- This topic has 57 replies, 3 voices, and was last updated 6 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

September 3, 2024 at 11:01 am #11214

Drilling Down’

While Bobby and I have different approaches to trading, it is interesting that we often agree on the important aspects. I suggest reading his Ibtra-0day Trading Techniques – Part 1 and then seeing how my Drilling Down is very similar in concept.

The following is from The Amazing Trader Guide

The term “drill down” means starting at longer time frame charts and then moving down to shorter time frames. The process is designed to look for confirmation of a trend or episode on multiple time frames and then find an AT ladder pattern to trade.

Drilling down time frames:

Daily => 4 hour => 1 hour => 30 minute > 15 minute => 5 minute

If you see AT ladders building in the same direction on say daily, 4 hour and 1 hour charts, you can assume there is an imbalance tilted in that direction

What the means for trading is that the institutional type traders who trade larger size and use longer term time frames will be looking to buy dips (ladder up) or sell blips (ladder down).

What this means for you is when multiple longer-term time frames confirm each other (I.e. AT ladders pointed in the same direction), you can identify the side to trade from, which is where big money traders are looking to do the same.

You then drill down time frames until you see an AT ladder pattern or a high-low reversal pattern and employ the strategy to trade.

However, you don’t trade blindly as you need to be aware of any levels, especially on longer term time frame charts, that would dampen or reverse the current episode. In this regard, go to the next lesson that describes the importance of preceding lows or highs.

Note, we will discuss AT Ladders and how to use them ti trade

August 28, 2024 at 9:33 am #11047I suggest reading this article I posted in our blog

The old trading adage that says “the reaction to news is more important than the news itself” is even more relevant in today’s market as central banks embark on a rate cutting path.

August 25, 2024 at 12:06 pm #10916Forex market Has a Never Ending Quest to Run Stops

I doubt you will see this discussed in many places but this is one of the strengths of the Trading Club, to share insights that you might not find elsewhere.

If you can master the skill to identify where stops might be vulnerable, it will help you identify the side most at risk.

For me, I find The Amazing Trader invaluable in identifying key levels, but you can use whatever works for you.

In any case, we can only share what we know works but if you want to take the next step, you should interact with us by either using the Q&A or ask your questions directly by email (jay@localhost) and we will answer in the Q&A.

Take a look at this video and see what I mean by the forex market’s never ending quest to run stops.

August 23, 2024 at 1:14 pm #10860PLEASE PARTICIPATE

We are looking to make our club responsive to the needs of our members.

In this regard, we have created a short questionnaire for members to fill out.

All answers will be kept strictly confidential and for our own use only.

Global-View Trading Club Questionnaire

Thanks in advance to make this the best trading club it can be.

August 20, 2024 at 2:29 pm #10728Let me explain further…

When I ran a dealing room for a commodities company that arbitraged futures vs. the spot forex market, there were days when trading was easy. Markets traded one way and we took advantage of it. However, if we missed maximizing that day and came in the next, the “easy money” was no longer there.

Now I am not saying trading is ever easy but it is the same concept with the indicator I am willing to share.

When the indicator lines up, and the key is how I use it, which you will not find in any trading book or course, the odds can be tilted to your side. Let’s say trading those times are not easy but easier as with one glance you can identify the side to trade.

Note, this was a big decision for me to share this with our club members so if this makes sense to you, as it should, then contact me.

August 20, 2024 at 12:10 pm #10717An Indicator You Can Use Right Away

Let me be clear. I am not an educator. I am not a teacher. I am not a mentor. I am just a trader like you with a lot more experience to share. This is the aim of the Trading Club, which is to pass on some of what we have learned over the years, often the hard way, that we have found works.

In this regard, there is an indicator I use that helps me identify, at a quick glance, what side and when I should be trading. I find it invaluable for short-term trading. The key is not so much the indicator but how to use it.

With full transparency, I am trying to figure out how to say this. This is not something I am willing to share in public. However, it is something I am willing to show in private to a select group of club members who are really interested in elevating their trading, or for beginners finding a tool they can use right away.

So, if this perks your interest as it should, then either post a request in the Q&A or contact me directly at jay@localhost

August 15, 2024 at 7:00 pm #10573Stealing Pips

Look at this 15 minute EURUSD chart (5 minute is even clearer) and ask yourself whether you would have gone short. For me it was like Stealing Pips.

Logic

1-1/2 hours trying to break 1.0989-90

There are no key stops until the high of the day – this is the key to the trade

Worth a 5 pip risk and reward would have been up to 17 pips

Key takeaway is the high of the day was out of reach and only above it would see key stops.

August 15, 2024 at 10:40 am #10542How Markets Work – Trading the News

You need to understand the dynamics of the market and how it works so you can evaluate the reaction to a news event or a news headline.

There are news algos that are programmed to react to keywords. So, if a news headline comes out, such as a geopolitical news headline, the algos would react by buying or selling even if it eventually turned out to be a non-event.

Now, let’s get down to what most traders look at, which are economic data reports. No matter how fast a news feed you have, the news algos, programmed to react to economic reports, will be faster. I have a fast news feed and before I even see the data, markets have already reacted.

This was the case overnight and is a classic example.

As this chart shows, AUDUSD was trading at .6588 prior to the release of the July employment report. fell to .6556 on the release and then quickly rebounded, currently trading at.6627.

This is commonly called a whipsaw, which can be painful to seasoned traders but disastrous to retail traders without deep pockets.

Whipsaw: In trading, a whipsaw is a slang term that describes a volatile market where price suddenly moves in one direction and then quickly reverses.

Why did it react that way?

News algos reacted to the headline, including a tick up in the jobless rate but on closer inspection, it was not a weak report. This was no solace to those who saw their stops get run on the initial reaction only to see the market quickly reverse.

This is why I do not hold positions into economic data releases, as stops are not safe, even if you have the right idea as witnessed by the AUDUSD reaction to the data.

So, bottom line, if you want to be a player in the global trading market, you have to understand how it works and why you see sharp reactions to data that sometimes follow through and other times quickly reverse. News algos are mindless, and react first while traders evaluate the moves afterwards.

Feel free to ask questions.

August 14, 2024 at 5:42 pm #10529Identifying a Potential Reversal – The Amazing Trader (AT) Directional Indicator

Bobby discussed different reversal patterns. Here is one I use that you will not find in a trading book. This is just to wet your appetite to what comes next. Notre AT Alerts, which are included in the AT program, are based on Directional Indicator patterns.

The AT Directional Indicator

The AT Directional Indicator is a name I came up with to describe a trading pattern highlighted by the Amazing Trader. It is formed by 2 AT lines drawn off the low or high of a day (or time frame). .

The AT Directional Indicator can act as a POTENTIAL indication of a CHANGE in the directional risk in the market. There are times when it provides a great opportunity to trade using its lines by itself and other times the market may make a sharp move before the indicator pattern is confirmed.

The AT Directional Indicator is a pattern you will see repeated across all time frames, in all currencies, metals, stock indices, CRYPTOS and other asset classes. .

The AT Directional Indicator acts as a compass. it either points North (up), South (down) I FIND THE BEST FOR DAY TRADERS IS USING A 15 OR 30 MINUTE CHART It helps indicate when an episode ends and a new one begins. It is like an early alert signal. that the directional risk MAY BE CHANGING.

This is how it works

The Amazing Trader trading lines form patterns that can be used as a Directional Indicator. It is formed by higher red lines or lower blue lines drawn off the low or high of the day (or time frame chart. It tells you the side where the odds are best and helps determine whether to be a buyer or seller of a currency in a new episode. The strongest patterns often occur after a high or low of the day or time frame.

Why the Directional Indicator works – read this

The reason it works is that once a low or high is made the market often makes another run at the low or high and ultimately fails. That failure results in a higher or lower ladder rung and a Directional Indicator,

This, in turn, sees the market lose interest if there are no stops to run as long as the low or high stays untouched As you will see, this often results in the start of a new episode as the ladder builds in the opposite direction of the current episode.

NOTE A Directional Indicator by itself can signal a new episode. However, there are times, especially in shorter time frames, when a Directional Indicator only indicates a pause before the market continues on in the direction of the current episode.

August 14, 2024 at 5:42 pm #10528Identifying a Potential Reversal – The Amazing Trader (AT) Directional Indicator

Bobby discussed different reversal patterns. Here is one IU use that you will bot find in a trading book.

The AT Directional Indicator

The AT Directional Indicator is a name I came up with to describe a trading pattern highlighted by the Amazing Trader. It is formed by 2 AT lines drawn off the low or high of a day (or time frame). .

The AT Directional Indicator can act as a POTENTIAL indication of a CHANGE in the directional risk in the market. There are times when it provides a great opportunity to trade using its lines by itself and other times the market may make a sharp move before the indicator pattern is confirmed.

The AT Directional Indicator is a pattern you will see repeated across all time frames, in all currencies, metals, stock indices, and other asset classes. .

The AT Directional Indicator acts as a compass. it either points North (up), South (down) or East/West (sideways) when you see it on both sides. I FIND THE BEST FOR DAY TRADERS IS USING A 16 AND 30 MINUTE CHART It helps indicate when an episode ends and a new one begins. It is like an early alert signal.

This is how it works

The Amazing Trader trading lines form patterns that can be used as a Directional Indicator. It is formed by higher red lines or lower blue lines drawn off the low or high of the day (or time frame chart. It tells you the side where the odds are best and helps determine whether to be a buyer or seller of a currency in a new episode. The strongest patterns often occur after a high or low of the day or time frame.

Why the Directional Indicator works – read this

The reason it works is that once a low or high is made the market often makes another run at the low or high and ultimately fails. That failure results in a higher or lower ladder rung and a Directional Indicator,

This, in turn, sees the market lose interest if there are no stops to run as long as the low or high stays untouched As you will see, this often results in the start of a new episode as the ladder builds in the opposite direction of the current episode.

NOTE A Directional Indicator by itself can signal a new episode. However, there are times, especially in shorter time frames, when a Directional Indicator only indicates a pause before the market continues on in the direction of the current episode.

August 11, 2024 at 11:05 am #10363August 7, 2024 at 9:41 pm #10241August 7, 2024 at 11:35 am #10209How You Can Use Currency Crosses to Trade Spot Forex and Carry Trade (follow ups)

How do we know that cross flows are driving the market?

When two currencies move in opposite directions you can assume there are real money cross flows

Look at USDJPY and USDCHF (both up sharply) vs firmer commodity currencies and GBP is up as well once the carry trade unwinds ended.

Currently:

USD STRONGER

USDJPY +2.0%

USDCHF +1.4%USD WEAKER

GBPUSD =0.3%

USDCAD -0.3%

AUDUSD +0.7%

NZDUSD +1.1%August 6, 2024 at 8:00 pm #10187What is a Carry Trade?

Trading can be more than jusf looking at charts as real money flows are often driven by more than just technicals.

This has been the case of late with the sharp drop in USDJPY has been fueled by unwinding of carry trades.

What is A carry trade?

Strictly speaking, carry trade is a strategy used in the financial markets where an investor borrows money at a low-interest rate in one currency and uses it to invest in another currency or financial instrument that offers a higher return. The primary goal is to profit from the difference between the interest rates, known as the “interest rate differential.” Here’s a basic rundown of how carry trades work:

Borrowing in a Low-Interest Currency: The investor borrows funds in a currency with a low-interest rate, such as the Japanese yen (JPY) or the Swiss franc (CHF).

Investing in a High-Interest Currency: The borrowed funds are then converted into a currency with a higher interest rate, such as the Australian dollar (AUD) or the New Zealand dollar (NZD), and invested in financial instruments like government bonds or other assets that yield a higher return.

Earning the Differential: The investor earns the difference between the higher interest earned on the investment and the lower interest paid on the borrowed funds.

Example of Carry Trade

Borrow: Borrow 1,000,000 JPY at an interest rate of 0.5%.

Convert and Invest: Convert the 1,000,000 JPY into AUD and invest in Australian government bonds yielding 5%.

Profit: Earn the interest from the Australian bonds (5%) and pay the interest on the Japanese loan (0.5%), keeping the difference as profit. (Full transparency, I used ChatGBT for the carry trade definition)However, in reality, hedge funds, for example, borrow low yielding currencies such as the JPY and CHF and use the proceeds to buy bonds, stocks, cryptos, metals and commodities. So, when these massive positions unwind, as happened recdently, it can affect all markets.

The following is an article worth reading so you will understand the impact of carry trades.

Global market rout has more to do with end of cheap funding than US economy

This may be alot to digest but it is important to be aware of what drives what you are seeing on your charts and times that those exiting positions care more about liquidity than price.

If you have any questions, post them in the Q&A

August 5, 2024 at 12:13 pm #10082The Market Isn’t Your Enemy

In the current one way markets, the temptation to try and pick a top or bottom can be very strong. So, I am posting the article as a warning, one I learned many years ago the hard way and hopefully you will be able to avoid it. I suggst reading Bobby’;s Risk mangament update in the Trading Academy along with this article.

The Market Isn’t Your Enemy

One of my favorite articles I wrote as a warning to all traders is entitled, The Market Isn’t Your Enemy and it is worth repeating in the current market. I posted this (see below) several years ago to go along with the article and if it was today, I would not be surprised to see traders trying to fight the current trend the other way and sell the JPY with similar results. This is an article that has stood the test of time.

(November 2014)

I saw the trade recap of a trader I know for a long time, who I believe possesses good skills, and took a double take. I was really surprised by his trading sheet to say the least. It was last Tuesday when the JPY fell sharply. On that day, he lost on 13 consecutive trades either selling EURJPY or GBPJPY. You heard it right, 13 losers in a row until he finally gave up for the day.

While I cannot get inside his head, the trade recap suggested he lost discipline and got into a battle with a mindless market. It appears he fell into the trap I warned about in The Market Isn’t Your Enemy. It can happen to even experienced traders and for that reason I am repeating the article below for all to read:

The Market Isn’t Your Enemy

Have you ever had one of those trading days? Have you ever lost money trading and gotten mad at the market? Have you ever taken it personally, lost discipline and tried to convince yourself the market is wrong? Did this make you feel like the market was your enemy? Did this have you fight the trend in order to beat the market only to see your efforts repeatedly stopped out? This has probably happened to most traders at one time or another but it is not something you want to repeat.

The market is not your enemy. It is not a living organism although sometimes it might feel that way. The market is just a place where trades are transacted. Price action may sometimes seem illogical, even irrational but the market is never wrong as it does not have an opinion. It is only a place where forex rates are set. It is the collective will of those trading the market.

There is a term used in forex trading, the trend is your friend. When you catch a trend right, there is little stress, especially if you manage stops so that there is no risk of a loss. When you fight a trend, the market may feel like your enemy if you make it a battle of wills, yours against a place that has no will or opinion. .

Now, this is where the “market is my enemy” can take over. You can’t believe the market is acting irrationally and keep selling at every pause. Each time you get stopped out you get angry, not at yourself but at the market. You can’t believe the market is doing this to you and stiffen your back. You forget about what charts are saying, throw discipline out the window and become determined to catch the top by selling when charts are telling you to buy. By the time the move stalls out, you are beaten, having taken your lumps in what has been an emotionally draining day battling with an unemotional market. The market corrects without you on board.

Does this sound familiar? If so, then don’t repeat it. Step back when that feeling comes and take a deep breath. Walk away and come back with a clear head. Remember, the forex market is not your enemy. It is not a living organism. It is only a place where trades are transacted and prices set. When that feeling comes, remember the adage, “the market can remain irrational longer than you can remain solvent.”.

July 31, 2024 at 8:28 am #9829July 30, 2024 at 11:49 pm #9825How You Can Use Currency Crosses to Trade Spot Forex

If I told you that there was a large order in the market to buy EUR and sell GBP would you be looking to sell EURUSD and buy GBPUSD, do the opposite or step aside as the order gets executed?

We are just outsiders in the forex market

As outsiders, we are not privy to the flows in the market. Due to increased regulation, banks that are executing the orders are no longer able to pass on information. In addition, the increased use of online platforms makes it even more difficult to get information on order flows.

As a result, all we are left with is guesswork. However, the price action in major crosses, such as EURGBP, EURJPY, GBPJPY, etc., can give a clue to the order flows driving the price action in respective currency pairs. The focus of this article is on how to use this information to trade spot forex.

What is a currency cross?

Before I go on to the current trading world, let me define a currency cross.

A cross is the relationship between two currencies. It is simple algebra. There are two variables and one product that do not directly involve the dollar as that portion gets netted out. In all cases, the dollar portion is netted out and you are left with one currency vs. another with no US dollar component.

Example 1: EURGBP is calculated by EURUSD/GBPUSD = EURGBP. Let’s say EURUSD is trading at 1.0650 and GBPUSD at 1.2450. Then 1.0650/1.2450 = EURGBP .8554.

Example 2: EURJPY is calculated by EURUSD x USDJPY = EURJPY. Let’s say EURUSD is trading at 1.0650 and USDJPY at 154.60. Then 1.0650 x 154.60 = EURJPY164.65

The difference in the calculations where we divided the two currency pairs in example 1 and multiplied in example 2 is the way each currency pair is quoted vs. the US dollar.

For example, EUR and GBP are quoted as dollars per one EUR (or GBP) while USDJPY is quoted as Japanese Yen per US dollar.

However, this does not mean, as you will soon see, that the dollar is not impacted by cross trades as the market has to go into and out of the US xurrency (as the case may be) to create the cross.

No longer a dollar-centric world

When I first started trading in the forex market it was a dollar-centric world. The dollar was the center of all transactions and currencies rarely moved in opposite directions from one another. Most times currencies moved in the same direction in line with the prevailing dollar trend but not necessarily at the same pace. For example, if there was a EURGBP sell order and the dollar trend was up, both EURUSD and GBPUSD would both move down but the EURUSD might move farther and faster than the GBPUSD

Now, we no longer live in a US dollar-centric trading world but a multi-currency world. What I mean by that is while the dollar is still the dominant trading currency, cross-currency flows have become a large part of forex trading and more often than not drive the spot market. It is not unusual to see two currencies move in opposite directions direction against all currencies.

How to take advantage of crosses to trade spot forex

So, the question is how do you take advantage of cross flows, even if you do not trade the crosses directly? In other words, you do not have to trade the crosses to use them to your advantage in trading a spot currency, such as EURUSD or GBPUSD.

Let’s say there is a flow in EURGBP to buy EUR and sell GBP in a market where the overall dollar trend in both is up. By looking at EURGBP, you may assume there is buying of EURUSD and selling of GBPUSP to execute an order. In this example, the overall dollar trend is up but more so vs. the GBP than vs. the EUR. The EURUSD initially trades higher and GBPUSD tries to follow as the order gets executed. The EURUSD buying is easily absorbed as there are willing sellers as the trend is down ivs. the dollar. Once EURUSD hits resistance, the GBPUSD sell component of this flow takes over and GBPUSD falls sharply.

Why? The answer is that the market has less capacity to absorb the GBPUSD selling than the EURUSD buying to execute the buy order in EURGBP. Once the order is completed and/or EURGBP meets resistance, EURUSD will lose its cross-related bid.

If the EURUSD was in a strong uptrend and that was the dominant side, GBPUSD would have initially dipped but would not have gone that far. EURUSD demand out of this cross-flow would have then taken over and pushed it higher as that was the side where flows were less easily absorbed.

As we all know, trading rarely works like a textbook but in this simple example, you can see how crosses can give a clue to trading spot fx. They tell you what flows are going through the market in what can often look like a tug-of-war with respective currencies pulling in opposite directions. When the dollar trends are mixed, you can see currencies trade in opposite ways with the dollar only acting as an intermediary. As a general rule, one currency will have less capacity to absorb the flows and this is the side of the cross-trade that tends to be most vulnerable.

One way to confirm that there is real money driving a cross is when two currencies move in opposite directions vs. the dollar.

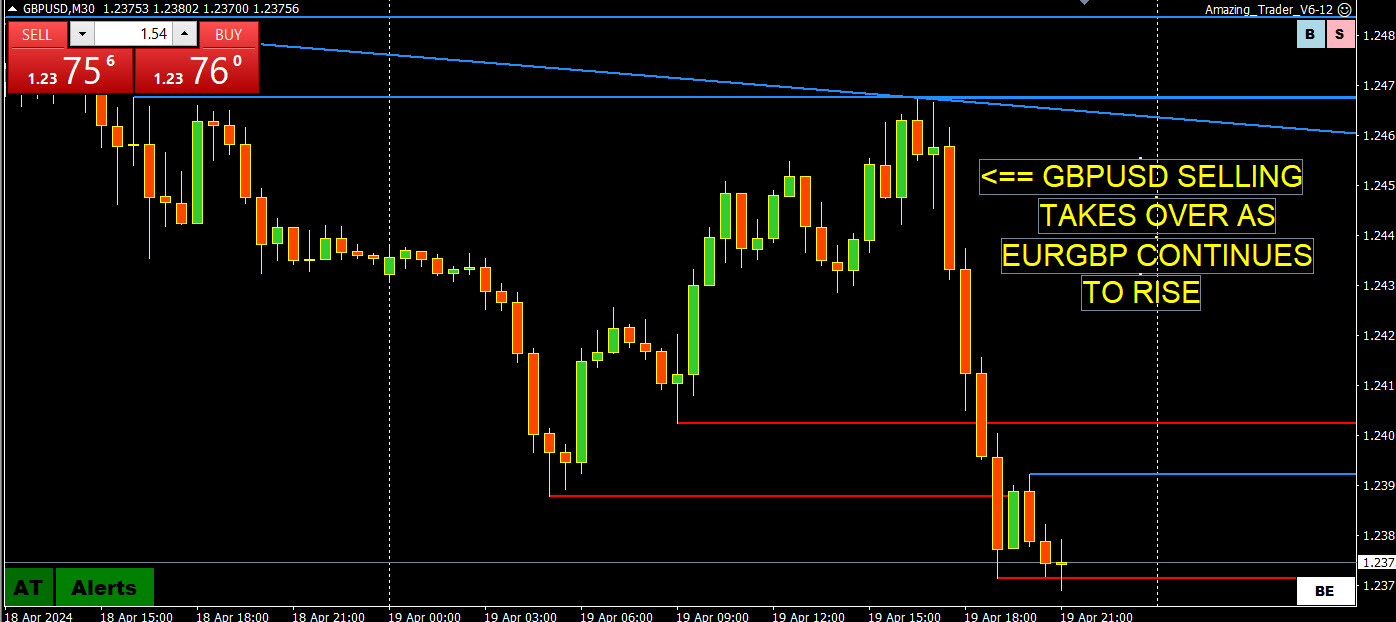

Real-time illustration

Here is a real-time illustration from April 19, 2024, where a move up in EURGBP has a greater impact on GBPUSD (sell) than EURUSD (buy)

EURGBPUSD MOVES HIGHER

EURUSD TESTS UPSIDE AND THEN STALLS

GBPUSD SELLING TAKES OVER

So, let’s conclude with the same question I asked initially:

If I told you that there was a large order in the market to buy EUR and sell GBP would you be looking to sell EURUSD and buy GBPUSD, do the opposite, or step aside as the order gets executed?

This just scratches the surface but should give you an idea of how to use crosses to trade spot forex.

Feel free to contact me with any questions or comments.

July 28, 2024 at 10:48 pm #9730Let me explain further

Capital preservation is a key to retail trading. Without it you have no capital to trade.

When placing a trade, you must always use a stop. Otherwise you risk not preserving your capital so you can live to trade another day.

This is an issue for trading on news.

Stops are not safe!

Even with the idea you can get stopped out on a news reaction.

Wirth the wrong idea, a market can run and never turn back.

There can be slippage on your stop if there is a gap on the news.

You can also get stopped by a spread widening.

TThis is just common sense if you want to stay in the trading game for the long haul.

July 28, 2024 at 1:28 pm #9715Do Fundamentals Matter? They do in the coming week.

Pure technical traders will tell you that fundamentals do not matter, it is all in the charts.

While most new traders rely on their charts, you need to be aware of news that affect fundamentals. You no not have to become an economist but you must be aware of what news is coming out (see our Economic Calendar),

Ask anyone who has tried to trade purely on charts and gotten whipped by a surprise economic or news event.

As I said, you do not have to become an economist but you need to be aware of what markets are focusing on. To keep it simple, the reason why markets react to news is the extent to which it affects expectations of changes in monetary policy.

In the current market, the focus, except for Japan (focus is on tightening monetary policy) , is on the number and pace of interest rate cuts.

We can discuss fundamentals in more details but the reason for this update is to make you aware that the upcoming week has more kep news events that I can ever remember.

My suggestion is to stay flat into these key events and then decide after whether to go with the flow or fade the reaction. This is how I trade news events.

So let’s take a look at the week ahead. The previews in this report may be too much to digest so be aware of the day/time/and the consensus forecasts.

See full detailed previews

‘

Newsquawk Week Ahead 29th July-2nd August: Highlights include FOMC, BoJ, BoE, NFP, ISM Mfg. PMI and OPEC+ JMMCJuly 25, 2024 at 3:19 pm #9650 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View