As for becoming a billionaire , I have never had that Go at the first place, but I guess that I was on the right road back in the beginning of 2000 .

Also, there is a limit on the size of the positions set up by your broker ( believe me – I know )

This is another issue I can see many have – thinking way too big . And that is going against one of the main rules of this game : never be greedy.

I quit trading big, late 2008 , and spent my time in mainly doing research.

Just in last two years I started trading again constantly ( even my doctors are not happy with it ) checking in real time and real money all that I had figured out .

I understand your disbelief , but you have also to understand my stance – I am selling nothing, so I really don’t have to prove anything ( however, several days ago I had an urge to show you how it really looks like after our small discussion here – took pics as well, but decided not to go public at the end 😀 – so don’t waste your time with it

All that is of no importance – what is important is to understand how all of it works.

Be aware that we are talking here hypothetically – apply all said on your own positions…

– Big time frames – Big losses – stops are at minimum 50 pips ( just talking out of my head now )

– You can hit the right direction and still be kicked out if your stop was not big enough

– Feeling of loss can be disastrous – losing at once tens of thousands of dollars is never good for psyche

– Being locked in a position for days and weeks sometimes ( you have no life – only forex)

– Same patterns and formations are happening on any time frame

– So I quit on it long ago…

The above is just my short explanation why I chose smaller time frames, but I am not saying that everyone now has to go that way – it is on every single one of us to find his/her appropriate time frame, system, strategy….

To explain Formations/Patterns – I am never talking about those widely known from different books and theories – I am talking about those that I have figured out myself – and I will never reveal it all – it is my life’s work and only ones privy to it are my daughters – even they are not interested even a bit…

Bots, data, news…I don’t care a little bit about all those…I just watch not to be in the position while it happens.

Try to open your mind a bit more and go beyond “facts”, established trading knowledge , rules that some other people established as Dogma – there is no Forex Trading Bible – and never will be as market is a Liquid Chaos ( some academics tried to apply even theory of chaos from quantum physics and it didn’t work – killed a well known Fund by it ) .

Only way to take on it is constant watch, adjusting to every move it makes, re-adjusting after every single change …..lots of work…full time job and then some.

I will share all that I think is valuable , short of giving my systems away….

P.S. Just to get an idea – one of the simplest system that I have developed , based on just one simple pattern has over 85% probability , with almost 20 years of data testing and real time trading 😀

February 10, 2025 at 1:14 am #19263Every trading course I have ever took all say that if you trade on the higher timeframe, your win rate will be much better than if you trade on the lower timeframe, and I have seen that it is true for several reasons;

1.) YOU ARE WITH THE OVERALL TREND

2.) YOU ARE LESS LIKELY TO BE STOPPED OUT DURING VOLATILE PERIODS LIKE NFP AND OTHER ECONOMIC NEWS RELEASES

3.) YOU ARE LESS LIKELY TO BE MANIPULATED, IT TAKES MORE MONEY TO TAKE OUT LIQUIDITY ON A HIGHER TIMEFRAME THAN IT DOES ON A LOWER TIMEFRAME

4.) YOU ARE TRADING IN LINE WITH FUNDAMENTALS

5.)THERE IS MORE PRESENCE OF HIGH FREQUENCY TRADING BOTS IN THE LOWER TIMEFRAME, MAKING PRICE MORE CHOPPY AND TAKING ADVANTAGE OF SIMPLE PATTERNS THAT THE AVERAGE TRADER USES.

6.) PATTERNS ARE MORE RELIABLE, A BEARISH ENGULFING ON A WEEKLY TIMEFRAME HAS MORE SIGNIFICANCE THAN A BEARISH ENGULFING ON THE 1 MINUTE TIMEFRAME

FOR THIS VERY REASONS, I FIRMLY BELIEVE THAT IT IS WAY EASIER TO TRADE ON THE HIGHER TIMEFRAMES THAN ON THE LOWER TIMEFRAMES, I WILL BE WAITING FOR YOUR REASONS WHY YOU BELIEVE THEY ARE BOTH THE SAME

February 10, 2025 at 1:05 am #19262Mr. Bobby, thanks for taking out your time to reply me, I really do appreciate, but you lost me at the 96% win rate at 1 to 3 RR, was it a typo or you really meant what you said. That win rate means you lose on average once every 25 trades, that is incredibly high for a positive RR of above 1 to 3, you should literally be a billionaire if those stats hold true. And is there any sort of broker statement or any third party tracker you have connected to your account, to help me solidify my belief in you. Maybe Tradezella or myforexbook or any of them? Because truly I have never seen anyone win 96% of the time with a positive RR. I look forward to seeing the broker statement, Thanks so much in Advance Sir

February 9, 2025 at 10:03 pm #19256Let me try to explain it all Edikan :

– Win rate has nothing to do with the time frame you trade on – It is directly connected to your system probability rate

– R/R- as long as above 1:2 you are winning

– R/R is not connected to your win rate : they serve the same purpose in unison , but saying that if R/R is higher – win rate is lower is not correct. It all depends on your trading system ( I will have to show all of you what I mean when I say “System” , but for now try to understand it as like set of rules that you follow even in your sleep when you trade.

– As for smaller time frames and choppy – in my opinion it is exactly the same as on big time frames, just it rolls way faster , so later on you get an impression that if you go with big time frame it is calmer and easier.

– Now about stop losses : if your system delivers 50% probability ( win rate ) , it means that out of 100 trades, you’ll win 50 and lose 50 – no matter the time frame…

– Depending on your R/R your profit will be different, but let’s take this R/R 1:2 and 50% probability = 50 x 2 = 100 ….50×1 = 50 ….so you win 50

– Most important part is actually what leverage would you apply :

– If you go with 1-30 leverage or you go with 1-100 leverage – this is where you start asking yourself how much you can afford to lose in one trade. With smaller leverage your stop can be bigger and still lose less when hit and vice versa – this is how you should look at it – not simply how to avoid a stop – as you can’t – stops are part of this game and if applied correctly no need to worry about it.

– Now to give you some facts : I trade on a very small time frames ( reason for it is lack of patience on my side and decades of not sleeping , waiting to close a position sometimes for months ) , but also because of a very small stop losses that gives me opportunity to trade on extremely high leverages . My stop is fixed at 1.5 pips ( yes, one and half ) , my R/R is minimum 1:3 , but in practice goes as high as 1:10 , my probability rate ( win rate ) is over 96%.

– You have to make a trading system first, check it in past performance and minimum data that you need is 500 ( so 500 system signals for trade) – I prefer 1.000 + and on daily for example it might be problematic to do, not to mention weekly or God forbid monthly …

– I fully understand the angle you are coming from with these questions, but for now just accept what I am talking about. I know why you think that if R/R is higher win rate is lower-but I have different approach to all of it – I’ll explain it all within time…

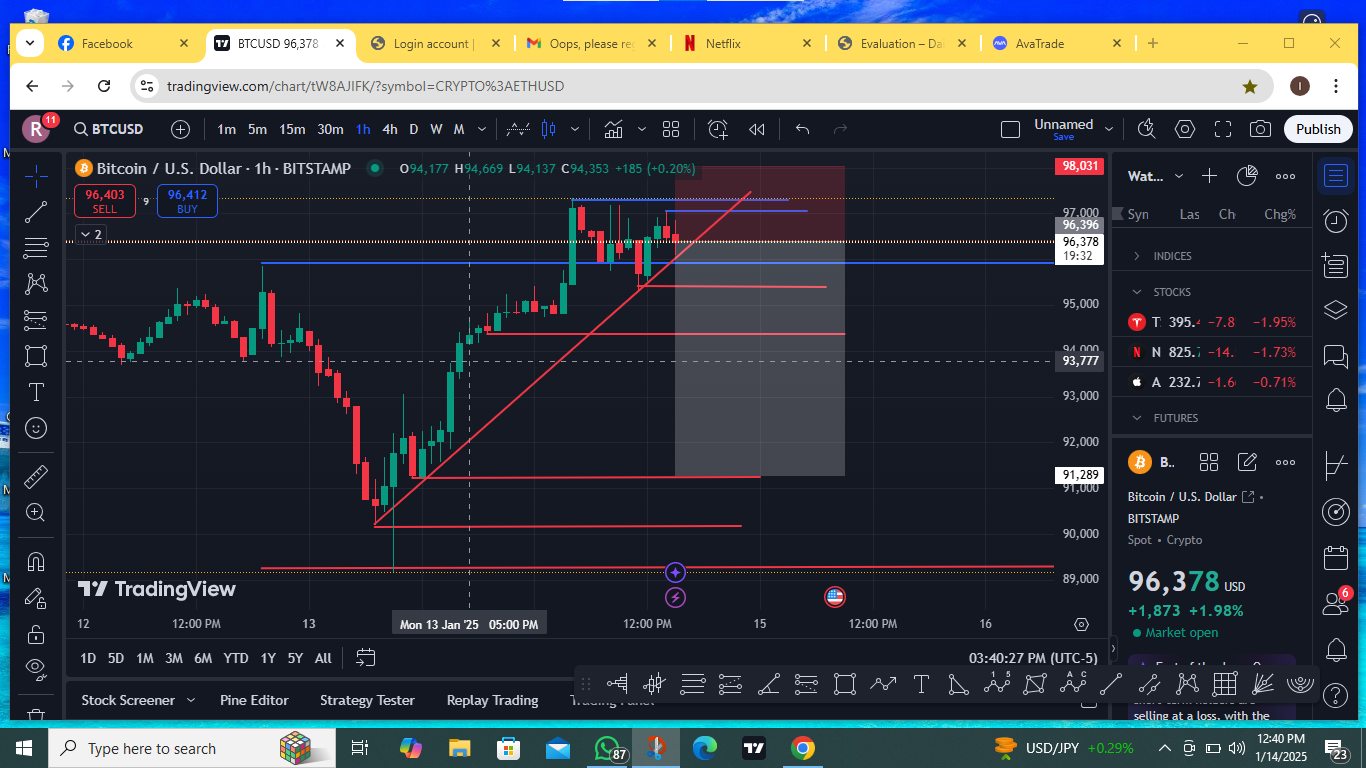

February 2, 2025 at 6:06 pm #18887January 20, 2025 at 11:42 am #18085January 20, 2025 at 6:20 am #18082January 19, 2025 at 11:39 am #18060January 18, 2025 at 7:08 pm #18046Only thing that bothers me with BTC and its advances is time-space correlation right now.

This is a fifth day in a row of pushing Up – so might be the time for some consolidation.

Do not try to sell it – it can just continue Up with some sideways corrections.

Personally I wouldn’t touch it till Tuesday – Monday is Trump Inauguration day….so be very careful.

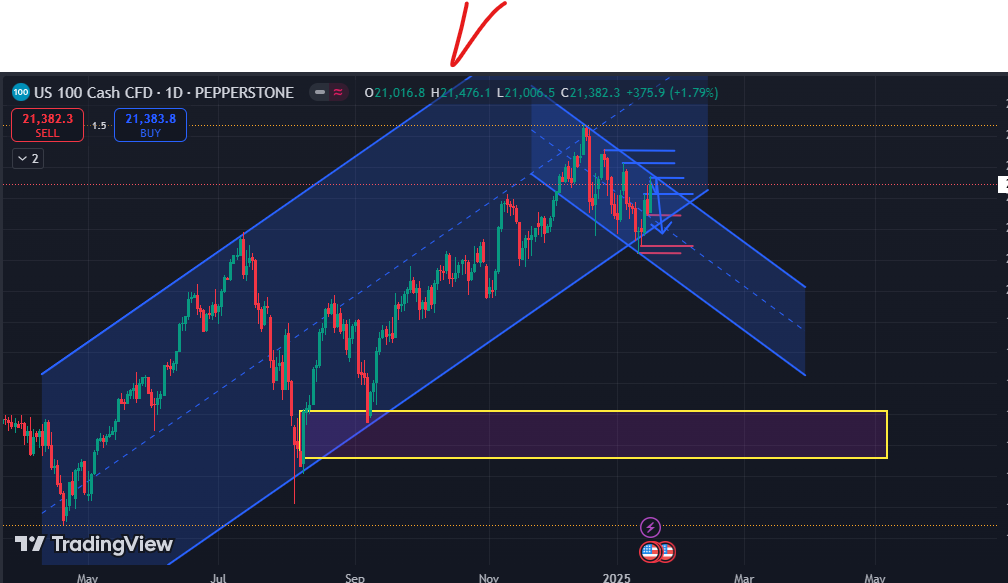

January 18, 2025 at 5:48 pm #18045January 15, 2025 at 8:51 pm #17855January 14, 2025 at 9:08 pm #17800This looks really good Idris !!

Seems to me that AT does it well….now let me give you a word of advice :

As I can see from this chart, you are following it on hourly basis – Always check the daily – each morning you wake up , first a look at the daily!

Now read what I wrote today HERE

January 14, 2025 at 8:43 pm #17796December 30, 2024 at 1:48 pm #16870EURUSD Monthly – End of the Year

EURUSD spent previous two years (2023/2024) quite undecided, even we had some tremendous shakings in the World, and lots of tremors.

For the first time I am going to take into account some heavy Fundamentals coming in and lots of speculation on the outcomes…

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

very effective and i try this out ,please is there any improvement i need to make sir?

very effective and i try this out ,please is there any improvement i need to make sir?

i think btc bull rally was failling consider the wicks at the top ,any correction

i think btc bull rally was failling consider the wicks at the top ,any correction