- This topic has 57 replies, 3 voices, and was last updated 6 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

July 25, 2024 at 12:01 pm #9630

What is a Liquidating Market and How to Trade It

Not all markets should be treated the same. It is therefore tmportant to identify whether you are in a trend, correction, consolidation or what I call a liquidating market.

What is a liquidating market?

A liquidating market is one where the flows are looking to exit positions and not add to existing ones.

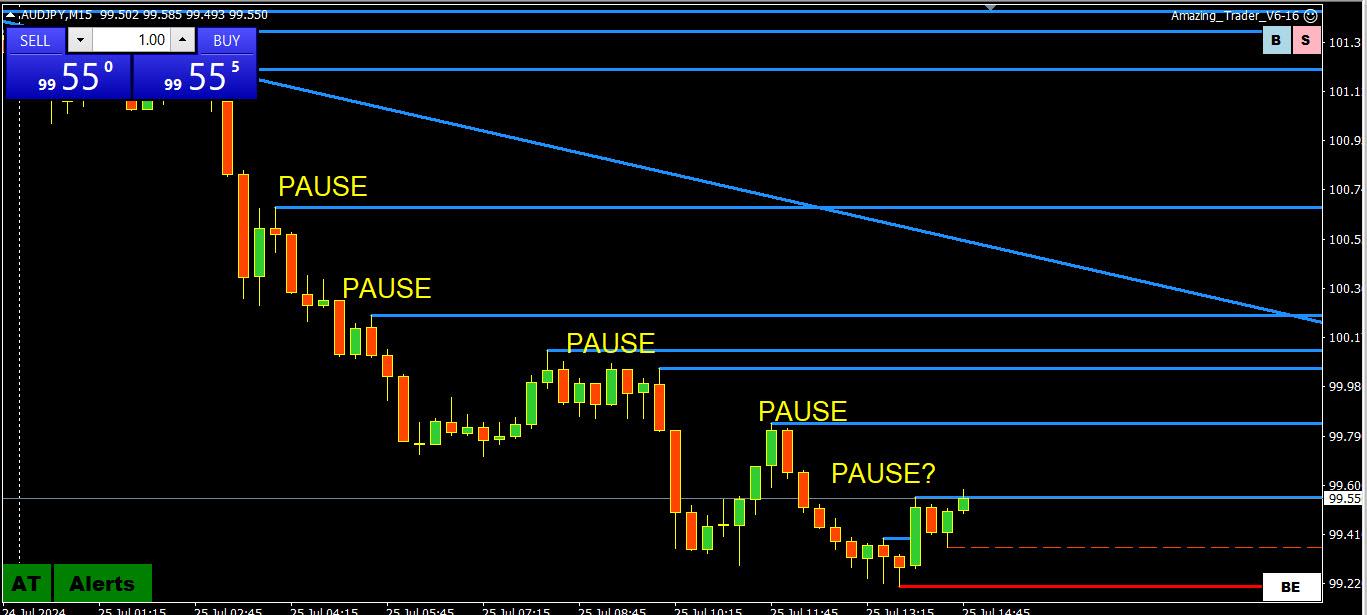

For example, take the current market where short JPY carry trade positions (we will discuss carry trades) are unwinding in forex, gold, stocks. One of the lead in fx is AUDJPY, which is down 11 days in a row. See this 15 minute chart from July 25, 2024 and not how at each pause, there is a minor uptick followed by a push to fresh lows.

So the question is once you recognize the market is in a liquidating mode, how do you trade it?

IDENTIFYING THE TYPE OF MARKET YOU ARE IN IS ONE OF MY KEY FOREX TRADING TIPS.

The way these types of markets tend to trade is that they move in spurts as orders get executed and positions liquidated. Once the order is done, you may see some backing and filling as selling (as in the above case) is done and bottom pickers come in. (and vice versa when short positions are liquidated).

This often gives a false sense of a bottom as the market backs away from the low until the next wave of sell orders. This squeezes those trying to pick a bottom as they get stopped out by fresh selling and a new low.

Much depends on whether key technical levels get triggered as this can accelerate the move and bring in fresh selling. Liquidating markets will eventually exhaust themselves and finally reach a bottom, either by a key technical level holding or by the selling just running out of steam.

How to trade a liquidating marker

The way to trade a liquidating market is either to sell (or buy as the case may be) on the backing and filling but that is often difficult as it is hard to find a nearby stop if the chart is like a one-way street.

Another way is to put a stop entry at the low or high to go with the next wave of sell (or buy =0 order liquidations.

The other way is to wait it out and only go against the move if you sense it has completely lost steam.

However, the tendency is to buy at each pause, hoping to catch the falling knife after a new low. The danger in this approach is that by the time a low is in place you may be too beaten up to catch the bottom.

The key point is to recognize the type of market you are in and that the hardest trade is often the right trade. The easy and in this case the wrong trade is to buy the easy to get filled at what looks like an attractive level trade.

Note I used a market that is liquidating long positions as an example. The same principle applies to when short positions get liquidated.

July 23, 2024 at 10:59 pm #95598-forex-trading-tips-for-a-lower-volatility-market

It seems it has been eons ago the forex market was characterized by higher volatility, with average daily ranges exceeding 1% of the spot price more the norm than the exception.

If you are currently trading the forex market, it is hard to not recognize the lower volatility and choppy trading that have frustrated not only trend traders but day traders as well. I look at volatility as a market characterized by tight daily ranges and limited follow through with choppy trading, limited trends and often false starts in both directions. It is a matter of adapting in this environment to take advantage of opportunities to trade.

July 23, 2024 at 10:16 am #9507July 19, 2024 at 4:53 pm #9383A taste of things to come

Look at this chart and you get a taste of what you will see here going forward.

This is a chart with my Amazing Trader program running on it. It is the definition of a liquidating marlket.

Note the top 2 blue lines, the first indication of a potential top and change in direction.

Often after a third line, you will see an acceleration, in this case to the downside and you can see what followed.

This is a 4 hour chart but the same patterns work on any time frame, 5. 15. 30 etc.

Now let me tie this together.

Do you remember what I said about the importance of the high and low of the day or time frame chart.

This is the only level where there are stops to run., If the market cannot break to a new high or low, it will lose interest on that side and probe the other side in search of stops.

This is what happened in gold after breaking to a new record high.

This is a simple and common sense way of looking at trading. You can use any charting application to apply it. I find The Amazing Trader is the clearest way to identify a pattern.

We will cover the finer details in a later discussion/

July 18, 2024 at 7:51 pm #9338LIQUIDATING MARKET

As we are in the early stages of the club and before I start going into specific strategies, I want to re-emphasize that my main goal when I trade is to identify what side to trade and that includes what type oif market.

The following 30 minute chart is from July 18, 2024 and is typcial of a liquidting market. Trend has been strong up and after topping out yesterday, we saw a liqudating market today.

Notice how each pause and blip failed, forming another blue Amazing Trader line, which was then followed by a new low. At each poause GBPUSD looked like it was bid. So, you tell me what side of the market was most at risk. Trying to pick a bottom was a sucker bet.

T

I suggest reading this article as it explains what I mean by a liquidating market.What is a Liquidating Market and How to Trade It?

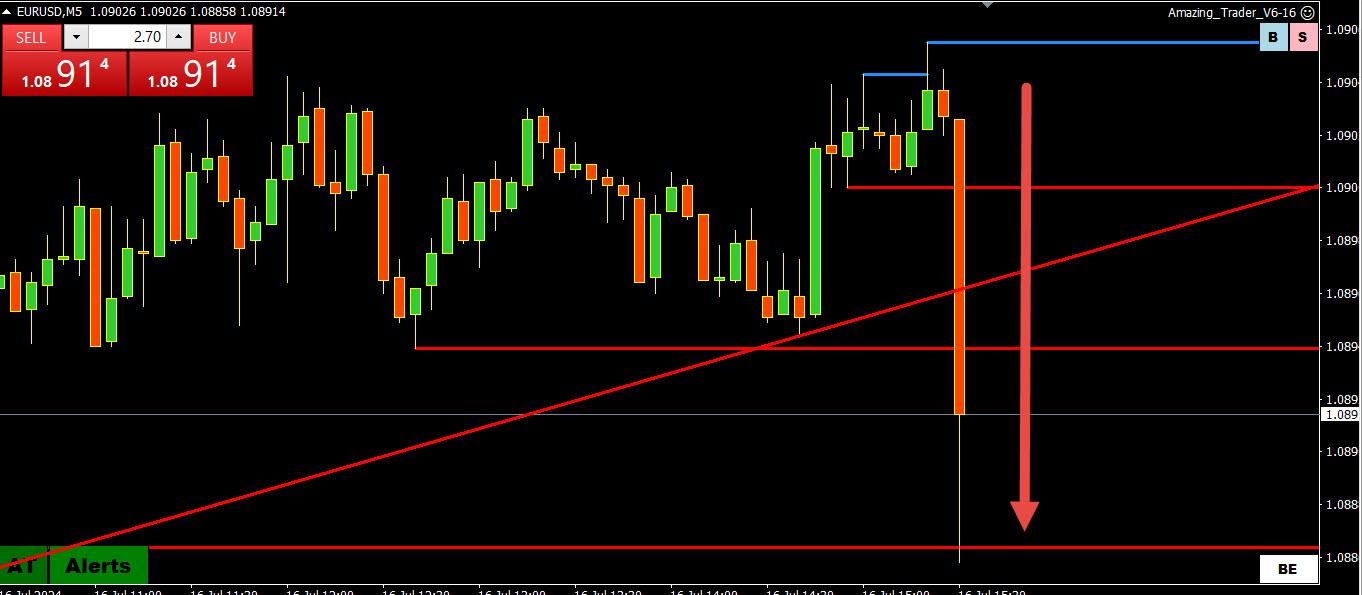

‘July 17, 2024 at 11:56 am #9263Why News Matters Follow Up

As you can see by this chart the initial reaction to the news did not follow through and an AT Directional Indicator gave a strong signal to the upside, which remained at risk as long as EURUSD stayed above 1.0860 (low was 1.0872)

It is easy to post this with hindsight but the takeaway is if you were on the wrong side when US retail sales came out you would likely have been stopped out.

By keeping your powder dry, you could decide whether to go with the reaction or wait for a sign to go the other way.

‘July 16, 2024 at 12:39 pm #9200Why News Matters

One of my personal trading rules is not to hold positions into data as it only takes a surprise to catch you the wrong way. I prefer to keep my powder dry and then determine whether to go with the reawction oir fade it.

Here is an illustration with a 5 minute EURUSD chart from July 16, 2024 where the market was setup for a weak US retail sales report and then got caught out when the data came in above the consensus

July 15, 2024 at 10:16 am #9133July 12, 2024 at 2:23 pm #9058

July 15, 2024 at 10:16 am #9133July 12, 2024 at 2:23 pm #9058What is Common Sense Trading?

As a trader, you have 3 choices.

1) 100% fundamentals

2) 100% technicals

3) A combination of fundamentals and technicals.

I will assume that most mainly follow technicals and this is where common sense trading comes in.

Many follow technicals, whether it be moving averages, patterns, Elliot waves or anything else with a touch of blind faith.

My approach is to explain why markets move, why what I will share with you works and what the logic is behind it. The more you understand why something works the more confidence you will have using it in live trading.

This is why I call it Common Sense Trading

July 12, 2024 at 11:16 am #9029Let me sum up a common sense approach to trading with 2 statements of fact.

1. Identifying the side to trade is more than half the battle in putting on better odds trades

2. Forex market is always looking to run stops

In forex, I focus on specific chart levels

Why?

Because forex has a common price feed. This means everyone sees around the same prices on their charts. Therefore, one can predict a market reaction if a level holds or is broken since everyone is looking at the same levels on a chart.

FACT: In forex, there is a never ending quest to run stops

You want to position by identifying the side least likely to see stops run against your position. Identifying where stops may be lying is a skill you can develop, especially by using The Amazing Trader.

Where do you find stops?

1) Above/below the high/low of the day. Algos will probe the high/low of the day to see if there are stops or not and react accordingly.

2) Above/below the high/low of the current week, prior week, prior month.

3) If in a trend stops often rest above/below the recent high/low in the direction of a trend after there is a retracement off those levels.

4) Stops are often are placed at prior support or resistance after a currency retreats from a high if bounces off a low

5) Market will often probe for stops around the “50” level (e.g. 1.0850, 1.2850, eyc). We will discuss this at a future time.

Here is a a illustration oif stops being run above the high of the day after a retracement of a major uptrend ended.

It is different with CFDs.

Brokers can have different symbols (e.g. NAS100 and NDX100) for the same underlying instrument.

They can also have different price feeds for the same symbol.

So I focus on patterns for CFDs rather than specific levels as there is not a common price feeds.

This just scratches the surface surface but gives you an idea what can drive the forex market,

We will see how to take advantage of this knowledge as we continue this journey.

July 9, 2024 at 11:39 am #8789July 8, 2024 at 9:51 pm #8764July 8, 2024 at 12:56 pm #8724July 7, 2024 at 9:49 am #8665Opening Week Gaps

(Reply to a Q&A)

In addition to using The Amazing Trader to illustrate and discuss the market, I will also share insights you might not find elsewhere.

There is a long-time Global-View member who says that opening week gaps in the price of a currency are more often than not filled. He is specifically referring to a gap between the closing week price and the opening price of the next week.

Take a look at this EURUSD chart for the week of July 1, 2024 and note the opening gap on the upside, moved down to fill the gap and then moved sharply higher in the following days.

The Amazing Trader charting pattern (red lines) gave confirmation to a bullish risk after the gap was filled (for another discussion).

July 7, 2024 at 7:52 am #8651Why Does Technical Analysis Work?

Most traders use charts to trade but my guess is that few have stopped to ask why the technicals that they use work. Once you understand why, you will be able to anticipate which levels or tehnical indicators should produce a market response, as you will see in this short video and the write up below it.

Why does technical analysis work?

The answer may come as a surprise but it will help you to use technical analysis to predict future price action. This is a concept I want you to understand so you can use technical analysis and charts to your advantage.

Some pure chartists may want to take me out and burn me at the stake for heresy as I have a different view of why technical analysis works. Some see it as predictive, like Elliott waves. I see it the opposite. It is not predictive by itself but rather you can use it to predict price behavior and here is the reason why.

There is nothing magic about technical analysis. It works because those who trade and follow markets use it. If they didn’t use it, then it would not be considered useful for trading. Let’s say the 173 day moving average was considered to be more important than the 200 day moving average. There is nothing magic about this level other than it becomes significant because more people use it in their trading.

In other words, the more people who use the same technical indicator, the more significant it becomes, I personally prefer to focus on chart levels, as I explain below, as it becomes easier to predict the reaction when a level holds or is broken.

Models by themselves do not predict future price behavior. Anticipating how technical traders will react to changes in price can give a clue as to market direction and momentum. This is common sense.

So if I am the only one looking at a specific level, does it really matter?

I prefer to focus on specific chart levels as they are more likely to appear on most traders’ charts. As an example, I am keen on using trendlines but I have to keep in mind that my line may differ from others based on my data differing or how I draw it. The same is true for moving averages (depending on what closing rates are used) and retracements (depending on what range and time frame is used). This is why I focus mainly on chart levels as it is easier to predict the reaction knowing others are looking at the same points as well.

For example, let’s say the key support/breakout level on the downside in the EURUSD is 1.0660 seen across multiple time frames. You can then assume there will be a reaction by technical traders if this level holds or is decisively broken.

So why does technical analysis work?

It works because people use it. The more people who use it the more significant it can become. How can you predict price behavior? The first step is to identify key chart levels and then anticipate the reaction if they hold or are broken.

You can find ways to identify key levels on your own but I find the best way for me is by using The Amazing Trader charting algo, which is programmed to use my uncanny ability to identify key chart levels and deliver them to charts in real-time.

In my updates in the Trading Club, I plan to show how to use this knowledge to take advantage of predictable behavior by technical traders and use it to trade.

July 5, 2024 at 2:40 pm #8617Day Trader’s Guide to Beating the Market

Let’s get started with a video I created to show you a way to look at the market and identify what I call the strong side to trade.

You will find that I take a common sense approach to trading and one that should make sense to you.

If you have any questions post them in the Q&A forum.

If you would like to take a trial for The Amazing Trader, Click Here.

To watch the video click on the image below.

July 4, 2024 at 10:49 am #8576Introduction to the Amazing Trader Classes

and

(A Key to Successful Trading)

Trading is not rocket sciecne.

It is all about odds and the ability to put them in your favor by identifying what I call the strong side (i.e. side least likely to get stopped out) at any point in time.

In my discussions you will see me using my Amazing Trader charts, which come from an algo I created.

My approach is to keep it simple with a logic that will make sense and is easy to follow.

I will also share insights from my many years of trading that you might not find elsewhere.

I will share how to identify the risk, what side to trade, and a strategy to put this knowledge into practice. You can use the same logic with your charts but you find it easier using The Amazing Trader program.

This is what one of my charts looks like.

And here is what I see as… (click on the image below)

July 3, 2024 at 6:40 pm #8547 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View